Putting A Collar On The Dogs Of The Dow

2020 was tough year for the Dogs of the Dow. The strategy backtest shows a loss of 7%, while the Dow Jones index was up 6%. Could returns have been improved with the use of options? Yes, it could.

Applying a collar to the Dogs of the Dow limits the losses.

Let’s backtest this for 2020 and look at the numbers.

We will:

- Sell cash-secured puts to acquire the stocks at a discount

- Then use covered calls to further reduce cost basis

- If stock drops, put a collar on the Dog by buying a protective put

The Dogs of the Dow

The Dogs of the Dow are the 10 out of the 30 Dow Jones Index stocks that have the highest dividend yield. The investor holds these ten for a year. That’s it.

It is a mechanical strategy. No need to look at technicals or fundamentals. The sole selection criteria is the dividend yield and that it be part of the Dow Jones Index.

Dividend Yield

The dividend yield is the dividend payout divided by stock price. The dividend yield tends to be high for stocks that have dropped and are attractive to value investors. We can call them good value, or we can call them under-performing (as the term “dogs” would imply).

You need to make sure the yields are within reason. Double-digit yields are a red flag because it may mean that the stock price has dropped too much. This usually does not happen on Dow stocks which is why we limit our selection to these.

Results of the Dogs of the Dow Strategy in 2020

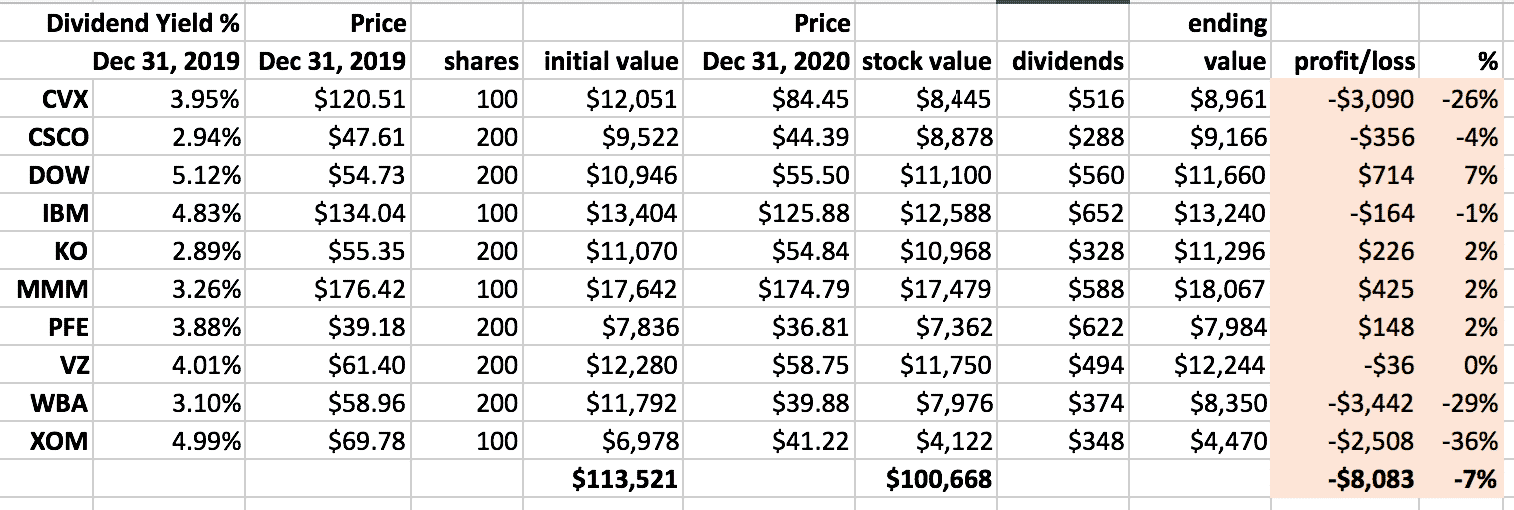

Suppose that an investor implements the strategy for year 2020 by buying roughly $10000 worth of each of the 10 Dogs of the Dow. We rounded to the nearest 100 shares.

At the end of one year, the net loss is around $8000, or 7%. Not too good for the Dogs.

Why the Dogs of the Dow Failed

Like most buy-and-hold strategies, the Dogs of the Dow strategy typically does not use a stop-loss. This was the downfall in 2020 due to the severe sell-off in March. XOM dropped 41% during the year. And there was no mechanism in place to stem that loss.

But then why did the Dogs do worse than the Dow Index?

The idea behind the strategy is not only to pick up high dividends, but to also take advantage of sector rotation in the market. The thought is to buy under-valued stock that will eventually rotate back into favor. Unfortunately, sometimes this rotation can take years to happen. Dogs can remain dogs.

Under-performers can continue to under-perform until they get de-listed. All of our Dogs at the start of 2020 remained Dogs at the start of 2021, with the exception Pfizer (PFE) and ExxonMobil (XOM).

Not because they outperformed the others, but because they got de-listed from the Dow Jones Index.

Dogs of the Dow Using Options

Step 1: Sell Cash-Secured Puts to Acquire Stock

Sell cash secured puts one strike out-of-the-money with a monthly expiry about 30 days out or less.

Hold till expiration.

If assigned, we acquire the stock.

If not assigned, we keep the premium received and sell another put.

Step 2: Sell Covered Calls

Once shares of a stock is acquired, sell covered calls with a monthly expiry about 30 days out or less. If the 20-day moving average is sloping upwards, sell calls one strike out-of-the-money. If it is sloping down, sell calls one strike in-the-money.

Otherwise, sell calls at-the-money.

Step 3: Buy Protective Put to Complete the Collar

Buying protective puts is expensive, so we buy only when we need to. If and when the stock price closes more than 5% below the price at which it was acquired, buy a protective put one strike out-of-the-money below the current price.

Use the same expiry date as the covered call. This position now is a collar.

If we have a short put but no stock yet, then purchase a protective put whenever the stock price closes more than 5% below the strike price of our short put.

Buy the put one strike out-of-the-money below the current price to make this into a bull put spread. This limits the loss of a cash-secured short put.

If we hold any stock position across an earning date, we collar the stock by buying the protective put. If any short put spans an earnings date, we also buy the protective put.

Note on Strike Selection

Our short call and short put strikes are very close to the money and sometimes in-the-money.

This is because we don’t mind if our stock is called away, and we don’t mind if our puts are assigned to acquire the stock again.

Since at-the-money options have the highest time value, selling them and waiting till expiration enables us to generate the most theta. Selling in-the-money covered calls is a valid strategy under certain conditions. It lowers the break-even price.

If the stock doesn’t move and is called away, we still make money. Generally, sell out-of-money calls when bullish. Sell in-the-money calls when bearish.

Similarly, there is nothing inherently wrong with buying protective puts that are in-the-money. Nor is there anything wrong with selling cash-secured puts in-the-money.

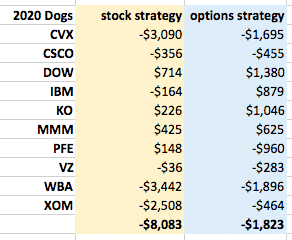

The Results

Here are the results of the options strategy in comparison…

While it was still a loss for the year, the loss was much smaller due to the fact that the options strategy uses the collar to limit losses on stock positions, and uses put spreads to limit losses in short puts.

The Collar

The collar position is long stock, and selling a covered call, and buying a protective put. It caps the profits and limits the losses.

The long stock position, the covered call position, and the collar position are all bullish strategies — the difference is the amount of bullish-ness. They do better when the stock goes up. They do worst when the stock goes down.

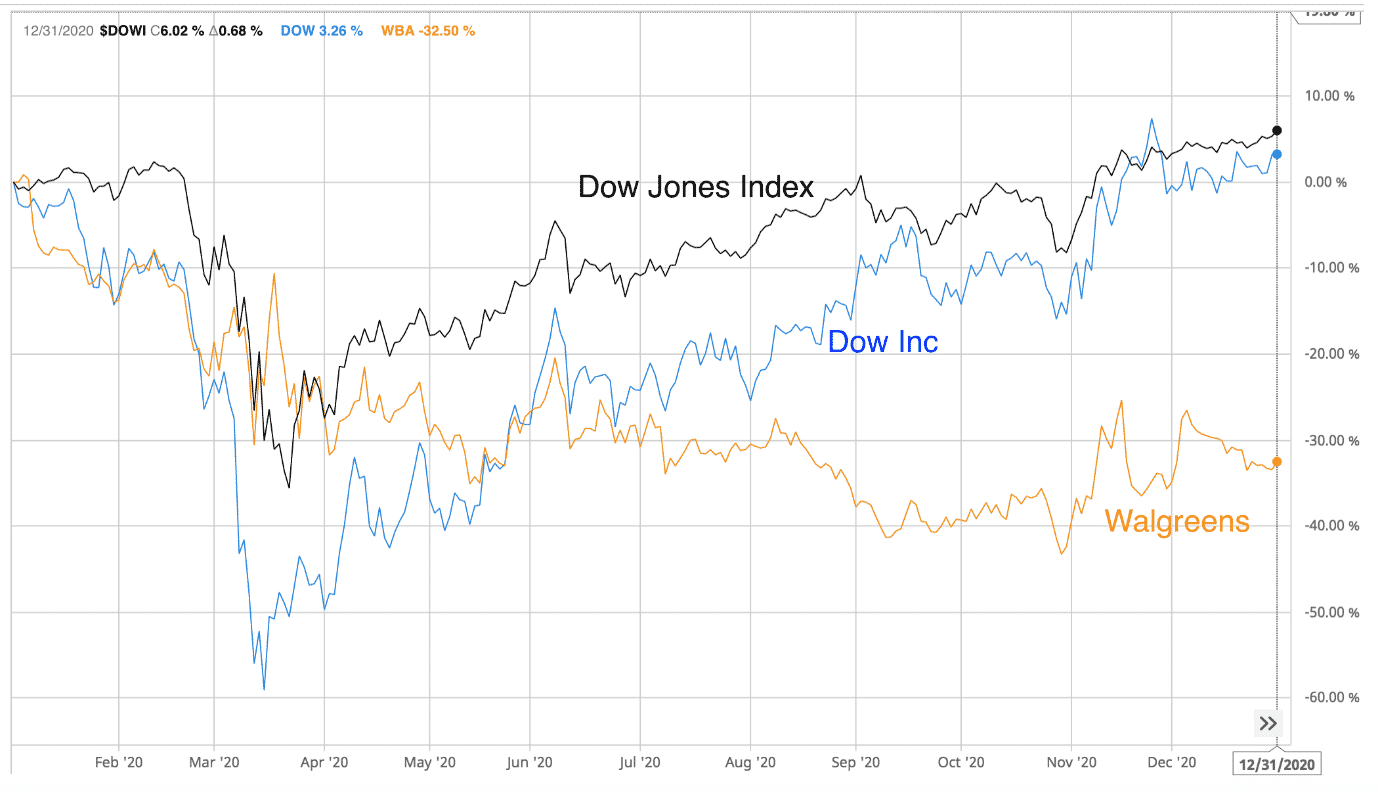

Walgreens (WBA) did the worst in both the stock and options strategy.

The loss using the options strategy was smaller.

Dow Inc (DOW) did the best in both the stock and options strategy. The gains where greater using the options strategy.

A Better Alternative?

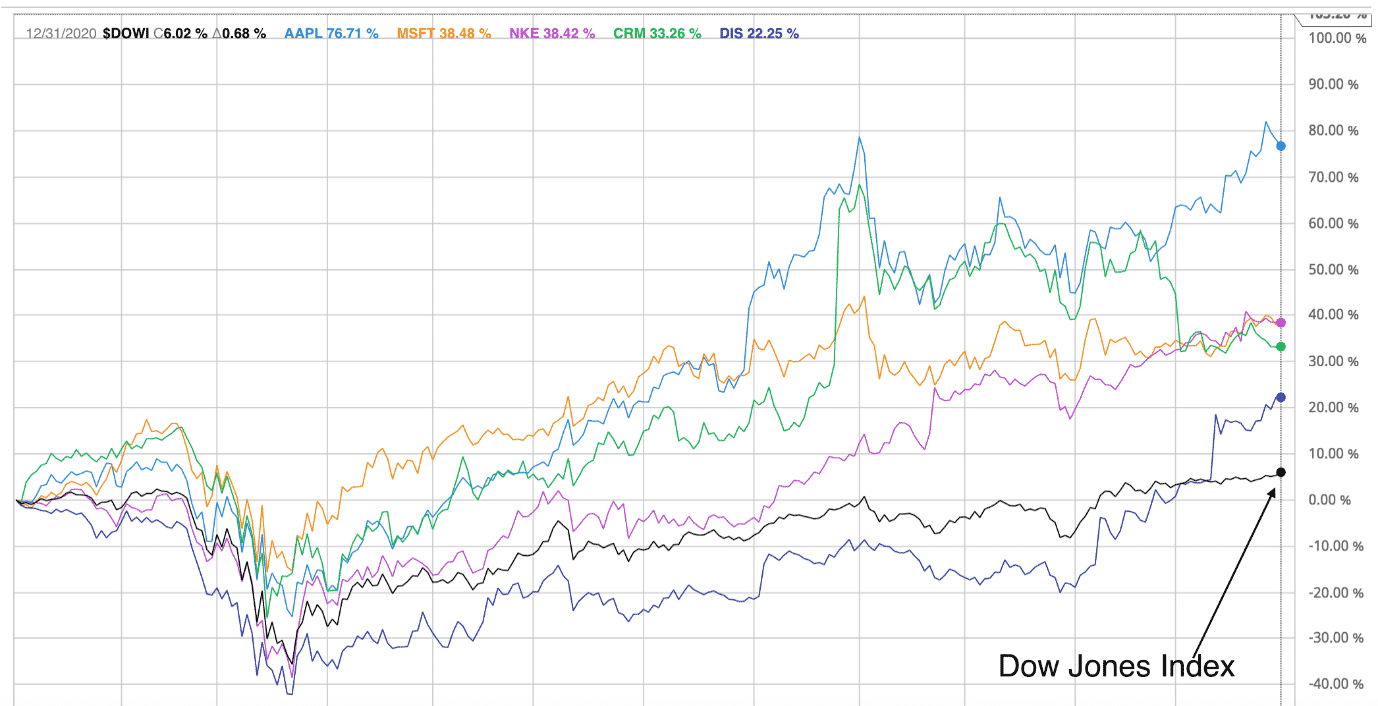

None of the 10 Dogs of the Dow stocks were able to beat the Dow Jones Index.

Instead of picking the Dogs of the Dow, how about picking the Dow leaders.

AAPL, MSFT, NKE, CRM, and DIS had the greatest capital appreciation (without considering dividends) in year 2020.

Using Barchart’s compare feature with a specific date range set, we clearly see that these five surpassed the Index in 2020. Although past performance does not guarantee future success. We’ll leave it as an exercise to the reader to backtest these using the options strategy.

You may also want to test out different strike selection or expiration timeframes.

The Data

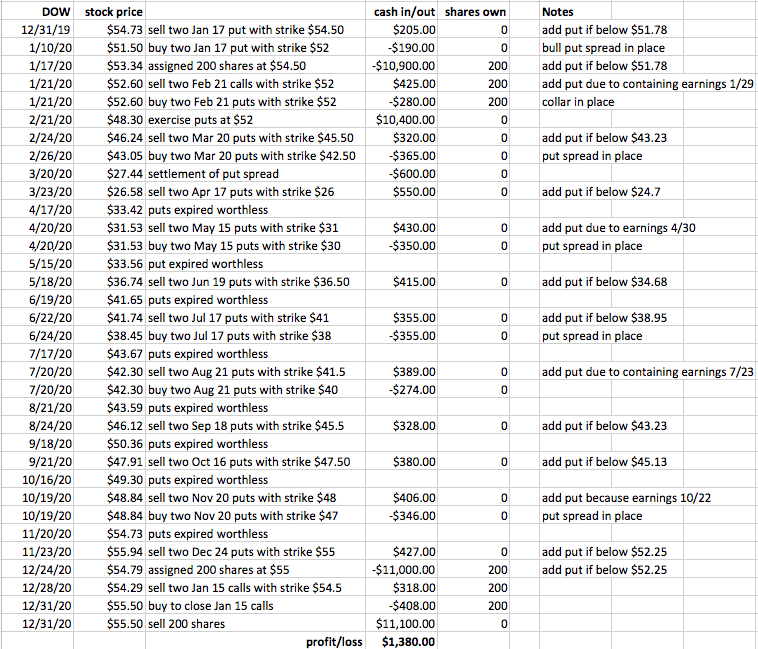

Here is an example of how we backtest a symbol:

The dividend payout amounts and earning dates were from nasdaq.com. We looked at the ex-dividend date to determine if dividend payouts were made.

The historical option prices were obtained using OptionNet Explorer with end-of-day data. The covered call is sold and protective put is bought the next trading day after expiration day.

The dividend yield of the 30 Dow Jones stocks for a given year can be found at dogsofthedow.com.

Conclusion

As this particular backtest of 2020 shows, options used responsibly can provide benefits over just investing in stocks. That’s why we love them.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more