Questioning Zoltan's Claims

Credit Suisse strategist Zoltan Pozsar (photo via Credit Suisse).

Messing With Zoltan

Credit Suisse strategist Zoltan Pozsar has become the E.F. Hutton of the 2020s: when he speaks, investors listen.

Video Length: 00:00:30

In his latest note (which ZeroHedge summarizes here), Zoltan offers ideas on how to handle the geopolitical situation impacting inflation. I think he may be wrong on two of them: his approach to globalization, and domestic energy ("re-wiring the grid"). Consider his take on globalization, for starters.

Globalization Doesn't Require A Single Hegemon

As a child of the Cold War, the Hungarian-born Pozsar dates the start of globalization to the fall of the Berlin Wall, which was the beginning of America's reign as the sole global hegemon. That leads him to this rather extraordinary passage:

Today, the assumption among investors is that globalization is Too Big to Fail…

…but globalization is not a bank in need of a bailout. It’s in need of a hegemon to maintain order. The systemic event is someone challenging the hegemon, and today, Russia and China are challenging the U.S. hegemon. For the current world order and its trade arrangements and network of global supply chains to survive the challenge, the challenge must be squashed quickly and decisively,

in the spirit of the Powell Doctrine.

Let's start at the end, with Zoltan's reference to the Powell Doctrine. Here's Wikipedia's summary of it:

The Powell Doctrine states that a list of questions all have to be answered affirmatively before military action is taken by the United States:

- Is a vital national security interest threatened?

- Do we have a clear attainable objective?

- Have the risks and costs been fully and frankly analyzed?

- Have all other non-violent policy means been fully exhausted?

- Is there a plausible exit strategy to avoid endless entanglement?

- Have the consequences of our action been fully considered?

- Is the action supported by the American people?

- Do we have genuine broad international support?

Clearly, taking on both Russia and China simultaneously fails multiple elements of the Powell Doctrine (as does our proxy war with Russia in Ukraine, for that matter). But the good news is we don't have to do this. Russia and China aren't challenging the U.S.; we are challenging them. Russia isn't arming our enemy in a war on our border; we're doing that to Russia. China isn't sending its senior leaders to an island territory claimed by us; we're doing that to them.

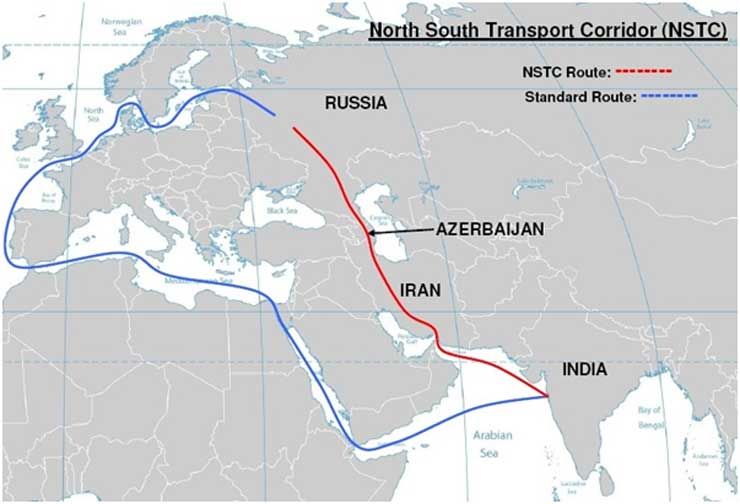

It's true that Russian President Vladimir Putin has said that the world is moving toward multipolarity, but that doesn't mean an end to globalization. Russia's North-South Transport Corridor and China's Belt and Road Initiative are efforts to expand globalization (albeit in routes that are resistant to American military or diplomatic pressure).

The International North-South Corridor

Globalization doesn't require a single global hegemon, and it of course began long before 1989. Arguably, it began with Columbus and da Gama.

The South China Morning Post has a wonderful multimedia feature on Spain's China Ships, which brought silver mined from the New World to Manilla, where they traded it for Chinese goods, which they then sold back in Europe. The key point here, with respect to Zoltan's latest note, is that while this trade was happening in the 16th Century, neither China nor Spain was subordinate to the other: there was no global hegemon.

If that example seems too dated for you, recall that there was plenty of global trade during the Cold War when the world had two superpowers, the U.S. and the Soviet Union. But there's no good reason for us to have another Cold War now. Russia is no longer communist, and neither Russia nor China are ideological empires. The U.S. is the last ideological empire. We can stop being that, and focus on improving the living standards of Americans. We can respect Russia and China's respective spheres of influence as we expect them to respect ours, and we can coordinate with them in maintaining global order against pirates, terrorists, and rogue states.

The Four Pillars of Pozsar's Industrial Policy

Pozsar says America's industrial policy over the next several years will have to have four main components:

- Re-Arming

- Re-Shoring

- Re-Stocking

- Re-Wiring the Electric Grid

Re-shoring key industries such as microchip fabrication from Taiwan to the U.S. and re-stocking commodities such as the oil President Biden has been selling off from the Strategic Petroleum Reserve makes a lot of sense. As for re-arming, Zoltan notes how U.S. stores of artillery shells and other armaments have been depleted in Ukraine. One way to stop that depletion that Zoltan doesn't suggest is to end the Ukraine War. Others are starting to suggest it though, e.g.,

My column in The Mail on Sunday today. pic.twitter.com/UK46kkrdu0

— Peter Hitchens (@ClarkeMicah) August 28, 2022

It really doesn't seem like Europe in particular has time to wait for Zoltan's five-year plan.

The Western strategy appears to be:

— Philip Pilkington (@philippilk) August 28, 2022

“Turn yourself into a late Soviet Union-style basket case to prove to Russia how powerful you are.”

It’s a look… I guess…https://t.co/c8X0Hf4nmb

Also, with respect to re-arming, it's worth noting we already spend more than double on our military than what Russia and China spend combined.

A reasonable, moderate position on American defense spending would be to cap it at what Russia 🇷🇺 and China 🇨🇳 spend combined. pic.twitter.com/FQWaX9jL4D

— David Pinsen (@dpinsen) August 24, 2022

But let's move on to the last one, "Re-Wiring the Electric Grid". What does Zoltan mean by this? He doesn't elaborate much, beyond a parenthetical mention of "energy transition", but a search of the phrase "re-wiring the electric grid" takes me to this page from the progressive think tank Center For American Progress, and that links to a paper on their Clean-Energy Investment Agenda.

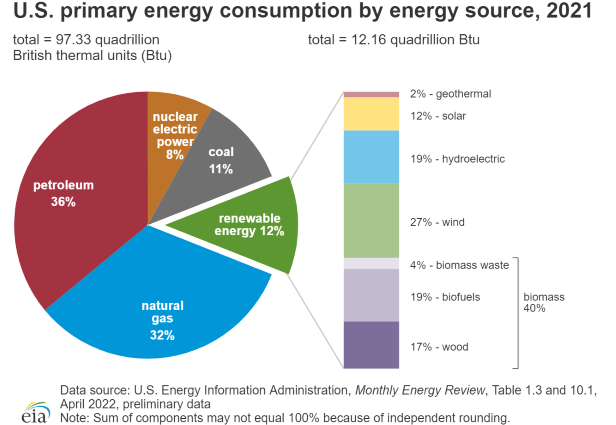

Someone should try to pin Zoltan down on this because unless the "energy transition" he has in mind is to nuclear power, it's going to lead to more shortages and higher prices ("Nuclear" does not appear once in Zoltan's latest note, but "wind turbines" does). There's simply not enough green, "renewable" energy to move the needle.

The Big Picture

Inflation is too much money chasing too little stuff. A big part of the reason there's too little stuff now is that we are sanctioning the world's largest supplier of stuff (oil, steel, coal, natural gas, wheat, etc.), Russia. Another reason is the West's own misguided green energy policy.

Excellent article on how the green cult caused the imminent recession/depression. Most people still have no idea how bad things will be in six months. https://t.co/KoKLaCHvx3

— Luke Johnson (@LukeJohnsonRCP) August 27, 2022

We can stop sanctioning Russia, and stop pursuing quixotic green energy policies. Of course, there's little chance we're going to do either under our current leadership, so Zoltan is probably right that inflation will be here for a while.

Investment Implications

If oil and gas are in demand, it would seem logical to invest in them, and the companies that produce them. Since we added a new factor to our security selection algorithm in June, oil and gas names have often been in our top ten. For example, these were our top ten names on June 24th, the first top names cohort to include the new factor.

Image via Portfolio Armor on 6/24/2022

Here’s how they’ve done, as of Monday’s close:

On average, our top names were up 28.27%, versus 3.22% for SPY.

Later top names cohorts have included bearish bond ETFs and other securities with the potential to do well in an inflationary period. As always, though, please consider hedging if you buy any of our top names. Each of them is cost-effective to hedge, as that's part of the screening process for them.

More By This Author:

Nord Stream 2 And The Ukraine War

Who Is Shelling The Zaporizhzhia Nuclear Power Plant?

Top Names Update

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more