Proprietary Strategies, May 28

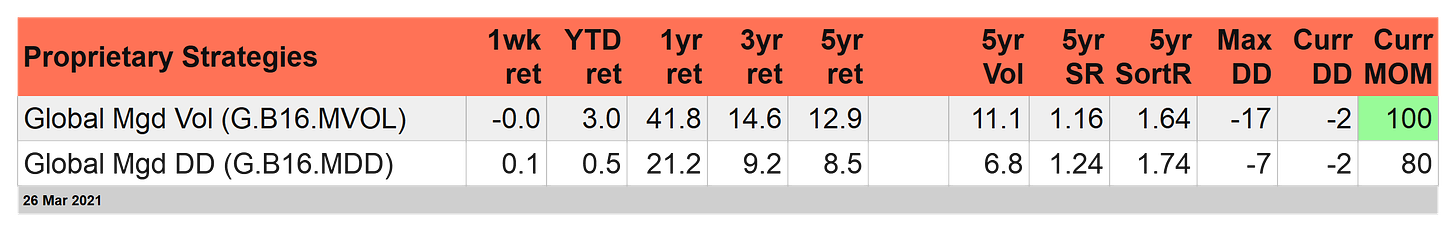

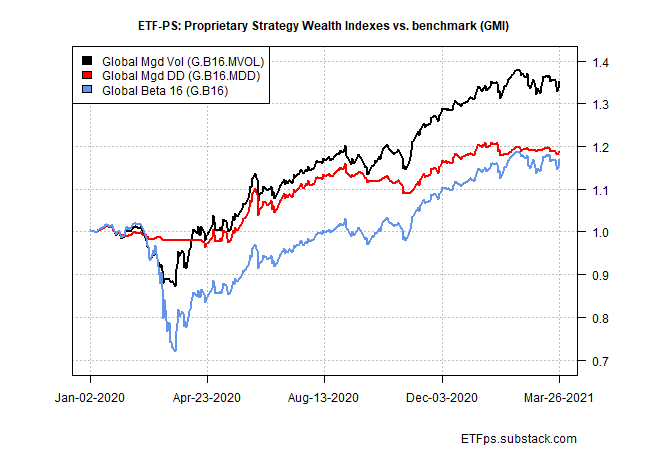

Mixed performances for the global markets last week kept our proprietary strategies essentially unchanged for the week through Friday, Mar. 26. Nothing to brag about, but at least it’s better than the previous week’s sharp declines.

Global Managed Volatility (G.B16.MVOL) was off by the thinnest of fractions last week, which left the strategy with a respectable 3.0% year-to-date gain.

Global Managed Drawdown (G.B16.MDD) edged up 0.1% for the week just passed, boosting it’s 2021 total return slightly to far less impressive 0.5%.

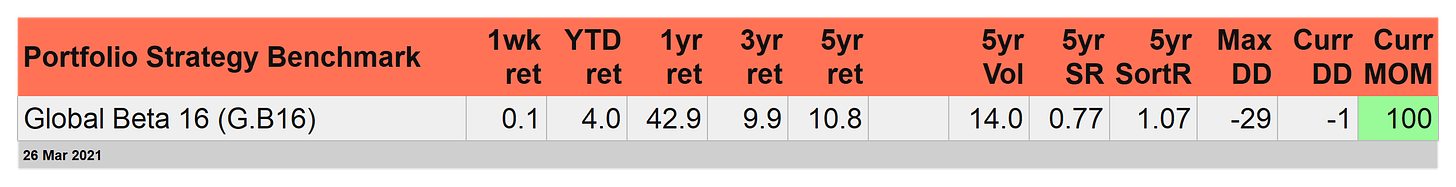

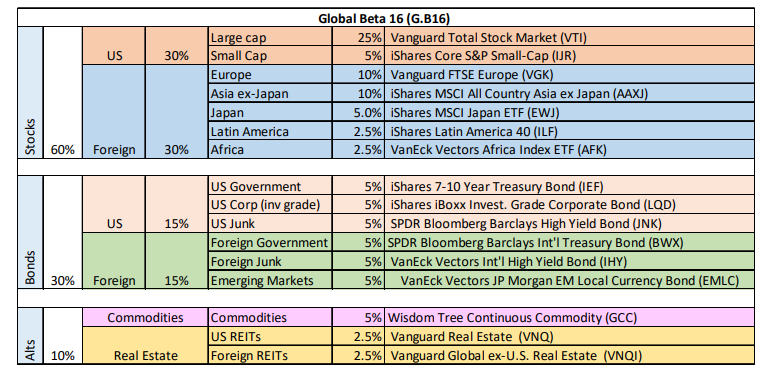

The benchmark – Global Beta 16 (G.B16) was also up 0.1% last week. Year to date, G.B16 is in the lead via a 4.0% return.

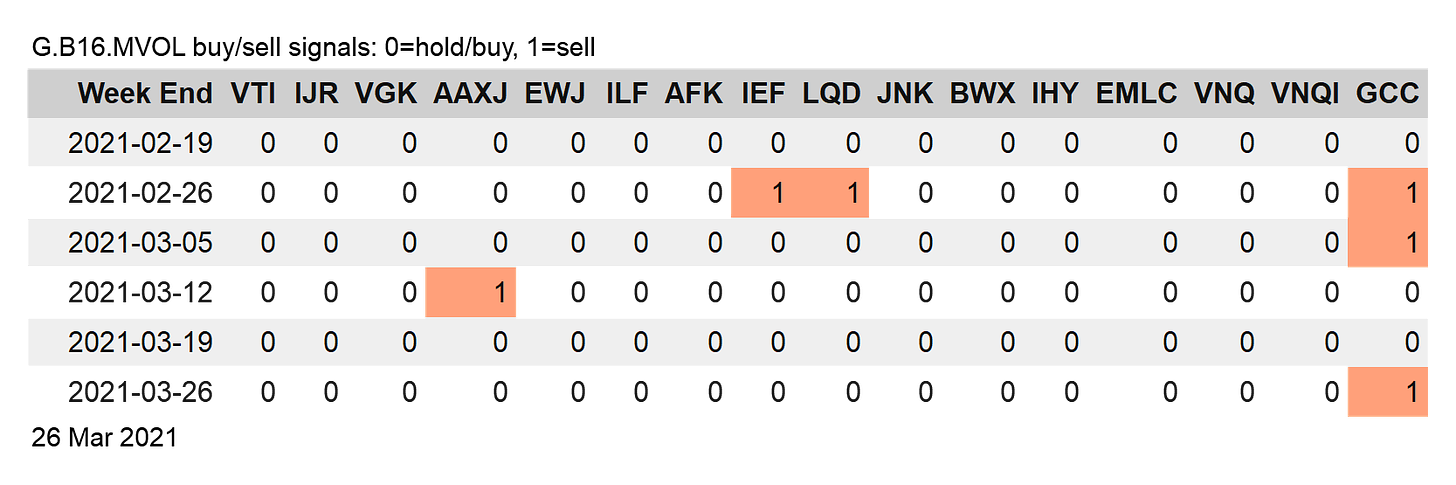

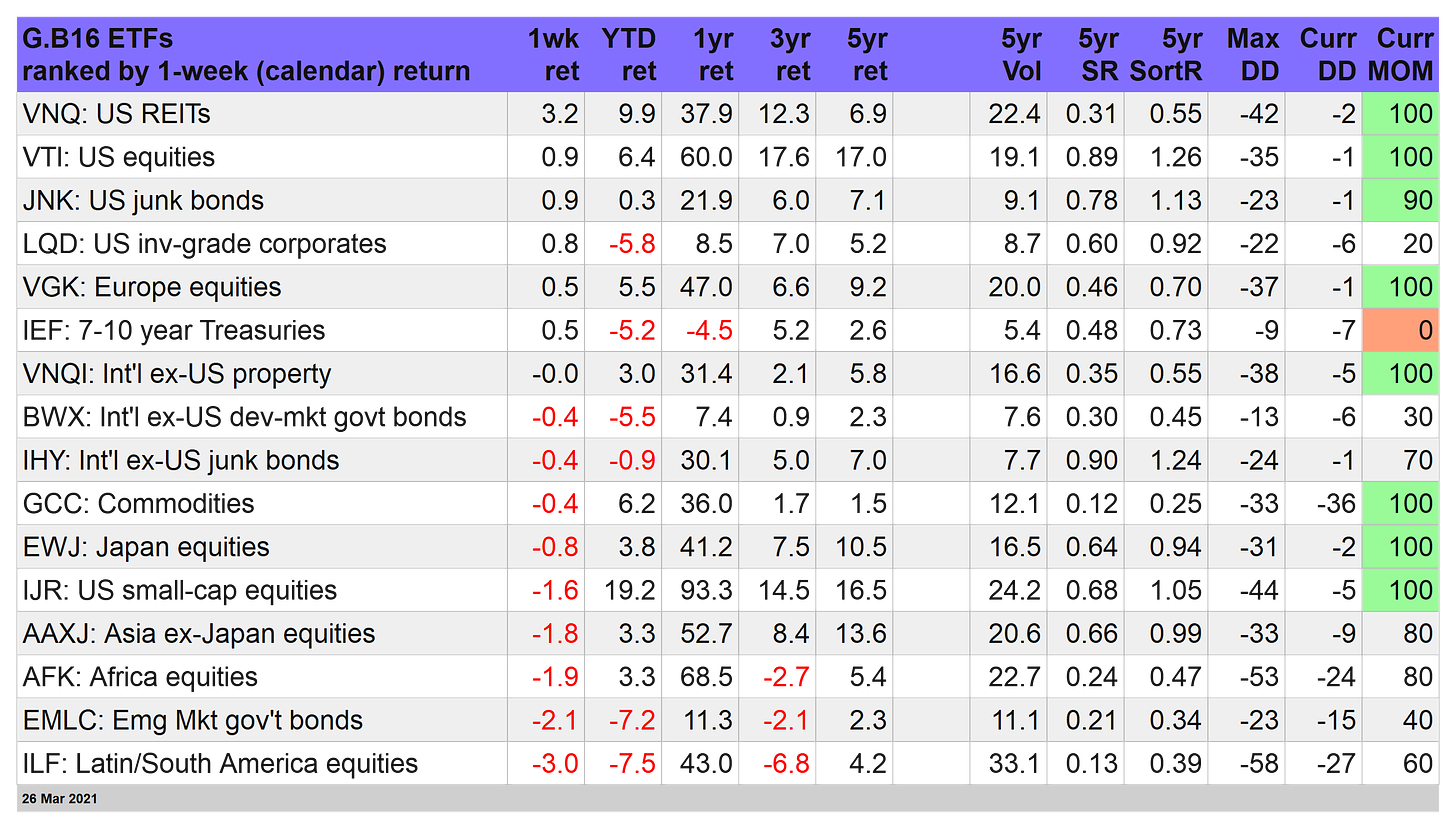

For the revised risk allocations for the strategies as of Friday’s close, G.B16.MVOL remains nearly all risk-on vis-à-vis its fund holdings. The one change is for commodities (GCC), which switched to risk-off. Otherwise, it’s still risk-on for the rest of the holdings.

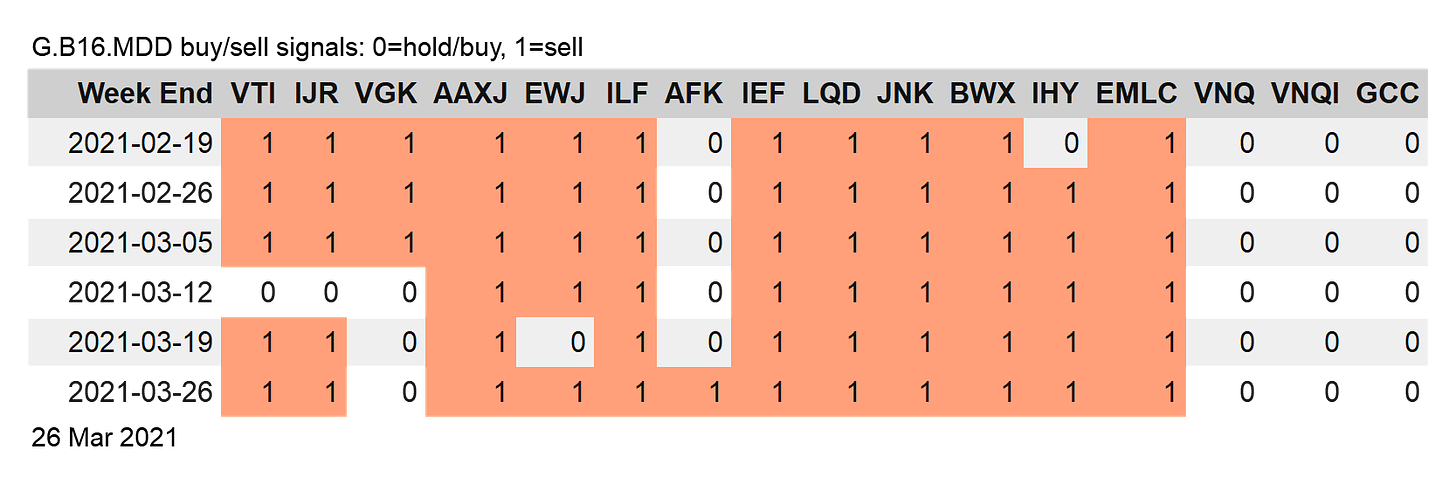

G.B16.MDD, on the other hand, remains heavily weighted toward risk-off. That hasn’t been productive this year, at least not so far. In any case, there’s a new risk-off position via iShares MSCI Japan ETF (EWJ), which brings the risk-off total to 12 out of 16 fund buckets held in cash (SHV).

Overall, the proprietary strategies continue to grind away in trading range, echoing their G.B16 benchmark, which holds the same 16-fund opportunity set sans tactical adjustments. For details on strategy rules and risk metrics, see this summary. ■

Disclosures: None.