Procter & Gamble: We Expect Solid Returns From This Dividend King Ahead

Procter & Gamble (PG) is one of the largest consumer goods companies in the world. This giant with a long and successful history has turned into a well-liked income stock among retail investors, due to its stability and its track record of raising its dividend for more than fifty years in a row.

Procter & Gamble should continue to produce solid total returns and consistent dividend growth under the helm of CEO David Taylor, but due to its above-average valuation we believe that investors should wait for slightly better entry prices before establishing a position.

Company Overview

Procter & Gamble was founded in 1837 and is headquartered in Cincinnati, Ohio. The company operates through the following segments: Beauty, Grooming, Health Care, Fabric & Home Care, and Baby, Feminine & Family Care. Its portfolio includes major global brands such as Pampers, Tide, Ariel, head & shoulders, Gillette, Oral-B, and many more.

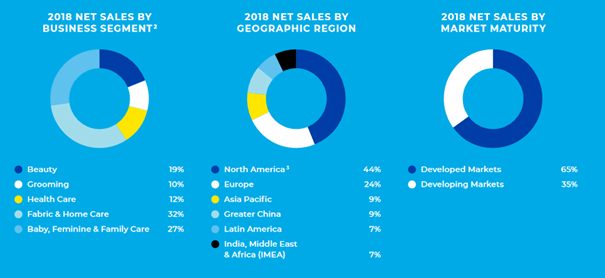

Source: Procter & Gamble investor presentation

Procter & Gamble is well diversified across its different segments, with none of its operating units providing more than a third of all revenues. Geographically, less than half of the company’s sales are made in North America, with the rest of the world being responsible for more than half of Procter & Gamble’s revenues. A large portion of ex-US revenues makes Procter & Gamble somewhat vulnerable versus currency rates (a strengthening dollar is a headwind for reported results), but on the other hand Procter & Gamble is not dependent on one single market to a large degree.

Procter & Gamble has reported its most recent quarterly results on October 19. The company generated revenues of $16.7 billion during Q1 (fiscal 2019), which was marginally more than Procter & Gamble’s revenues during the previous year’s quarter. Organic net sales growth, which excludes the impact of currency rates as well as the impact of acquisitions and dispossessions, was quite solid, at 4%. Procter & Gamble also earned $1.12 on a per-share basis, which was 3% more than during the previous year’s first quarter. Overall results were solid, and better than what the analyst community had forecasted, but Procter & Gamble’s Q1 results were not overwhelming.

Growth Prospects

Due to being active in non-cyclical, lower-growth industries Procter & Gamble does not generate massive sales growth rates. The stable demand for the products that Procter & Gamble sells is a positive during times when the economy is not doing well, as Procter & Gamble is not hurt a lot during recessions, unlike companies which are active in more cyclical industries. Procter & Gamble is, on the other hand, not able to grow its top line massively during times when the economy is doing well, as consumers do not increase their spending on non-cyclical consumer goods such as washing powder when their disposable income rises.

Procter & Gamble has grown its earnings-per-share by ~2% annually over the last decade, which was a quite weak growth rate. During these times Procter & Gamble endured a strategic repositioning that included the sale of many business units and brands with low or even no growth, and where margins were not high enough for them to be attractive. Procter & Gamble has lowered its brand count by two-thirds over the last decade, and is now positioned in fewer markets, but with a more focused and more attractive portfolio of brands and products. This should lead to somewhat higher growth rates going forward.

Through inflation, some growth in the amount of goods that Procter & Gamble sells (due to market share gains and/or growth in the underlying market) and the impact of operating leverage (rising margins) and share repurchases, Procter & Gamble should be able to grow its earnings-per-share at a mid-single digits pace going forward, we believe. Procter & Gamble guides for earnings-per-share growth of 5.5% during fiscal 2019, which shows that a ~5% long-term earnings-per-share growth rate seems like a realistic assumption.

Valuation, Dividends, And Expected Returns

Procter & Gamble trades at $92 right now, which means that shares are valued at roughly 20.7 times 2019’s expected net profits right now. Unlike the broad market, which has declined substantially over the last couple of months, Procter & Gamble’s shares are trading at a slightly higher price than they did one year ago, and just a couple of percentage points below the 52-week high. Procter & Gamble’s current valuation seems relatively high, as Procter & Gamble is not a high-growth stock, and yet the company’s shares trade for more than 20 times this year’s net profits. Procter & Gamble’s stability during recessions and troubled times is a reason for a premium relative to how shares of other low-growth companies are valued. Over the last decade its shares have been trading at ~19 times profits on average, which means that shares look slightly overvalued compared to the historic norm.

Procter & Gamble’s dividend yields 3.2% right here, which is roughly one and a half times as much as the broad market’s yield. Procter & Gamble has made three dividend payments at $0.717 per share, which means that the company will most likely raise its dividend in the foreseeable future (usually Procter & Gamble raises the payout in April). Last year Procter & Gamble increased the payout by 3.9%, which is roughly twice as much as the rate of inflation.

Through a combination of earnings-per-share growth, partially offset by multiple compression towards the historic norm of a price to earnings ratio of 19, and through its dividend Procter & Gamble should be able to produce total returns of roughly 6%-7% annually going forward from the current level.

Final Thoughts

Procter & Gamble is a consumer goods giant that has a successful track record. The company is not a high-growth company, but could still produce solid total returns. We think that buying shares below our fair value estimate of $84 is attractive, whereas shares look more like a hold in the low-$90. The above-average valuation will be a headwind for Procter & Gamble’s total returns over the coming years, but returns should still be solid, and Procter & Gamble is a low-risk investment that provides stability to a portfolio during times when the market is shaky.

Disclaimer: Modest Money is designed to provide entertainment and information to investors and those who would like to learn about the market, personal finance, loans and more. You should never ...

more