Price To Sales Ratio

Rounding out the fundamental analysis series, we are now going to look at the Price to Sales Ratio, what it is, and how it might be helpful in evaluating an investment.

What is the Price to Sales Ratio?

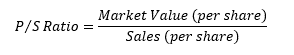

The Price to Sales Ratio (P/S Ratio) may also be referenced as a sales multiple or revenue multiple.

Similar to the Price to Book (P/B) Ratio, it compares the market price of a company to another fiscal number, in this case, sales, to help investors when comparing companies, they may want as an investment.

Again like the P/B Ratio, you can take the market capitalization of a company (its share price times the number of outstanding shares) and divide by overall sales.

Alternatively, you could take the market share price and divide it by sales per share.

In this case, sales would be over a specific timeframe, usually one year or 12 months.

Generally, one would use the past four quarters, also referred to as the trailing 12 months (TTM), but may also use the most recent or current fiscal year (FY).

For example, if Company XYZ had a share price of $20 and it had 1 million shares outstanding, its market capitalization would be $20 Million.

If XYZ had TTM sales of $5 Million, its Price to Sales Ratio would be 4.

We would get the same answer if we took XYZ’s share price of $20 and divided it by the sales per share.

$5 Million in TTM sales divided by 1 Million outstanding shares = $5 of sales per share. $20 / $5 = 4.

Putting the P/S Ratio to Use

Numbers don’t live in a vacuum, and one number doesn’t necessarily tell you much.

However, if you know what the average P/S Ratio is for a given industry, you could compare a company’s P/S Ratio to the average to determine whether it may be overvalued or undervalued.

You may see that one company has a premium added to its P/S Ratio when compared to other peers in its sector, and take that information to do a deeper dive to determine why that might be.

Is that company expected to have larger growth than its peers, thereby justifying the premium, or is something else causing it to be otherwise overvalued?

Sales Don’t Equal Earnings

Keep in mind, a company may have large numbers in sales but still may not make earnings.

The P/S Ratio doesn’t account whether a company is currently making – or will ever make, for that matter – any earnings.

Startups, for instance, often have zero or negative earnings the first few years or longer.

One prominent example would be Tesla: founded in 2003, it had negative earnings through 2019. Yet looking at 2018, Tesla had over $21.4 Billion in sales.

Other Considerations

The P/S Ratio doesn’t account for debt loads, so it’s possible that two companies may have the same P/S Ratio, but one company has a tremendous debt load while the other does not.

When P/S Ratios are the same, the company with little to no debt is more attractive than another company with large debts.

For that reason, another ratio, Enterprise Value to Sales Ratio (EV/S Ratio) is said to be superior as it does take debt into consideration.

However, calculating it involves more steps and isn’t always easily available. You could use one of the other metrics we discussed in this series; such as the Debt to Equity Ratio, the Current Ratio, or Quick Ratio; to help gauge a company’s handle on any potential debt.

Conclusion

As we’ve seen with the other metrics we discussed in fundamental analysis, one cannot just calculate a number and expect to be able to compare companies across sectors or industries.

They are most useful for comparing peer groups to determine if one company is better than another.

Also, one metric alone is usually not enough to definitively conclude anything about a particular company.

Oftentimes, multiple metrics must be evaluated and compared, and more investigation is needed before a clear “winner” can be chosen.

However, for investors interested in longer-term investment opportunities, the proof is in the pudding.

Taking some time to investigate whether a company is overvalued or undervalued, how solvent the company is, along with growth potential, can have a positive impact on the bottom line of your portfolio.

After all, that is why you got into investing to begin with, isn’t it?

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more