Three Examples Of Pre-Earnings Diagonals

Being a hybrid of a vertical and a calendar, the diagonal is one of the most versatile and configurable option structures.

The diagonal can be tailored to suit the investor’s particular trading style or sentiment of the underlying.

Today, we will look at three examples of diagonals can be used on stocks with upcoming earnings.

Example 1: Bullish Long Call Diagonal

There is a tendency for certain growth and momentum stocks (often in the tech sector) to rally in price prior to earnings report due to bullish investors wanting to take ownership of the stock expecting it to beat earnings and gap up in price.

There is also a tendency for implied volatility (IV) to increase as we approach earnings.

Or if not increase, it will at least not decrease.

The diagonal can be used to take advantage of three things.

- price going up

- volatility going up or staying stable

- time decay differential between the short and long strikes

As soon as earnings is announced, we would lose our edge on price and volatility.

Because price can gap up or down and volatility will drop.

Therefore, we exit this trade prior to the earnings announcement.

There are some investors who believe that a stock will have a slightly better chance of exhibiting pre-earning run ups if it ran up in the last earnings.

This had been the case for the technology company CrowdStrike (CRWD) which ran up prior to its earnings announcement on September 2nd, 2020.

A bullish investor in anticipation of its next earnings report on Dec 2 buys a long call below the strike price, and finances it by selling a shorter term call above the stock price.

Date: Nov 13, 2020

Price: $132.18

Earnings Date: Dec 2, 2020

Buy one CRWD Dec 18, 2020 call with strike $125 @ $14.33

Sell one CRWD Nov 27, 2020 call with strike $140 @ $2.51

Net Debit: $1181.50

You can think of this as similar to a covered call where the long call is your stock replacement and your short call is your incoming generating leg.

In this example, the long call was purchased at the 65 delta with expiry about a month away.

The short call was sold at the 30 delta with expiry about two weeks away.

The call that we are selling always has an expiry shorter than the call that we are buying.

The shorter expiry options will lose value faster than longer expiry options.

We want options that we sell to lose value.

We want options that we buy to maintain value.

To further enhance this differential, the short option will expire prior to earnings.

The long option will expire after earnings.

Because the long option spans across the earnings date, it will hold its value better.

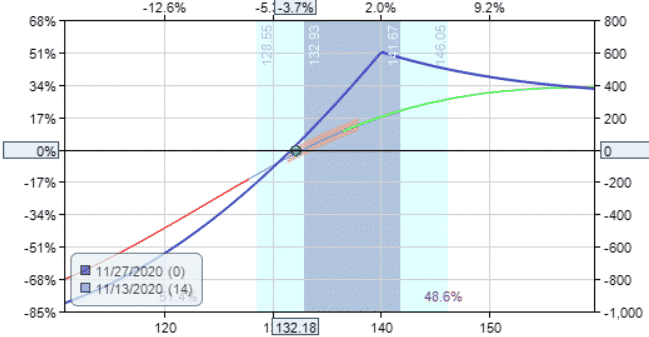

The dark blue line of payoff diagram shows the profit and loss on November 27th when the short option expires.

There is no upside risk.

As long as the stock goes up regardless of how high, the investor will profit.

The max profit will be occur when CRWD ends up at $140 on November 27th.

This is a very bullish trade because there is no room for error on the downside.

The break-even price on November 27 is close to where the price is currently.

The Greeks of this trade are:

Delta: 34.25

Theta: 3.13

Vega: 6.10

The trade will profit if price goes up (positive delta), if time passes (positive theta), and if volatility increases (positive vega).

By exiting the trade as close to the short strike expiration as possible, we take full advantage of the fast decay of the short strike.

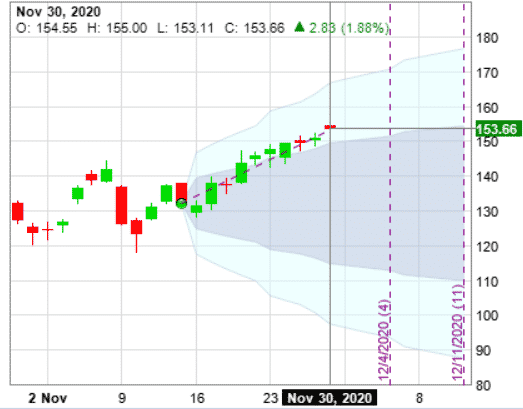

On November 24th, two trading days prior to the expiration of the short call, CRWD is at $149.45.

Since this price is higher than the call strike price of $140, it is at risk of assignment.

Closing out the trade now by buying back the short strike and selling the long strike would net a profit of $461, or 39% of the initial debit paid.

Closing out the trade one day later would net $493.50, or 42%.

Closing out the trade one hour before market close on expiration day of November 27th would net $486.00, or 41%.

If the investor had not closed the trade prior to expiration, the short call would be assigned and 100 shares of stock would have been sold at $140.

The next trading day Monday November 30, the investor sees a short stock position of 100 shares and buys 100 share of CRWD at market price of $153.66 at the open (the stock gapped up on open).

This is a loss of $1366.

However, the investor still has the long call which can now be sold for $2990.

Initial debit: –$1181.50

Call exercised sell 100 shares at $140: $14,000

Buy to cover 100 shares at $153.66: –$15,366

Sale of long call: $2990

Net profit: $442.50, or 37% of debit paid

Example 2: Diagonal Using Puts

This next example is less bullish.

You can think of this construction as a bull put spread but with the long leg expiry further out in time than the short leg expiry.

On January 6, 2021, an investor puts on the following diagonal in anticipation of Netflix’s (NFLX) next earning report on Jan 19, 2021.

Date: Jan 6, 2021

Price: $500.49

Earnings Date: Jan 19, 2021

Buy one NFLX Jan 29 put with strike $480 @ $16.30

Sell one NFLX Jan 15 put with strike $500 @ $12.775

Net Debit: –$352.50

Netflix’s earning previous to this one on October 20 saw a run down into its earnings announcement followed by a gap down.

So the investor is not very confident of this upcoming earnings and has constructed the diagonal with room for error.

The investor sells the at-the-money put because options close to the current price have greater time value (extrinsic value).

In addition, this creates a payoff diagram where the max profit is achieved if the price does not move.

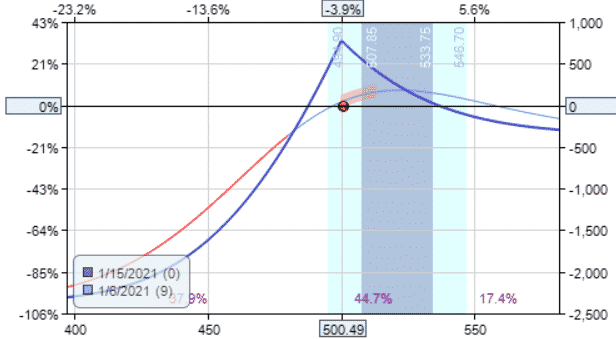

From the payoff diagram, we see that this trade is less bullish.

The investor still expects NFLX to go up, but not more than $530.

If NFLX goes down slightly, the trade can still be profitable.

With current price at $500, the investor will profit if NFLX is between about $480 to $530 on January 15 (when the short put expires).

The exact break-even price can not be calculated because it depends on the remaining value of the long put at the time, which depends on the implied volatility at the time.

On January 15, one hour prior to expiration of the short put, the net profit is $738, or 31% of the max risk.

This is a good place to take profits.

The run-up into earnings did not happen for NFLX.

It moved sideways and ended up at $497.98 on expiration.

If the trade had not been taken off, the investor would have been assigned 100 shares of NFLX at $500, paying $50,000 to take ownership of NFLX.

But fortunately, NFLX gapped up the next trading day to $504 at the open.

Selling the stock back, the investor would have made $400.

In addition, the investor could have sold the long put for $1130.

Initial debit: –$352.50

Stock assignment buy 100 shares at $500: –$50,000

Sell 100 shares at $504: $50,400

Selling long put: $1130

Net profit: $1177.50

Being assigned like this requires a large cash balance. To help avoid assignment, close any trades where the short option is in-the-money and has very little time premium left.

The Greeks at the start of the trade are:

Delta: 13.26

Theta: 17.16

Vega: 15.13

In this example, the price did not go up.

The trade had profited because IV went up slightly and time had passed.

The amount of theta and vega is affected by the difference between the expiry of the two legs.

The more time between the two expiry, the larger exposure to theta and vega.

Example 3: Two Chances To Win

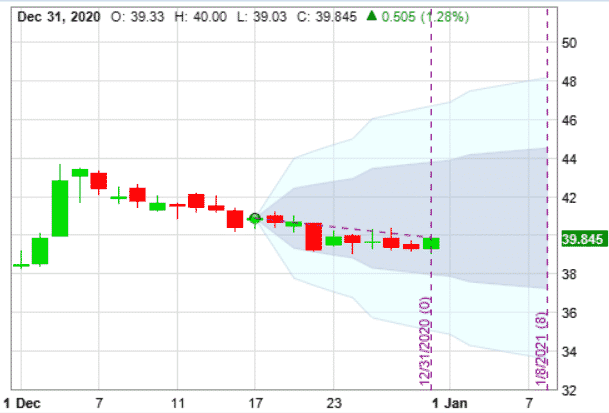

On December 17, 2020, Walgreens (WBA) is sitting right above the 20-day and 200-day moving averages with earnings coming up on Jan 7, 2021.

(Click on image to enlarge)

Believing the WBA will not break below these two moving averages, the investor put on the following diagonal trade using puts.

Date: Dec 17, 2020

Price: $40.88

Earnings Date: Jan 7, 2021

Buy five contracts WBA Jan 15 puts with strike $40 @ $1.39

Sell five contracts WBA Dec 31 puts with strike $42 @ $1.715

Net credit: $162.50 ($32.50 x 5)

Since WBA being a part of the Dow Jones Index is a large cap well-known stock that are already in most people’s retirement account via index or other mutual funds, the investor is willing to take ownership of the stock if WBA is at or below $42 on December 31.

The investor sets aside $21,000 cash in preparation to do so.

The investor is treating this as a cash-secured put with a protective put in place should stock be assigned.

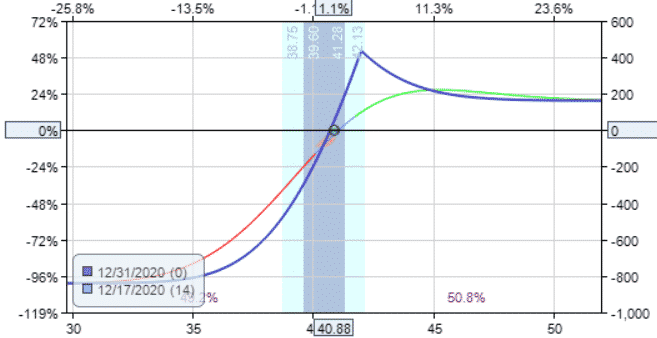

The Greeks:

Delta: 124.70

Theta: 2.57

Vega: 7.41

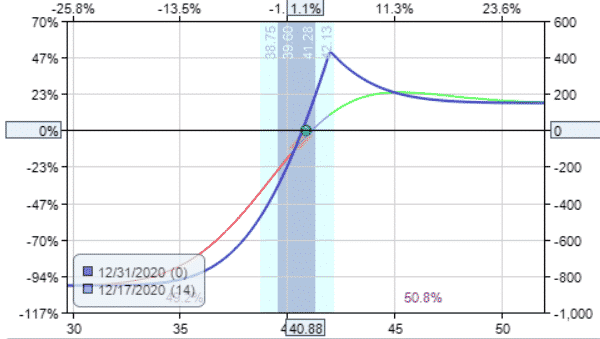

And the payoff diagram:

On December 31, expiration day of the short put, WBA is at $39.85, and the trade is showing a loss of $130.

The price had gone down instead of up as anticipated.

If it had shown a profit, the investor would have closed out the entire trade taking the profit.

But with a loss, the investor goes with the backup plan of taking ownership of the stock at $42 and lets the short put be assigned.

Now the investor has a married put position with 500 shares of WBA stock and five protective puts at $40.

With protection at around the current price, the investor holds through the earning date of January 7th.

WBA earnings beat expectation and WBA is at $45.21 at the end-of-day on January 8th.

At this point, investor takes profit by selling all 500 shares of WBA and liquidating the five put contracts.

Initial credit: $162.50

Assignment of 500 shares: –$21,000

Sale of 500 shares: $22,605

Sale of long puts: $17.5

Net profit over entire trade: $1785

In this example, an initially losing trade had turned profitable because the investor had enough cash on hand to purchase the WBA shares; and because of the protection provided by the long put that allowed the investor to hold over earnings.

What if hypothetically that WBA had missed earnings and stock tumbled downwards?

In that case, the investor would have held the trade until the long protective put expires on January 15.

If WBA is anywhere below $40, the protective put would have been exercised.

Initial credit: $162.50

Assignment of 500 shares: –$21,000

Exercise of protective put: $20,000

Net loss over entire trade: –$837.50

This is the max loss at the expiration of the long strike.

It could have been computed at the start of the trade by…

(long strike price – short strike price) x (number of contracts) x 100 + (credit received) =

-2 x 5 x 100 + 162.50 = -837.50

Puts Versus Calls

While this trade is using puts, the payout diagram looks very similar to that of the first example using calls.

Since the short put strike of $42 is above the current price at the start of trade, most investors would use a call in this case to keep the short strike out-of-the-money.

However, this investor is using puts in order take ownership of the stock at $42.

Any diagonal that can be constructed with puts can be constructed with calls, and vice versa — although the initial credit or debit may differ.

If this trade was done using calls, it would be for an initial debit (instead of for credit). E.g.

Date: Dec 17, 2020

Price: $40.88

Earnings Date: Jan 7, 2021

Buy five contracts WBA Jan 15 calls with strike $40 @ $2.31

Sell five contracts WBA Dec 31 calls with strike $42 @ $0.605

Net debit: –$852.50 (computed by –$170.50 x 5)

The Greeks would be nearly identical:

Delta: 124.69

Theta: 2.58

Vega: 7.41

As would be the payoff diagram…

At short call expiration, the trade is at a loss of $143 (similar to that of using puts).

With WBA at $39.85, the short calls expire worthless and no assignment occurs.

In this case, the investor is left holding the remaining long calls at the $40 strike.

If this was held to expiration on January 15, the call would be exercised at $40 since WBA is at $48.92 then.

Initial debit: –$852.50

Calls exercised buying 500 shares at $40: –$20,000

Sale of 500 shares at $48.92: $24,460

Net profit of entire trade: $3607.50

A single long call gives a higher profit potential than a married put position if price cooperates by going in the right direction.

In the event that the long call expires worthless, the investor loses the initial credit of $852.50.

So the max loss at long call expiration is –$852.50 — very similar to that of the case of using puts.

Conclusion

The diagonal is a highly configurable option structure.

That being so, it also makes it a bit complex.

Hopefully, with these three examples, you see some of the nuances of the diagonal — especially in pre-earnings trades.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more