The Probability Of Touch In Options

Some trading platforms will give an investor the probability of a stock reaching a certain price at some point prior to the expiration of an option. This is known as the probability of touch. Let’s look at some examples.

Example Using Cash-Secured Put

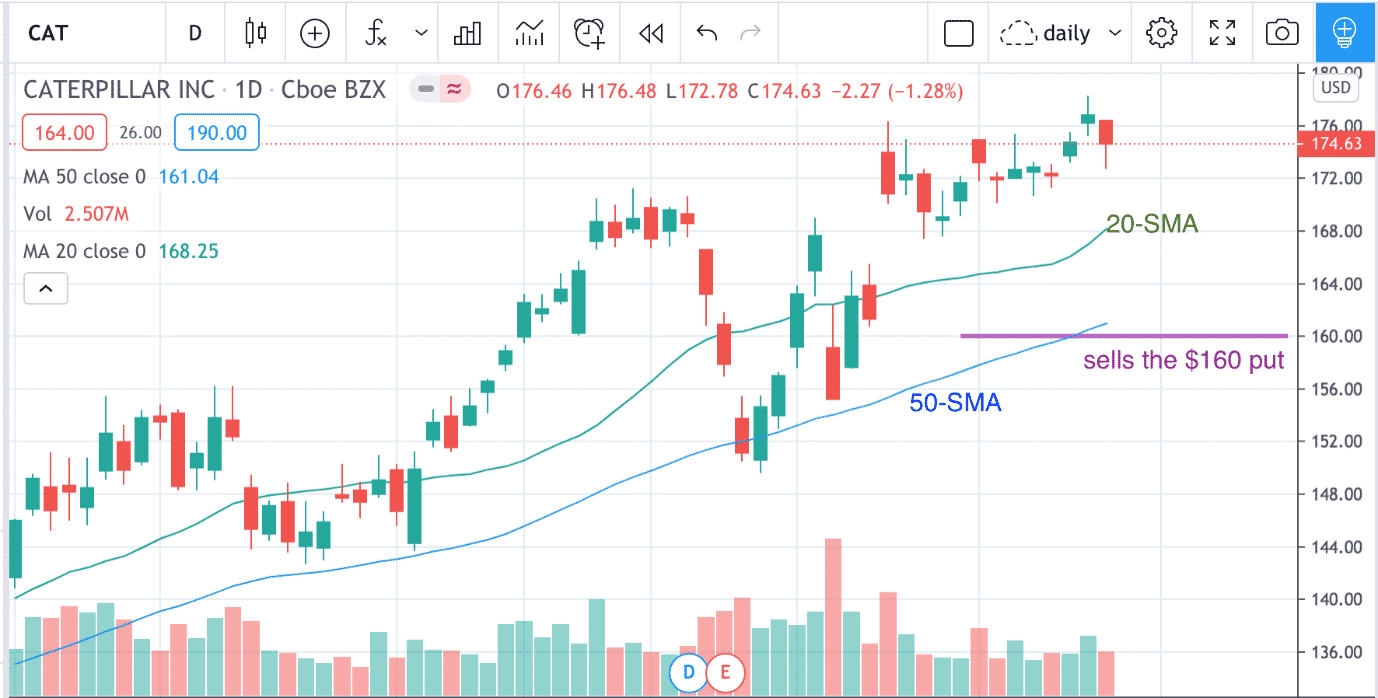

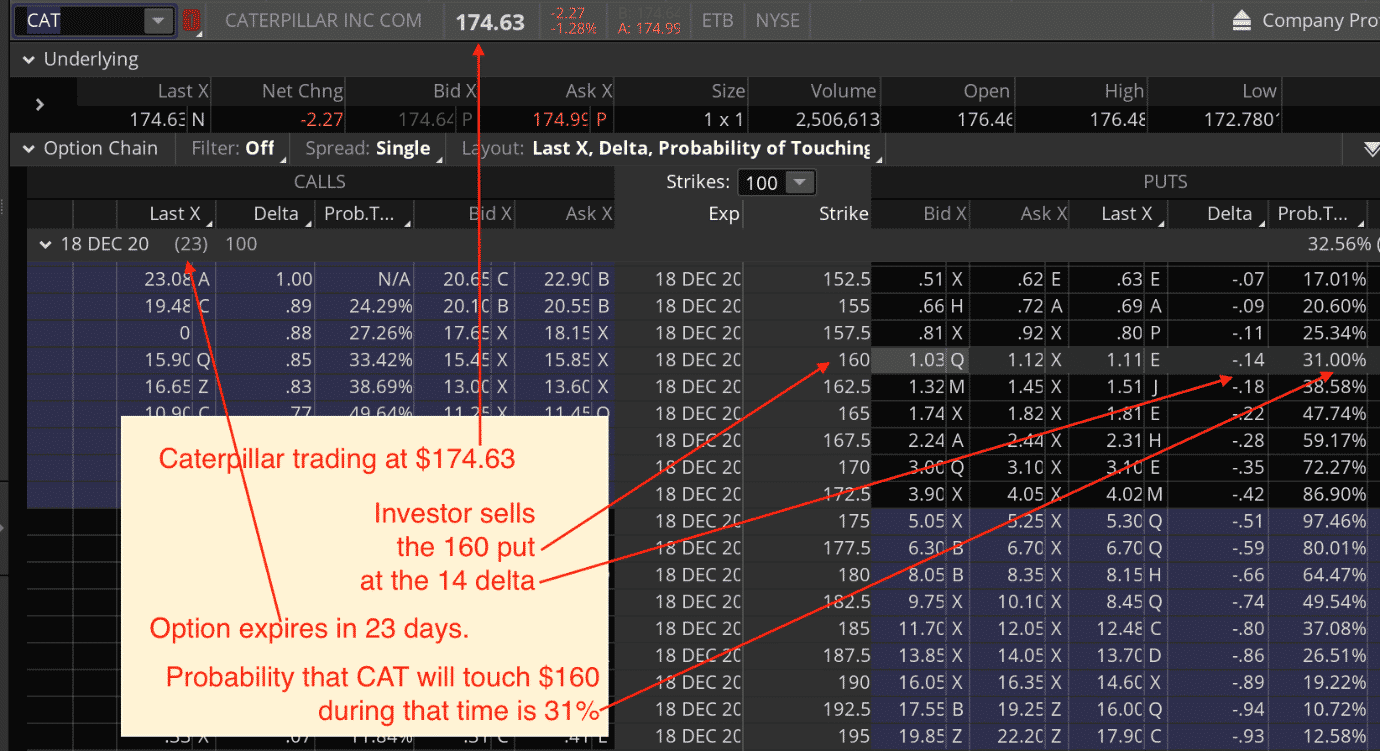

On Nov. 25, 2020, at market close, Caterpillar (CAT) trades at $174.63. This trade will be what we use as our example. An investor may be willing to buy 100 shares of CAT if the price drops back down to $160 near the 50-day simple moving average.

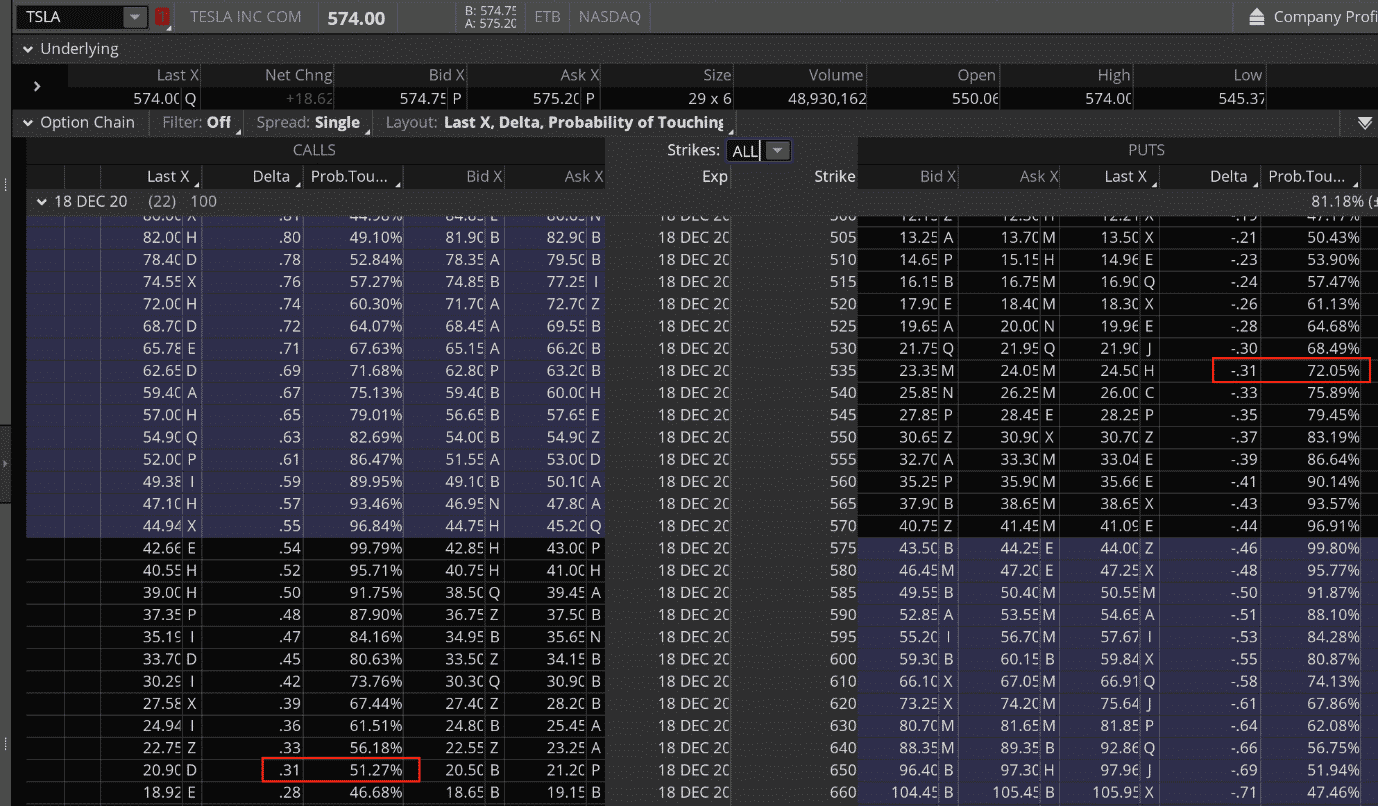

In this trade, the investor sells one put option on CAT at the strike price of $160, with the expiration being in 23 days on Dec. 18. With the ThinkOrSwim platform configured to show the Delta and the Probability of Touch, we see that the $160 strike corresponds to the 14 delta.

The delta can be thought of as an estimate of how likely the option will be in-the-money at expiration. In this case, there is a 14% chance that the $160 put option will be in-the-money at expiration on Dec. 18. We also see that there is a 31% probability of touch. In other words, the price of CAT has a 31% chance of touching $160 at some point prior to expiration.

It makes intuitive sense that the probability of temporarily touching the price is greater than the probability of the price ending up below the price expiration. Roughly, it is about as twice as likely. Because 2 x 14% is 28%, which is close to 31%.

In a trade like this, whenever the price reaches the short strike, the investor is on the brink of a loss. That is why adjusting is such an important skill. Nevertheless, if the investor does find the strike price being tested, then about half the time, a loss does not occur (the price reverses in the investor’s favor) and the other half of time, the loss does in fact occur — assuming that the option is held to expiration.

Example Using Long Call

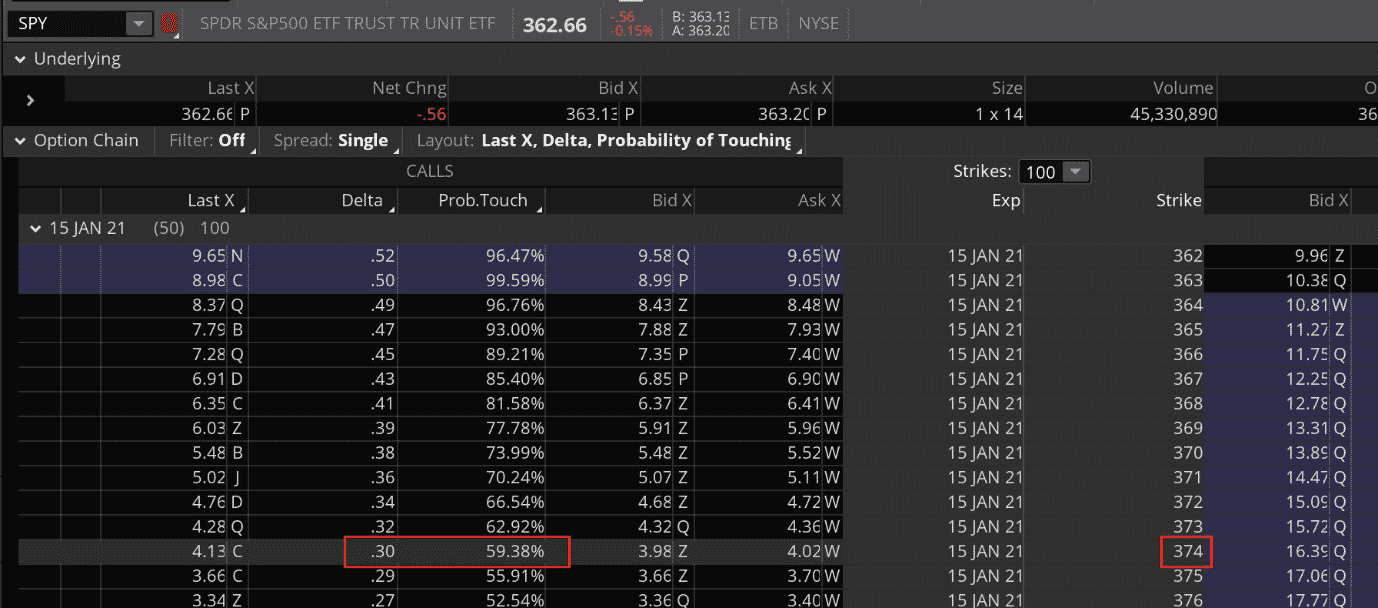

Suppose another investor is bullish on the overall market and decides to buy one call contract on the SPY with 50 days to expiration.

- Date: Nov.25, 2020.

- Underlying Price: $326.66.

- Buy one SPY Jan. 15, 2021 – $374 call @ $4.00.

The strike price of $374 corresponds to 30 delta, meaning there is a roughly 30% chance that SPY will be above $374 at expiration. We also see that the probability of touch is 59% — about twice as likely to touch $374 than ending below $374 at expiration. When investors talk about the probability of touch, it is almost always on out-of-the-money options.

General Rule of Thumb

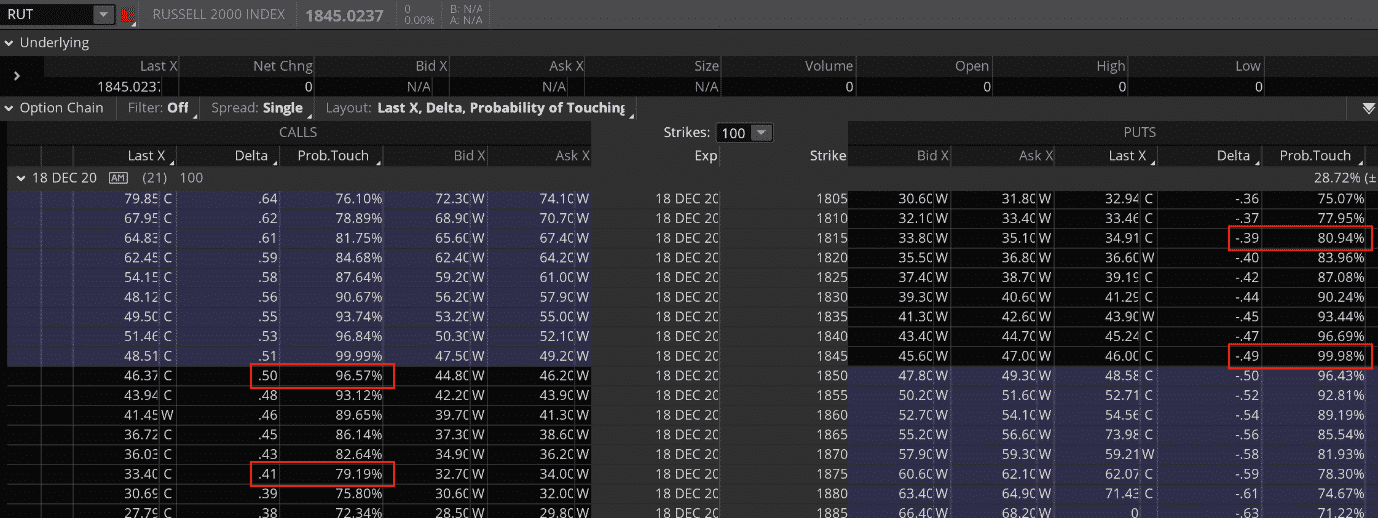

Looking at the probability of touch on the RUT Russell 2000 Index, we see again that the probability of touch is roughly twice the delta.

We also see that the probability of touch is higher for strikes closer to the money, which makes sense. From these three examples, we have a generalized rule-of-thumb that the probability of touch for out-of-the-money options is roughly twice the delta. It works for both the call side and the put side. But sometimes there is a probability skew between the calls and puts, as we shall see.

This rule is only a rough rule-of-thumb; certain volatile stocks may not cater to this rule as much. For example, take a look at Tesla Inc. (TSLA). When compared with CAT, it has a much higher ATR (Average True Range) relative to the price.

The probability of touch of the 31 delta put is computed by ThinkOrSwim as 72% — quite a bit more than twice the delta. The probability of touch of the 31 delta call is shown as 51% — quite a bit less than twice the delta. This suggests that for TSLA at this expiration cycle, the probability of touch on puts is higher than the probability of touch on calls (for the same delta).

Managing Winners

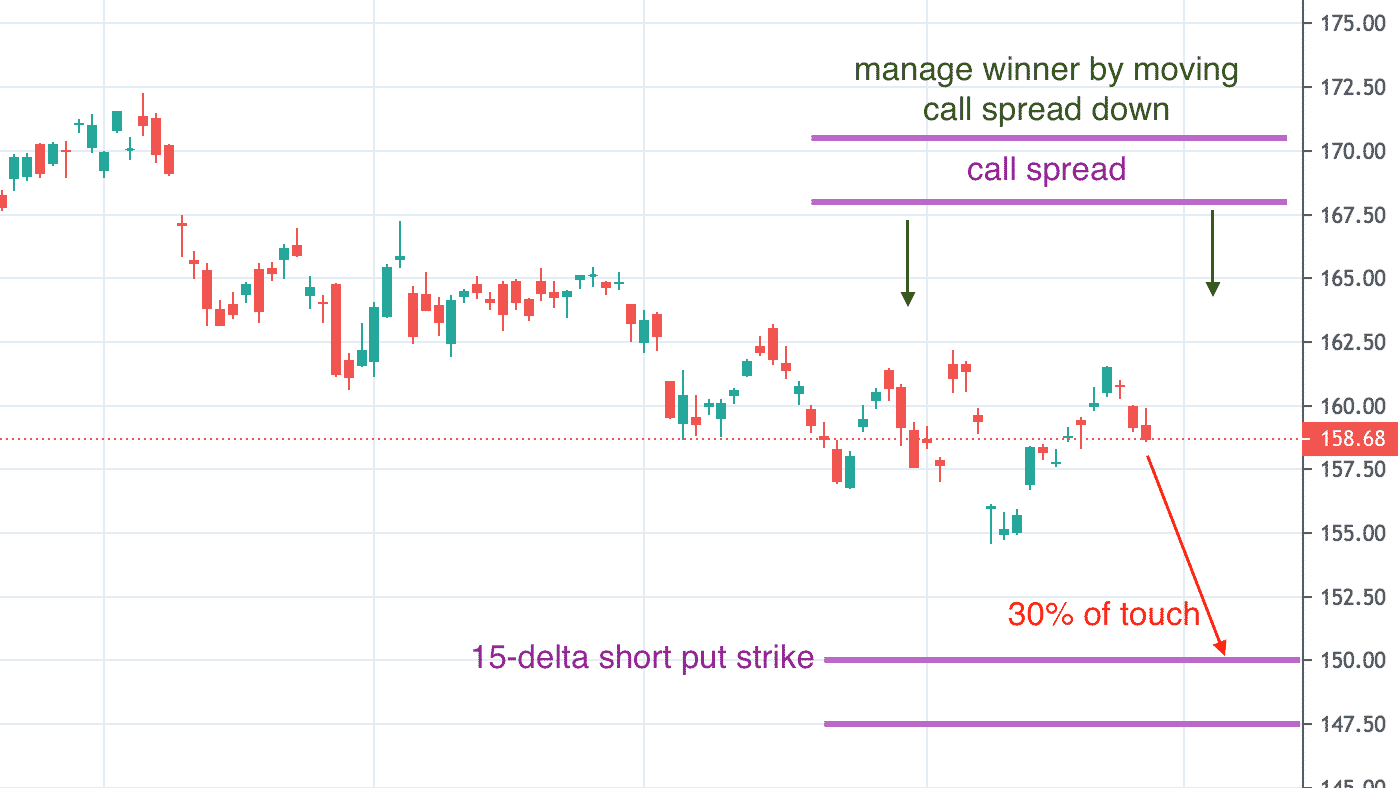

The concept that the probability of touch is twice as likely as the probability of being ITM (in-the-money) gives rise to the philosophy of some iron condor traders to be more likely to manage winners than to manage losers. Suppose that a call spread and a put spread is placed at the 15 delta on TLT.

If the price happens to touch the short put strike (which is 30% likely), the put spread is losing. And the call spread is winning. The investor can either make a defensive move by moving the put spread down, or make an offensive move by moving the call spread down. We are not suggesting one way is better than the other.

Managing winners means moving the winning spread closer rather than adjusting the losing spread. The rationale for this is that (about half the time) the touch on the losing spread will only be temporary with price reversing. Some iron condor traders may even put in an automatic order to take profit on the winning spread whenever it can be bought back at $0.10 or less.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more