The Various Stock Order Types

Image Source: Pexels

There are four main order types:

- Market Order.

- Limit Order.

- Stop Loss Order.

- Stop Limit Order.

The Market Order

The market order is probably the first one that an investor learns. This type of order says to buy or sell securities at the next available price (also known as the market price). A market order remains in effect only for the day.

In some brokerage platforms, an investor can specify “On the Open” or “On the Close."

- “On the Open” means the order will be executed as close to the market open time as possible.

- “On the Close” means the order will be executed as close to the market close time as possible.

If an investor puts in a day market order to buy 10 shares of Apple (AAPL), the order will buy 10 shares as soon as 10 shares are available at whatever price Apple stock happens to be trading. This type of order gets filled the fastest — nearly immediately. The trade-off is that it may not be at the best price.

One can say that a market order guarantees that the order gets filled, but it does not guarantee at what price. For a well-known and heavily traded stock like Apple, this is not going to be a problem, because it is likely to be filled at a fair market price. When a security has a large volume of buyers and sellers and is heavily traded, we say it is highly liquid.

The “bid” price is the highest price a buyer is willing to buy at. The “ask” price is the lowest price a seller is willing to sell at. Therefore the bid price is lower than the ask price. When a security is liquid, the bid price and the sell price is going to be fairly close together — we say that the bid/ask spread is narrow.

The bid/ask spread of AAPL during market hours is about a penny. When a security or the market becomes more volatile, the bid/ask spread becomes wider. In those cases, market orders have increased risk because large and rapid price changes could result in the order being placed at a poor price, or possibly at a price that exceeds available funds.

In such cases, a limit order may be a better alternative.

The Limit Order

The limit order allows an investor to set the price at which the order is filled. This type of order is not guaranteed to get filled. But if it is filled, this order guarantees that the order is filled at the price specified or better.

A buy limit order is used by an investor who wants to buy a security. The investor sets a limit price. This is the maximum price that the investor is willing to buy at. The order will only get filled if the price is at or below that price.

A sell limit order is used by an investor who wants to sell. The investor sets a limit price, which is the minimum price that the order will get filled at. Limit orders are preferred when bid/ask spread are wide.

Because option prices have much wider bid/ask spreads, an investor buying and selling options should generally use limit orders instead of market orders. It is also important to trade only liquid options. Not all available options are liquid. One can determine the liquidity of an option by its bid/ask spread (more so than by volume and open interest).

The bid/ask spread of a near at-the-money option in AAPL is about 10 cents. A bid/ask spread of 10 cents or less is considered liquid for underlying assets that have a price of $100 or less. Options of more expensive assets will naturally have wider bid ask spreads, in terms of cents.

With limit orders, an investor can specify additional conditions, such as “Day," “Good till Cancel," “Fill or Kill," “Immediate or Cancel," and “All or None."

With a Day order, the order will cancel at the end of the day if it cannot be filled. The “Good till Cancel” order will remain in effect until the investor cancels it. This does not literally mean forever, however. If an order does not get filled and investor does not cancel, most brokers will automatically expire the order after some time (for example, around 180 days).

“Fill or Kill” means that if the order cannot be filled in its entirety immediately, then it cancels the whole order. “Immediate or Cancel” is similar ,except that it cancels any portion of the order that cannot be filled immediately. This allows for the possibility for orders to be partially filled. For example, if an investor orders to buy 200 shares of GE, it is possible that only 50 shares end up being purchased.

“All or None” means the investor wants either the whole order to be filled, or not at all.

Stop Loss Order

Investors use stop loss orders to prevent further loss, or to prevent a loss of profits. Suppose an investor bought 20 shares of Johnson and Johnson (JNJ) at $144 and it is now currently trading at $152. In order to not lose this profit, the investor places a sell stop loss order to sell 20 shares at $150. The stop loss price must be lower than the current price.

If the price of JNJ ever drops down to $150, the order will trigger and 20 shares of JNJ will be sold at market price, which could end up being slightly higher or lower than $150. If volatility is high and the bid/ask spread is wide at the time, the filled price can be somewhat different than $150.

Trailing Stops

If JNJ continues to go up in price, the investor can remove the existing stop loss and place one higher up in price to protect the additional profit. Or the investor can set a trailing stop where the stops will automatically be moved up. The “trailing stop loss amount” that an investor specifies for this order can be in terms of dollar amount, or in a percentage amount.

Suppose an investor owns JNJ and the current price is at $154. The investor sets a trailing stop loss of $2. The stop loss will automatically be adjusted to be $2 lower than the highest price of JNJ from this point forward. This means that the sell will trigger if JNJ drops to $152 or lower.

If the price of JNJ goes up to $155, then the stop loss will move up to $153. If the price then drops back down to $154, the stop loss will continue to stay at $153. In other words, a trailing sell stop loss only moves the stop up. The stop does not go down.

Buy Stop Loss

A buy stop loss order is often used when an investor has shorted a stock and then sets a buy stop loss at a price greater than the current price. If the stock rallies up to that price, the investor needs to buy in order to stop losing more money if the price were to continue up.

When the price reaches the stop loss price, it becomes a market order at that price. Therefore it is possible that the buy or sell will get filled at a higher or lower price than the stop loss price.

The Stop Limit Order

The stop limit order works just like the stop loss order, except that when the price reaches the stop limit price, it becomes a limit order. This order lets the investor enter two prices: the stop price at which the order will be triggered, and the limit price.

Suppose an investor owns GLD with the price currently at $172, and they want to sell if the price drops to $170. The investor can set a sell stop limit order with a stop price of $170, and a limit price of $170.25. If GLD drops to $170, it triggers and becomes a limit order with a limit price of $170.25. It will not sell until the price comes back up to $170.25, or higher.

The limit order instructs the broker to sell only if the investor can get a good price of $170.25 or better. But if the price drops through $170 and it will not come back up to $170.25, the order will not get filled. Like any other limit order, the order may get filled completely, partially, or not at all. The risk with a stop limit order is that sometimes it does not get filled and thus does not protect the investor from loss.

Let’s say another GLD investor sets a sell stop limit order with a stop price of $170 and a limit price of $169.75. In this case, this order is more likely to get filled, because there is better chance that GLD will be above $169.75 at the time the stop is triggered. However, it is still not guaranteed to be filled.

An example of a situation where the order is not filled would be an overnight gap down from a price of $171 to $169 without the stock coming back up to $169.75 For this reason, when utilized for protecting a position from loss, we like to use the stop loss order (which guarantees a fill, but does not guarantee at what price).

Buy Stop Limit

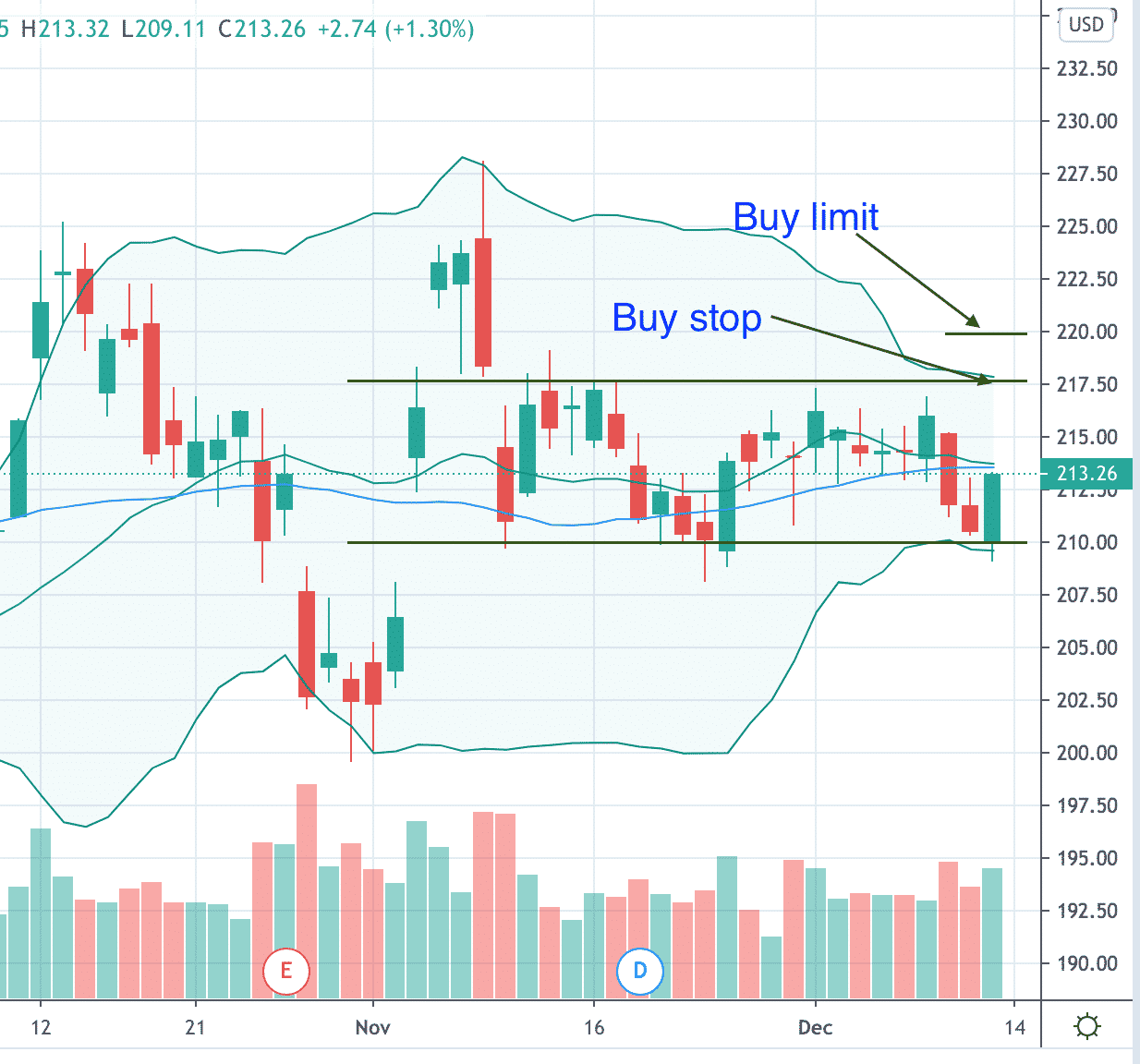

The examples with GLD were sell stop limit orders. The buy stop limit order has a different use case. Suppose that an investor sees that MSFT is trading in a tight range and they would like to buy it only if it breaks out of the range on the upside, and if price is not too expensive.

The investor would set up a buy stop limit order with a stop price of $217.50 and a limit price of $220. This means that if the MSFT price goes up to $217.50, the order will buy MSFT at the market price as long as it is not more than $220.

If MSFT does an overnight gap up from, say, $217 to $221, then the order does not get filled. The investor doesn’t want to buy immediately after such a big move up.

Stop Loss on Options?

Yes, it is possible to place stop loss orders on options. However, they can be problematic for several reasons. The option price can fluctuate due to volatility changing, the price of the underlying changing, or just time passing. Also, the bid/ask spreads are wider than with stocks.

These factors make it difficult to set a precise stop loss target on the option’s price. And even if we try, often the stop loss is triggered by random fluctuations of the option price rather than due to a technical movement of the underlying stock.

A better alternative would be to have the brokerage platform buy/sell the option if the underlying hits a certain price. For example, if the price of ADBE drops below $470, the investor may like to sell the ADBE call option that they currently own. Here, the trigger is based on a stock price and the order is to sell a call option.

To do this, the investor would have to place a conditional order instead of a regular order type. We’ll learn about conditional orders in another article.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more