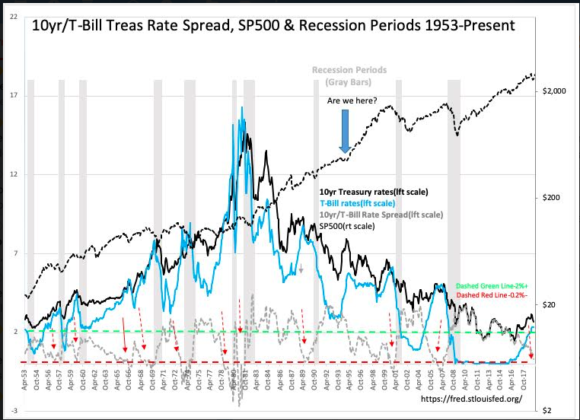

1995 Redux?

“Davidson” submits:

We could be in the same conditions as 1995 just before the Internet Bubble. The Internet Bubble began with capital flows generated by the Community Reinvestment Act 1995 leading to the subprime crisis 14 yrs later. This time Dodd-Frank has constricted mtg lending so much that we have been at half-pace the historical rate of 1.4 mil Single-Family Starts.

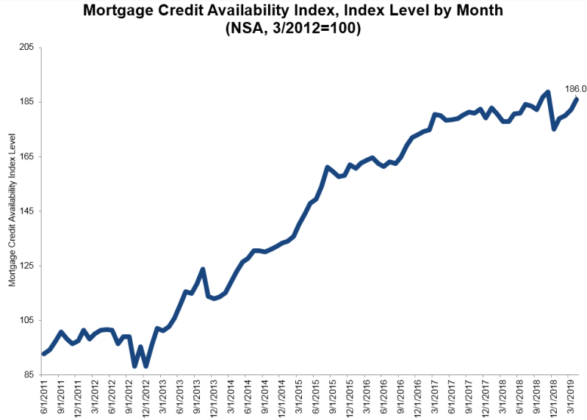

Should we see regulation relief and the MCAI begin to hit a series of new cycle highs (currently 186), the shift to higher bank mtg lending could prove similar to the beginnings of 1995.

This could prove a huge rise to the SP500 and this time Value Stocks would be propelled to all time highs.

We need to watch the MCAI next several months to confirm.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more