What Is A 1-2-3 Chart Pattern?

Today, we’re looking at a technical analysis formation known as the 1-2-3 chart pattern. We’ll discuss what it is and also give some recent examples.

Introduction

Technical analysis can be quite intimidating if you’ve never used it before. So, what is it and how do you start using it? Technical analysis involves using price action and chart patterns to analyze and attempt to predict future price movement. The other type of analysis is called fundamental analysis and uses financial statements and examination of the company itself to predict future price movement.

Which is better? Neither are foolproof and it really depends on how you want to approach trading. As for technical analysis, you are probably already performing technical analysis.

Ever look at support or resistance levels? How about indicators like MACD, RSI, CCI, or moving averages? Ever notice a chart pattern like head-and-shoulders or triple tops? These are all examples of technical analysis.

Today, we are going to focus on a particular chart pattern called the 1-2-3 chart pattern. I am going to couple it with a popular momentum indicator, RSI. Once you’ve been around the markets awhile, you will learn to never base your trades on a single pattern or indicator. We always want our patterns and indicators to provide confirmation or divergence as a way to signal a buy or sell for our trade.

You could just as easily combine this pattern with a trend indicator like the average directional index (ADX). It is a trend indicator used to measure the strength and momentum of a trend, and it is what I would most likely use, myself. I opted to use RSI instead because it’s easier to explain and I want us to focus mainly on the chart pattern.

What is a 1-2-3 Chart Pattern?

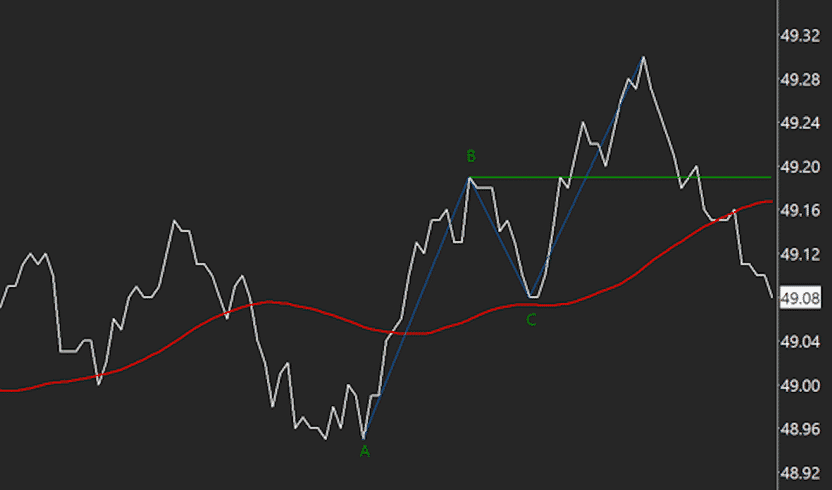

As with most chart patterns, there is a predefined set of price movements that satisfy the pattern criteria, which provides a buy or sell signal. The chart below shows the price pattern of a hypothetical stock called XYZ. Assume we are using the trading timeframe you normally use.

For me, this would be a one-year, daily chart. The basic 1-2-3 chart pattern has four required elements or points on the price chart for this pattern to indicate a trade signal.

1-2-3 Chart Pattern Criteria

- Low point (point A on the chart).

- Higher high point (point B on the chart).

- Retracement from point B, but not lower than point A (point C on the chart).

- Reversal from point C past the point B level (B line on the chart) – this would be the buy signal for a long trade.

I want to briefly point out that this chart pattern can also be used for short trades by reversing each of the pattern criteria above (i.e., the first point would be the High point). I don’t want to create a lot of confusion, so we will stick with the long signal here. There are also some variant entry signal criteria that can be used. We won’t use them in this example, but I want you to be aware of them.

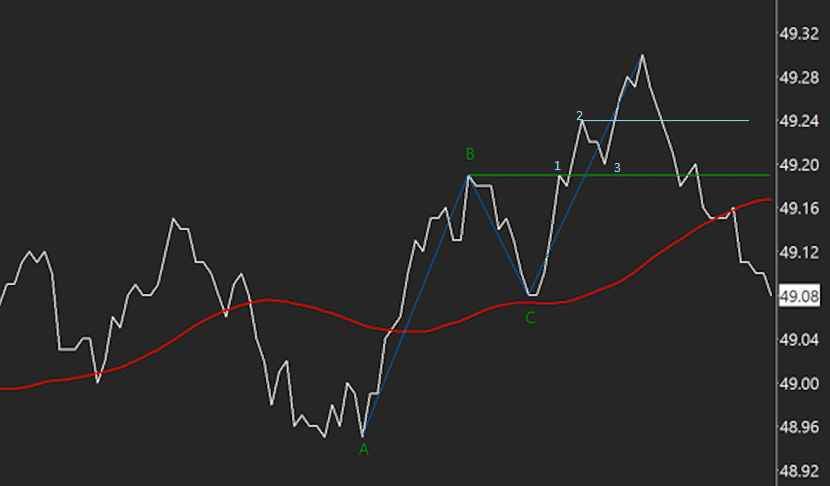

Normally, we wait for the price to move through the B line, but we can adjust the entry point depending on our risk tolerance. Both situations add another 1-2-3 chart pattern within the first pattern as a trade signal. In the chart below, we see another 1-2-3 chart pattern above the B line. This variation would be used by a more conservative trader who really want to make sure they have a good trade signal.

The trade signal would occur after the price passes the 2 line. On the other hand, a more aggressive trader might want to buy before the price crosses the B line. In this case, imagine the second 1-2-3 chart pattern between point C and the upward crossing of the B line. The trade signal would be indicated after the price crosses the 2 line.

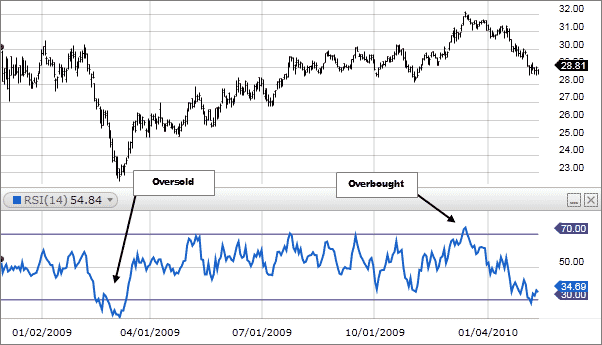

Brief RSI Usage Overview

RSI is a popular technical indicator that I use very often. It signals overbought and oversold conditions that can help us a lot. RSI indicates an overbought condition when the value, which ranges from 0 – 100, is over 70; and it indicates an oversold condition when the value is below 30. The overbought condition indicates that the price is ready to rise, and vice versa for the oversold condition.

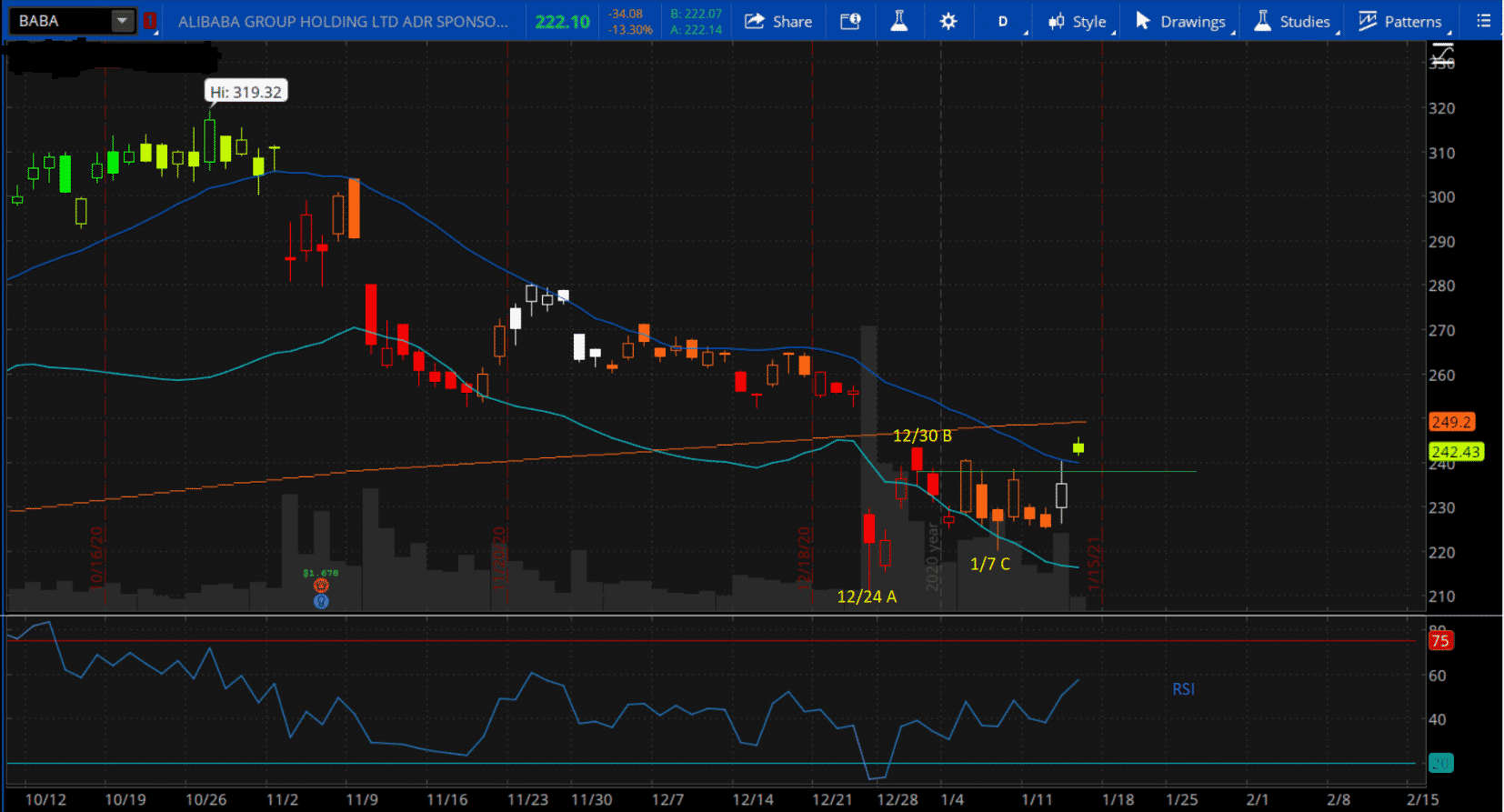

BABA Example Trade

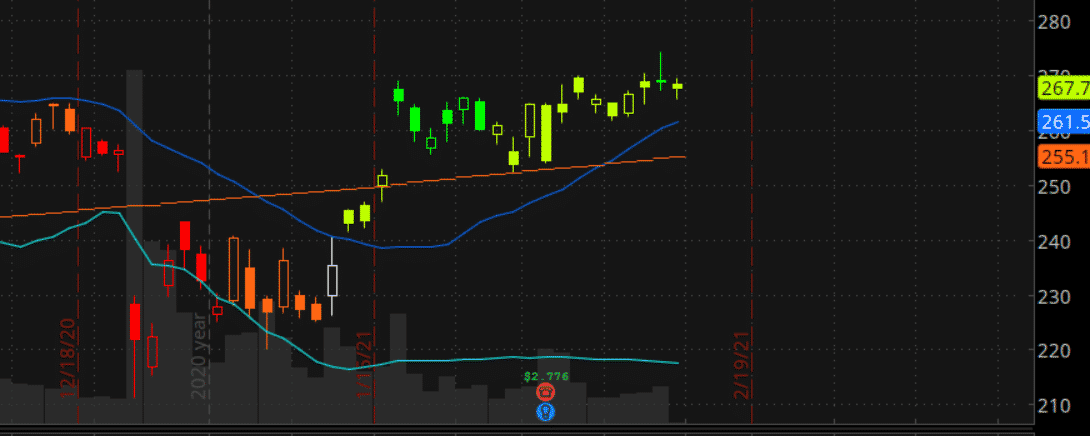

I like Alibaba (BABA) and trade it quite often. Imagine that we began looking at the price action on Dec. 24, 2020. This is our A point for the 1-2-3 chart pattern, and the closing price was $222. Take note of the RSI on Dec. 24. It is 12.7, indicating that our stock is oversold and poised to rally. On Dec. 30, 2020, we see our B point and on Jan. 7, 2021 as well.

Then on Jan. 14, we see BABA close at $242.98 and it has reached above the B line ($238.39). Here is our buy trigger on Jan. 14, and the RSI is about 58. It’s a little higher than we might like, but it tells us that BABA is not oversold and it still has room to rise.

Our strategy is indicating a trade trigger based on the stock rallying higher, great. So, what to trade? I am a big fan of defined risk trades and the put credit spread (PCS) is among my favorites.

Bull Put Spread Trade Setup

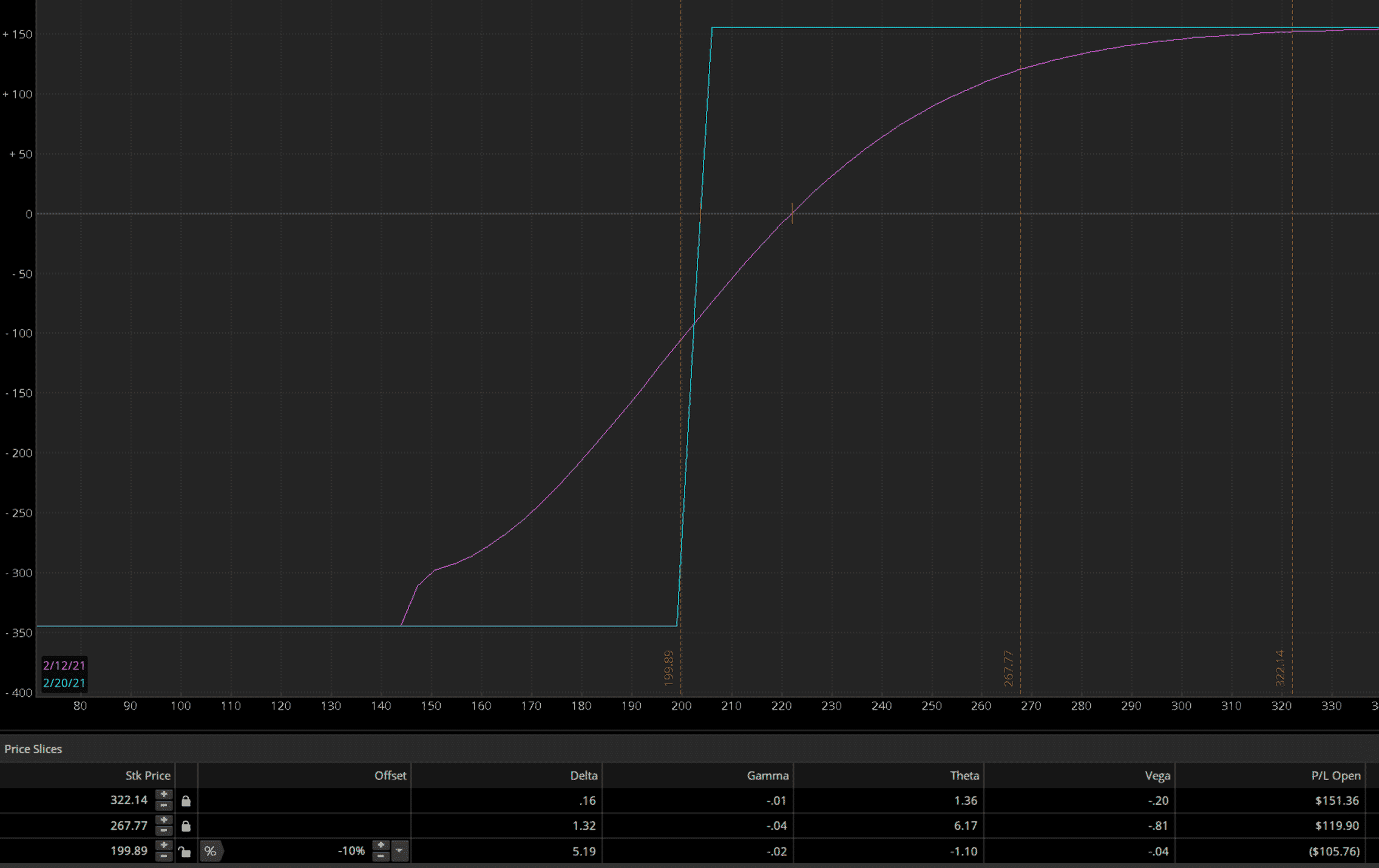

- Date executed: Jan. 14, 2021.

- Sell 1 put option, expiration Feb. 19, 2021 (36 DTE), strike $205.

- Buy 1 put option, expiration Feb. 19, 2021 (36 DTE), strike $200.

- Premium: $155.

- Capital At Risk: $345.

Let’s fast forward to Feb. 12, 2021, one week prior to expiration. I don’t like to hold winning trades into expiration week because gamma can quickly wipe out all your gains very quickly. In our example case, BABA is trading at $267.77 on Feb. 12. This serves as a nice profit for us.

We had to put up a $345 margin, and we received $155 premium to open the trade. Depending on your account size, you could have traded 5-7 spreads easily, as each spread only had a $345 buying power reduction in your account. So, how did we do? Well, we made $119.90 and we had a buying power reduction of $345, so our profit is 34.75% ($119.90 / $345.00).

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more

Really quite interesting. But how can something with no mass have inertia? Or is inertia being used to describe a slow response time? And the quick trading, buying at that "c" point on the curve and hoping to sell at that unmarked peak that follows is trusting that there will be a buyer at that price. And I have not found a way to magicly produce buyers always wanting to pay what I ask.