Tesla Crashes

Image via Tesla.

Did S&P 500 Inclusion Work Against Tesla?

In our last post (Tesla: Navigating The Risk Cluster), we mentioned Lilly Francus's theory the S&P 500 adding Tesla (TSLA) to the index would stabilize Tesla.

We didn't catch it at the time, but our friends at Squeeze Metrics offered an opposite prediction last December.

Our system, which estimates returns over the next six months, was bullish on Tesla as of Friday's close. Time will tell if it's right, or if Squeeze Metrics is right that no further returns are possible for Tesla as an S&P component. But we remember what happened with Tesla last year. The same gauge of options market sentiment that makes us bullish on Tesla now (and has led to a 15-week streak of our top names beating SPY) made us bullish on it on February 13th, 2020. By March 23rd, Tesla had tanked nearly 46%.

Screen capture via Portfolio Armor.

And yet, by August 13th, 2020, Tesla had more than doubled from its February 13th price.

That wasn't the first time Tesla shares had crashed sharply before hitting new highs. Because of Tesla's past volatility, we have consistently recommended longs hedge it. We shared optimal hedges for Tesla near its high back in January.

Crash Protection Kicks In For Tesla

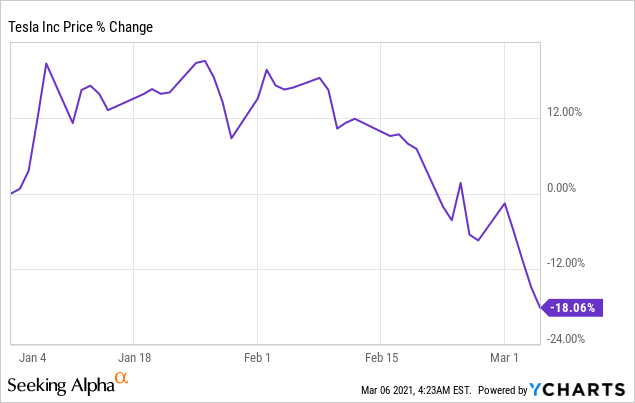

In January, we presented two ways Tesla shareholders could protect themselves in case Tesla shares collapsed. Since then, shares of Tesla are down more than 18%.

Let's look at how the hedges ameliorated that drop and briefly discuss courses of action for hedged Tesla longs now.

The January Optimal Put Hedge

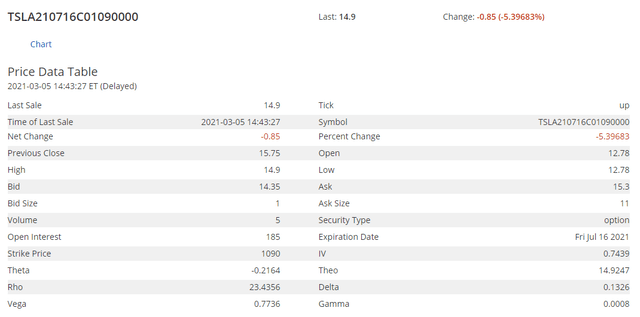

On January 4th, this was the optimal put option contract to hedge 100 shares of Tesla against a >25% drop by mid-July.

Screen capture via the Portfolio Armor iPhone app.

Note that the cost of the put protection was fairly high: $10,960 or 15.02% of position value (the app calculated it conservatively, using the ask price of the puts).

Let's look at how that hedge has reacted to the 18% drop.

How The Optimal Put Hedge Has Reacted

Here's an updated quote on those puts as of Friday's close (via CBOE):

How That Hedge Ameliorated Tesla's Drop

TSLA closed at $729.77 on January 4th. A shareholder who owned 100 shares of it and hedged with the puts above then had $72,977 in TSLA shares plus $10,960 in puts, so the net position value was $72,977 + $10,960 = $83,937.

TSLA closed at $597.95 on March 5th, down about 18% from its close on Jan 4th. The investor's shares were worth $59,795, and the put options were worth $14,238, using the midpoint of the spread. So, the net position value as of Friday's close was $59,795 + $14,238 = $74,033. $74,033 represents an 11.8% drop from $83,937.

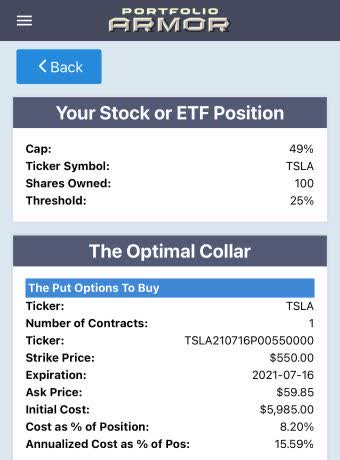

The January Optimal Collar Hedge

If you were willing to cap your upside at 49% over the same time frame, this was the optimal collar we presented in January to hedge your Tesla shares against a >25% decline by mid-July.

Here the cost was negative, meaning you would have collected a net credit of $100, or 0.14% of position value, assuming, to be conservative, that you placed both trades at the worst ends of their respective spreads (i.e., buying the calls at the ask and selling the calls at the bid).

How That Optimal Collar Hedge Has Reacted

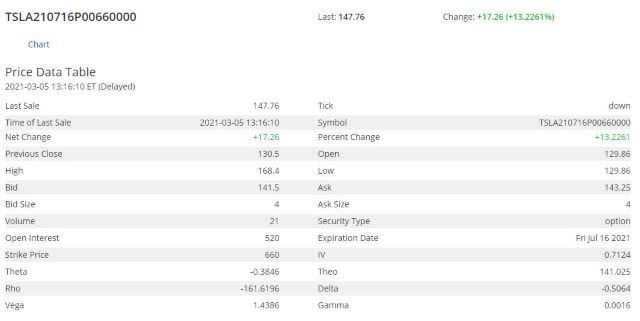

Below is an updated quote on the put leg of the collar (note that it's at a different strike than the first hedge):

And here's an updated quote on the call leg:

How That Hedge Ameliorated Tesla's Drop

Recall that TSLA closed at$729.77 on January 4th. A shareholder who owned 100 shares of it and hedged with the collar above then had $72,977 in TSLA shares, $5,985 in puts, and if the investor wanted to buy-to-close the short call position, it would have cost him $6,085. So, the net position value on Jan 4th was ($72,977 + $5,985) - $6,085 = $72,877.

Since TSLA closed at$597.95on Friday, the investor's shares were worth $59,795, the put options were worth $7,935, and it would have cost $1,483 to buy-to-close his calls, using the midpoint of the spread in both cases. So: ($59,795 + $7,935) - $1,483 = $66,247. $66,247 represents a 9.1% drop from $72,877.

More Protection Than Promised In Both Cases

Although Tesla had dropped by about 18% from Jan 4th to March 5th and both hedges were designed to protect against a >25% drop, the optimal put hedged position was only down 11.8% and the optimal collar hedged position was down 9.1%. In both cases, the time value of the put options gave a bit more protection than promised since the hedges were structured to protect based on intrinsic value alone.

What Now?

That's up to you, and it will probably depend on whether you agree with our current bullishness on Tesla or Squeeze Metrics' bearishness. The nice thing about being hedged though, is that it gives you options (no pun intended). A hedged shareholder doesn't have to worry so much about how much further Tesla might drop because his downside is strictly limited. You can exit now, for a smaller loss; you can buy-to-close the call leg of your collar to remove your upside cap if you're bullish; and if you're even more bullish, you can sell your appreciated puts and buy more Tesla shares. In any case, you have breathing room to let the dust settle and decide on your best course of action, without the anxiety of an unhedged investor.