Market Turmoil Exacerbated By Record Gamma, Option "Pins"

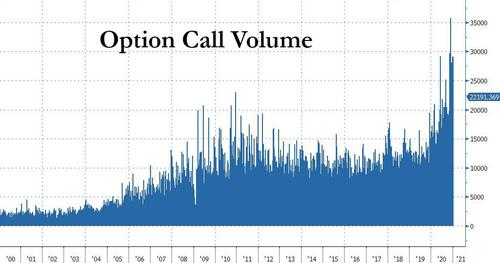

As we showed recently, single stock open-interest has increased to all-time-high levels, which is why today’s expiry is important for stocks, especially for names with large open interest in at-the-money (ATM) 15-Jan options, because as Goldman notes, market makers delta-hedging their unusually large options portfolios are likely to be very active (see the odd report on Exxon from the WSJ which has crashed the stock just as call open interest exploded, leaving countless investors suddenly out of the money). This flow is exacerbating stock price moves in an already jittery market.

(Click on image to enlarge)

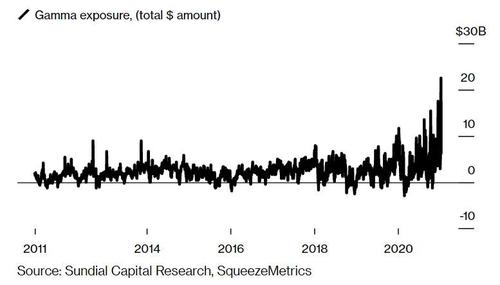

As an aside, and as we pointed out as recently as yesterday for energy names, the furious buying of calls has led to gamma exposure soaring to an all-time high as the following chart from Sundial Research shows.

(Click on image to enlarge)

“Dealers are short calls due to the unprecedented call activity previously mentioned, and as a result have been forced to chase stocks higher to hedge,” Chris Murphy, Susquehanna’s co-head of derivatives strategy, wrote in a note to clients according to Bloomberg. "The unwind could potentially be violent given all the excess euphoria. It is more likely a question of when and not if."

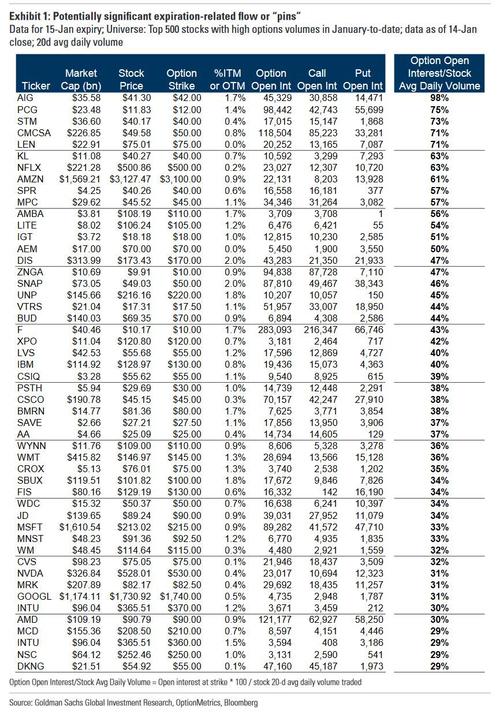

Well, the unwind is taking place as we speak, because as Goldman further explains, at major expirations, options traders track situations where a large amount of open interest is set to expire. In situations where there is a significant amount of expiring open interest in at-the-money strikes (strike prices at or very near the current stock price), delta-hedging activity can impact the underlying stock’s trading that day. If market makers or other options traders who delta-hedge their positions are net long ATM options, expiration-related flow could have the effect of dampening stock price movements, causing the stock price to settle near the strike with large open interest. This situation is referred to as a “pin” and can be an ideal situation for a large investor trying to enter/exit a stock position. Alternatively, if delta-hedgers are net short ATM options (have a “negative gamma” position), their hedging activity could exacerbate stock price moves, read accelerate sell offs.

Who is most exposed?

As Goldman's Vishal Vivek notes, expiration-related trades are causing trading activity to pick up for stocks with a significant amount of ATM open interest. As a result, the bank has identified possible focus stocks with large ATM 15-Jan open interest, and compare this to the average daily volume of the underlying stocks. Expiration-related activity is likely to have more of an impact if the open interest represents a significant percentage of the stock’s volume.

The table below lists those stocks where a large percentage of contracts, relative to their average daily volume traded, expire today leading to acute “pinning”.

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more