JPMorgan Fears Gamma-Imbalance 'Fragility-Events' In These Stocks

Single stock option gamma imbalances have become a focus for market participants recently amid concerns of the role they may have played in recent price and volatility spikes in Technology stocks, and most recently in high short interest stocks.

Specifically, SoftBank's “Gamma Whale,” which has now been replaced by Reddit-Raiders, provides a lesson on how a gamma squeeze operates. Before explaining the scheme, we define option Delta and Gamma. As a quick reminder, we explained previously, delta quantifies the rate of change of the options price per the change in the underlying stock price. A delta of .50 means the option price will increase 50 cents for every $1 in the stock.

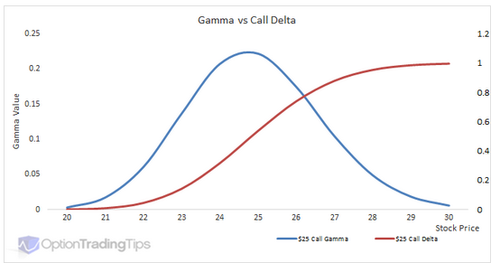

Delta is not a linear function, meaning it will not change proportionately with the stock price. Gamma quantifies how Delta will change per the change in the stock price. The chart below shows the non-linear “S-like” shape of Delta and the Gamma curve that warps it.

Options trade on leverage of sorts as a relatively small option premium can control many shares. In most cases, the premium is a tiny fraction of the price of the underlying shares. However, if the option is in the money at expiration, the option’s holder takes delivery of the underlying stock and must pay fully for the shares. In most cases, options traders sell the option or roll it to a future month to avoid payment.

A Gamma squeeze relies on the hedging actions of options dealers.

The banks and brokers who are the largest sellers of options must hedge their trades. Most dynamically hedge, meaning they frequently adjust the hedge amount according to the Delta of the option. If the Delta is .35, then they buy 35 shares for every option contract they are short. If the Delta then rises to .40, they buy five more shares. Conversely, they sell when the Delta falls.

If the Whale buys enough calls, they can trigger a Gamma squeeze. The option purchases force the dealers to buy the stock, which pushes the share price higher. As this happens, the dealers’ buying activity increases the Delta at a non-linear rate (gamma). In circular fashion dealers then must buy more of the stock, and on and on.

Like Hunt’s strategy, this one works as long as you can keep buying calls, and the stock price keeps rising. As the Hunt’s found out, that is not always possible. Here are a few problems the Whale and others face.

-

If they elect to sell the calls, the dealers will also sell the underlying stocks, which hurts their underlying large share positions.

-

The popularity of such strategies results in increased options premiums, making it costlier to execute.

-

Since they do not take delivery of the underlying stock, they have to continue to roll the positions until they sell the underlying stock. Again, selling the options will force dealer selling. Further, there are times they may not want to buy or roll calls, such as heading into the coming election or at quarter/year ends.

-

Dealers will get tired of being on the losing end of a trade and purposely push stock prices lower. Lower prices have the reverse effect, as dealers must sell when deltas decline.

It is also worth considering; the Whale (or angry horde of Redditors) can short a stock and then buy puts to create a squeeze but one that pushes share prices lower.

All of which brings us to the latest note from JPMorgan's Marko Kolanovic quant derivatives group, who highlight 30 stocks with significant gamma-imbalances.

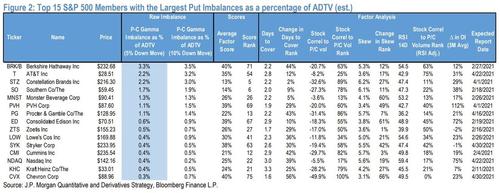

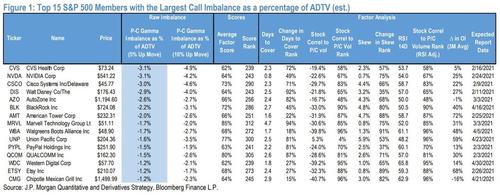

Specifically, Kolanovic explains that an elevated Put or Call imbalance may position a stock for elevated levels of volatility, particularly in low liquidity environments or during impactful events, such as earnings

The following list are the 15 stocks with the biggest put-imbalance in the S&P 500:

And this list is the 15 stocks with the biggest call-imbalance in the S&P 500:

Finally, JPMorgan point out that while a single stock gamma imbalance alone is often insufficient to spark a fragility event as under a normal operating environment these imbalances are typically hedged by dealers, low liquidity environments do lay the groundwork for dealer positioning that can exacerbate existing market trends and volatility.

Typically, an unexpected or underappreciated event sparks this fragility feedback loop.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more