Options Update: October 2019

My goal in 2019 is to collect $21,000 in options income and I'm very happy to report that I've achieved that goal with October's options income! Year to date, I've collected $21,541 in options income!

With two months to go, I'm wondering if my options income will exceed my dividend income goal of $25,200? That would be quite an achievement!

This month I'm reporting on one assignment and a multitude of income-generating trades.

Recap

Through the end of September 2019, I collected options income totaling $19,949 in 2019 at an average of about $2,217 per month. This was well ahead of my monthly target average of $1,750.

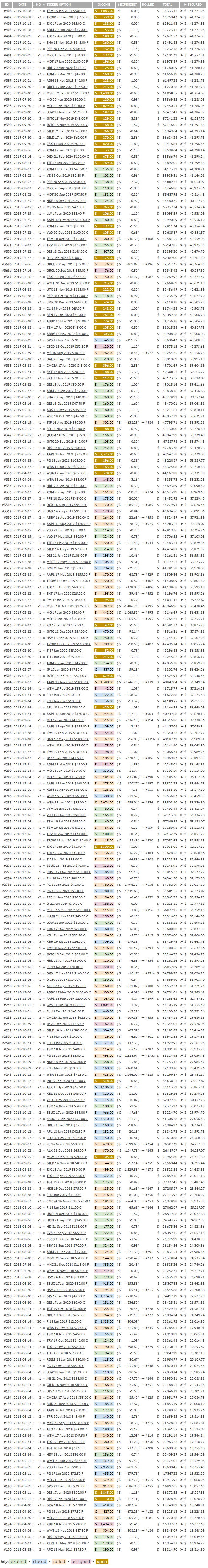

Below is a snapshot of October's trades, which included an assignment, eleven expirations, three trades to close options early, four trades rolling forward options, and eight trades in which I sold new options for income.

(Click on image to enlarge)

Assigned Options

When the holder of an option exercises the option, it is said to be assigned.

| #356 | 2019-06-21 | : | -1 | × | CSCO 18 Oct 2019 $52.50 P | $ 120.00 | ( $ -1.10 ) |

On 9 October, the option holder of the CSCO $52.50 put I'd sold decided to exercise the option. On that day, CSCO closed at $46.84 per share, some 11% below the strike price.

As a consequence of the assignment, I bought 100 shares of CSCO for $52.50 per share. Since I collected $120 for selling the option, my effective cost basis is $51.31. The buy adds $140 to DivGro's projected annual dividend income (PADI).

The buy doubles my CSCO position, which now has an average cost basis of $42.09 and an average yield on cost of 3.33%. CSCO currently yields 2.97% at $47.20 per share.

Expired Options

In October, the following option expired:

| #383 | 2019-08-02 | : | -1 | × | XOM 18 Oct 2019 $67.50 P | $ 135.00 | ( $ -0.80 ) | |||

| #382 | 2019-08-02 | : | -1 | × | VZ 18 Oct 2019 $52.50 P | $ 108.00 | ( S -0.96 ) | |||

| #378 | 2019-07-25 | : | -2 | × | NKE 18 Oct 2019 $75.00 P | $ 124.00 | ( $ -0.99 ) | |||

| #375 | 2019-07-25 | : | -1 | × | AAPL 18 Oct 2019 $180.00 P | $ 180.00 | ( $ -0.65 ) | |||

| #371 | 2019-07-22 | : | -1 | × | TRV 18 Oct 2019 $155.00 C | $ 255.00 | ( $ -0.35 ) | |||

| #370 | 2019-07-22 | : | -1 | × | DIS 18 Oct 2019 $145.00 C | $ 407.00 | ( $ -0.80 ) | |||

| #364 | 2019-06-28 | : | -2 | × | PEP 18 Oct 2019 $110.00 P | $ 118.00 | ( $ -0.99 ) | |||

| #347 | 2019-05-16 | : | -2 | × | GIS 18 Oct 2019 $47.50 P | $ 260.00 | ( $ -1.60 ) | |||

| #346 | 2019-05-16 | : | -1 | × | AOS 18 Oct 2019 $45.00 P | $ 180.00 | ( $ -1.10 ) | |||

| #345 | 2019-05-15 | : | -2 | × | WFC 18 Oct 2019 $42.50 P | $ 240.00 | ( $ -1.00 ) | |||

| #342 | 2019-05-15 | : | -2 | × | QCOM 18 Oct 2019 $65.00 P | $ 156.00 | ( $ -0.99 ) |

I secured options income totaling $2,163 with these trades.

Closed Options

When an out of the money option goes further out of the money, you can close the option early and secure most of the options income.

| #357 | 2019-06-21 | : | -3 | × | GPS 17 Jan 2020 $20.00 C | $ 345.00 | ( $ -111.72 ) | |||

| #302 | 2019-01-24 | : | -19 | × | F 17 Jan 2020 $10.00 C | $ 722.00 | ( $ -238.39 ) | |||

| #301 | 2019-01-24 | : | -1 | × | F 17 Jan 2020 $10.00 C | $ 36.00 | ( $ -13.32 ) |

I decided to close my GPS and F positions as I'm no longer comfortable holding lower-quality stocks in my portfolio. You can read about these trades here and here. As a consequence, I closed the covered calls and secured $1,153 in options income in the process.

Rolled Options

Rolling forward options means buying back an option and selling another option with a later expiration date. You can do this to avoid options assignment for in the money options, or to collect more options income for out of the money options.

I rolled forward the following options this month:

| #408 | 2019-10-18 | : | -2 | × | TSM 15 Jan 2021 $50.00 C | $ 1,083.00 | ( $ 0.00 ) | |||

| #372 | 2019-07-22 | : | -2 | × | TSM 18 Oct 2019 $45.00 C | $ 380.00 | ( $ -946.30 ) | → #408 | ||

| #407 | 2019-10-18 | : | -2 | × | TROW 20 Dec 2019 $115.00 C | $ 339.00 | ( $ 0.00 ) | |||

| #320 | 2019-02-22 | : | -1 | × | TROW 18 Oct 2019 $110.00 C | $ 220.00 | ( $ -10.59 ) | → #407 | ||

| #310 | 2019-02-20 | : | -1 | × | TROW 18 Oct 2019 $110.00 C | $ 209.00 | ( $ -10.59 ) | → #407 | ||

| #406 | 2019-10-18 | : | -2 | × | TJX 17 Jan 2020 $65.00 C | $ 188.00 | ( $ 0.00 ) | |||

| #319 | 2019-02-22 | : | -2 | × | TJX 18 Oct 2019 $60.00 C | $ 130.00 | ( $ -128.08 ) | → #406 | ||

| #404 | 2019-10-01 | : | -1 | × | TJX 17 Apr 2020 $50.00 P | $ 180.00 | ( $ -0.30 ) | |||

| #278a | 2018-12-06 | : | -1 | × | TJX 17 Jan 2020 $45.00 P | $ 436.50 | ( $ -36.29 ) | → #404 |

On 18 October, I noticed that TSM was trading just below $50 per share. Rather than chancing assignment, I rolled forward the $45 covered calls to the 15 January 2021, $50 strike price. Net of commissions, the trade generated $137 in options income, but it also cost me $566 in previously secured options income.

TROW closed at $109.41 on 18 October, only 59¢ below the $110 covered call I'd sold. Because TROW practically traded at the money, I decided to protect my shares by rolling forward both options. Net of commission, the trade earned an additional $318 in options income and I secured options income of $419 in the process.

The $60 covered calls I'd sold on TJX were in the money on 18 October, so to protect my shares I rolled forward the options. Net of commissions, the trade generated options income of $188 but I secured only $2 in options income as a result. Moving the strike price to $65 gives me a little more breathing room!

Finally, TJX closed at $55.39 per share on 1 October and with momentum behind the stock price, I decided to roll forward one of my $45 January 2020 puts to the April 2020, $50 strike price. The trade generated $144 in options income and I secured $400 in options income in the process.

Covered Calls

Selling covered calls is a way to collect extra income on stocks you already own.

I sold the following covered calls in October:

| #405 | 2019-10-18 | : | -1 | × | ADM 20 Mar 2020 $45.00 C | $ 53.00 | ( $ -1.10 ) | |||

| #402 | 2019-10-01 | : | -3 | × | PFE 20 Mar 2020 $40.00 C | $ 132.00 | ( $ -1.13 ) | |||

| #399 | 2019-10-01 | : | -1 | × | HRL 20 Mar 2020 $47.50 C | $ 125.00 | ( $ -0.60 ) | |||

| #398 | 2019-10-01 | : | -2 | × | ADM 20 Mar 2020 $45.00 C | $ 160.00 | ( $ -0.99 ) |

#405 : 2019-10-18: Sold to Open 1 Contract of Option ADM Mar 20 2020 45.00 C

I own 100 shares of Archer-Daniels-Midland (ADM) at a cost basis of $43.30 per share. I'm willing to sell these shares for $45.00 on or before 20 March:

|

This covered call yields 1.20%, or 2.84% on an annualized basis. The yield on cost of my ADM position is 3.23%, so I'm boosting dividend income by a factor of 0.88. If the option is exercised, I'll sell 100 shares of ADM at a reduced cost basis of $42.76 per share, for capital gains of 5.24%.

#402 : 2019-10-01: Sold to Open 3 Contracts of Option PFE Mar 20 2020 40.00 C

I own 300 shares of Pfizer (PFE) at a cost basis of $37.05 per share. I'm willing to sell these shares for $40.00 on or before 20 March:

|

This covered call yields 1.18%, or 2.51% on an annualized basis. The yield on cost of my PFE position is 3.89%, so I'm boosting dividend income by a factor of 0.65. If the options are exercised, I'll sell 300 shares of PFE at a reduced cost basis of $36.61 per share, for capital gains of 9.27%.

#399 : 2019-10-01: Sold to Open 1 Contract of Option HRL Mar 20 2020 47.50 C

I own 100 shares of Hormel Foods (HRL) at a cost basis of $34.74 per share. I'm willing to sell these shares for $47.50 on or before 20 March:

|

This covered call yields 3.58%, or 7.65% on an annualized basis. The yield on cost of my HRL position is 2.42%, so I'm boosting dividend income by a factor of 3.16. If the option is exercised, I'll sell 100 shares of HRL at a reduced cost basis of $33.48 per share, for capital gains of 41.86%.

#398 : 2019-10-01: Sold to Open 2 Contracts of Option ADM Mar 20 2020 45.00 C

I own 200 shares of Hormel Foods (ADM) at a cost basis of $43.30 per share. I'm willing to sell these shares for $45.00 on or before 20 March:

|

This covered call yields 1.84%, or 3.92% on an annualized basis. The yield on cost of my ADM position is 3.23%, so I'm boosting dividend income by a factor of 1.21. If the options are exercised, I'll sell 200 shares of ADM at a reduced cost basis of $42.50 per share, for capital gains of 5.89%.

For covered calls, I think an achievable goal is to earn double the dividend yield. Only the HRL covered call achieves this goal.

New Put Contracts

Selling put options allows me to set the price I'm willing to pay for a stock I want to buy. In effect, I get paid while waiting for the share price to drop!

I sold the following put contracts in October:

| #403 | 2019-10-01 | : | -1 | × | SNA 15 Nov 2019 $145.00 P | $ 260.00 | ( $ -0.35 ) | |||

| #401 | 2019-10-01 | : | -1 | × | MRK 15 Nov 2019 $80.00 P | $ 127.00 | ( $ -1.58 ) | |||

| #400 | 2019-10-01 | : | -1 | × | MDT 17 Jan 2020 $100.00 P | $ 196.00 | ( $ -0.80 ) | |||

| #397 | 2019-10-01 | : | -2 | × | ADM 15 Nov 2019 $40.00 P | $ 228.00 | ( $ -1.00 ) |

#403 : 2019-10-01: Sold to Open 1 Contract of Option SNA Nov 15 2019 145.00 P

I'm willing to buy 100 shares of Snap-on (SNA) for $145.00 per share on or before 15 November. SNA closed at $154.78 per share on the date of my trade:

|

This put option trade yields 1.68%, or 13.62% on an annualized basis. At $154.78 per share, SNA yields 2.46%, so I'm boosting dividend income by a factor of 5.55. If the option is exercised, I'll buy 100 shares at a cost basis of $142.40 per share, a discount of 8.00%.

#401 : 2019-10-01: Sold to Open 1 Contract of Option MRK Nov 15 2019 80.00 P

I'm willing to buy 100 shares of Snap-on (MRK) for $80.00 per share on or before 15 November. MRK closed at $83.61 per share on the date of my trade:

|

This put option trade yields 1.50%, or 12.18% on an annualized basis. At $83.61 per share, MRK yields 2.63%, so I'm boosting dividend income by a factor of 4.63. If the option is exercised, I'll buy 100 shares at a cost basis of $78.71 per share, a discount of 5.86%.

#400 : 2019-10-01: Sold to Open 1 Contract of Option MDT Jan 17 2020 100.00 P

I'm willing to buy 100 shares of Medtronic (MDT) for $100.00 per share on or before 17 January 2020. MDT closed at $108.22 per share on the date of my trade:

|

This put option trade yields 1.80%, or 6.10% on an annualized basis. At $108.22 per share, MDT yields 2.00%, so I'm boosting dividend income by a factor of 3.06. If the option is exercised, I'll buy 100 shares at a cost basis of $98.03 per share, a discount of 9.41%.

#397 : 2019-10-01: Sold to Open 2 Contracts of Option ADM Nov 15 2019 40.00 P

I'm willing to buy 200 shares of Archer-Daniels-Midland (ADM) for $40.00 per share on or before 15 November. ADM closed at $40.33 per share on the date of my trade:

|

This put option trade yields 2.81%, or 22.84% on an annualized basis. At $40.33 per share, ADM yields 3.47%, so I'm boosting dividend income by a factor of 6.58. If the options are exercised, I'll buy 200 shares at a cost basis of $38.86 per share, a discount of 3.66%.

For selling puts, I like to see a dividend boost factor of 5.00 or more unless I can buy shares at a discount of at least 10%. Only the put options trades on SNA and ADM achieve this goal, though the one on MDT comes close with a discount of 9.41%

Options Income Tally

Here is a running tally of the total amount received from options trades, as well as the options premiums secured due to options that expired or are closed. Secured means I no longer have related obligations and "own" the corresponding options income free and clear.

Options Expiring Soon

Below I'm listing options expiring in the next two months. On expiration day, in the money options will result in options assignment, which I'd like to avoid in some cases, if possible.

November 2019:

| #403 | 2019-10-01 | : | -1 | × | SNA 15 Nov 2019 $145.00 P | $260.00 | ( $ -0.35 ) | → Out of the money with a 15% safety margin | |||

| #401 | 2019-10-01 | : | -1 | × | MRK 15 Nov 2019 $80.00 P | $127.00 | ( $ -1.58 ) | → Out of the money with a 6% safety margin | |||

| #397 | 2019-10-01 | : | -2 | × | ADM 15 Nov 2019 $40.00 P | $ 228.00 | ( $ -1.00 ) | → Out of the money with a 6% safety margin | |||

| #391 | 2019-09-20 | : | -3 | × | INTC 15 Nov 2019 $45.00 P | $ 129.00 | ( $ -3.83 ) | → Out of the money with a 26% safety margin | |||

| #390 | 2019-09-20 | : | -2 | × | INTC 15 Nov 2019 $55.00 C | $ 168.00 | ( $ -1.59 ) | → In the money by 3% — caution! | |||

| #377 | 2019-07-25 | : | -2 | × | MS 15 Nov 2019 $42.00 P | $ 263.00 | ( $ -0.85 ) | → Out of the money with a 13% safety margin | |||

| #365 | 2019-06-28 | : | -1 | × | UTX 15 Nov 2019 $115.00 P | $ 222.00 | ( $ -0.80 ) | → Out of the money with a 28% safety margin | |||

| #362 | 2019-06-28 | : | -2 | × | CL 15 Nov 2019 $65.00 P | $ 248.00 | ( $ -1.00 ) | → Out of the money with a 3% safety margin | |||

| #360 | 2019-06-28 | : | -2 | × | ABBV 15 Nov 2019 $60.00 P | $ 224.00 | ( $ -1.00 ) | → Out of the money with a 36% safety margin | |||

| #358 | 2019-06-28 | : | -2 | × | ABBV 15 Nov 2019 $80.00 C | $ 303.00 | ( $ -0.85 ) | → In the money by 2% — caution! | |||

| #343 | 2019-05-15 | : | -2 | × | SO 15 Nov 2019 $45.00 P | $ 88.00 | ( $ -0.99 ) | → Out of the money with a 38% safety margin |

Two options expiring in November are in the money and three are out of the money with small margins of safety, so I'll have to monitor these carefully as the options expiration dates approach.

December 2019:

| #407 | 2019-10-18 | : | -2 | × | TROW 20 Dec 2019 $115.00 C | $ 339.00 | ( $0.00 ) | → In the money by 2% — caution! | ||

| #373 | 2019-07-22 | : | -1 | × | VLO 20 Dec 2019 $100.00 C | $ 105.00 | ( $ -0.68 ) | → At the money — caution! | ||

| #366 | 2019-06-28 | : | -1 | × | WMT 20 Dec 2019 $100.00 P | $ 213.00 | ( $ -0.80 ) | → Out of the money with a 18% safety margin | ||

| #363 | 2019-06-28 | : | -2 | × | EMR 20 Dec 2019 $60.00 P | $ 374.00 | ( $0.00 ) | → Out of the money with a 20% safety margin | ||

Two options expiring in December are in the money (or at the money), so I'll have to monitor these carefully as the options expiration dates approach.

Concluding Remarks

My options goal in 2019 is to collect a total of $21,000 at an average of $1,750 per month.

|

Total |

Secured |

||

|

End of Month: |

$ 64,333 |

$ 41,275 |

|

|

Previous Month: |

$ 62,741 |

$ 37,819 |

|

|

This Month: |

$1,592 |

$3,456 |

After collecting $1,592 in options income in October, my year to date total is $21,541.

Happily, I've achieved my 2019 options income goal!

In 40 months of options trading, I've collected options income totaling $64,333.

Disclaimer: I'm not an investment professional or a licensed financial advisor. This article represents my personal views and decisions, which may not be appropriate for other investors. ...

more