Peloton Pops Post Precor

Peloton instructor Leanne Hainsby (image via Peloton).

Peloton's Annus Mirabilis

2020 has been a miserable year for hundreds of millions suffering from social isolation and economic hardship due to COVID lockdowns, but it's been a wonderful year for Pelaton (PTON). With gyms closed, demand for Pelaton's home fitness equipment skyrocketed. The stock added to its already huge gains on Tuesday after news broke of its acquisition of Precor late Monday. Here we'll note why we're still bullish on the stock, and look at ways longs can limit their risk if we're wrong.

The Precor Surprise

Two somewhat surprising aspects of Pelaton's Precor acquisition are that it happened and that Peloton shares jumped nearly another 12% on the news. Portfolio manager Eddy Elfenbein had a cleverly cynical spin on the company's big day:

Precor is known for its commercial gym equipment, and often, companies see their shares drop after announcing an acquisition. Bloomberg's Tara Lachappelle summarized the market appeal of the move:

The biggest benefits of the deal would seem to be gaining Precor’s 625,000 square feet of manufacturing space in North Carolina and Washington state as well as its large roster of commercial customers, such as hotels, gyms and apartment buildings. The first helps to solve Peloton’s supply difficulties now, while the latter will give it an edge in the post-Covid economy when consumers are no longer forced to exercise at home and avoid travel.

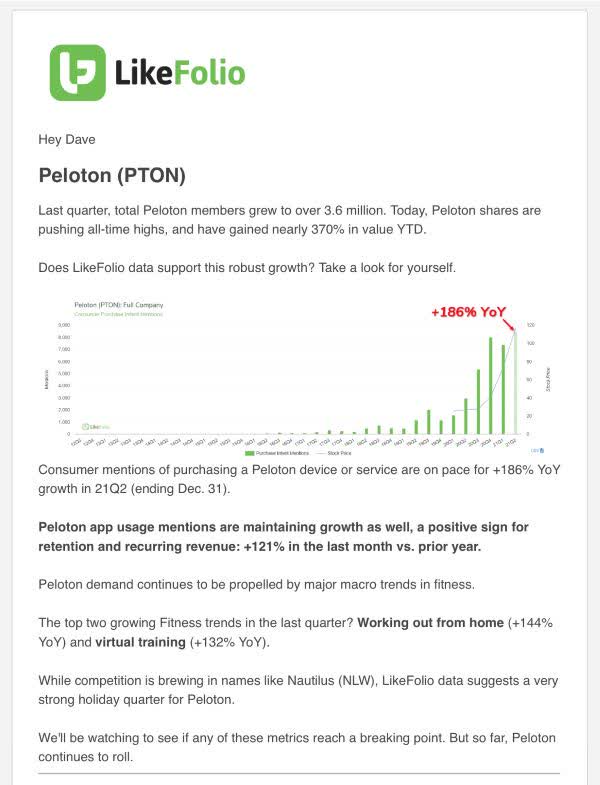

Social Data Remains Bullish On Peloton

Our friends at LikeFolio look at social media mentions of sentiment and purchase intent regarding consumer brands. They use that to forecast sales for companies behind the brands. LikeFolio's most recent email alert on Peloton, screen captured below, predicted a strong holiday season for the company.

We're Still Bullish On Peloton

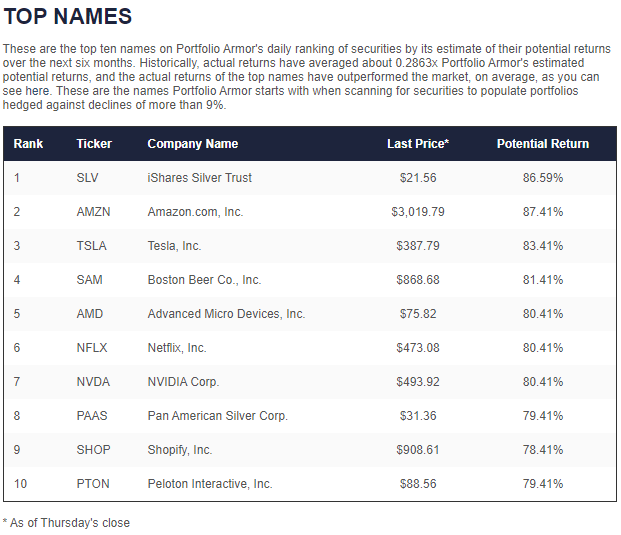

Each day the market's open, our system analyzes past returns as well as forward-looking options market sentiment to estimate potential returns for securities (For a detailed look at our security selection process, see this article where we demonstrate it using the iShares Silver Trust (SLV) ETF as an example.). As of Tuesday's close, Peloton was one of our top ten names.

Hasn't It Gone Up Too Much Already?

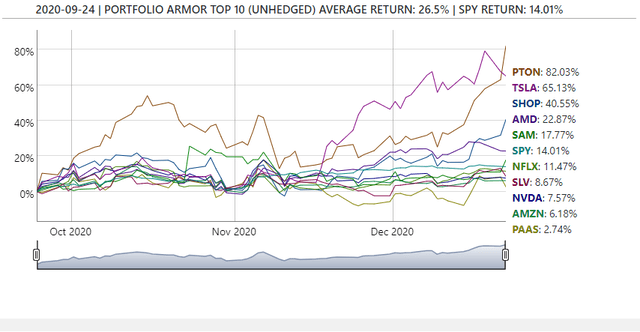

Let's look back to when Peloton appeared on our top ten list on September 24th, alongside SLV, Amazon (AMZN), Tesla (TSLA), Boston Beer (SAM), Netflix (NFLX), Pan American Silver (PAAS), and Shopify (SHOP).

Portfolio Armor's top ten names on Thursday, September 4th.

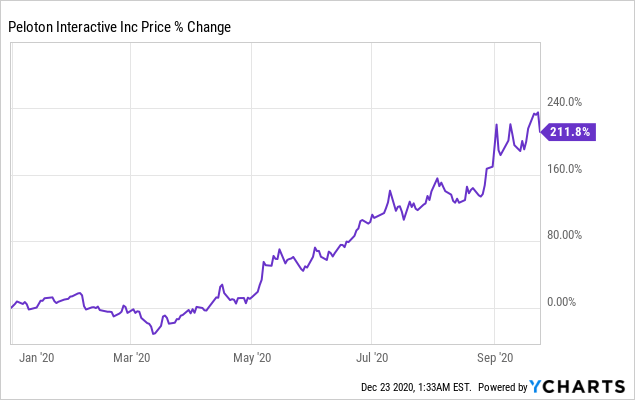

At that point, Peloton was already up nearly 212% on the year.

Data by YCharts

Presumably, a lot of investors thought it had gone up too much by September 24th. Since then, it's up another 82%, the best performer of our September 24th top names cohort so far.

That said, we might be wrong about the stock now. Here are a couple of ways Peloton shareholders can stay long while strictly limiting their risk if we are.

Hedging Peloton

Let's say you own 200 shares of Peloton and can tolerate a 25% drawdown, but not one larger than that. Here are two ways you could hedge against a greater-than-25% decline over the next several months.

Uncapped Upside, Positive Cost

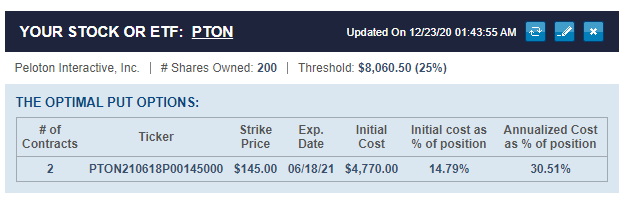

As of Tuesday's close, these were the optimal, or least expensive, puts to hedge against a >25% decline in PTON by mid-June.

(Click on image to enlarge)

The cost there was $4,770, or 14.79% of position value (to be conservative, the cost was calculated at the ask price of the puts; in practice, you can often buy and sell options at some point between the bid and ask).

Capped Upside, Negative Cost

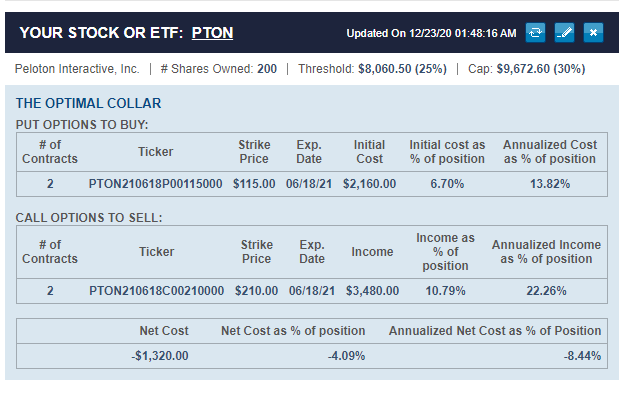

If you were willing cap your possible upside at 30% over the same time frame, this was the optimal collar to hedge against a greater-than-25% decline:

Here, the net cost was negative, meaning you would have collected a net credit of $1,320, or 4.09% of position value when opening this collar on Tuesday. That assumed, to be conservative, that you placed both trades (buying the puts and selling the calls) and the worst ends of their respective spreads.

Pick Likely Winners, Hedge In Case We're Wrong

That's our approach in a nutshell. It's worked fairly well in shifting markets, as we showed using two examples in our previous post: our 6-month hedged portfolio created in late 2019 lost money when it finished near the market nadir in March, but it lost less than the market. Our hedged portfolio created using the same parameters in June of 2020 beat the rising market over the next six months.