Tesla Self-Drives Into Fiery Texas Wreck; WIll Stock Follow?

Tesla's Full Self-Driving Mode Still Needs Work

In an interview with Bloomberg TV last month, Ark Invest founder Cathie Wood said that one of the reasons she was bullish on Tesla (TSLA) was the potential of its full self-driving capability.

Wood said profit margins for full self-driving capability could be in the 80% range. At the time, Elon Musk had tweeted that a beta version of full self-driving capability might be available in ten days; last week, he suggested it might be available next month.

Near Houston over the weekend, a 2019 Tesla Model S in self-driving mode went off on a tangent to a curve and crashed into a tree, bursting in flames and killing both occupants.

According to KPRC 2 news, the owner of the car was sitting in the back seat during the crash, with his friend in the front passenger seat. It took 32,000 gallons of water to put out the fire because the Tesla's battery kept reigniting it.

Our Take On Tesla

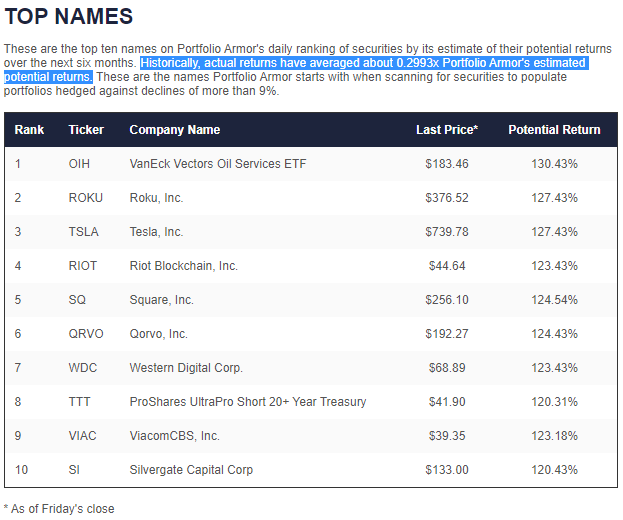

Like Cathie Wood, our system has been bullish on Tesla. Our system gauges price action and options market sentiment on thousands of stocks and ETFs each trading day, and ranks them according to its estimate of their potential returns over the next six months, net of hedging cost. On Friday's ranking, Tesla was at #3.

We'll have to see how news of the latest crash impacts Tesla shares, but given that Tesla's full self-driving capability hasn't been released in beta yet, we suspect the impact of this on Tesla shares won't be large.

In Case We're Wrong

The reason we sort our top names by potential returns net of hedging cost is that, like everyone else, our predictions are wrong sometimes. And when they're wrong, we want your downside to be strictly limited. If you're long Tesla, here are a couple of ways you can hedge your bet in case we're wrong about it.

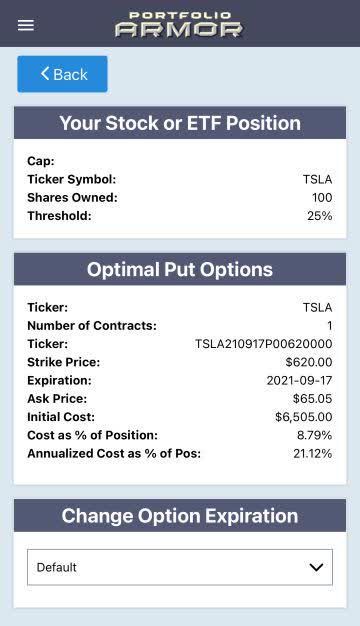

Uncapped Upside, Positive Cost

This one's a bit pricey. Let's say you were willing to tolerate a 25% drop in your Tesla shares over the next ~6 months, but not one larger than that. If so, these were the optimal, or least expensive put options to do that, as of Friday's close.

This and the following screen captures via the Portfolio Armor iPhone app.

As we said, this one's a bit pricey: the cost here was $6,505, or 8.79% of position value. That cost was calculated conservatively, using the ask price of the puts (in practice, you can often buy and sell options at some price between the bid and ask).

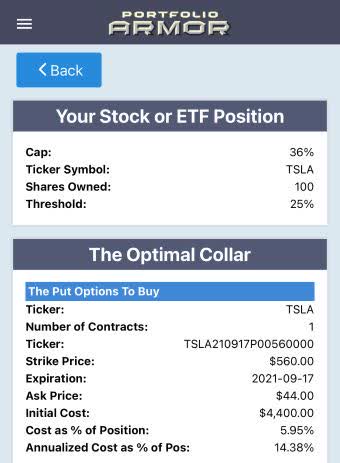

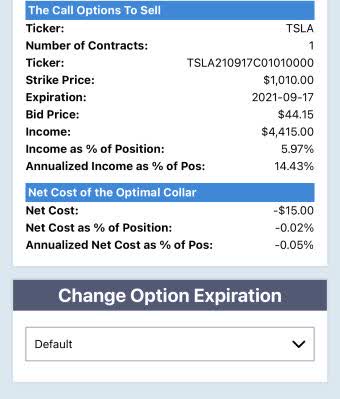

Capped Upside, Slightly Negative Cost

If you were willing to cap your potential upside at 30% over the next six months (an annualized return even more ambitious than Cathie Wood's), this was the optimal collar to hedge against the same, >20% decline as the previous hedge.

With this one, the net cost was slightly negative, meaning you would have collected a net credit of $15 when opening the collar, assuming, to be conservative, that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Go For The Cheaper Hedge?

If cost is your main concern, then yes. If you want to maximize your return net of hedging cost, it depends. We described how our hedged portfolio construction algorithm decides whether to hedge with collars or puts here.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more