When To Hedge With Puts Versus Collars

Still image from TikTok user @robinhoodkid's video explaining call options. Short call options are one leg of a collar.

Puts Versus Collars: When To Use Which

We've developed a simple quantitative approach to determine when to hedge with collars or puts in a portfolio. If you know what puts and collars are, you can skip the next section. If not, let's start with a quick refresher.

Puts, Calls, And Collars

Puts: Put options give an investor the right, but not the obligation, to sell a particular security at a specified price, on or before a certain date.

Calls: A call option is the opposite of a put option: it gives an investor the right, but not the obligation, to buy a particular security at a specified price, on or before a certain date.

Collars: A collar is a strategy that pairs buying a protective put option on a stock or ETF with selling a call option on the same security. By selling a call option, you give an investor the right to buy your stock or ETF if it appreciates beyond a certain level, and obligate yourself to deliver the stock or ETF if the option is exercised; in this way, you cap your potential upside. In return, you get paid by the buyer of the call option. The income you get from selling the call option offsets some of the cost of buying the protective put option. So your net cost in opening a collar will lower than the cost of just buying a protective put.

How We Determine When To Hedge With Puts Or Collars

First, we test if it's possible to hedge the security in question both ways. Depending on the drawdown you're willing to risk, it may not be.

If it is possible to hedge the security both ways, we scan for the optimal, or at least expensive, version of both types of hedges, and note their respective costs. The optimal collar will always have a lower cost than the optimal put hedge, but there's another factor to consider beyond hedging cost. We call it the put preference factor.

The put preference factor quantifies an empirical phenomenon we've observed over years of tracking tens of thousands of positions: the gross returns (i.e., not subtracting hedging costs) of securities hedged with puts are, on average, significantly higher than those hedged against the same declines with collars.

Doesn't That Depend On Where You Cap The Collars?

Actually, no. There's a limit to how high you can set the upside cap on a collar. There have to be bids on calls that far out of the money, and they have to be high enough to offset enough of the cost of the put leg to make the hedge reasonable. It would be unreasonable to pay, say, 15% of position value to hedge against a 10% decline, for example. And if you collar enough stocks or ETFs, over time, some of them will rise far above your upside caps. With collars, you won't capture the excess returns of those positive outliers; you will with optimal puts because they are uncapped. We quantify the put preference factor - the extent to which the gross returns of positions hedged with puts outperform those of positions hedged with collars - and update that figure every trading day. Currently, it's approximately 1.8, meaning that, on average, security hedged with optimal puts will have a gross return 1.8x that of the same security hedged with an optimal collar.

Applying The Put Preference Factor

For simplicity's sake, let's consider two possible hedges against the same drawdown:

- An optimal collar capped at a security's estimated potential return.

- An optimal put hedge.

When we construct hedged portfolios, we test optimal collars capped at a few other levels as well, but the two possible hedges above are sufficient to show how we apply the put preference factor. For the position hedged with the optimal collar, we simply take the estimated potential return and subtract the hedging cost. We call this the net potential return (the potential return net of hedging cost).

For the position hedged with optimal puts, we multiply the estimated potential return by the put preference factor and then subtract the hedging cost. If the resulting number is greater than the net potential return of the collared position, we hedge with optimal puts; if it's less, we hedge with an optimal collar.

A Real-World Example Using GOOG

Each trading day, our system analyzes total returns and options market sentiment to estimate potential returns for thousands of stocks and ETFs. Since we added a new source of alpha last May, the returns of our top ten names have consistently beaten the market. Google parent Alphabet (GOOG) wasn't one of our top names on Tuesday: it was #223. Did it make more sense to hedge GOOG with puts or a collar then? That depended on your risk tolerance. Let's see how it worked with two different risk tolerances. First, one where you were only willing to risk an 8% decline over the next several months. And then another where you were willing to risk a 15% decline.

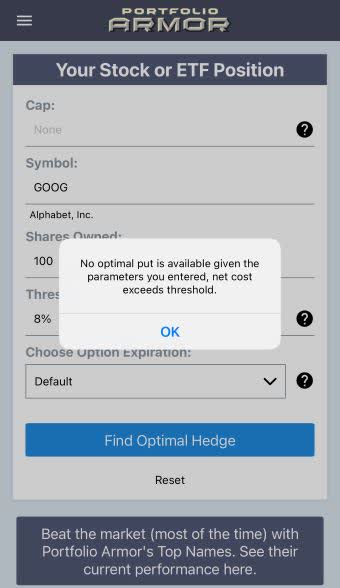

Hedging GOOG Against A >8% Decline

If you tried scanning for optimal puts to hedge GOOG against a >8% decline over the next several months on Tuesday, you would have gotten this error message:

This and subsequent screen capture via the Portfolio Armor iPhone app.

So, no more analysis needed. If you wanted to hedge GOOG against a >8% decline, you needed to use an optimal collar.

Hedging GOOG Against A >15% Decline

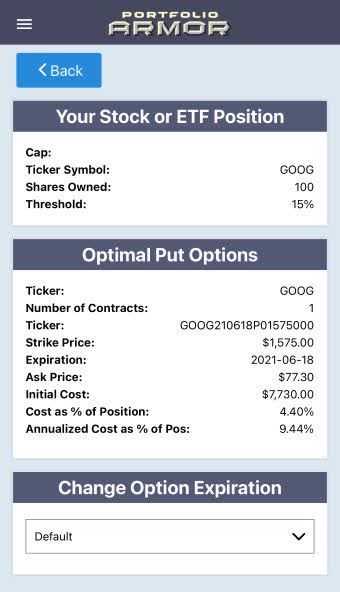

With An Optimal Put

This was the optimal put to hedge 100 shares of GOOG against a >15% decline over the next ~6 months, as of Tuesday's close.

Here the cost was 4.4% of position value (calculated conservatively, using the asking price of the puts).

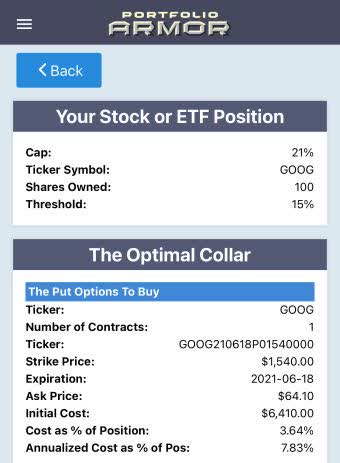

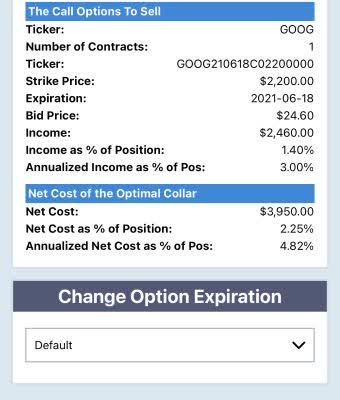

With An Optimal Collar

Our potential return estimate for GOOG over the next 6 months was about 21% (to see how we estimate potential returns, see this post where we break it down using the Silver ETF SLV as an example). If you were willing to cap your upside at 21%, this was the optimal collar to hedge it against a >15% drop over the same time frame.

The hedging cost there was 2.25% of position value.

The Puts Win Out In This Case

Recall our potential return estimate for GOOG over the next 6 months was 21%. To get the net potential return for the put position, we first multiply that 21% by our put preference factor, 1.8 to get 37.8%. Then we subtract the hedging cost: 37.8% - 4.4% = 33.4%.

For the collared position, we just subtract the hedging cost from the potential return estimate, so 21% - 2.5% = 18.5%. Since 33.4% > 18.5%, our portfolio construction algorithm would hedge GOOG with optimal puts in this case.

Wrapping Up

The GOOG example here was pretty clear-cut, but there are cases where it's harder to guess which hedge makes more sense, for example when the hedging cost is negative. We may explore that in a future post.