Iron Condors - The Basics

Most traders struggle to make money when trading directionally, especially at first. The idea of consistently picking the right stock and selecting the right option trade often leads to quick losses. This is a result of traders initially being drawn to the unlimited profit potential of buying options, but they fail to understand their low probability nature.

However, the great thing about the options market is that you can structure trades that have a high probability of making money and trades with defined risk. One such trade is the iron condor.

Spread Your Wings

An iron condor is a relatively easy trade to place and manage. However, the initial perception is that it’s complicated because you’re trading four separate options contracts at once. The idea of placing a four-legged option trade for new traders is a little unnerving, but if you follow a framework or trading plan, it can be rather simple.

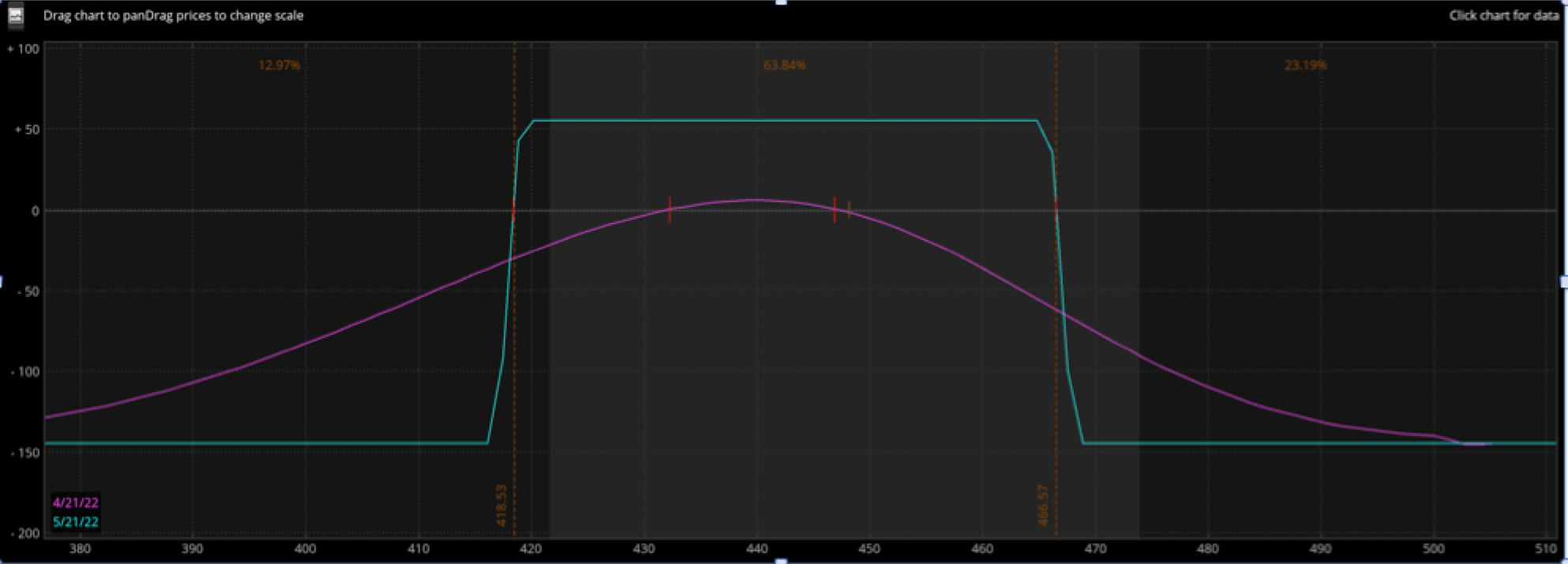

The use of the word ‘condor’ becomes clear when you see the profit and loss graph for the strategy. The image below is the risk profile graph of an iron condor. If you look at the cyan line on the graph, you’ll see the body in the middle and the wings extending out. This is where the term ‘condor’ comes from. The use of the word ‘iron’ comes from the fact this trade employs both calls and puts.

Iron Condor Construction

The short iron condor trade is like a short strangle where an out-of-the-money (OTM) call and put are sold. However, unlike short strangles, an iron condor has defined risk. The risk is defined through the purchase of a further OTM call and put. Those long options come in handy when the price moves above the call sold or below the put sold. As a result, the loss is capped.

Based on that description, you may be familiar with the idea that you’re selling a put vertical and a call vertical to construct the iron condor. Where you sell the corresponding vertical determines the probability of the trade. If the call and put are close together, that leads to a small body, higher credit, but lower probability of making money. If the short call and put strike share the same strike price, it then becomes an iron butterfly.

Since condors are a lot bigger than butterflies in nature, it makes sense that the spread between the short strikes would be larger option trades as well. As a result, iron condors are typically constructed as a high probability trade. By widening the distance between the short call and put, you’re increasing the range where the stock price can close by expiration and reach maximum gain.

Option Selection

An iron condor reaches its maximum gain if the stock price closes in between the call and put options sold. Therefore, how you select these short strikes will dictate the credit received and the probability of reaching maximum gain. That means that you’ll want to apply a methodology that will allow you to consistently maintain a similar probability of success, risk, and reward.

The first step in creating an iron condor is to select an expiration. While you can technically pick any amount of time to expiration, it’s important to balance the time decay of the options with the ability to manage the trade. That means choosing an expiration that is between 30 to 50 days to expiration.

The next step is to select which call and put option you’re going to be selling. One approach is to consider the option’s delta. The delta is a way of estimating the probability of the option expiring in-the-money (ITM) at expiration. If you were to select a call and put strike with a 0.15 to 0.20 (see image below), that means that the call and put will have a 15% to 20% chance of expiring ITM.

By following that rule, you will end up having a 60% to 70% probability of reaching max gain by expiration. While you can select a lower delta and increase the odds, it’s not a bad idea to consider closing the trade before the last week of expiration. A larger credit will enable you to systematically accomplish that.

Lastly, you need to determine which strikes to purchase as a protection against a major move in the price. Since this is a neutral trade, the idea of a significant move higher or lower can lead to large losses. Picking a call and put strike price that is one to two strikes further OTM is a reasonable approach to take. It’s typical to have a $2 strike width between the long and short strike for most stocks.

The ability to use iron condors on a wider array of stock types is one advantage over selling strangles alone. Also, the higher probability approach makes them more attractive compared to a typical butterfly trade.

Iron Condor Timing

There is a reason why there are so many option strategies. It’s because conditions aren’t always right to trade a specific strategy. Failure to understand this will typically result in losing money over time. Since iron condors are neutral and have a higher probability of success, traders can get lulled into thinking that there isn’t a bad time to consider this strategy. However, that isn’t the right mindset to have.

Condors like to spread their wings and similarly, iron condors like too, as well. For high probability trades like iron condors, this means that you will want to see higher implied volatility conditions. As implied volatility rises, the 0.15 to 0.20 delta gets pushed further away from the stock price. As a result, the price range of profitability increases.

While, in theory, the probabilities are the same whether implied volatility is higher or lower, the mean-reverting nature of implied volatility suggests that higher implied volatility conditions present the best time to consider the strategy.

Since we’re looking at implied volatility to consider when to trade an iron condor, the question then becomes what the best way is to determine this. You can certainly eyeball the implied volatility by plotting it over time, but there is a better way.

Many trading platforms have a calculation for IV percentile. This looks at the one-year range and lets you know where the current implied volatility falls. A value above 50 indicates that the implied volatility is in the upper half of the one-year range. A value of 50 and above is a good starting point when considering an iron condor trade.

Another benefit of choosing higher implied volatility conditions is that a drop in implied volatility will benefit your trade when the stock price is in between your short strikes.

Iron Condor Profitability

If you were to follow the rules above for strike selection, you should have a minimum of 30% return on your risk. If you have a $2 spread between your long and short options, that means your credit will be at least $0.46 (max gain) with a max loss of $1.54. Again, the max gain is attained when the price closes between the short call and put strikes at expiration.

While holding to expiration is a possibility, the gamma risk of the last week makes it reasonable to consider other options. Holding out for last $0.05 as expiration approaches can be risky. That means closing early for less than the maximum gain. One rule to consider is to close when you’ve reached 65% to 70% of max gain. That would mean closing the condor for $0.15 if you received a $0.50 credit.

Another consideration is to close the call and put sides of the iron condor separately. For example, if you can buy back the short call or put for $0.05, that will remove the risk on one side of the trade. This can happen regularly since it is unlikely that the stock price will stay at the same price throughout the holding period. This approach can help you capitalize on the swings in the price.

Who Should Consider Iron Condors?

This is a strategy that can be used by beginner traders to even the most advanced traders. Beginners may find the strategy intimidating because its multi-leg, but once they overcome the hurdles of knowing how to place the trade, it’s relatively easy to execute. Also, because of its defined risk, it allows new traders to hone their craft with little risk. This is because you’re typically risking about $150 per trade.

Iron condors are typically used by traders that like higher probability trades and desire more consistent income. Compared to the low probability nature of buying options, learning iron condors can be a breath of fresh air when used in the right conditions. These qualities are a big reason why many people gravitate to this strategy.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more