What If NFTs Aren't A Bubble?

Jack Dorsey, looking like Rasputin on C-SPAN.

NFTs: Bubble Or Profound Innovation?

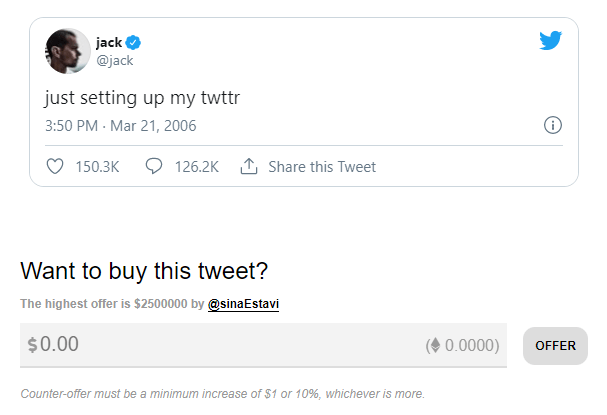

From his meditation retreats in the country formerly known as Burma to his Rasputin-like appearance in Congressional testimony, Twitter (TWTR) and Square (SQ) CEO Jack Dorsey cuts an eccentric figure. Given that, you might think to dismiss his recent auction of the NFT (Non-Fungible Token) of his first tweet as another eccentricity.

Image via Valuables by Cent.

You might also think the current $2.5 million bid on his tweet is the sign of an insane bubble.

What if it isn't?

I Am The Louvre

To explain the logic behind NFTs, we turn to Albert Wenger, managing partner of Union Square Ventures. As we mentioned when we interviewed him a few years back, by some measures, Union Square Ventures is the top-performing venture capital firm in the world. Notably, it was also an early investor in Twitter. In a post over the weekend (A Word On NFTs), Dr. Wenger offered a thought experiment. Imagine a future where you could scan the Mona Lisa that's hanging in the Louvre, and then 3-D print an exact duplicate in your home.

Do you now own the Mona Lisa? No, you have a copy of it. Even though your copy is now identical to the original. Imagine for a moment trying to sell it.

You: I am selling the Mona Lisa

Buyer: You mean the one that’s hanging in the Louvre?

You: Well, …

As long as a buyer can easily call up the Louvre and ask them if they still have the Mona Lisa and they can credibly assert that they do, your copy will be worth very little.

Wenger then extends the thought experiment: what if someone switched your exact replica with the one in the Louvre? You'd have the same problem trying to sell it. He concludes:

This is what NFTs do for digital content. They let someone assert “I am the Louvre” (for that piece of content).

This is not a fad. It is a fundamental and profound innovation. And one that I and others had envisaged a long time ago.

A Picks & Shovels Play On NFTs

The old cliché about the gold rush was that the businesses selling picks and shovels to the gold miners were the ones who made the most money on it. So what's a picks & shovels play on NFTs? Consider Square. W.E. Deming, noting Square's recent acquisition of the Norwegian music streaming service Tidal, suggested Jack Dorsey would use NFTs to differentiate Tidal from streaming competitors such as Apple (AAPL) and Spotify (SPOT).

$SPOT is trying to create exclusivity around podcast content. Tidal contains exclusive concerts and videos. I’m not sure what $AAPL is doing to create exclusivity. Probably why Jimmy Iovine bounced 🤷♂️

— W.E. Deming 🌷 (@edwards_deming) March 6, 2021

We Like The Stock

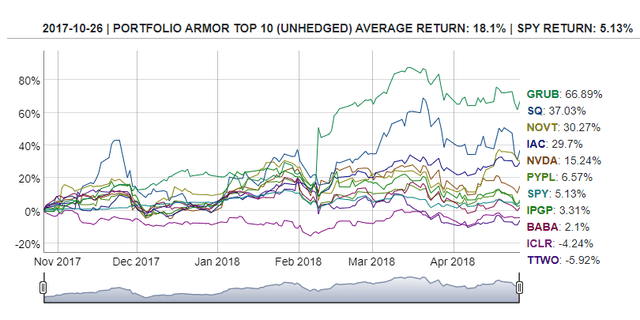

Every trading day, our system analyzes every stock and ETF with options traded on it in the U.S., based on their past total returns and forward-looking options market sentiment on them. It then ranks the ones that pass its initial screens by their potential returns over the next six months, net of their hedging costs. Square first made the top ten names of our ranking in October of 2017.

Screen capture via Portfolio Armor.

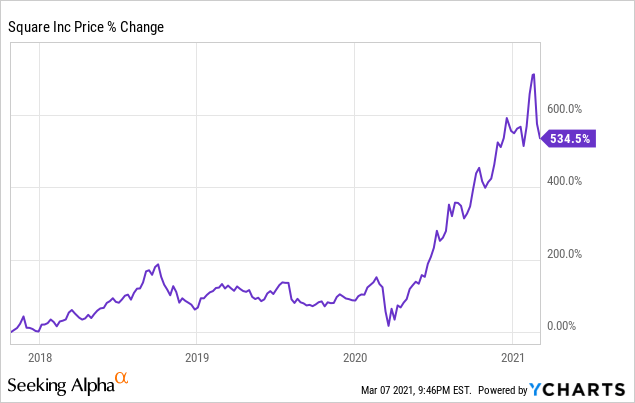

Since then, it was up 534% as of Friday's close.

Square was one of our top ten names again on Friday.

In Case We're Wrong About Square

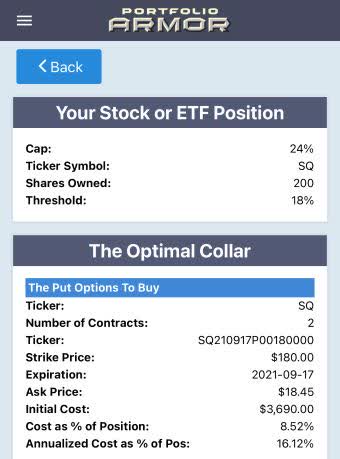

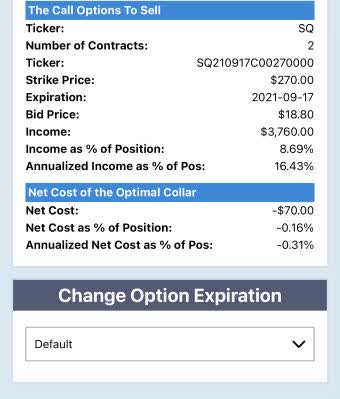

In case we're wrong about Square over the next six months, here are a couple of ways you can hold it while strictly limiting your downside risk.

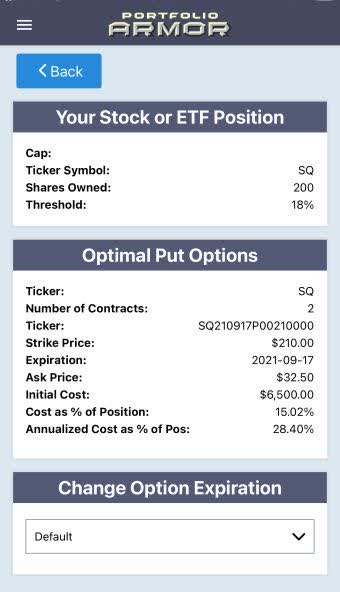

Uncapped Upside, Higher Cost

As of Friday's close, these were the optimal puts to hedge 200 shares of SQ against a greater-than-18% drop by mid-September.

Screen capture via the Portfolio Armor iPhone app.*

The cost there was $6,500, or 15.02% of position value (calculated conservatively, at the ask; in practice, you can often buy and sell options at some price between the bid and ask). If you don't want to pay that much to hedge, you can scan for hedges at closer expiration dates, or scan for an optimal collar. Here's an example of an optimal collar on Square

Capped Upside, Negative Cost

If you were willing to cap your possible upside at 24% by mid-September, this was the optimal collar to hedge 200 shares of SQ against a >18% drop by then.

This time, the net cost was negative, meaning you would have collected a $70 net credit when opening the hedge. That cost assumes, to be conservative, that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

*We're raising the price of the app from $38.99 to $64.99 on Tuesday, so if you've been thinking of downloading it, you can save $26 by doing so before Tuesday.