VVIX Vs VIX: Volatility And The ‘Vol Of Vol’

Today we’re looking at the differences in VVIX vs VIX.

We’ll discuss the basics of the two indexes and then things you should watch for in your trading.

Introduction

When it comes to volatility products investors are often confused.

This article provides a brief overview of two major volatility indices.

The VIX and VVIX. We will then explore similarities, differences, and comparisons between the two products.

What is the VIX?

VIX is an index that represents the market expectations for volatility over the next 30 days.

This index is derived directly from a large basket of different SPX options.

This allows the index to take into account things such as skew and curvature.

Essentially it provides a good overall picture of implied volatility across the S&P 500 surface.

Therefore, the VIX shows a snapshot of implied volatility for the S&P 500.

What is VVIX?

VVIX is an index measuring the volatility of the VIX index over the next 30 days.

The methodology is almost the same but instead of SPX Options, the VVIX uses VIX options. It, therefore, measures the volatility of volatility.

Often for simplicity, it is referred to as the vol of vol.

The VVIX shows a snapshot of implied volatility for the VIX.

Is VVIX a Derivative of VIX?

Yes, VVIX is a derivative of VIX. Just like our first level greeks like delta, theta and vega have their own derivatives.

These are second-order greeks such as gamma, vomma, and vanna.

We then have 3rd order greeks that are derived from the second-order greeks. It is just like the movie Inception!

Source: Meme Generator

The idea that we can go deeper and deeper mathematically can make options feel daunting.

Though fret not.

As we get into 3rd and 4th order greeks they lose importance for retail traders and are mainly only relevant for market-making firms.

The main focus of options traders should be on the first few orders of greeks.

The same goes for the VIX. If you don’t fully understand the VIX, stop and figure it out before diving into products like the VVIX.

After all, the VVIX doesn’t exist without the VIX.

If you don’t understand the VIX it is impossible to understand its derivatives.

Does VVIX Really Matter?

I mentioned that as you go down the list of derivatives they matter less and less to the average retail trader.

For most people involved with vanilla single name options VVIX is not resoundingly important.

That being said, an exception needs to be made for VVIX.

The uniqueness of VVIX is it is easy to trade directly though trading VXX options.

Odds are you or someone you know have traded VXX options as a “hedge” or to speculate.

Most people trading VXX options think they are trading volatility of the S&P 500.

Yet by buying and selling options on VXX they are actually trading the vol of vol or VVIX! If they wanted to trade the VIX directly they would simply buy or short VXX as it is already measuring the volatility on the S&P 500.

Thankfully, the majority of the time both products move in a similar fashion, as we will see later.

Unfortunately, this also prevents investors from learning what they are actually trading when they trade VXX options.

VVIX vs VIX Similarities and Differences

One of the biggest similarities between the two products is they are both indexes.

As such they are unable to be directly traded.

Trading the VIX revolves around trading VIX futures and VVIX around trading options on these VIX futures.

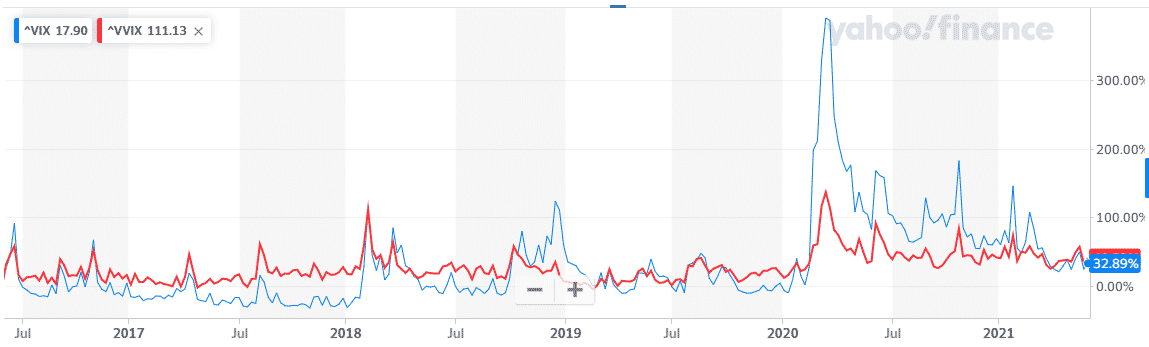

Another similarity between the two products is in their high correlation.

Below I have plotted a graph of the VIX vs VVIX (in red). We can see how correlated they are to each other.

Source: yahoo finance

So why are they so correlated? Let us think about it logically.

When are the times that the VIX moves up and down the most at the fastest rate?

If you are thinking during times of market stress, then you are correct.

This happens when the VIX is already high. A simple analogy is like this.

If it is sunny today it is most likely sunny tomorrow.

If there is a windstorm today, tomorrow could be calm or there could be a hurricane.

This uncertainty about the volatility of tomorrow is what VVIX measures.

So, does it have to be the case that when VIX is high VVIX is high as well?

No.

For example, if the market was entering a new more volatile regime and there was little doubt of lower volatility coming back in the future that would constitute a high VIX and a lower VVIX.

Though even then the divergence may not be too pronounced.

Trading the VIX Against VVIX

Due to the high correlation between of VIX vs VVIX, a strategy could be to trade one against the other, betting on mean reversion.

This is because over time VIX and VVX will converge upon each other, as both are mean reverting and correlated assets.

For example, if a trader thought that VVIX was high against the VIX they could buy VXX shares while selling VIX calls.

This could express a view on the VIX/VVIX ratio.

Just don’t call it part of a covered call strategy!

Hedging with VIX or VVIX

Alternatively, imagine we are looking for a hedge on our stock position.

The first place we should always look for a hedge is in the position itself.

For example, if you are long shares of the S&P 500, SPX puts will be a better hedge than being long VIX.

Don’t randomly buy insurance on your neighbor’s house instead of your own.

Sure, it might work some of the time, but it better be offered at a discount to do so.

The same thing applies for a short volatility portfolio.

Here the best hedge is buying and selling the VIX directly, not VIX options.

That being said, being tactical and trading VVIX vs VIX depending on your view will be rewarded if you are correct while also providing relatively good protection to your holdings.

Conclusion

Both the VIX and VVIX are similar. While the VIX measures the implied volatility of the S&P 500 the VVIX measures the implied volatility of the VIX.

Both indices are correlated and will move often in conjunction thus making for a good pairs trade.

Despite this, they are not the same thing and can move in different directions occasionally.

They also cannot directly be traded.

Exposure to the VIX can be gained by buying or selling VIX futures or VXX while exposure to VVIX can be obtained by trading options on these products.

Most importantly of all, whether you are trading VIX or VVIX. Know what you are trading and why you are trading it.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more