Origin House Reports Record Q2 Revenue As It Prepares To Be Acquired By Cresco Labs For $1.1B

Origin House (CSE: OH, OTCQX: ORHOF), a North American cannabis products and brands company, has announced its financial results for Q2 that ended June 30, 2019.

About Origin House

Origin House is a growing cannabis brands and distribution company operating across key markets in the U.S. and Canada. Its California brand development platform is operated out of six licensed facilities located across California and provides distribution, manufacturing, cultivation and marketing services for its brand partners.

Q2 Financial Highlights (All figures are reported in Canadian dollars unless otherwise indicated.)

The following are financial highlights of Origin House’s operating results for the three months ended June 30, 2019, compared to the same period a year ago:

- Revenue increased by 509% of which 88.6% came from the California segment;

- Gross profit increased by 441%, including gains on biological assets;

- Gross Margin declined to 21% from 23%;

- Operating expenses increased by 274%;

- Adjusted EBITDA decreased to a loss of $21.0M from an income of $11.1 million;

- Net loss increased by 475% as a result of the following non-operating factors:

- the expense of $2.1M in transaction costs related to Cresco Labs purchase,

- two non-cash, balance sheet adjustments totaling $13.4M arising out of the terms of the Arrangement with Cresco Labs

Liquidity (compared to December 31, 2018)

- Cash and cash equivalents decreased by 78.6%;

- Total assets increased by 12.2%;

- Current assets decreased by 33.7%;

- Current liabilities increased by 139.7%; and

- Long-term debt financing reduced to $0 as compared to $16.0 million.

Q2 Operational Highlights

- Agreed to be acquired by Cresco Labs for approximately $1.1 billion;

- Closed the acquisition of Cub City LLC;

- Began the cultivation of ultra-premium cannabis at FloraCal’s newly expanded facility in Sonoma County, California which should double capacity;

- Began to distribute Cresco-branded products across California through its distribution division, Continuum.

Subsequent to Q2 Operational Highlights

- Entered into a binding term sheet agreement with Opaskwayak Cree Nation for C$12M in debt financing;

- The shareholders of the company’s subsidiary Trichome Financial and 22 Capital Corp. approved their amalgamation via a reverse take-over of 22 Capital by the shareholders of Trichome; and

- Closed the sale of its equity interest in Alternative Medical Enterprises LLC marking the completion of a key step toward the closing of the Company’s Arrangement with Cresco Labs.

Cresco Labs Acquisition Plans

In connection with the antitrust review by the United States Department of Justice Antitrust Division:

- the DOJ has requested additional information from Origin House and Cresco Labs

- and both companies are confident that the sale will be completed as planned.

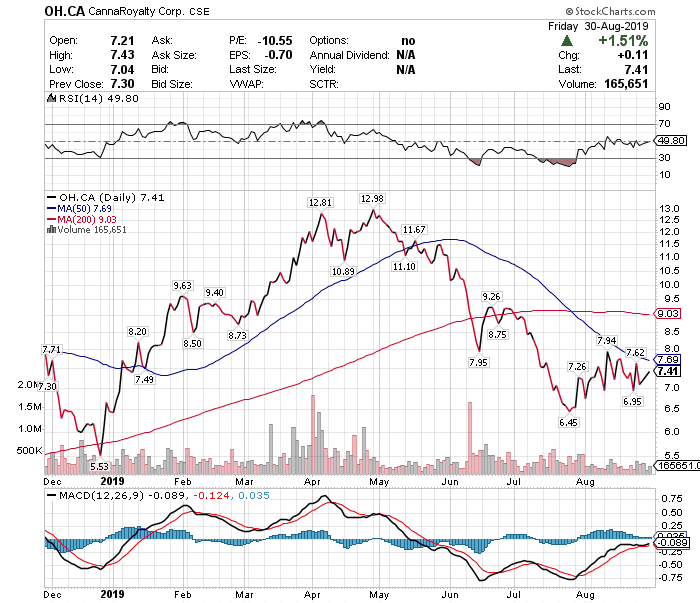

6-Month Stock Performance

As illustrated in the chart below:

- Origin House's stock price is up 14.9% from the end of 2018

- albeit down 42.9% from its peak earlier this year.

- On a positive note, the stock was up marginally in July (2.6%) from the previous month

- and was one of only 5 stocks out of the basket of 21 non-penny marijuana stocks that I follow on a monthly basis that appreciated (the stocks in my basket were down 10.4% during that same period).