The Chicken Iron Condor

What Is An Iron Condor?

First of all, let’s start with “what is an iron condor” before we get into the chicken variety.

The iron condor is an option trading strategy that consists of four contracts – a bull put spread and a bear call spread.

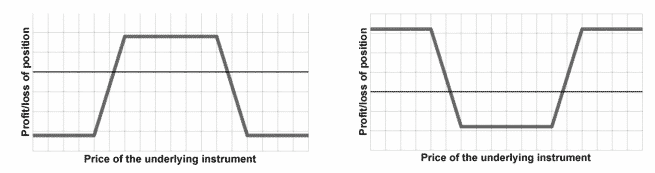

The first image above shows a regular iron condor where the trader is selling the closer to the money options and buying options further away. The trader is looking for the stock to stay within the specific range over the course of the trade.

The second image shows a reverse iron condor where the trader buys the closer in options and sells the further out options. Here the trader is looking for the stock to break out and make a big move in either direction.

A regular iron condor will result in a credit being received in the traders account whereas a revers condor needs to be paid via debit from the account.

The maximum profit on an iron condor is equal to the premium received and the maximum loss is the difference between the strikes prices less the premium received.

The situation is swapped around for a reverse iron condor.

Now that we know what a regular iron condor is, let’s take a look at the chicken iron condor.

What Is A Chicken Iron Condor?

Now that we have a solid understanding of the iron condor and the reverse condor, let’s take a look at the chicken iron condor.

Chicken iron condors are a directional neutral trade and are like a regular iron condor they are profitable when the underlying expires between the inside strike prices rendering all 4 contracts worthless.

A typical benchmark for iron condors is that you’ll try to sell your spreads for one-third of the width of the spread itself.

For example, if the spread is $3 wide you’ll want to collect $1 in premium.

The chicken iron condor seeks to take advantage of sharp moves in implied volatility and will collect 50% of the spread width in premium.

A common spread width is $5 and in this scenario, you’ll want to collect $2.50 in premium.

This increases your maximum profit and decreases your maximum loss.

The caveat here is that you’ll likely need to be selling your spreads closer to the money than you might otherwise be interested in.

For this reason, it’s important to be careful and not get pulled in too close to the money by chasing premium.

The strategy relies on unusually high volatility and traders need to keep this in focus.

If volatility is not as high as you’d like, then adjust your strategy.

If you chase the premium to close to the money, your chicken will get roasted!

When Would You Use a Chicken Iron Condor?

The strategy was pioneered by tastytrade and they say that this strategy is best for trading around earnings statements.

“We normally use this strategy for earnings announcements. If we are correct in our assumption, we get paid more than a normal iron condor, and if we are wrong, we lose less. It is not uncommon to see underlying blow through their expected move, which is why we tend to lean towards this strategy instead of a regular iron condor for earnings.”

This last sentence is very important.

Again–be sure to remember that this strategy is meant to be implemented in situations where the expected moves (implied volatility) are very large.

In many cases, the underlying will stay within the expected move around an earnings call.

In this case, you will be making more money on the chicken iron condor than you would have with a standard iron condor.

As tastytrade notes, the chicken iron condor is also safer around an earnings call since it’s always possible that the underlying moves much more than anyone expected.

In this case, because you collected more premium when opening the position, you will lose less money if one of your spreads gets blown up.

Tastytrade also says, “Much like other standard premium-selling strategies, we close iron condors when we reach 50% of our max profit.”

If the strikes are closer to the money and there is still quite a bit of time until expiration, you may want to consider taking your chips off the table.

You were paid more to open the position which means you’re being compensated for the added risk that the market is pricing in.

If implied volatility is decreasing or you are banking theta, don’t stick around too long to see the position reverse.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more