10 Of The Highest Yielding REITs Analyzed In Detail

Investors looking to generate higher levels of income from their investment portfolios should take a look at Real Estate Investment Trusts, or REITs. These are companies that own real estate properties and lease them to tenants, which generates a steady stream of income. The bulk of their income is then passed on to shareholders, through dividends. You can see all 171 REITs here.

The beauty of REITs, for income investors, is that they are required to distribute 90% of their taxable income to shareholders annually, in the form of dividends. In return, REITs typically do not pay corporate taxes. As a result, many of the 171 dividend-paying REITs we track offer high dividend yields of 5%+.

Bonus: Listen to our interview with Brad Thomas on The Sure Investing Podcast about intelligent REIT investing in the below video.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure the high yields are sustainable. This article will discuss 10 of the highest-yielding REITs around, with market capitalizations above $1 billion. The list excludes mortgage REITs, which have their own unique risk factors. Some of the REITs presented here are high-quality businesses worthy of further consideration, while others should be avoided.

High-Yield REIT No. 10: The GEO Group (GEO)

- Dividend Yield: 9.0%

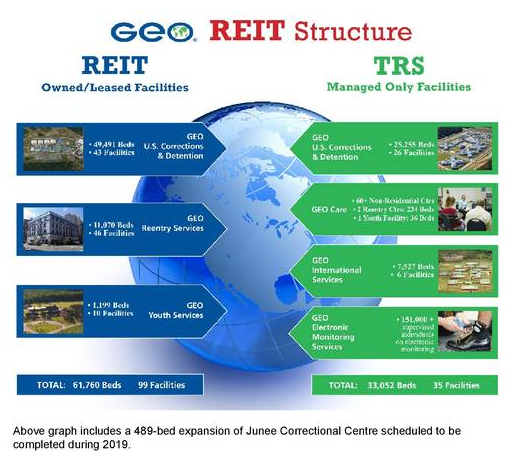

GEO operates a diversified portfolio of correctional, detention, and residential treatment facilities. It provides these services to government agencies around the world. The company has operations in the United States, Australia, South Africa, and the United Kingdom. Geo owns and/or manages a total of 141 facilities.

Source: Earnings Presentation, page 3

On 4/30/19, Geo Group reported first-quarter earnings. Total revenue of $610.7 million rose 8.1% from $564.9 million in the same quarter a year ago. FFO-per-share, as adjusted, increased 17.5% to $0.67.

The company believes its shares are currently undervalued, which is why it has $105 million currently authorized to repurchase shares.

For 2019, Geo expects total revenue of approximately $2.5 billion and full-year 2018 adjusted FFO-per-share to be in a range of $2.64 to $2.70, which represents an increase of 7.2% at the midpoint.

Geo appears to have a secure dividend. The annualized payout of $1.92 per share represents a 2019 payout ratio of 71% to 73%.

High-Yield REIT No. 9: Apollo Commercial Real Estate Finance (ARI)

- Dividend Yield: 9.9%

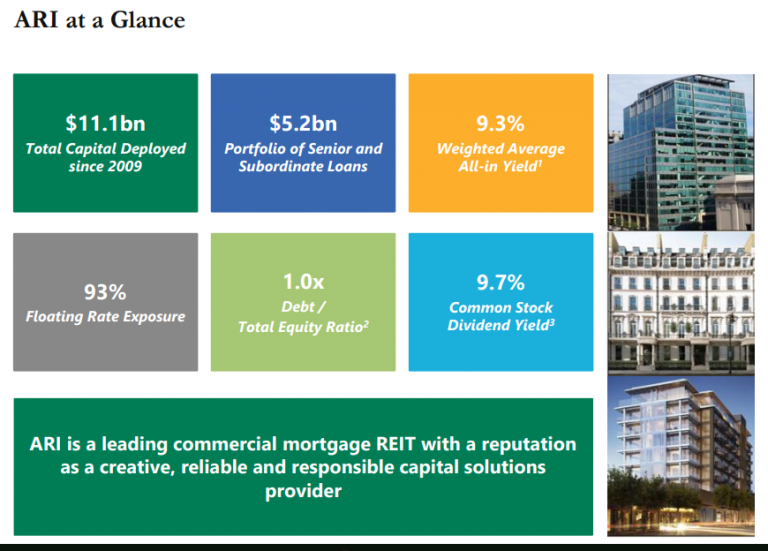

Apollo Commercial Real Estate Finance, Inc. was founded in 2009. It is a real estate investment trust (REIT) that invests in debt securities including senior mortgages, mezzanine loans, and other commercial real estate-related debt. Apollo’s investments, placed in the U.S. and Europe, are collateralized by the underlying estate properties. Apollo is externally managed by ACREFI Management, LLC, an indirect subsidiary of Apollo Global Management, LLC. Apollo Commercial Real Estate Finance holds a $4.9 billion commercial real estate portfolio, with 26% of this portfolio made up of Hotels, 17% Office Properties, 14% Urban Predevelopment, 12% Residential-for-sale inventory and 11% Residential-for-sale construction. The company has roughly 34% of its portfolio based in Manhattan, New York, 14% in the United Kingdom, 13% in the Midwest, 12% in the West and 11% in the Southeast.

Source: 2019 Investor Presentation, page 3

On April 24th, 2019, Apollo announced first-quarter results. For the quarter, operating earnings increased 16.3% year-over-year and beat analyst estimates by 8.7%. Furthermore, net interest income grew 31% year-over-year. Meanwhile, book value per share declined by 0.4% sequentially from Q4 2018 as stock awards vested. The company also invested over $200 million in a first mortgage loan as well as nearly a quarter billion dollars-worth of subordinate loans during the quarter.

Apollo’s two main growth catalysts are growth of its overall loan portfolio and higher investment returns from existing loans. In the most recent quarter, Apollo committed $744 million to first mortgage loans and $52.8 million to subordinate loans. These continued investments should buoy the business.

The company successfully grew earnings-per-share since its 2009 inception, but growth has stagnated over the past several years. Apollo has leaned heavily on equity sales to finance its growth. Moreover, the company has outstanding preferred securities with 8% dividend rates that take up more than 10% of net income. As a result of this dilution, we do not anticipate a significant improvement in bottom-line results over the intermediate-term.

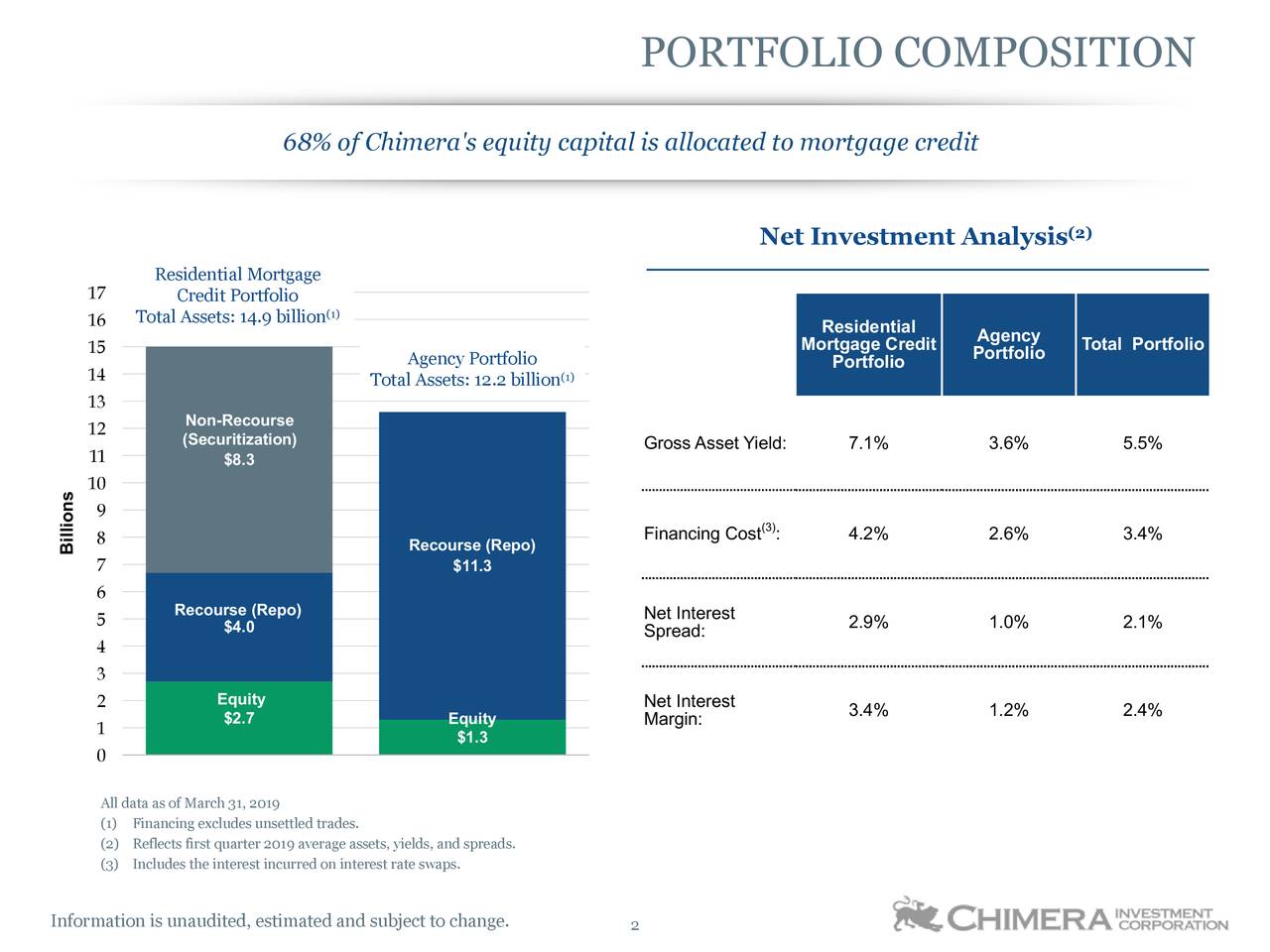

Source: 2019 Investor Presentation, page 8

Apollo has an exceptionally high dividend yield, but it also has a high dividend payout ratio that investors should closely monitor going forward. This is often the case with extreme high-yielders. The company has frequently distributed over 100% of annual earnings. While payout ratios greater than 100% are possible when cash flows exceed earnings – as is the case with Apollo – this significantly limits the company’s safety in lesser times.

During the last recession, Apollo posted a net loss in 2009, reflecting its sensitivity to recessions and downturns in commercial real estate activity. Due to the elevated payout ratio, the company funds growth through the issuance of common and preferred equity, both with dividend yields of 8%+. In turn, this creates a high hurdle rate, limiting the company’s growth prospects. So far it has worked out fine, but we are certainly cautious moving forward.

As of the most recent report, the Apollo held $110 million in cash and $5.1 billion in total assets (comprising of 76% commercial mortgage loans and 21% subordinate loans) against $2.6 billion in total liabilities (73% of which were secured debt arrangements). As a mortgage REIT, the company lacks any significant competitive advantages and remains highly sensitive to interest rate and macroeconomic conditions.

High-Yield REIT No. 8: Chimera Investment Corporation (CIM)

- Dividend Yield: 10.6%

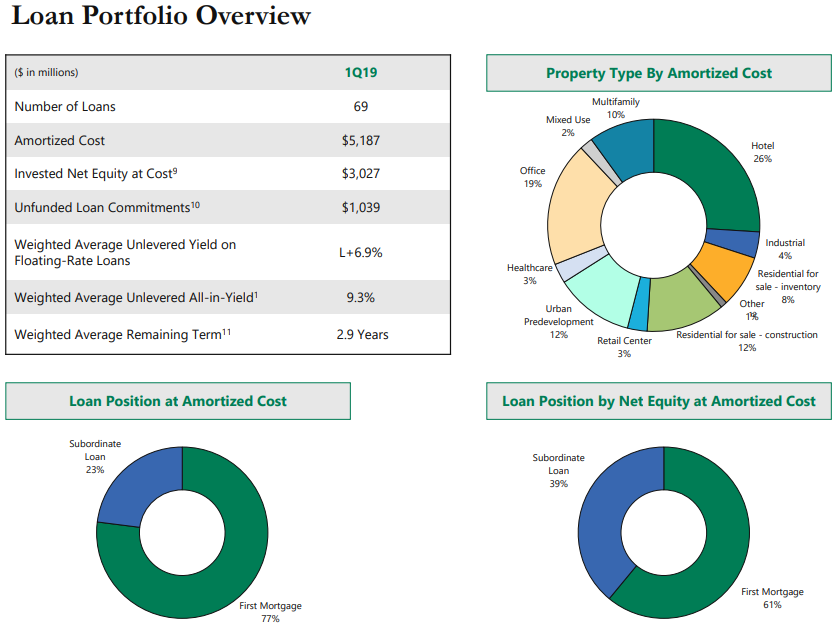

Chimera Investment Corporation invests in a portfolio of mortgage assets, including residential mortgage loans, agency and non-agency residential mortgage-backed securities, agency mortgage-backed securities secured by pools of commercial mortgage loans, commercial mortgage loans, and other real estate related securities. Chimera Investment Corporation was founded in 2007 and is headquartered in New York, New York.

Source: Q1 Earnings Slides, page 3

CIM reported earnings on May 1st. Q1 core EPS of 57 cents slipped from 58 cents in both Q4 2018 and Q1 2018. By issuing $200M of series D preferred stock in the quarter, the company was able to grow its investment portfolio and lower the company’s overall cost of capital. Q1 net interest income of $147.4M was almost even with $147.9M in the year-ago quarter while economic net interest income of $151.3M compared with $153.6M in Q4 2018 and $145.4M in Q1 2018. The total portfolio net interest margin stood at 2.4%, with agency portfolio NIM at 1.2% and residential mortgage credit portfolio NIM at 3.4%.

The company’s average interest-earning assets balance of $25.4B increased from $19.2B a year ago and the average interest-bearing liabilities balance at $22.9B was significantly higher from $16.6B a year earlier. Q1 core earnings/average common equity of 13.61% fell from 13.72% in Q4 and 14.03% in Q1 2018.

Looking ahead, the company plans to continue adding scale to boost its operating efficiency and increase its cash flows per share.

High-Yield REIT No. 7: MFA Financial Inc (MFA)

- Dividend Yield: 10.9%

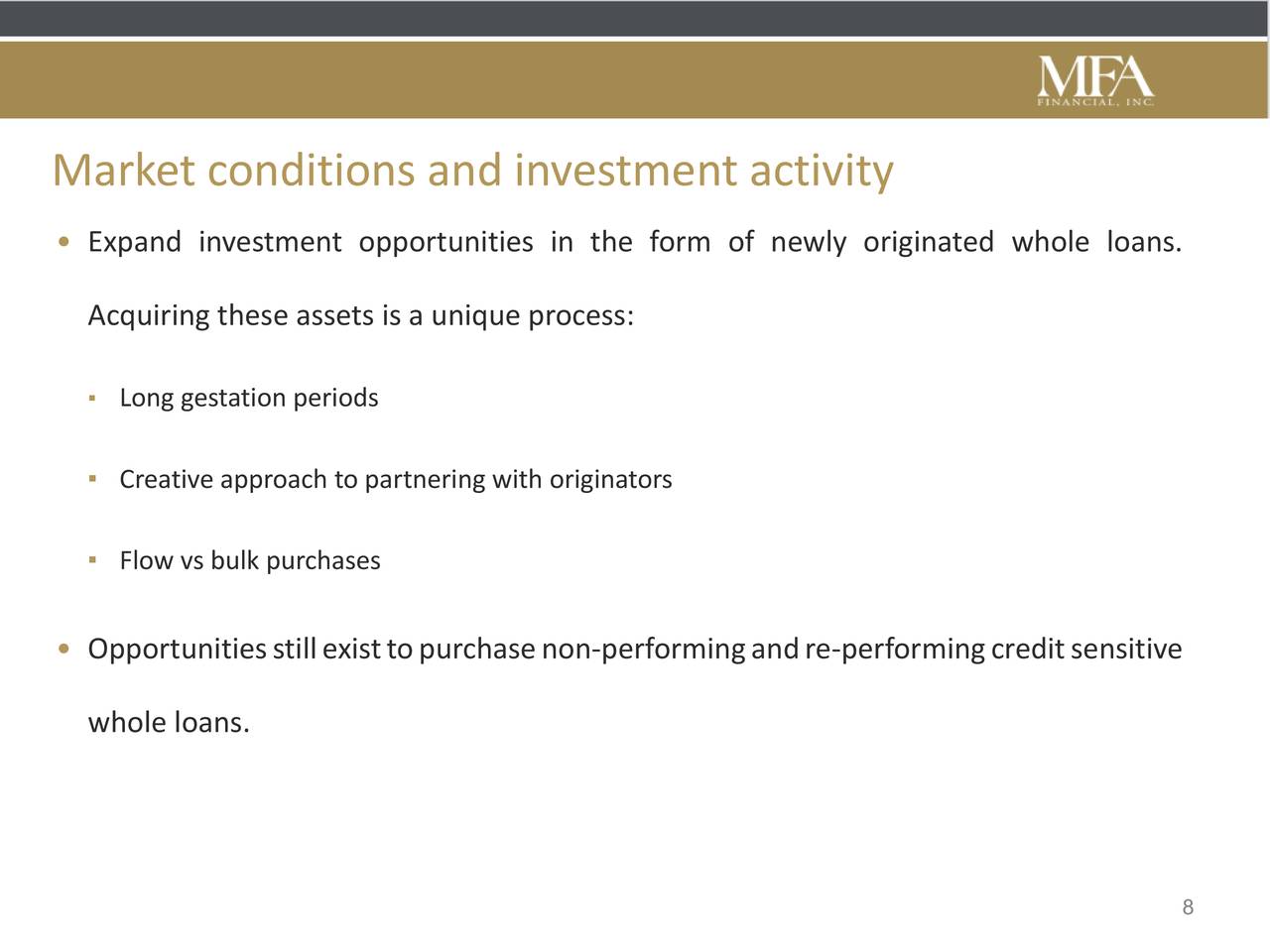

MFA Financial, Inc., invests in residential mortgage assets, including non-agency mortgage-backed securities (MBS), agency MBS, residential whole loans, credit risk transfer securities, and mortgage servicing rights related assets. Its MBS are secured by hybrid, adjustable-rate, 15-year fixed-rate, and 30-year and longer-term fixed-rate mortgages, as well as mortgages that have interest rates that reset annually or more frequently. MFA Financial, Inc. was incorporated in 1997 and is headquartered in New York, New York.

Source: Q1 Earnings Slides, page 8

On May 7th, MFA Financial reported first-quarter earnings. Core earnings of $77.6M, or 17 cents per share, fell from $96.1M, or 21 cents per share, in the year-ago quarter. However, Q1 net interest income of $61.9M increased from $53.2M in the year-ago quarter and the company acquired $1.2B of new assets during the quarter.

Residential whole loan and REO portfolio increased by $595M, largely on investments in purchased performing loans, and MSR-related assets increased by $213M. Book value per share of $7.11 at quarter end slipped from $7.15 at year-end 2018. Total assets at quarter end were $12.8B, up $0.4B from year-end 2018.

Looking ahead, the company is optimistic since its interest rate spread remains attractive despite nine Fed Funds increases over the past three years. Furthermore, excluding hedges, their asset duration remains relatively low at 1.58 while their assets continue to be primarily sensitive to mortgage credit fundamentals. In addition, their leverage remains low, with a debt-to-equity ratio of 2.7x. Through asset selection and risk management MFA has consistently limited quarterly book value fluctuations. Protecting book value gives MFA the ability to take advantage of new opportunities as they arise.

High-Yield REIT No. 6: Global Net Lease (GNL)

- Dividend Yield: 11.0%

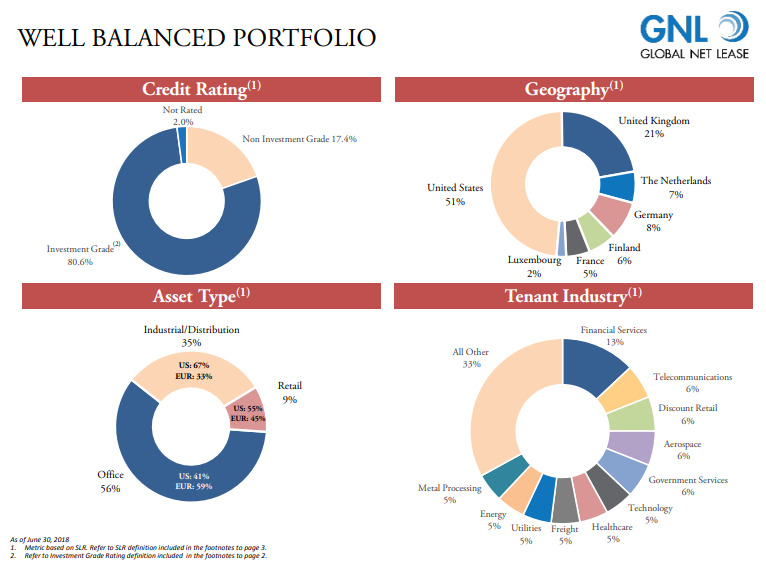

Global Net Lease is a Real Estate Investment Trust (REIT) investing in commercial properties in the U.S (56% of locations) and Europe (44% of locations) with an emphasis on sale-leaseback transactions. As of December 31st, 2018 the company owned 342 properties with total square footage of 27.5 million. Office properties accounted for 53% of the company’s holdings, with industrial / distribution and retail making up the remaining 39% and 8% respectively. Global Net Lease is a $1.4 billion market cap business which generated $147 million in adjusted funds from operations (AFFO) last year.

Source: Investor Presentation, page 4

On February 27th, 2019 Global Net Lease reported Q4 and full year 2018 results for the period ending December 31st, 2018. For the quarter, revenue increased 6.9% to $71.2 million while AFFO came in at $37.1 million, a 5.6% increase compared to Q4 2017. For the year revenue increased 8.8% to $282.2 million, while AFFO totaled $147.3 million ($2.11 per share) against $140.7 million ($2.10) in 2017. The portfolio was 99.2% leased (down from 99.5% in Q3 2018) with an 8.3 year weighted average remaining lease term.

Note that Global Net Lease was not publicly listed until 2015, which results in a very short observation history. In addition, the company does not directly report AFFO per share, a measure we find to be more accurate for REIT valuation but does calculate total AFFO for each year. From first glance, Global Net Lease appears to be a reasonable REIT with 111 tenants, including well-established names like FedEx, U.S. Customs, ING Bank, and Family Dollar, diversified across seven countries. However, there are a variety of underlying concerns, especially as it relates to potential growth.

General concerns include potential conflicts of interest due to being externally managed by AR Global Investments (which invests for other entities), the office space industry requiring increased capex, and categorizing some of its tenants as investment grade using an “implied” credit model. Growth concerns can be more or less boiled down to what you see in the table above. Global Net Lease pays out effectively all of its AFFO in the form of cash dividends. As such, future growth cannot be fueled by internal funds and instead require additional debt or share dilution. Global Net Lease has elected to issue more and more shares, which carry a very high cost given that the current dividend equates to a 11.2% starting yield. There’s a hurdle rate problem in that properties must be more attractive than the 11.2% cost of issuing shares. Stated differently, even if the company continues to increase total AFFO, the real test will be whether or not AFFO per share can increase.

Global Net Lease holds $100 million in cash and $3.0 billion in net real estate against $1.9 billion in total liabilities, which strikes us as a reasonable capital structure. However, one thing we have learned is that in lesser times you don’t want to have an elevated payout ratio. Just like you don’t want to be forced to sell at the bottom as an individual investor, as a business you don’t want to need to raise funds when debt becomes more expensive or your share price has dropped significantly. Global Net Lease is adhering to a near 100% payout ratio and thus has to issue shares in good times, which makes us skeptical of the inevitable lesser times to come.

High-Yield REIT No. 5: Invesco Mortgage Capital Inc. (IVR)

- Dividend Yield: 11.1%

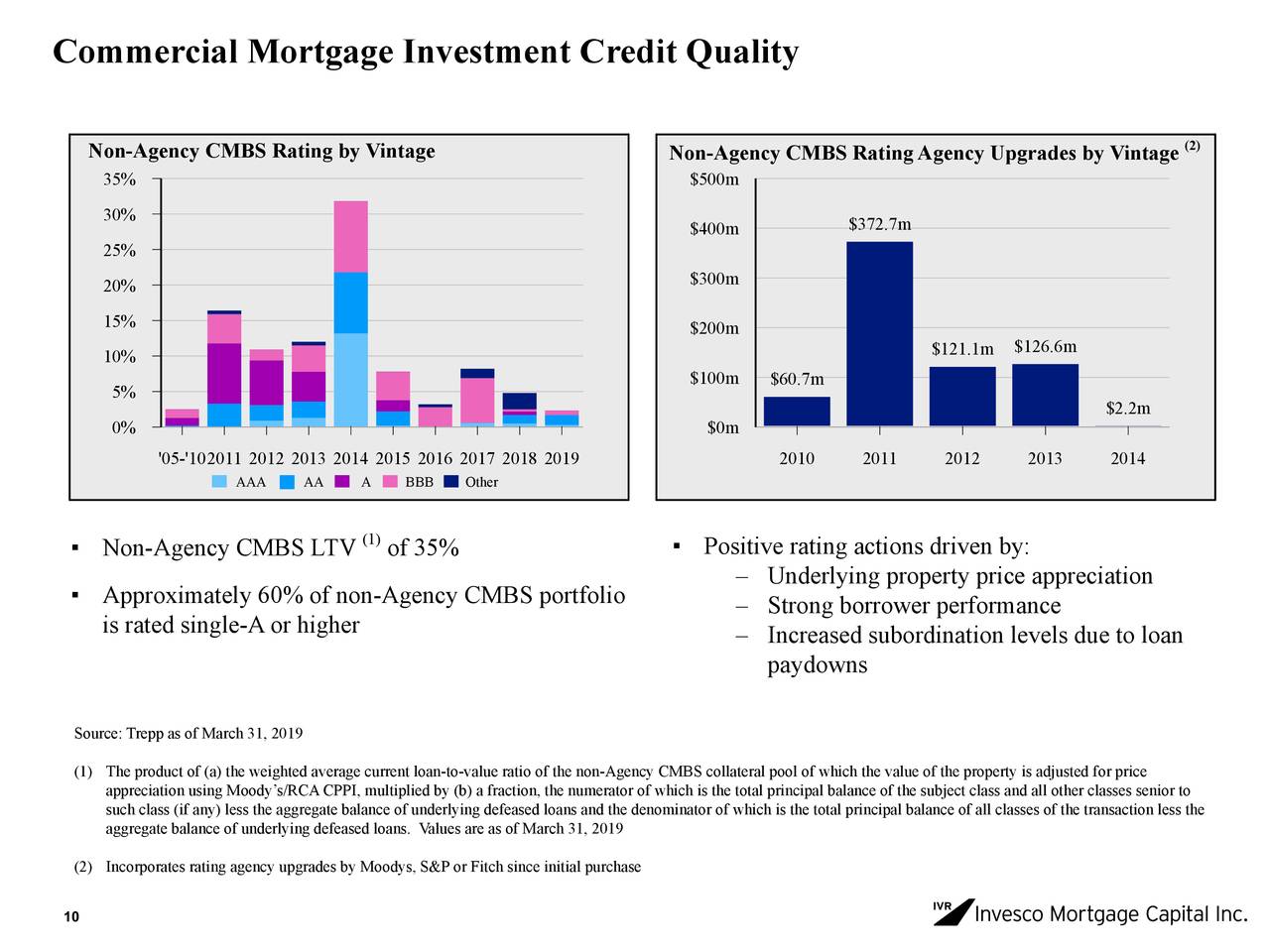

Invesco Mortgage Capital Inc. focuses on investing in, financing, and managing residential and commercial mortgage-backed securities, and other mortgage-related assets. It invests in residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS) that are guaranteed by a U.S. government agency or federally chartered corporation; RMBS and CMBS that are not issued or guaranteed by a U.S. government agency or federally chartered corporation; credit risk transfer securities that are unsecured obligations issued by government-sponsored enterprises; residential and commercial mortgage loans; and other real estate-related financing arrangements. The company was formally known as Invesco Agency Securities Inc. and changed its name to Invesco Mortgage Capital Inc. in June 2008. Invesco Mortgage Capital Inc. was incorporated in 2008 and is headquartered in Atlanta, Georgia.

Source: 2019 First Quarter Earnings Slides, page 10

On May 8th, Invesco reported first-quarter results. Q1 core EPS of 47 cents exceeded the average analyst estimate of 45 cents, and increased from 46 cents in Q4 2018. Core earnings were boosted by recent portfolio repositioning efforts, lower effective cost of funds and the deployment of recent common stock issuance proceeds into accretive investments. Q1 book value of $16.29 per common share increased from $15.27 at Q4 2018, reflecting tighter interest rate spreads across its investment portfolio. Effective cost of funds was 2.68% during Q1, down 6 basis points from 2.74% in Q4 2018 due to changes in the composition of the company’s interest rate swap portfolio. Overall, the company achieved an economic return of 9.6% for the quarter.

The company currently has $16.8 billion of repurchase agreements with 31 active counterparties and $1.65 billion of secured loans from FHLBI. Their average cost of funds increased as borrowing rates moved higher with LIBOR and financing spreads for credit assets improved. The impact of further increases in interest rates mitigated by interest rate swaps, variable rate investments and treasury futures.

High-Yield REIT No. 4: New Residential Investment Corporation (NRZ)

- Dividend Yield: 12.0%

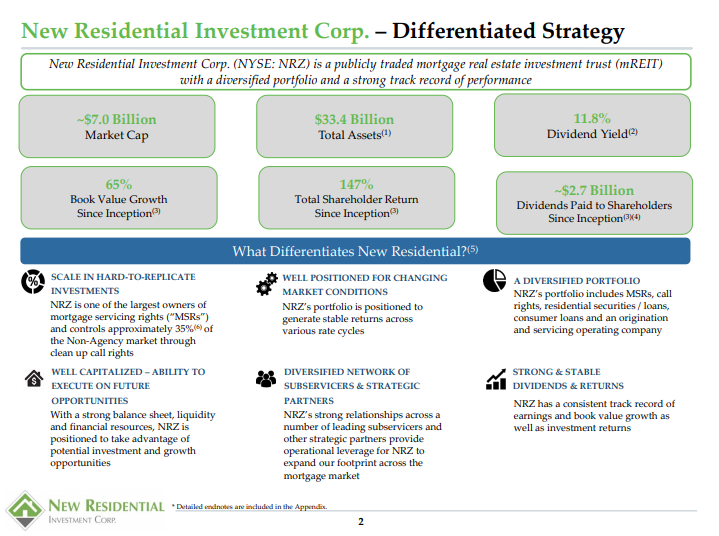

New Residential Investment Corporation is a real estate investment trust that invests in Excess Mortgage Servicing Rights (MSRs), real estate securities, residential mortgage loans, consumer loans, and other real estate-related securities. The REIT is focused on the residential real estate market. New Residential was founded in 2013 as a spin-off of Newcastle Investment Corporation, is headquartered in New York, NY, and is currently valued at $6.3 billion.

Source: 2019 Q1 Supplemental, page 2

New Residential reported its fourth quarter and full year earnings results on February 12. The company generated GAAP net income of $0.3 million during the quarter, but the significantly more important core earnings were substantially higher than that, at $208 million. This equates to core earnings-per-share of $0.58 for the fourth quarter of 2018, which was more than 5% above the analyst consensus, even though core earnings declined from an even higher level of $0.63 during the third quarter of fiscal 2018. New Residential bought $19 billion unpaid principal balance of mortgage servicing rights in the quarter. In the full fiscal year, purchased $114 billion of unpaid principal balance of mortgage servicing rights to grow its asset base. Its total unpaid principal balance of mortgage servicing rights stood at $539 billion at the end of the fourth quarter.

New Residential has grown its core profits at a strong pace over the last couple of years. New Residential’s profits declined during 2018, though, and growth will, in all likelihood, not be overly strong going forward. New Residential is not a typical mortgage REIT, as it is primarily active in the mortgage servicing rights (MSR) field. Mortgage servicing rights are paid by financial institutions that do not want to handle the mortgage loan, and that outsource the back office work in exchange for a certain amount of the unpaid principal balance of such loans. These MSRs are partially paid to the licensed mortgage service that gets the basic servicing fees, but a part of the MSR can be sold to other parties such as New Residential. These so-called excess MSRs allow New Residential to acquire a small part of the cash flows a mortgage generates for a very low price, which is why New Residential is able to generate relatively strong cash flows and earnings relative to its asset holdings. This business model requires New Residential’s management to find attractively priced MSRs, mortgage-backed securities and other assets that the company invest in to grow the portfolio, especially as existing debt securities that New Residential owns will, at one point, get paid off. During the last couple of years this has worked out very well for New Residential and its shareholders, as management has been able to grow the mREIT’s asset base fast and very profitably, but it will likely get harder for the company to find the assets it seeks as less housing starts and lower mortgage originations will limit the size of the asset base New Residential can invest in. This will likely make it harder to make accretive asset purchases during the coming years, which is why our growth estimate is relatively low. New Residential has grown its dividend relatively fast since 2013, but there was no dividend increase in 2018.

New Residential does not have a long history as a standalone company, but during the years of its existence its dividend payout ratio has been quite high during most years. The company pays out more than 80% of its earnings right now, which is why we do not rate New Residential’s dividend as overly safe. Since New Residential was only spun off in 2013, we do not have any historical data on how it performs during a major recession. Due to the nature of the assets New Residential invests in, which includes risky items such as credit-card debt and unsecured mortgages, it is appropriate to assume that New Residential’s profitability would be hit relatively hard during a steep economic downturn. Because of this, New Residential should only be held in a diversified portfolio.

High-Yield REIT No. 3: ARMOUR Residential REIT (ARR)

- Dividend Yield: 12.3%

ARMOUR Residential (ARR) is a mortgage REIT that was formed in 2008. The trust invests primarily in residential mortgage-backed securities that are guaranteed or issued by a United States government entity including Fannie Mae, Freddie Mac, and Ginnie Mae. ARMOUR has a $1.1 billion market capitalization and produces about $165 million in annual revenue.

Source: May Company Update, page 3

ARMOUR reported Q1 earnings on 4/24/19 and results were roughly in line with expectations. Cash income per share came in at 61 cents, which represents an annualized return of 13.2% based on stockholders’ equity at the beginning of the quarter. The company also issued 16.1 million shares during the quarter at an average share price of ~$20, higher than the current share price. Core income also exceeded dividends paid for the eleventh straight quarter, reflecting the sustainability of the hefty dividend yield. The company’s average yield on assets was 3.7% with a 3.9% annualized average principal repayment rate and 1.6% average net interest margin. In all, the company achieved a 4.8% total economic return, representing dividends plus change in stockholder’s equity per common share during the quarter.

ARMOUR’s cash flow has been volatile since its inception in 2008, but this is to be expected with all mREITs. Of late, a shrinking balance sheet and declining spreads have crimped the company’s ability to produce cash flow, but as stated, it is still more than able to cover its coveted dividend payment. With short-term rates still rising and long-term rates rising less quickly, spreads for mREITs like ARMOUR are shrinking. In addition, ARMOUR continues to see a slight decline in its balance sheet size, which impacts its earning asset base.

The dividend has declined enormously over time as the trust has earned less cash through the years. But the current 19 cent monthly dividend appears to be comfortable for the trust and is also highly rewarding to shareholders at the current stock price. We do not foresee another dividend cut at this point; Q1 results support this position.

ARMOUR’s quality metrics have been volatile given the performance of the trust as rates have moved around over the years. Gross margins have moved down since short-term rates began to rise meaningfully a couple of years ago, although it appears most of that damage has been done. Balance sheet leverage had been moving down slightly but it saw an uptick again this past quarter. However, we do not forecast significant movement in either direction from this point. Interest coverage has declined with spreads but also appears to have stabilized, so we are somewhat optimistic moving forward while keeping in mind the significant potential for volatility. The dividend is covered by cash flow and we foresee that continuing indefinitely. ARMOUR is not beholden to recessions so much as it is rated. However, long-term rates tend to move down in a recession, which would make it less attractive for mREITs to purchase more securities. That, in turn, would crimp balance sheet growth and thus, the outlook for cash flow growth.

High-Yield REIT No. 2: Annaly Capital Management (NLY)

- Dividend Yield: 12.6%

Annaly Capital Management, Inc., a diversified capital manager, invests in and finances residential and commercial assets. The company invests in various types of agency mortgage-backed securities, non-agency residential mortgage assets, and residential mortgage loans. It also originates and invests in commercial mortgage loans, securities, and other commercial real estate investments. Annaly provides financing to private equity-backed middle market businesses and operates as a broker-dealer. Annaly Capital Management, Inc. was founded in 1996 and is based in New York, New York.

Source: 2019 Investor Presentation, page 4

Q1 results were reported on May 1st. Net interest income declined sharply sequentially and year-over-year, while net interest margin actually improved by 2 basis points sequentially and was only down by 1 basis point year-over-year. Due to the plunging earnings, the company cut its dividend from 30 cents per share to 25 cents per share for Q2 and the remainder of the year citing the flattening yield curve and compressed spreads as the reason behind their faltering results. In the meantime, the management remains committed to delivering high-quality earnings and a stable yield without assuming excessive risk or sacrificing liquidity, which it seems to be accomplishing by holding its net interest margins steady and increasing its book value by 3% sequentially from Q4 2018.

Instability in the markets created valuation drops across the sector in 2018 highlighted by a challenging fourth quarter which put pressure on the bottom line, revealing the cyclical nature of this investment. With increasing interest rates, Annaly has seen a narrowing between interest income and expenses, as well requiring greater amounts of leverage to produce declining results. The stock price has also continued to decline as additional shares have been issued to grow their capital base without the results transferring to the bottom line. A stabilization of interest rates could help them to catch up in 2019; however, with interest rates still below long-term averages, there will be pressure to continue increasing as the economy continues to grow negatively impacting Annaly.

The advantage Annaly has over some of their mortgage REIT competitors is diversification within their income stream providing them the opportunity to pivot depending on the circumstance. That said, Annaly is very interest rate sensitive and just as it was able to benefit from the drop in interest rates through larger spreads during the last recession, it is now being challenged by increasing interest rates and compression of spreads during this rising rate period. Although it is less levered than others in the sector, we have concerns that Annaly is using more leverage to generate results and issuing additional shares to drive capital expansion, rather than growing based on increased profitability. Based on the 2018 year-end conference call, it appears Annaly will continue this strategy, which could lead to further share dilution. We also believe Annaly may be forced to cut the dividend to a more sustainable level, which would have a negative impact on share price for this dividend-driven stock. With debt ratios rising and interest rates being currently stable, but with the potential to rise further, the payout ratio will almost surely remain very high.

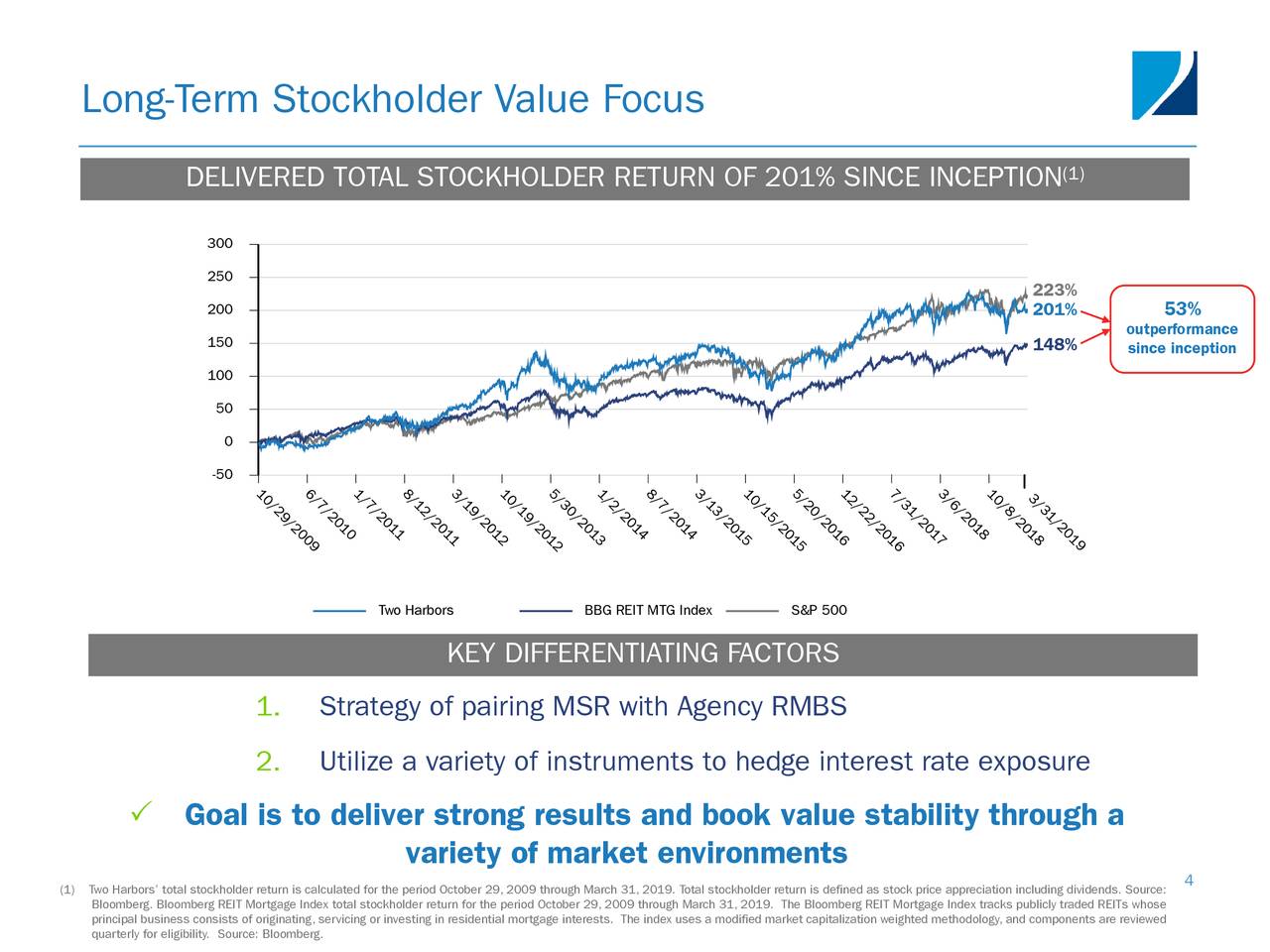

High-Yield REIT No. 1: Two Harbors Investment Corp (TWO)

- Dividend Yield: 14.2%

Two Harbors Investment Corp. focuses on investing in, financing, and managing residential mortgage-backed securities (RMBS), non-agency securities, mortgage servicing rights, and other financial assets in the United States. Its target assets include agency RMBS collateralized by fixed rate mortgage loans, adjustable rate mortgage loans, and hybrid adjustable-rate mortgage (ARMs); non-agency securities collateralized by prime mortgage loans, Alt-A mortgage loans, pay-option ARM loans, and subprime mortgage loans; and other assets, such as financial and mortgage-related assets, as well as residential mortgage loans and non-hedging transactions. Two Harbors Investment Corp. was incorporated in 2009 and is headquartered in New York, New York.

Source: Company Q1 Earnings Slides, page 4

On May 7, TWO reported first-quarter results. Q1 core earnings, including dollar roll income, was $122.7M, or 49 cents per weighted average basic share, representing a return on average common equity of 14.3%. This compares with $120.7M, or 49 cents per share, representing ROCE of 13.8% in the year-ago quarter. Book value of $13.83 per common share at March 31, 2019, increased from $13.11 at March 31, 2018, and represents a 9.1% total quarterly return on book value. TWO added $16B unpaid principal balance of MSR through bulk acquisitions and monthly flow-sale arrangements, bringing total holdings to $174B UPB and closed a new $350M MSR financing facility, bringing total MSR financing capacity to $1.1B.

Looking ahead, the company is combining Agency RMBS and MSR which it believes will generate mid-double digits at a lower risk. Meanwhile, their discounted legacy non-Agencies continue to benefit from residential tailwinds that support strong total returns. Baseline returns to lower priced bonds will come in the high single digits and upside price appreciation can drive total returns in low-to-mid double digits. As deeply discounted legacy non-Agency securities realize their upside potential, management expects to recycle capital into the best market opportunities available at the time.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more