Locking In Nano Dimension Gains

Macro Gains For Nano Dimension

Each trading day, our system selects the ten names it estimates will perform best over the next six months. Often, these include large cap stocks with high share prices, but last month we picked up a couple of small caps, Nano Dimension (NNDM) on December 11th, and Ampio Pharmaceuticals (AMPE) on December 17th. By late December, both were up big, as we wrote at the time ("Big Gains From Small Stocks"). In that post also described how we found both names. Since we picked them, AMPE is down about 20%, but NNDM is up 86%. Below, we'll show a way you can lock in NNDM gains while staying long for more. First, let's look at the full performance for both the December 11th and December 17th top names cohorts.

Image via Nano Dimensions, Ltd.

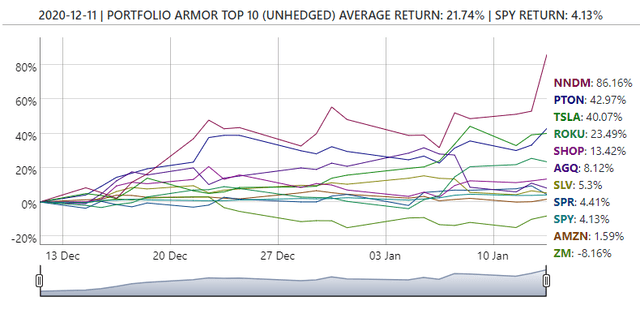

Performance Of Our December 11th Top Ten

In addition to Nano Dimension, our top ten names on December 11th included Peloton (PTON), Tesla (TSLA), Roku (ROKU), Shopify (SHOP), the Pro Shares Ultra Silver ETF (AGQ), the iShares Silver Trust (SLV), Spirit AeroSystems (SPR), Zoom (ZM), and Amazon (AMZN).

This and subsequent screen captures are via Portfolio Armor.

So far, that cohort is up 27.7% versus SPY, with Nano Dimension leading the pack (its shares spiked 21.6 % Wednesday after the company priced a $332.5 million direct offering). Our December 17th cohort has beaten the market so far as well, despite our other small cap pick, AMPE, being down.

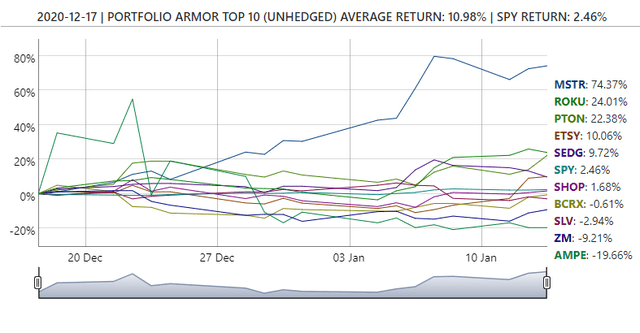

Performance Of Our December 17th Top Ten

Our top ten names from December 17th included a few of the names from the previous week's cohort as well as MicroStrategy (MSTR), Etsy (ETSY), SolarEdge (SEDG), and BioCryst Pharmaceuticals (BCRX).

AMPE was the worst performer there, down 19.66%. Since that highlights the utility of hedging, let's look at hedging Nano Dimension.

Hedging Nano Dimension

For this example, we'll assume you had 10,000 shares of Nano Dimension on Wednesday, and were willing to risk a 30% decline over the next several months, but not one larger than that.

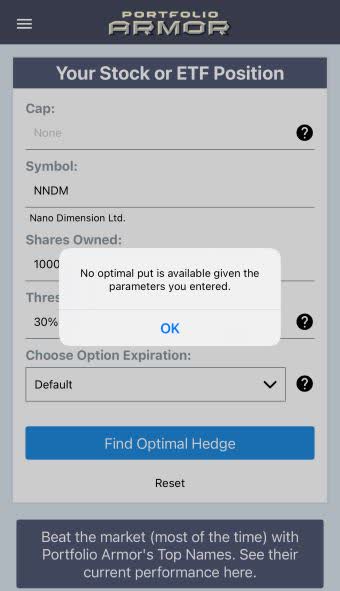

Uncapped Upside - Too Expensive

If you scanned for an optimal put hedge against a >30% decline in NNDM over the next several months, you would have gotten this error message on Wednesday.

No optimal put hedge was available, because the cost of protecting against a >30% decline in NNDM using one was itself greater than 30% of position value.

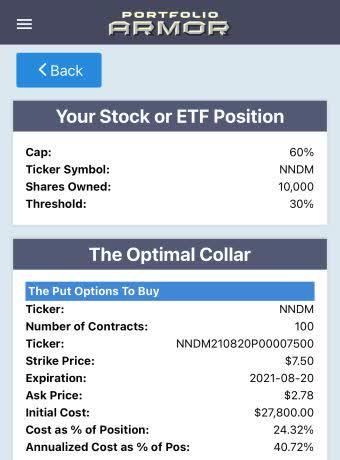

Capped Upside - Negative Cost

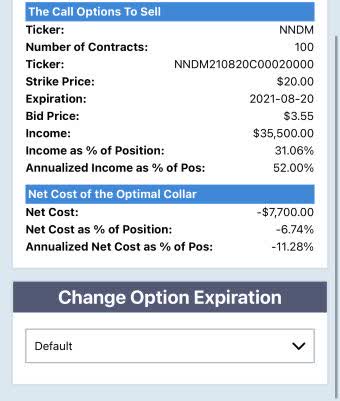

It was possible to find an optimal collar for NNDM on Wednesday though, if you were willing to cap your possible upside at 60% over the same time frame (in this case, going out to late August).

Here, the cost was negative, meaning you would have collected a net credit of $7,700, or 6.74% of position value when opening this hedge. That's assuming, to be conservative, that you placed both trades at the worst ends of their respective spreads (buying the puts at the ask and selling the calls at the bid).

Heads You Win, Tails You Don't Lose Too Much

If you take into account the net credit/negative hedging cost above, your maximum upside from here would be a gain of 66.7%. And in a worst-case scenario, your maximum decline would be a drop of 30%. Heads you win, tails you don't loose too much.