Planet 13 Is A One-Hit Wonder So Far

Planet 13 Holdings (CSE: PLTH) (OTC: PLNHF) debuted on the public markets in mid-2018, a bit ahead of most of the publicly-traded cannabis operators. Its stock performed reasonably well in 2018 and 2019, but is off to a slow start in 2020, down 21% through February 7th. The all-time trading indicates success for holders, with a rally since it began trading despite the overall pressure on the cannabis sector:

At this time, 100% of the revenue of the company is coming from a single store in Las Vegas, though it has plans to expand into other locations. Given the success of the company in that market, I wanted to take a closer look at the company’s business, finances and valuation.

BACKGROUND

Known for its Superstore, which opened in late 2018, Planet 13 had been operating in Las Vegas since April 2016 at a different location six miles away. The company tried to win additional licenses in the last Nevada round but lost and is now pursuing litigation. If it fails, it will acquire them, as it wants to reopen its former dispensary, Medizin. The company has a license that allows it to offer customers delivery.

Cultivation and production take place indoors in Clark County at a 15K sq. foot building it claims can grow 2100 pounds per year. It also has 80 acres of land in Nye county and was pursuing a build out to up to 2.3 million sq. feet of greenhouse but has delayed due to a robust wholesale market. It operates two processing facilities, including one in the dispensary and one in the Clark County cultivation facility.

The flagship (and sole) dispensary, which is always open, is located at 2548 W. Desert Inn Road. Across the street is Reef (in the process of being acquired by Cresco Labs). While the company likes to tout its proximity to the Strip, it is a hike from any part of it (I did it). Several others are theoretically within walking distance as well, and billboards are situated right by all of these dispensaries by competitors offering delivery. Here is a view of the approach by foot from the strip:

Presumably, most people don’t walk but rather drive or take a taxi/rideshare. Alternatively, they can jump into the van:

The dispensary is over 16K sq. ft. and has all sorts of interactive features. The company has installed some manufacturing on-site, and it is in the process of adding a cannabis museum (a project called Cannabition that involves Steve DeAngelo). There will also be a consumption lounge that includes an outdoor deck and pool. The company recently opened a restaurant inside. Here is the interior of the dispensary:

The company reports that its Superstore can serve up to 5K per day, and it has reached about 2100 a day in May. It balances brand offerings with its own extensive private-label products, including Medizin, Trendi, Planet m and Leaf & Vine.

An important project for the company is in Southern California, what it calls its Los Angeles Superstore, located in Santa Ana and expected to open in Q2 this year. Santa Ana is one of the few areas in SoCal with extensive licensed dispensary operations already. It will pay $6 million cash and issue 2.04 million Class A shares for the license and 40K sq. ft. dispensary.

The company believes that it has opportunities to expand into other markets but hasn’t announced plans as of this time.

MANAGEMENT

Planet 13 is led by co-CEOs Robert Groesbeck and Larry Scheffler. Groesbeck has been a Las Vegas entrepreneur most of his life and has a legal background. Formerly an attorney for 25 years, he served as mayor of Henderson in the 90s.

Scheffler is a Nevada resident who preceded Groesbeck as the mayor of Henderson and who founded what is now the largest commercial printing company in Nevada in 1978.

VP of operations Chris Wren joined the company in its earliest days and is a long-time veteran of the cannabis industry. CFO Dennis Logan in an investment banker who has most recently served as CFO for several Canadian companies. He joined the company in 2018 ahead of listing publicly.

Insiders with substantial ownership include Groesbeck, who owns 26.13 million Class A voting shares through PRMN Investments, LLC and 13.17 million shares held mainly by that same entity, and Scheffler, who owns 26.13 million A Voting shares through Thirteen, LLC, and 13.55 million common shares held mainly by Thirteen, LLC, and Wren, who owns 2.11 million shares and 2.98 million A voting shares. CFO Logan has 676K shares and 125K warrants.

The Board includes two independent directors a CPA who provides CFO services to companies primarily in Las Vegas and marriage counselor. Former Origin House CEO Marc Lustig recently departed the Board.

FINANCIALS

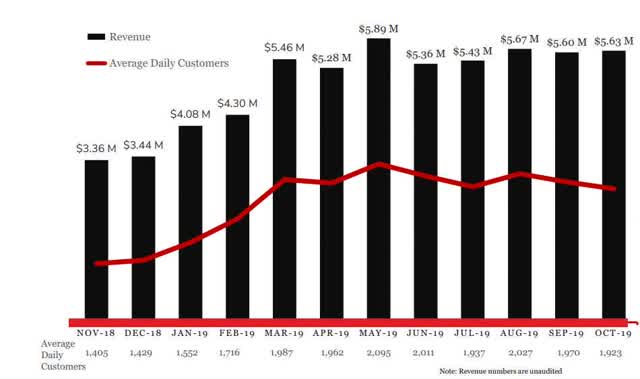

The company has ramped up revenue tremendously since opening its Superstore:

The above slide, which is from the November investor presentation, can be updated by piecing together information released subsequently. First, it pre-announced total revenue in 2019 of $63 million on January 9th. It followed this up with disclosure that revenue in January rose about 10% from seasonally slow November and December.

Based on this information, I have projected revenue of about $5.16 million for November and December and $5.67 million for January. Based the January number, growth from a year ago was 39%. This has been driven by 18% growth in customers and 18% growth in spending per customer. Some of that spend includes the food offerings.

Total revenue for Q4 looks to be $15.94 million which would be a sequential decline of almost 5%. In the prior quarter, sequential growth was just 1%. It appears that growth has maxed out.

Looking at the last reported quarter, Q3, the company reported annual growth of 241% as it posted revenue of $16.7 million. The prior period was based on sales from its prior location. Q4, at $15.94 million, which is below the consensus of $17.67 million (2 analysts), would represent growth of 93%, which demonstrates the slowing growth theme.

In Q3, the company reported a gross margin of 59%, which is impressive. Note, though, that full year guidance, revealed in January at 57%, suggests that the Q4 margins were lower than Q3 and likely just below 57%. For January, it reported it to be in a range of 56-59%.

Operating income in Q3 was $462K and $2.08 million year-to-date. The company includes some non-operating expenses, and, after taxes, reported a net loss of $1.7 million in Q3 and $3.86 million year-to-date.

Due to substantial expansion in income tax payable by $5.5 million, operating cash flow for the first three quarters was an impressive $7.6 million, but this should wash out as the company makes the tax payments. The company spent $12.7 million in the first three quarters on capital expenditures.

The balance sheet had $18.1 million cash at the end of Q3, a function of a capital raise in 2018. Current assets o $28.9 million are almost twice the value of the current liabilities, suggesting good liquidity.Balance sheet equity was $41.1 million, all tangible. There is debt of less than $1 million.

Note that the company has changed auditors recently, moving from MNP to Davidson & Company.

VALUATION

At 11/25, the company had 136.75 million shares outstanding, including 81.5 million common shares and 55.2 million Class A shares, which can be converted into common one-for-one under certain conditions. It also had 753K options at a weighted average of C$1.17 and 15.9 million warrants, including 10.7 million at or below C$1.40, 524K at C$3.00 and 4.79 million at C$3.75. Finally, the total share-count should include 4.45 million RSUs.

With about 152.5 million shares outstanding on a fully-diluted in-the-money basis and a closing price of US$1.53, the market cap is US$233 million, or about 3.7X 2019 sales. My own projection is below the analysts for 2020 at $93 million. I expect the company will do about $75 million in Las Vegas, and I don’t expect a material contribution for the Santa Ana store (which isn’t completed). For modeling purposes, I will add $5 million, giving it a ratio of 2.9X projected 2020 revenue, which is relatively low for the industry. Based on price-to-tangible book value, the stock trades at 5.7X, also slightly better than MSO peers.

STOCK PRICE

While the performance over the past year has been far better than peers, with the stock up marginally, it is trading near recent lows:

Given that the market doesn’t seem to be factoring in the negative financial information revealed thus far in 2020 about margins and growth, I believe it could test those late October lows.I would expect C$1.50 to provide a level of support if the C$1.75 area doesn’t hold. Keep in mind the 10.7 million warrants at C$1.40 or lower, as they expire in June.

CONCLUSION

While there has been a lot to admire about Planet 13 to date, I will continue to monitor it for now from beyond the Focus List. With growth slowing in Las Vegas and an unclear expansion plan due to the unique operational aspects of its Las Vegas Superstore, it’s not clear that success can be replicated in other markets. I would also be wary of the large amount of expiring warrants discussed above.

At the same time, the strong balance sheet and operational performance suggest less risk with Planet 13 than other companies.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Subscribe to the monthly more