Tuesday Talk: The Futures Are Bright

As markets in the U.S. and the U.K. return from the holiday weekend stock market futures in New York are modestly bright. S&P futures are up 16.5 points at 4,219, Dow futures are up 171 points at 34,684 and Nasdaq futures are up 48 points at 13,734. Corona guidelines are being lifted across the U.S. and the U.S. economy seems to be officially open. As Congress returns to Washington to continue discussing the Biden Administration's infrastructure bill TalkMarkets contributors take a look at what is up with the economy as well as cyrpto and cloud.

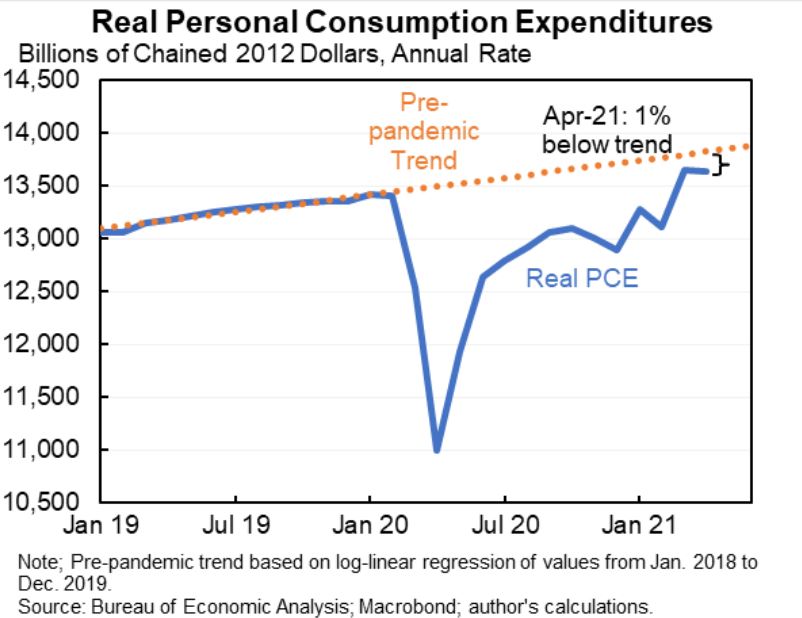

The Staff at Upfina in their article Rent Inflation Set To Soar This Summer have this to say about the economy based on recently released Personal Consumption Expenditure data from April.

"The latest PCE report from April completed a couple of recoveries and almost completed another. When it comes to compensation, spending, and inflation, the pandemic losses have been all but recuperated. Remember, the people who are able to work from home get paid the most. They have an outsized impact on compensation and spending. Clearly, the bottom third of the labor market hasn’t fully recovered. The hardest-hit areas of the economy haven’t recovered and neither has the entire labor market.

Specifically, compensation is 0.2% above the trend it was running at prior to the pandemic. Real personal consumption is still 1% below the trend. Finally, as you can see from the chart below, the core PCE price index is 0.2% above the 2% trend growth rate it was running at prior to the pandemic."

With regards to housing Upfina has these comments:

"Cities are recovering. There is no longer a need to leave the city since the vaccines have stopped the spread of the pandemic. We are within a couple of months of people returning to offices and restarting the much-dreaded work commute via public transportation. As we predicted, rent prices are improving as well. This is going to be a huge driver of core CPI in the summer."

"In a prior article, we explained that consumers soured on buying houses and cars in May because of price increases. A common phrase among home buyers is “I know I overpaid.” Technically, they might not have overpaid. Affordability still isn’t out of control. This is the opposite of a bubble. Banks have not made it easy to get a mortgage. However, people feel they overpaid because there is a mad dash to buy houses above asking prices."

Sounds likes transitory inflation.

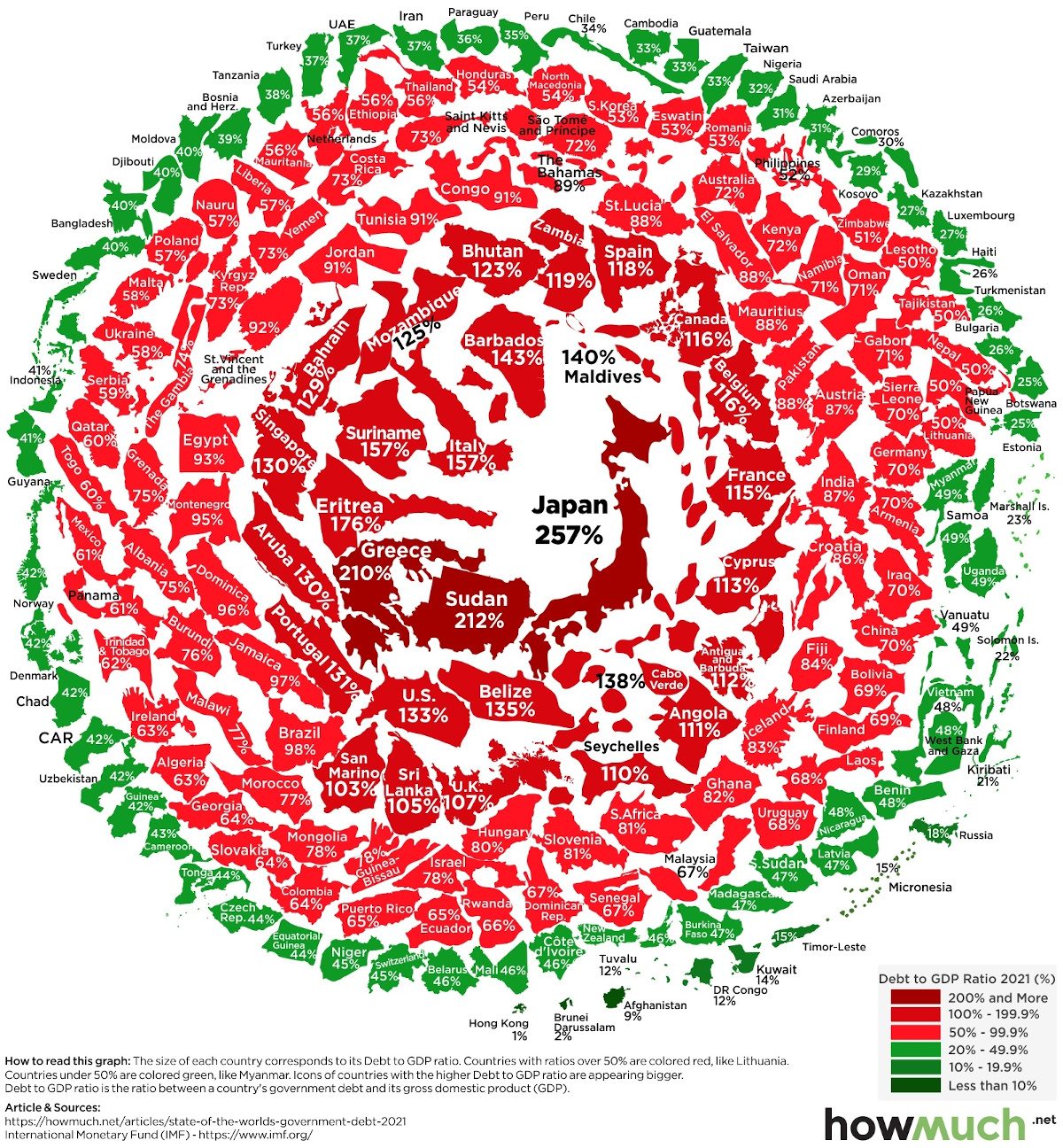

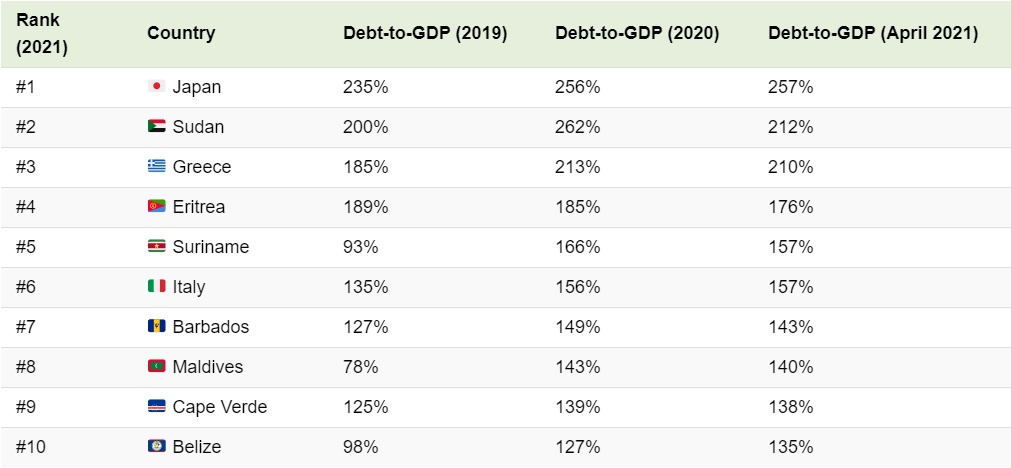

Contributor Marcus Lu helps readers visualize the size of government debt, which is another less savory part of the post-pandemic (though COVID-19 is still raging in many parts of the world) economy. His article Visualizing The Snowball Of Government Debt has some great infographics which you can see below and in the full article.

Top Ten Countries by Debt to GDP ratio

Check out the full article for some interesting observations about government debt worldwide.

In an exclusive for TalkMarkets, The US Economy Is Nearly Back To Pre-Covid Levels, But Still Far From Normal, economist Arthur Donner explains why the may be back, but not back to normal.

According to forthcoming reports (from the US Bureau of Economic Affairs) "There is little doubt that the US economy is bouncing back rapidly from its COVID downturn. The advance estimate (which likely will subject to major revisions), real GDP expanded at an annual rate of 6.4% in the first quarter of 2021 following 4.3% growth in the fourth quarter of 2020."

However...

"The US foreign trade picture worsened sharply in the first quarter and subtracted from growth, as exports dropped and imports surged. Indeed, net exports subtracted close to a full percentage point from GDP growth in the first quarter."

Regarding inflation...

"Currently, the Fed seems steadfast in its view that the recent bout of inflation is transitory. Thus, the Fed still plans to keep interest rates near zero to support the economic recovery and to reduce unemployment from its current 6.1% level. Indeed, there is little risk of a repeat of a 1970s style of entrenched inflation. This view is also obviously shared in the financial markets, since longer-term bond yields have been declining, despite the recent spike in inflation. All of this suggests that the US economic outlook is rather solid and will continue to be supported by policymakers well into next year."

Donner also, provides some excellent charts which illustrate the strength of the current recovery in the U.S. economy.

So how are these macro outlooks affecting specific areas in the markets?

Contributor Adam Sharp in a TM Editor's Choice piece, AMC Illustrates Market Insanity, shows readers one of the dangerous sides of a "hot" stock market.

"The hottest stock in the world is AMC. Yes, the movie theater chain. On Wednesday it was the world’s most traded stock and made up 11% of the total volume on the New York Stock Exchange. In March of 2020 — when the pandemic was beginning — AMC had a market cap of $166 million. Today, AMC is worth more than $15 billion."

"For people that don’t understand the markets or might be struggling financially, the temptation to get into the “meme stocks” (like AMC) must be overwhelming. And for now, it’s working out pretty well for buyers. But I’m concerned this thing is going to fall apart eventually. And when that happens, people are going to get burnt."

Sharp talks about the players pushing AMC in his article, as well and concludes with this warning:

"Just to be clear, I am NOT saying you should short AMC. This craziness could continue for some time. I have no position in AMC — long or short. And I don’t recommend getting involved in this stuff unless you’re a professional with an amazing trading track record. "

Caveat Emptor indeed.

Bitcoin (BITCOMP) is still on the minds of many investors and some TM followers may have even been singed in the month just ended which was one of the worst ever for the largest of the cryptocurrencies. David Pinsen attempts to get a handle on the situation and offers a few suggestions on how to catch a falling knife or two, in his article A Hedged Bet On A Bitcoin Bottom.

"Carter Worth's take on CNBC was that this looks like the right shoulder of that pattern (in the technical charts) and, if it is, Bitcoin is likely headed down to about $20,000, its all-time high during the last bull run in 2017."

One way to catch a knife - Bitcoin miner Marathon Digital Holdings (MARA)

"If you think May 19th was a bottom for Bitcoin, but want to hedge against the possibility that Carter Worth's bearish prediction ends up being right, one approach would be to buy Marathon Digital Holdings and hedge it...On Friday, if you scanned for an optimal put hedge to protect MARA against a greater-than-25% drop over the next several months, you would have gotten this error message (a message that no optimal put was available)...The reason you would have gotten that error message is the cost of hedging MARA against a >25% decline was itself greater than 25% of your position value. If you were willing to cap your possible upside at 49% over the same time frame, this was the optimal, or least expensive, collar to protect against a >25% decline by December 17th. Here, the net cost was negative, meaning you would have collected a net credit of $650, or 2.62% when opening this hedge...Taking into account the net credit from this collar, this approach offers you twice as much potential upside as a potential downside. It might be worth scanning for an updated optimal collar on MARA this week to see if you can get one as attractive or better. "

I'll remind readers here of the Charlie Munger approach to investing in Bitcoin: "Don't".

Closing out today's column is a what to expect peek at Cloudera's earnings which will be released tomorrow. Zacks Equity Research previews the results in Cloudera To Report Q1 Earnings: What's In Store?.

"Cloudera (CLDR) is set to release first-quarter fiscal 2022 results on Jun 2. For the quarter, the company expects total revenues between $216 million and $218 million. On a non-GAAP basis, earnings are expected between 7 cents and 9 cents per share. The Zacks Consensus Estimate for revenues is pegged at $217.3 million, suggesting growth of 3.3% from the figure reported in the year-ago quarter. The consensus mark for earnings has been steady at 8 cents per share over the past 30 days, indicating growth of 60% from the year-ago reported figure."

"Markedly, Cloudera announced the availability of CPD (Cloudera Data Platform) on Google Cloud in the to-be-reported quarter which is expected to have contributed to its customer base expansion.

Moreover, the increased importance of data, data analysis, and data security is expected to have augmented the uptake of Cloudera’s hybrid cloud solutions amid the pandemic."

Not bad for a newcomer.

It's a short week. Make the most of it and remember that summer is on the way. Here's to a great June.

Interesting article and I like that advice "Don't!"