Post-CPI Analysis - Friday, June 11

Below is a summary of my post-CPI tweets.

- It’s #CPI day again! Welcome to my data walk-up. And a special welcome to all the new followers this month. I can probably plot new followers as an indicator of interest in the subject of inflation.

- As the inflation guy, I ALWAYS look forward to this day but this is one that is going to be a lot more-widely watched than most. And for good reason.

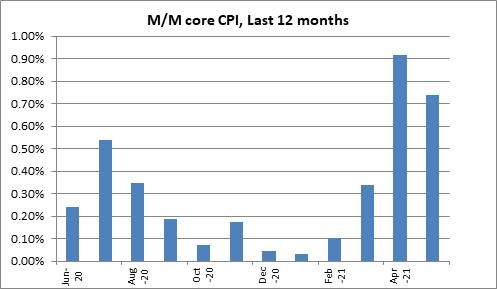

- Last month, core CPI shocked everyone with a +0.92% m/m reading, the highest in 40 years; the y/y core was the highest in a quarter-century. And this month, the y/y core will rise to the highest level since the early 1990s. Only question is what year in the early 1990s.

- That’s baked in the cake; the comp from last May was -0.07% so core will rise today, by a lot. Consensus is +0.5% m/m, pushing y/y to ~3.5%. The inflation swaps market is slightly above that, more like 0.6%. And the swaps market has been right on the last couple of surprises.

- Before we relitigate last month’s print, let’s actually look to the PRIOR month, the March figure that dropped [ed. note: meaning, “was released”, not “declined”] in April. With last month’s fireworks we forget that March’s number (+0.34% m/m on core) was also a surprise. Moreover, it was a BROADER surprise.

- The March CPI was NOT flattered by airfares and used cars, which were the main culprits from last month. Nor by rents. It was due to large moves in small components that no one was expecting to see jump.

- Honestly we could see last month’s jump coming (maybe not that much). March was a true surprise.

- THAT is the story we need to be watching behind the fireworks. The Enduring Inflation Diffusion Index, meant to measure the breadth of inflation pressures, last month reached the highest level since 2012.

- The Fed can write off Used Cars as “transitory.” But it’s less plausible that EVERYTHING is transitory.

- (At some level, “Transitory” doesn’t really mean anything useful unless you specify the period.

- So now moving forward to April’s figure last month. Used cars and airfares were both up more than 10% m/m. Lodging Away from Home rose 7.65% m/m. And that was the reason for the massive move.

- Spoiler alert: last month’s rise in Used Cars CPI is only a fraction of what is still coming. See chart of the Black Book index vs the CPI for Used Cars.

- Does that mean we will get another 10% rise in Used Cars this month? It actually could be worse (although the rise in the data could also smear over several months). This is why it’s not heroic to forecast 0.5% m/m on core CPI. Can get there easily.

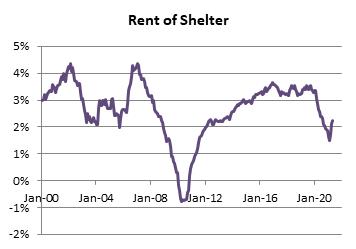

- Airfares and Lodging Away from Home should also see upward pressure but there are more zigzags there. But what I really want to look at are Primary Rents (you are a renter) and Owners’ Equivalent Rent (you own your home).

- The eviction moratorium, which by my estimate is dampening overall core CPI by around 0.9% through the medium of rents and OER, is still in place. So we DON’T have an a priori reason to look for a rental jump. Thus if we get one – it will be caused by something else.

- That something else is that as the country has opened up, and people have been moving hither and yon, rents have been jumping (along with home prices) even more than before. And some of that might find its way into the CPI. It probably should.

- Without housing turning higher, it’s hard to sustain big inflation figures. But rents are going to turn higher, just not clear exactly when.

- And of course, I’ll be looking at the broader pressures down the stack to the little stuff. That’s where the high cost of containers, plastics and packaging, freight, and the shortage of labor (among many other things) is going to show up.

- MY GUESS is that rents stay tame with just a little uptick, used cars are still strong, we see a little strength from new cars as well, and we get another above-consensus number. I can come up with scary scenarios for this print. It’s harder to come up with gentle ones.

- Well it should be a barn-burner. Up until now, the Fed hasn’t cared. Last month got them to talk about talking about someday maybe not doing as much QE. Another month might accelerate that talking about talking. Especially if it’s more than Used Cars.

- But the comps get “harder” for the next 3 months; Jun-Aug 2020 were +0.24%, +0.54%, and +0.35% on core CPI. So we’ll need the strength to last into the fall before the Fed gets truly nervous. And I still think the clear majority doesn’t put inflation as a serious priority.

- It’s up to the bond vigilantes to push the Fed to being more serious about inflation. But the bond vigilantes are enjoying the “Greenspan put” equivalent in the bond world.

- Buckle up! That’s my walk-up. Number is out in a few.

- Surprise! It’s a surprise. 0.7% on core.

- Actually 0.74% m/m on core, for those who still care about hundredths! Y/y is 3.80%.

- Core highest since June 1992.

- Lagarde comments that inflation pressures in Europe remain subdued. READ THE ROOM!

- Used cars +7.29% m/m. OER +0.31%. Primary Rents +0.24%. Airfares +6.98%. All of those are m/m.

- Used Cars…still could have more to go!

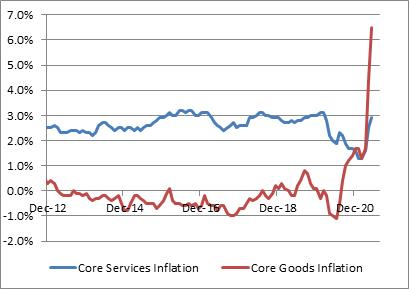

- Another month of changing the scale on my charts. Here is core goods and core services. Core goods (used cars) is getting the play but don’t ignore the recovery in core services.

- That rise in core services is with Medical Care very very soft. Pharma (which is core goods) was -0.08% m/m; Doctors’ Services -0.03%; Hospital Services +0.16%. This remains a real conundrum.

- Apparel was +1.22% m/m. Now, apparel is only 3% of the overall CPI, but I think we’re seeing the effect of shipping costs here since most apparel is imported.

- The small rise in rents was in line with my expectation. But we haven’t yet seen any of the real jump to come when the eviction moratorium is ended.

- Core CPI ex-shelter was +4.94% y/y. That’s something we haven’t seen since 1991. Of course, that’s also mostly cars at this point. Need to get further down the stack to see how broad it is.

- It probably though IS worth noting that the rise in core-ex-shelter isn’t compensating for a prior collapse. It dipped some in early COVID. But we’re way beyond that.

- I’d also mentioned expecting to see some participation in new cars. Here is y/y. Partly this is rise in the price of a substitute, part is increased costs (from plastics and rubber to steel).

- Rise in New Car prices is a little harder to explain away than used cars, which is spiking partly because of 2020 rental fleet shrinkage, which leaves the supply of used cars tight.

- Car and Truck Rental: tiny category but visceral. +10% m/m. If you’re traveling this summer and haven’t rented your car yet…you may already be too late. It’s hard to find them.

- Domestic Services +6.42% m/m NSA. Moving/storage/freight expense (from consumer’s perspective) +5.5% m/m NSA, +16.2% y/y.

- Early look at Median CPI, which gives a better look at pressures without outliers…my estimate is +0.32% m/m. That would be the highest in two years if I’m right. Median is never going to be as volatile as core, but we don’t want to see it +0.3% m/m regularly.

- Key point about median and core though: in a disinflationary environment core will generally be below median. In an inflationary environment, it will generally be above. So if we’re shifting environments so all the tails are higher, then the core/median switch will persist.

- My first glance at 10y breakevens since the number finds them +4bps on the day. They’ve been under pressure recently, I suspect less because people thought this would be a soft number and more because they’re looking for higher-inflation-beta products like commodities.

- As a brief aside, I think people underappreciate what breakevens could do if there is a movement in investor allocations. There’s nearly $2 Trillion of TIPS outstanding. But the FLOAT is nowhere near that. When they’re gone, they’re gone.

- Let’s see: rents tame with a little uptick. Check. Cars still strong. Check. a little strength from new cars as well. Check. Another above-consensus number. Check!

- Let’s see. Biggest losers and gainers. No category had an annualized decline more than 10%. But above 10%: Infants/Toddler’s Apparel, Motor Vehicle Parts & Equipment, Meats Poultry Fish & Eggs, Household Furnishings and Equipment, Footwear, Women’s & Girls’ Apparel, (more)

- Fuel Oil & other Fuels, Jewelry & Watches, Public Transportation, Used Cars and Trucks, Car and Truck Rental, Leased Cars and trucks.

- Haven’t run this chart in a few months. Shows the distribution of lower-level price changes, y/y. The big middle finger is mostly OER. But look at not just the far right tail but the group between 3% and 5%.

- Just a couple more items here. The diffusion index and then four-pieces. The Enduring Investments Inflation Diffusion Index rose to its highest level since 2012 today. Another way to look at the broadening of price pressures.

- We will do the four-pieces charts and then wrap up. The four-pieces charts is a simple way of looking at the drivers of inflation. Each of the pieces is very roughly 1/4 of the index (20%-35% actually). But it puts like-with-like.

- …and they’re also in roughly volatility-order. First, Food & Energy. BTW a lot of this is food for a change. Food inflation is not pretty. But this is ‘non-core.’

- Piece 2 is core goods. We’ve already seen this. New and Used Cars, Medicinal Drugs, e.g. Clearly this is a big driver at the moment.

- Piece 3 is core services less rent of shelter. And there’s no comfort here. This includes medical services, which really aren’t doing anything. Household services. Car rental. Stuff like that.

- And lastly the slowest moving piece, Rent of Shelter. This is rising, but right now it’s mostly because of lodging-away-from-home. To be fair that was a big part of the prior slide. Rents as we have already seen aren’t doing a lot. Yet.

- If you want to be optimistic about inflationary pressures, you want to have rents stay tame. This is really hard when home prices and asking rents are shooting higher. If you want inflation to be transitory, you really need a home price collapse. I don’t see that…

- Not to say home prices aren’t a bit frothy right now. But the conditions for them to collapse nationally, pulling rents and thus inflation down with them as in 2009-10, don’t seem to be there. But that’s the biggest/only risk I see to higher inflation through 2021-22.

- That’s all for today. I’ll publish a compiled tweet list on my blog later this morning. You can get that blog at https://mikeashton.wordpress.com . But if you want more than talk, visit Enduring Investments at https://enduringinvestments.com and drop me a line.

- Thanks for tuning in. Hope all of you new followers are generous with your RT and follow recommendations!

A second month of large increases in core inflation should be followed by a second month of Fed speakers downplaying the importance of the ‘transitory’ price increases. The rise in used cars and lodging away from home play into that narrative, but there are broader pressures here and they will show up more this month in other inflation measures such as median or ‘sticky’ CPI. But if bond yields don’t respond to the inflation threat, then neither will the Fed. Talk is cheap, and it is easy to say that inflation pressures will be “transitory” (and surely, they won’t continue at 0.8% per month on core), but when that talk is backed up by a placid government bond market it keeps the pressure off of the FOMC to do anything.

To be sure, I don’t really expect the Fed to be doing anything anyway. While the entire Committee isn’t exactly in line, Chairman Powell is the vote that matters. And he (along with the moral support from Treasury Secretary Yellen) continues to repeat that inflation is not a problem, and anyway it isn’t as important as making sure that everyone has a job, at any cost. (Students of history should note that the early days of the Weimar inflation saw a similar preoccupation with getting everyone employed, even if money had to be printed to do it!)

So, we continue to watch our money lose value, with the policymakers continuing to fiddle while Rome burns. There are places to hide, but they will get crowded pretty quickly once everyone realizes they need shelter. I don’t think this inflation is “transitory” in anything but a trivial sense that it will eventually pass. We don’t have to get to 8% inflation for it to be damaging to the psyche of the investor, consumer, and producer who has become acclimated to 2%. Sustained core inflation near 4% would be sufficient to break the back of the disinflation of the last forty years, in my view. We should get a test of that thesis, because we aren’t going to see appreciably lower core numbers until sometime in 2022.