The Broken Heart Butterfly Option Strategy

As its name suggests, the broken heart butterfly is a variation on the broken wing butterfly, which itself is a variation of the butterfly option trade. Some investors feel that the broken wing butterfly is a better alternative than the butterfly. Could it be that this newer broken heart butterfly variation is an even better alternative than the broken wing butterfly strategy?

We say newer since the earliest reference to the term “broken heart butterfly” was by TastyTrade during the last quarter of 2020. However, this type of trade is nothing new. It is a credit spread hedged by a debit spread, or vice versa. Investors have been doing it long before then. It’s just that they never had a good name for it.

Today, we will take a look at the broken heart butterfly as compared with the broken wing version.

Setup Put Side Broken Heart Butterfly

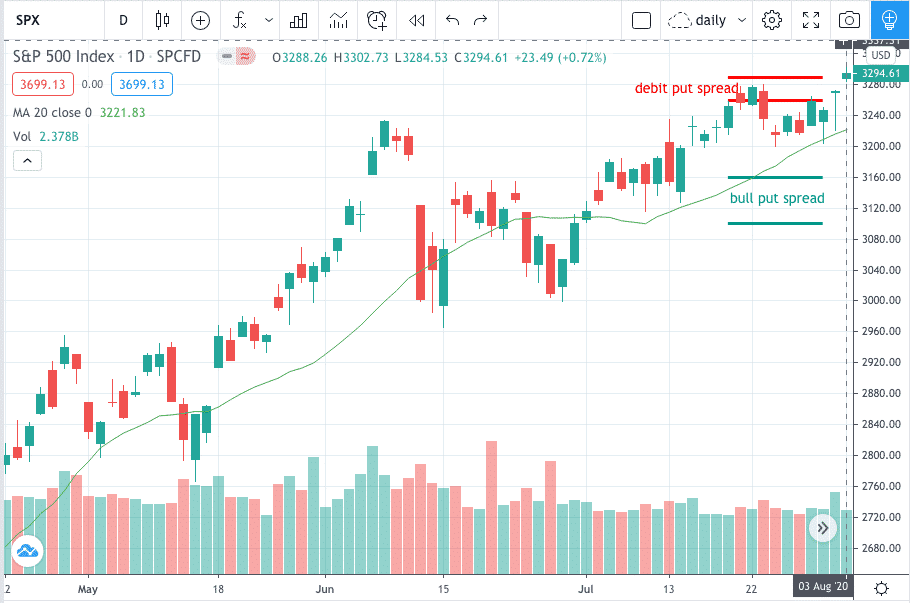

An investor sees a chart of SPX on August 3, 2020 with the market on a bull run. Price is above an upward sloping 20-simple-day-moving average.

As is natural for this investor, a bull put spread is placed on anything bullish. However, the investor’s conviction is not strong. The market has already gone up so much already. Can it really still continue up? This hesitancy causes the investor to add on a debit spread hedge. Not a full hedge, but enough to offer some protection if the market reverses.

The put broken heart butterfly is constructed as an out-of-money bull put spread with a bear put spread placed closer-to-the-money. This second spread is the hedge and is smaller (meaning strikes are closer together) so that an overall credit is received for the trade. Here is some data for the example trade.

- Date: Aug. 3, 2020.

- Price: SPX at $3294.61.

Short Put Spread:

- Buy 1 SPX Sept. 18 – $3100 put @ $56.60.

- Sell 1 SPX Sept. 18 – $3160 put @ $70.80.

Long Put Spread:

- Sell 1 SPX Sept. 18 – $3260 put @ $85.80.

- Buy 1 SPX Sept. 18 – $3290 put @ $96.60.

Conclusion:

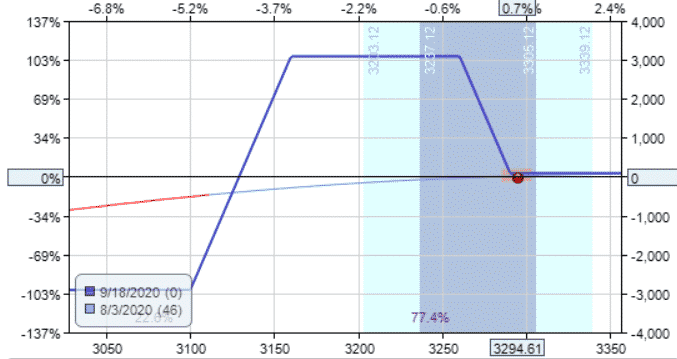

- Net Credit: $0.90.

- Max risk: $2,910.

- Max profit: $3,090.

- Breakeven price at expiration: 3129.

In this example, the short put spread was placed around the 30-delta. Because the investor has two hedging spreads, the investor feels comfortable putting them on closer to-the-money than if it was just a solo bull put spread.

However, this location can be adjusted per investor’s preference. Moving further out-of-the-money will give a smaller Delta and a flatter T+0 line — and thus would be an even more conservative and slower moving trade. This is not an aggressive trade. The T+0 line is fairly flat. The Greeks show low delta and gamma.

- Delta: 1.34.

- Gamma: -0.02.

- Theta: 7.45.

- Vega: -37.62.

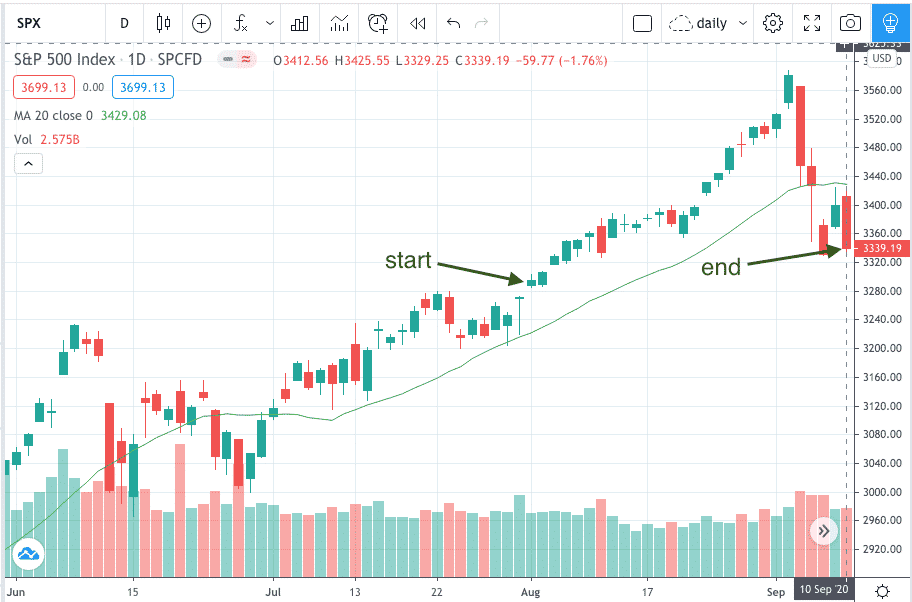

It does have decent theta, which is how this trade will profit through time decay. Running this trade in OptionNET Explorer using a stop loss of $582 (20% of max risk) and a take profit of $437 (15% of max risk), this trade exits with a profit of $455 at end of day on September 10. Ultimately, the investor was correct that SPX continued to rally.

Comparing To The Broken Wing Butterfly

The broken wing butterfly is a special case of the above, with the two short strikes coinciding.

- Buy 1 SPX Sept. 18 – $3190 put @ $65.70.

- Sell 2 SPX Sept. 18 – $3160 put @ $70.80.

- Buy 1 SPX Sept. 18 – $3100 put @ $56.60.

- Net Credit: $4.70.

We left the short bull put spread at exactly the same place. The long put spread was moved closer to the short spread so that the two short strikes are the same. The short strikes are the body of the butterfly, where the heart is.

In the broken heart version, the short strikes split apart, hence the title of broken heart butterfly. While both the broken heart and broken wing are typically constructed for a credit, a larger credit is collected for the broken wing butterfly approach.

- Max risk: $2,530.

- Max profit: $3,470.

- Breakeven price at expiration: 3125.30.

The broken wing butterfly has better risk-reward, with a lower max risk and a higher max profit. The Greeks for the broken wing butterfly are:

- Delta: 2.47.

- Gamma: 0.01.

- Theta: 3.69.

- Vega: -24.15.

The broken wing butterfly version has a higher delta (because we are decreasing the amount of hedging when we move the hedge spread further out-of-the-money). It also has a lower theta. With the two spreads close together, it tends to achieve its profits closer to expiration.

Let’s see how this trade does with a stop loss of $506 (20% of max risk) and profit target of $380 (15% of max risk). It turns out that neither the target nor the stop loss was hit with end-of-day data. The trade expired on September 18, and the investor kept the $470 initially collected. Both the broken heart and broken wing butterflies ended up profitable since the price went in our favor.

For longer-term trades, that is when price moves away from the butterfly. Next, we’ll see what happens if the price moves towards our butterfly.

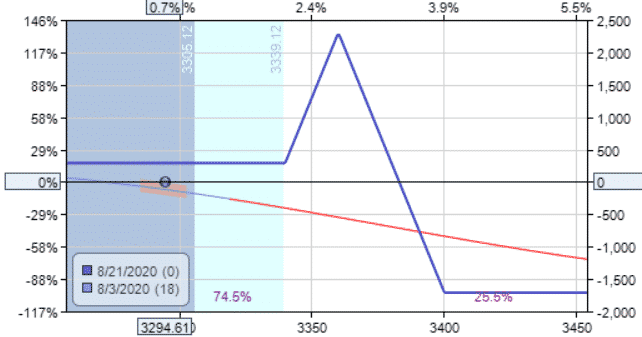

Call Side Broken Wing Butterfly

Another investor looking at the same chart of Aug. 3 may be thinking, “The market has gone up so much already. Maybe it will go up just a little more, but surely not much higher. It’ll probably reverse down soon.” Whenever that sentiment exists, the strategies that come into mind are diagonals and broken wing butterflies.

The investor fades the market top, expecting the price to drop, and uses a shorter time to expiration (18 days to expiration). A broken wing butterfly is constructed to have no risk on the downside.

- Date: Aug. 3, 2020,

- Price: $3294.61.

- Buy 1 SPX Aug. 21 – $3340 call @ $28.15.

- Sell 2 SPX Aug. 21 – $3360 call @ $20.60.

- Buy 1 SPX Aug. 21 – $3400 call @ $10.15.

- Net credit: 2.90.

- Max risk: $1,710.

- Max profit: $2,290.

- Breakeven price at expiration: 3383.

Backtesting this trade with a profit target of $257 (15% of max risk) and a stop loss of $342 (20% of max risk), the trade ends with a loss of $485 on end-of-day Aug. 12.

Let’s see if the broken heart butterfly does any better.

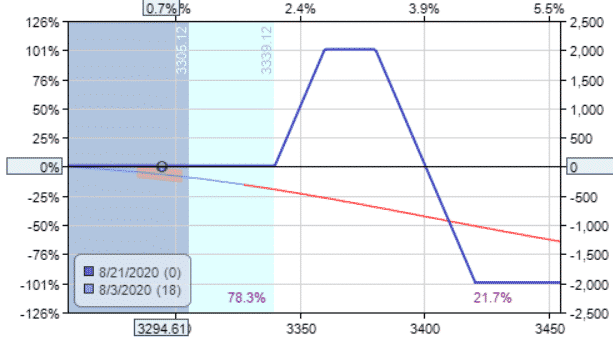

Call Side Broken Heart Butterfly

In this example, we split the two spreads of the previous call side butterfly to construct a broken heart butterfly. We keep the long spread the same, but move the short spread further out-of-the-money like this:

- Date: Aug. 3, 2020.

- Price: $3294.61.

Buy long spread:

- Buy 1 SPX Aug. 21 – $3340 call @ $28.15.

- Sell 1 SPX Aug. 21 – $3360 call @ $20.60.

Sell short spread:

- Sell 1 SPX Aug. 21 – $3380 call @ $14.65.

- Buy 1 SPX Aug. 21 – $3420 call @ $6.95.

- Net Credit: $0.15.

This reduces the credit to almost nothing. Another way to think about this is to consider it as an out-of-the-money call spread (the long spread), which is financed by selling a further out-of-the-money call spread (the short spread).

The short spread needs to be wide enough to be able to pay for the long spread, plus a slight credit. The slight credit exists to remove all risk on the downside.

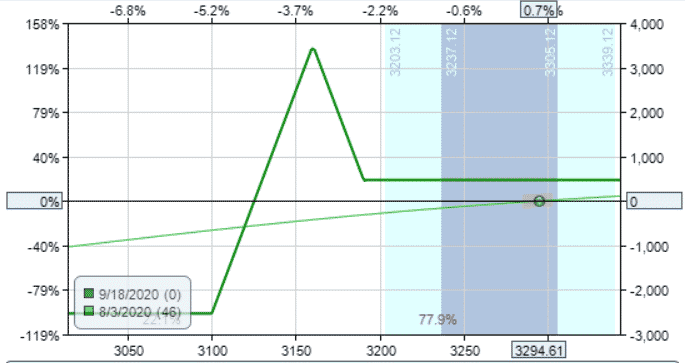

- Max risk: $1,985.

- Max profit: $2,015.

- Breakeven price at expiration: 3400.

The broken heart butterfly has a wider range of profit, as seen by a breakeven price that is further away from the current price. This means it is a higher probability trade.

With the price of SPX at 3295 at start of trade, the broken heart butterfly will profit if the price is anywhere below 3400 at expiration. The broken wing butterfly will profit only if price is below 3383.

Note that in this example, we split the call broken wing butterfly by moving the short spread away from the money and holding the long spread the same. In the put broken wing butterfly, we split the butterfly by moving the long spread closer to-the-money and holding the short spread the same.

Let’s see how the call side broken heart butterfly does. This example includes the same profit level of 15% of max capital at risk ($298) and a stop loss of 20%, or $397.

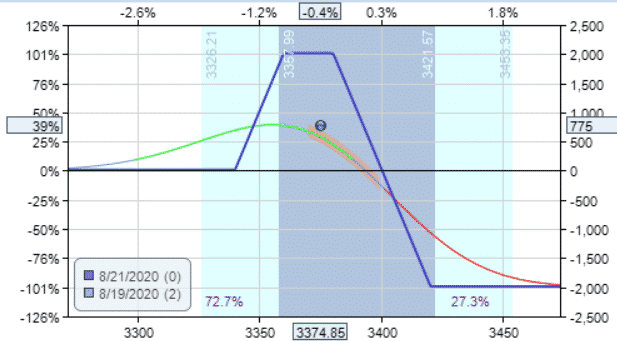

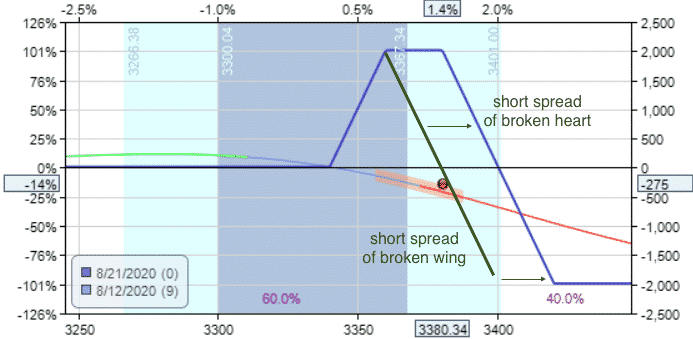

It ended with a profit of $775 at the end of day on Aug. 19. Why did the broken heart not get stopped out on Aug. 12 like the broken wing? The answer is because we had moved the short spread further away from the money.

Broken wing butterfly on Aug. 12:

Broken heart butterfly on Aug. 12:

Conclusion

The broken heart butterfly has a larger range in which we can profit from, which is good if prices are uncertain. The broken wing butterfly receives a larger credit upfront, which is good if there is no movement in price. One is not necessarily better than the other.

Depending on how the market moves, one trade can be more profitable than the other. Hopefully you now have a better understanding of the construction and dynamics of the two different butterflies.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more