Q4 GDP Growth Expected To Be 0.39%

Weak Industrial Production Growth

October industrial production growth was weak even if you don’t include the weakness caused by the GM strike. More than 2/3rds of manufacturing sub-sectors were in contraction. This the broadest, but not the deepest manufacturing recession of this cycle. It’s not as deep because energy prices didn’t collapse.

Yearly mining growth was 2.7% which is much above the trough of -12.4% in 2016. Growth will crater in December and January when it faces very tough comps, but I doubt it will come close to surpassing the decline last cycle which was worse than the 2007-2009 recession.

Specifically, industrial production fell -0.8% monthly which missed estimates for -0.4%. September’s growth was revised up slightly from -0.4% to -0.3%. Yearly growth was -1.1% which was the worst growth since September 2016. Growth troughed at -4.1% in December 2015. I don’t expect growth to trough that low this cycle since energy prices haven’t cratered. Credit Suisse forecasts industrial production growth will trough in Q4 2019.

It’s obvious with the rally in stocks that investors are betting on a turnaround in 2020. These results apparently don’t matter as investors are extremely confident that whatever is ailing the economy now won’t do so next year. Good news is fewer countries are seeing below-trend growth, central banks around the world have cut rates. And there might be a trade deal soon.

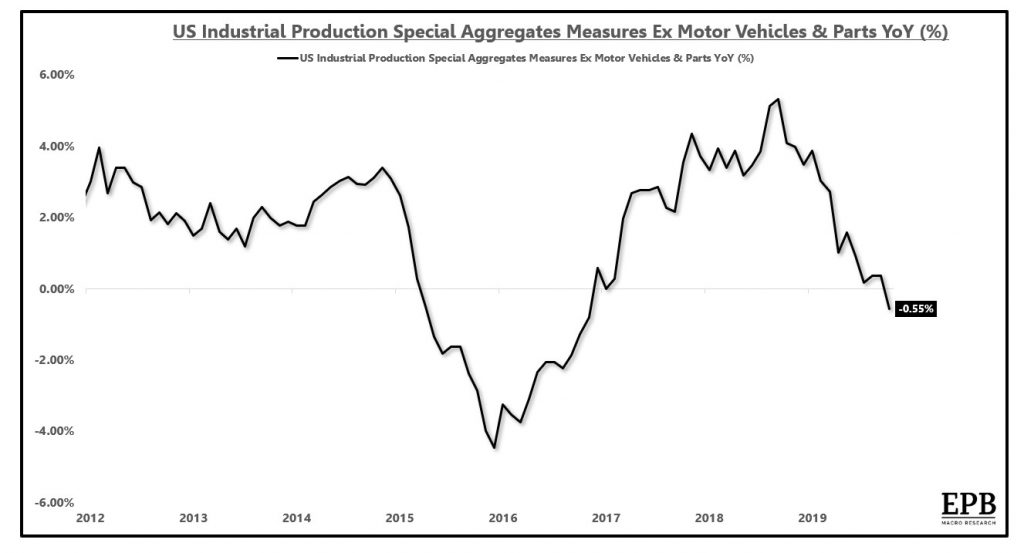

As you can see from the chart below, yearly industrial production growth excluding motor vehicles was -0.55%. Growth wasn’t as bad without the GM strike, but it was still negative. Yearly motor vehicle parts and production fell 11.8%.

(Click on image to enlarge)

Monthly manufacturing growth was -0.6% which missed estimates by one-tenth. Capacity to utilization rate fell from 77.5% to 76.7% which missed estimates for 77.2%. That was the worst monthly decline since March 2009. Yearly manufacturing growth was -1.5% which was the lowest growth since May 2016. The bottom last manufacturing recession was -2% in November 2015.

Yearly business equipment production growth was -2.5% which still isn’t close to the previous cycle trough of -7%. Utilities growth was -4.1% partially because of the weather. November has been a cold month with many record low temperatures in the northeast, so growth might improve in the next report.

Finally, industrial production of consumer goods fell 2.2% which was one of the weakest readings of this expansion. Weakest was this April at -2.8%. This category isn’t cyclical as the others. This could have been a blip.

Review Of Retail Sales 2 Year Growth Stacks

Growth did fall in the October retail sales report, but the October comp was responsible for that decline. Let’s review how the comp impacted the 2-year growth stacks. Yearly retail sales growth excluding food services fell from 3.8% to 2.9%. The comp got harder by 1%. So the 2-year growth stack actually improved by 0.1%.

Yearly growth with food services fell from 4.1% to 3.1%, while the comp git harder by 0.9%. That means the 2-year stack only fell 0.1%. Finally, real retail sales growth fell from 2.3% to 1.3%, while the comp got harder by 0.7%, so the 2-year growth stack fell 0.3%. This inclusion of the 2-year growth stack makes the retail sales report look better.

It was an ok report, rather than a bad one. This is important to keep in mind as December faces a very easy comp which should mean growth will spike. If growth increases slightly, that is bad news. We should see mid single-digit yearly nominal growth (4% to 6%).

Some GDP Growth Estimates Are Below 1%

It’s 100% clear that traders don’t care about Q4 GDP growth as stocks have rallied even though GDP growth estimates have slipped. To be clear, I think GDP growth will be above most estimates because I see the consumer having a strong holiday shopping season. Just because October saw a decline in yearly growth, doesn’t mean the consumer will be weak.

Plus, we should consider that industrial production growth would have been a bit better without the GM strike. Let’s not assume a disaster for the next 2 months of this quarter.

As you can see from the table below, estimates are for a fairly terrible quarter. JP Morgan’s estimate fell from 1.75% to 1.25%. Oxford Economics expects a 1.3% growth. It lowered its consumer spending estimate from 2.9% to just 1.4%. Tracking estimates don’t take context into effect. If there’s a one time impact, the tracking estimate won’t consider that. This explains why they can have big changes.

NY Fed’s estimate fell from 0.73% to 0.39%. The retail sales report oddly helped this Nowcast. That must be because the estimate for consumption growth was already very low. That must be why the estimate from last weak was one of the lowest. The industrial production report hurt this week’s estimate by 0.48%. I’m personally expecting business investment to be negative again this quarter.

(Click on image to enlarge)

Even the usually extremely optimistic St. Louis Fed Nowcast sees just 1.5% growth. That shows you how weak the October numbers imply growth will be. Many expect growth to beat that estimate, but I wouldn’t call myself a big bull on Q4 growth. I see it coming in between 1.5% and 2%. That still doesn’t justify the rally this fall. Stocks are pricing in a recovery next year. No one thinks real GDP growth will be strong this quarter.

Finally, the Atlanta Fed’s estimate fell from 1% to 0.3%. The latest economic reports caused the estimates for real consumption expenditures growth and real gross private domestic investment growth to fall from 2.1% and -2.3% to 1.7% and -4.4%. If business investment growth really falls 4.4%, it would be terrible.

This time economists don’t see the consumer bailing out the rest of the economy like it has in the past 2 quarters. It’s almost as if traders are hoping for a bad Q4 report, so the economy has room to recover next year. Personally, I think traders are ignoring this quarter as it’s highly unlikely growth comes in above 2.5% which would justify the current rally.

Disclosure: None.