Moderna; In Case Retail Investors Have Gotten Ahead Of Themselves

Image via Moderna.

Another Big Day For Moderna

Shares of Moderna (MRNA) spiked 20% Monday on news it had requested FDA clearance for its COVID-19 vaccine. Both Bloomberg's Joe Wiesenthal and Julianna Tatelbaum wondered why though.

After all, Moderna announced its vaccine was effective two weeks ago; who didn't expect them to seek clearance for it?

Are Retail Investors Getting Ahead Of Themselves?

Tatelbaum suggested in the tweet above that retail investors were the ones bidding up Moderna shares on Monday. We should note here that BMO Capital Research analyst George Farmer downgraded Moderna to "market perform" after the vaccine news two weeks ago, arguing that the COVID catalyst was already priced in:

We downgrade MRNA to Market Perform from Outperform and increase our target price to $109 on our view of limited upside from current trading levels following announcement of a positive COVE Phase 3 outcome. We believe a near-term best-case scenario is mostly reflected in shares including an mRNA-1273 EUA before year-end and full approval mid-2021. Although we recommend taking some profits, we think, nevertheless, that the now proven potential of MRNA's RNA/LNP platform establishes the company as a new vaccine development powerhouse.

Since Farmer wrote that, Moderna shares were up another 68% as of Monday's close.

Data by YCharts

Locking In Moderna Gains

The obvious way to lock in Moderna gains if you've been long the stock is to take profits here. If you'd rather stay long and try to get more gains, you can hedge. I tried hedging 100 shares of Moderna against a greater-than-20% decline over the next several months two ways: ones with optimal puts (uncapped upside) and once with an optimal collar (capped upside).

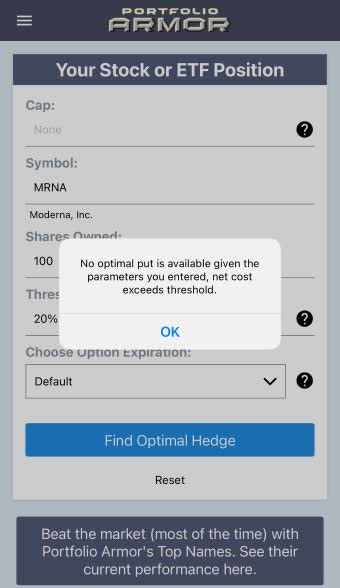

Uncapped Upside - Unavailable

On Monday, if you scanned for an optimal put to hedge Moderna against a >20% drop over the next 6 months, you would have gotten this error message.

Screen capture via the Portfolio Armor iPhone app.

What "net cost exceeds threshold" means is that the cost of hedging against a >20% decline was more than 20% of your position value. So, by buying that hedge, you would have incurred more than the loss you were looking to prevent.

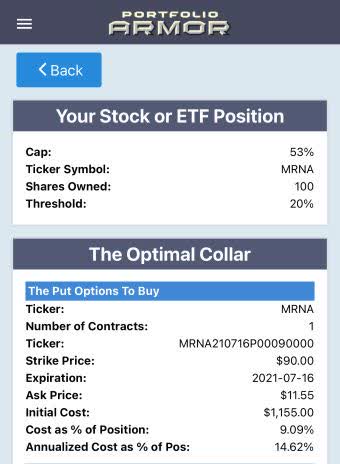

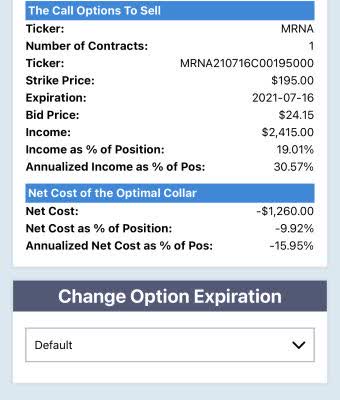

Capped Upside, Negative Cost

If you were willing to cap your possible upside in Moderna at 53% over the next six months, this was the optimal collar to protect against a >20% decline over the same time frame.

Here the net cost was negative, meaning you would have collected a net credit of $1,260, or 9.92% of position value, when opening this hedge, assuming, conservatively, that you bought the puts and sold the calls at the worst ends of their respective spreads. Here's the same hedge demonstrated via video.

Heads You Win, Tails You Don't Lose Too Much

Recall that the collar above capped your upside between now and July at 53%. That cap doesn't include the net credit though. Taking that net credit into account, your best-case scenario here would be a gain of nearly 63%. Your worst-case scenario would be a loss of 20%. Heads you win 63%, tails you lose 20%. Something to consider if you're long Moderna now.