Pipeline Stocks Are Quietly Recovering

“Horrific. Terrible. Abysmal. The worst. Those are terms equity analysts are using to describe investors’ attitude toward energy stocks.”

This is from a recent Wall Street Journal article (see Energy Stocks Fall Faster Than Oil Prices).

Sentiment in the energy patch is poor. Too much spending with too little returned to shareholders is the main gripe, along with what seems like a tendency for the sector to follow crude prices lower but then fail to participate in any recovery.

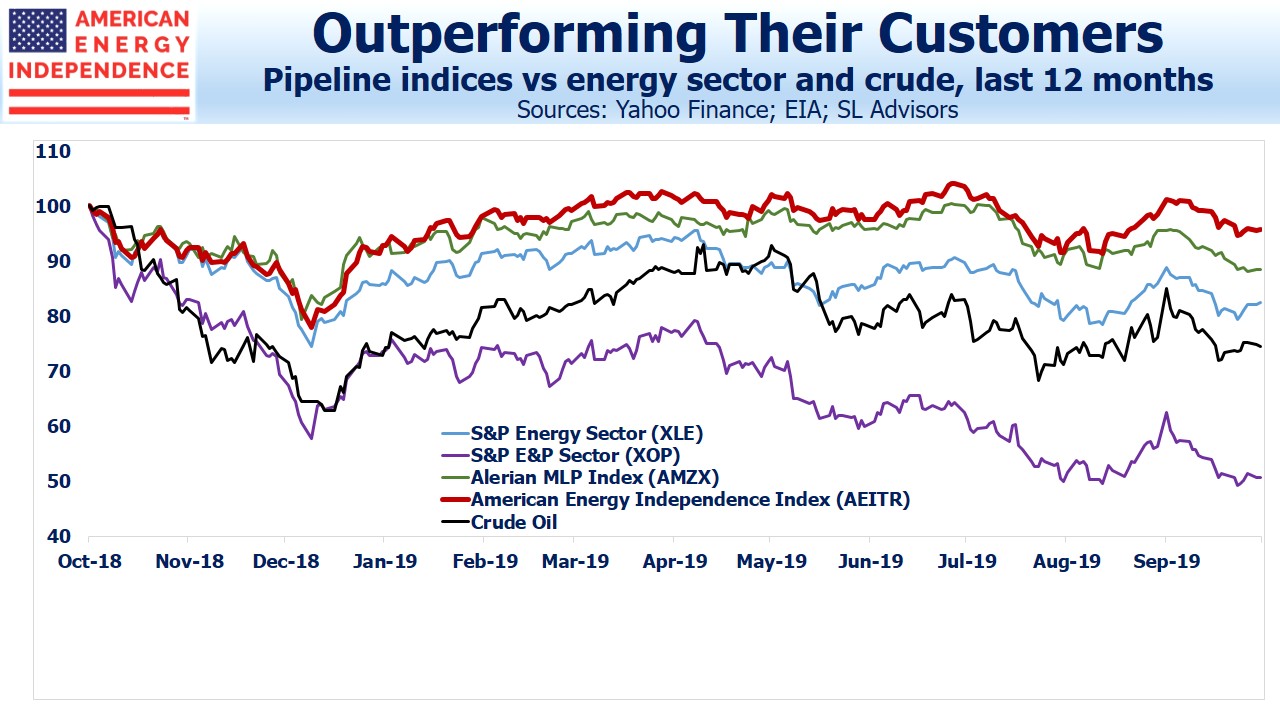

The WSJ article goes on to note that over the past year, crude has dropped 26% while the S&P Exploration and Production index (denoted in the chart by its ETF, XOP) has lost almost half its value.

It’s especially odd when E&P operating performance has been improving. In I Can’t Make You Love Me – E&Ps’ Performance Belies Negative Investor Sentiment, RBN Energy walks through metrics including profitability, reserve replacement and shareholder returns (buybacks and dividends) to illustrate that domestic energy companies are heeding the criticisms of investors. So far, it’s not helping their stock prices.

The gloom is overshadowing the improving outlook for midstream energy infrastructure stocks. Earnings season will provide another opportunity to confirm that the sector remains on track to grow free cash flow (see The Coming Pipeline Cash Gusher). But it’s already becoming clear that the performance of pipeline stocks is deviating markedly from the upstream E&P companies that are their customers.

While XOP is down 49% over the past year, the American Energy Independence Index (AEITR) is close to flat and was briefly positive following the attack on Saudi Arabia’s oil infrastructure. Although still lagging the S&P500, the sector has recovered from the 20% swoon during last year’s fourth quarter. E&P stocks remain a long way from recovery.

The AEITR is also 7% ahead of the Alerian MLP Index (AMZX) since last October, helped by inflows from ESG funds with their focus on standards of environmental, social and governance practices. The partnership-heavy AMZX holds little appeal to ESG investors, compared with the corporation-heavy AEITR where corporate governance provides stronger investor protections.

Weak commodity prices are another problem for E&P names. Natural gas gets less attention than crude oil, but prices for the benchmark Henry Hub recently sank to $2.25 per MCF (Thousand Cubic Feet). Production continues to grow strongly in the northeast, thanks to the Marcellus and Utica shale formations in Pennsylvania. But a shortage of pipeline capacity has recently led to a discount of as much as $1 per MCF, meaning Marcellus natural gas was worth as little as $1.25 per MCF locally.

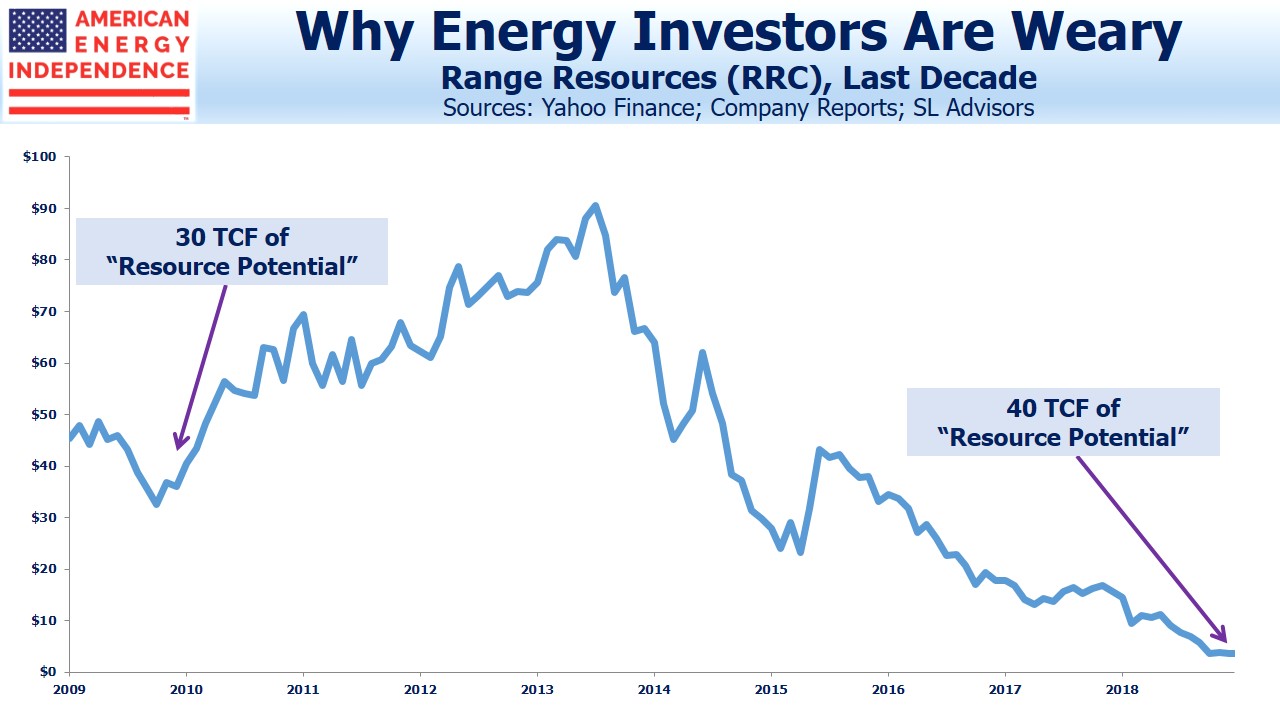

Some E&P stocks are almost worthless. Range Resources (RRC) is a company we followed almost a decade ago. In the years preceding the 2014 peak in the energy sector, RRC traded above $50 and was briefly above $90. We liked the management team very much but noticed that they continued to sell their own shares even while quietly confiding that they thought they could be acquired for $120. We sold out.

Today, RRC is at $3. In a recent presentation, they claimed resource potential of 40 TCF (Trillion Cubic Feet) of natural gas, enough to meet all U.S. domestic consumption for around 16 months. In our write-up from a 2010 RRC presentation, we noted their claim to 30 TCF of resource potential at that time. Holders from nine years ago (if any remain) have lost 90% or more of their investment, and RRC has access to ever more copious volumes of natural gas.

The Shale Revolution has produced enormous output, but profits for upstream investors have been elusive. The sorry history of RRC reflects the frustration investors feel with energy stocks, with abundant resources coinciding with capital destruction.

That’s why it’s a welcome sight to see midstream stocks performing so much better than their customers – the link to commodity prices has been weakening over the past couple of years, and the toll-model of pipelines is once again providing some differentiation.

The information provided is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Graphs and ...

more