Party On, Wayne - Market's Joyride To The Upside

The joyride to the upside continued in the stock market last week as the S&P 500 surged another 2.5%. If my calculator is correct, that means the venerable blue-chip index is now up 10.7% so far in 2019 and has put in a nifty gain of 18% since the December 24th panic attack. Impressive.

What is perhaps even more impressive from my seat is the reversal in Ms. Market's mood. Recall that back in December, traders assumed the worst. Everything was bad. There was nothing positive to be found anywhere. All news was bad news. Even the good news (record holiday shopping for example) was ignored because the markets were doomed. The Fed had lost its way. The administration was planning to flush the hundreds of billions it spent on tax cuts down the drain with the trade war. And the "R-Word" (recession) dominated the global view. Insert sad emoji here.

Now fast forward eight weeks. The S&P has soared. The index is back above its 200-day moving average. There is talk of a new bull market. I'm getting calls about keeping up with the stock market again. Everything is good. Nothing is bad. And any news that happens to fall in the disappointing category can simply be ignored. Amazing what an 18% gain in a couple months can do, right?

The Game Changers

Why the sudden mood swing, you ask? Easy. Because the Fed changed its tune and leaders in both China and the U.S. want a deal. As such, it is now assumed that the economies of the world will resume their long-lost upward mojo. So, the real question becomes, how long until we start hearing the words "synchronized global growth" again?

It appears that traders are now assuming the Fed will thread the needle and remain friendly to the stock market. That the trade deal will get done; completely and on time. Oh, and the aforementioned trade deal with China is going to fix everything.

No need to worry about all that negative economic data you've been seeing, folks. We can just blame it all on the trade war. And since the trade war will soon be over, everything is going to be hunky dory going forward.

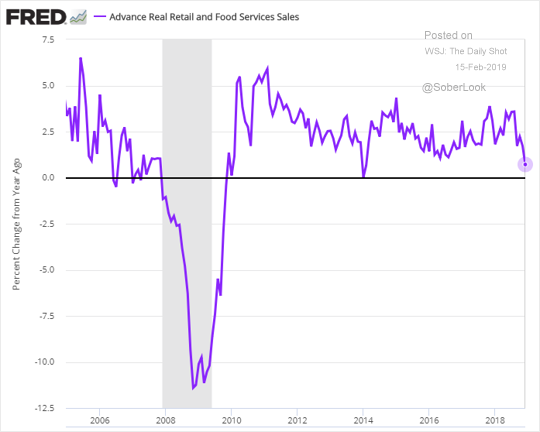

We can ignore the fact that Germany avoided slipping into recession by a mere 0.1%. We can look the other way on last week's surprisingly weak Industrial Production data. And we can simply wave off a downright ugly Retail Sales report (see below).

(Click on image to enlarge)

Image Source: The Daily Shot

But here's a question. Since consumer spending accounts for more than 70% of U.S. GDP, shouldn't we be concerned about the impact the worst Retail Sales numbers seen since 2009 will have on the economy?

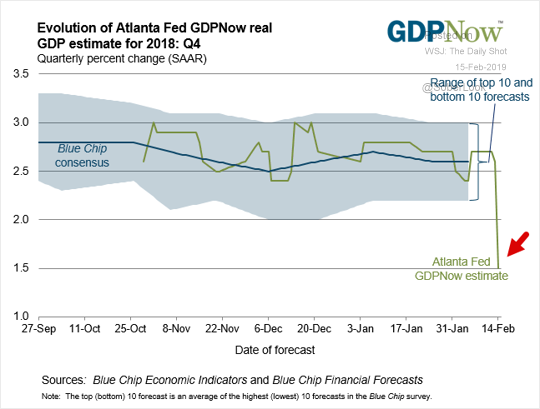

Sure, if the big dive in Retail Sales was "real" (there is talk going around that the government shutdown may have impacted the report and that the numbers will likely be revised higher), then GDP might be impacted a bit - or okay, maybe a lot. (See the Atlanta Fed's latest GDPNow below).

(Click on image to enlarge)

Image Source: The Daily Shot

But remember, the worry is out. Optimism is in. So, in a word, fuggedaboutit!

Let's remind ourselves that a trade deal is going to get done - and soon. And now that the Fed is our friend again, well, it's a new ballgame. As such, we need to put away those pesky concerns and start discounting the brave new world of renewed global economic prosperity. The only fear we should have is the fear of missing out!

Weekly Market Model Review

Now let's turn to the weekly review of my favorite indicators and market models...

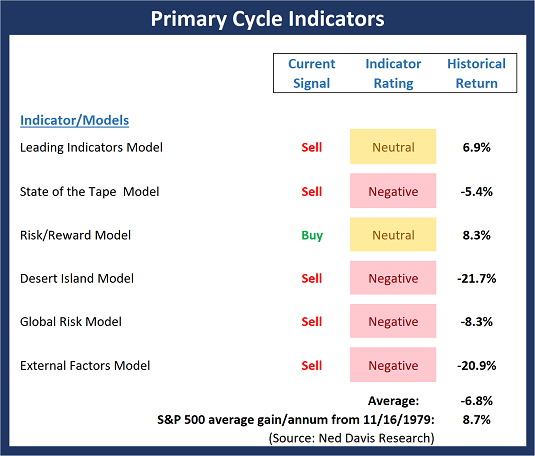

The State of the Big-Picture Market Models

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

(Click on image to enlarge)

The Bottom Line:

- Given another strong weekly gain for the market, it is easy to argue that the bulls are back and in control of the game. There are growing calls for new all-time highs. And it feels like stocks will never decline again. Yet, my "Primary Cycle" board, which is a group of my favorite, longer-term "state of the market" models, is clearly not in its happy place. And with another indicator flashing a sell signal last week, the board is negative on balance. So, given that stocks have been on a one-way trip for 8 weeks now and have become overbought in the process, this board suggests that some caution is warranted in the near-term.

This week's mean percentage score of my 6 favorite models slipped to 44.2% versus 48.9% last week (2 weeks ago: 48.9%, 3 weeks ago: 47.8%, 4 weeks ago: 41.9%) while the median fell to 40% from 46.7% last week (2 weeks ago: 46.7%, 3 weeks ago: 45%, 4 weeks ago: 40%).

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

(Click on image to enlarge)

The Bottom Line:

- With the Dow and S&P 500 pushing above their respective 200-day moving averages last week, many view the trend as being positive. And since the majority of the Trend board sports a bright shade of green, it would appear that the indicators agree. One nagging negative is the Long-Term Trend model, which reminds us that the bulls still have some work to do in order to regain control of the game.

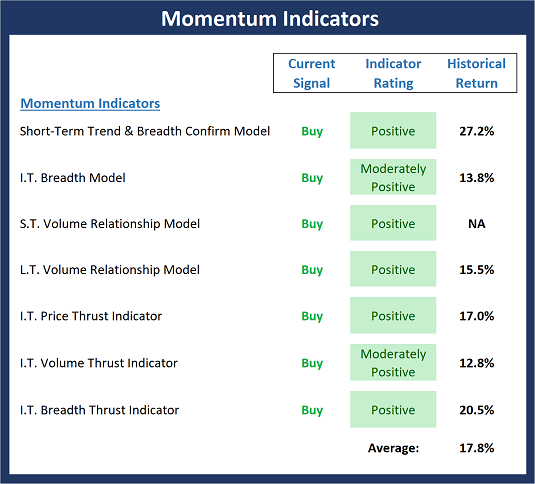

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

(Click on image to enlarge)

The Bottom Line:

- The primary color emanating from the Momentum board is green again this week. This should be viewed as an underlying positive and suggests that a buy-the-dip strategy should be employed.

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

(Click on image to enlarge)

The Bottom Line:

- The Early Warning board can be viewed as waving its arms for attention and currently suggests that the recent joyride to the upside is due for a rest/pause.

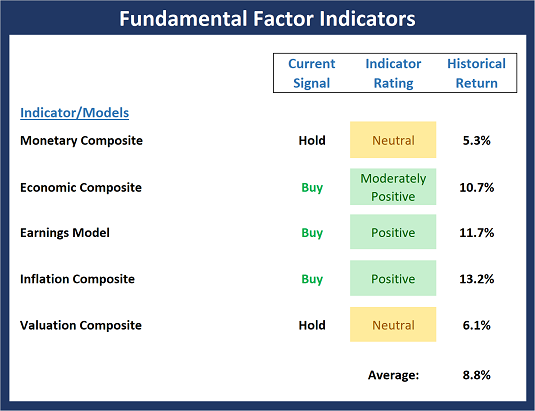

The State of the Macro Picture

Now let's move on to the market's fundamental factors - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

(Click on image to enlarge)

The Bottom Line:

- As I have written for the last few weeks, the Fundamental Factors board suggests that the backdrop for equities remains constructive. For now, the board says the bulls should be given the benefit of any doubt.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more