How To Survive And Prosper In A Bear Market?

After the CDC warned the U.S. population about a potential domestic coronavirus outbreak, the market has responded with a heavy sell-off that has sent the S&P 500 to last December levels.

Billions if not trillions of dollars have been already whipped out of the markets due to the fear that the virus will have a negative impact in the global economy and corporate earnings.

Even though these fears may be unsubstantiated and the sell-off could be an overly pessimistic response to a temporary situation, many economists are warning investors about the potential mid-term aftermath of coronavirus and how the current situation has already changed the course of the global economy for the next 12 months.

Therefore, since a bear market appears to be a possibility, I wanted to share a few tips on how you can survive and prosper during one.

#1 – The right mindset

A bear market is usually caused by slower economic growth and lower sales that usually result in smaller corporate earnings.

In this case, the coronavirus may be the trigger for a sell-off but is not necessarily the cause for a bear market.

The Nasdaq is up around 65% since the December 2018 low and some natural profit taking at these levels is normal. The coronavirus is just the excuse investors needed to reduce risk.

A bear market hasn’t official started yet, but we may be in for a least a prolonged and serious correction. Some of the following strategies should be useful to navigate this new market environment.

#2 – Hedge Your Positions by Using Put Options

A put option gives the holder the right to sell a stock at a certain price at a future date and one way investors can hedge their portfolio during a bear market is by purchasing these options to lock in the value of their holdings until the bear market is over.

A really simple way is to look at your overall position delta. Let’s say it’s +20. All you need to do as a temporary hedge is buy a 20 delta put which will neutralize your delta in the short-term.

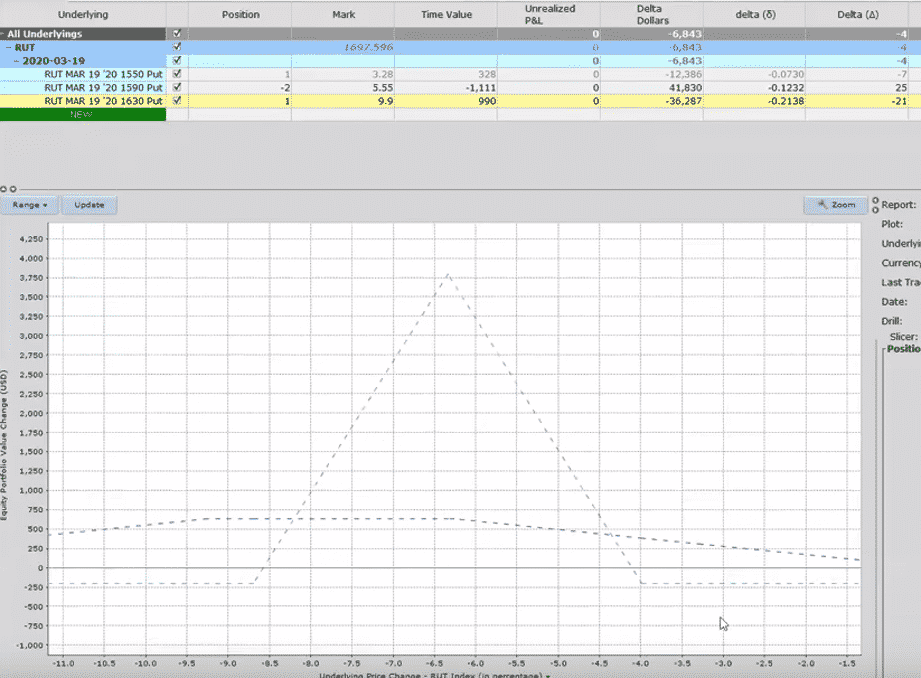

#3 – Buy out-of-the-money Put Butterfly Spreads

This is one of my favorite strategies and I even opened one of these on Feb 19th. The butterfly was centered 6.5% below the current RUT price. I thought there was a change RUT would drift down into that zone, I just didn’t expect it to happen within a few days!

(Click on image to enlarge)

The trade is currently +$450 so we’ll see what happens with this one.

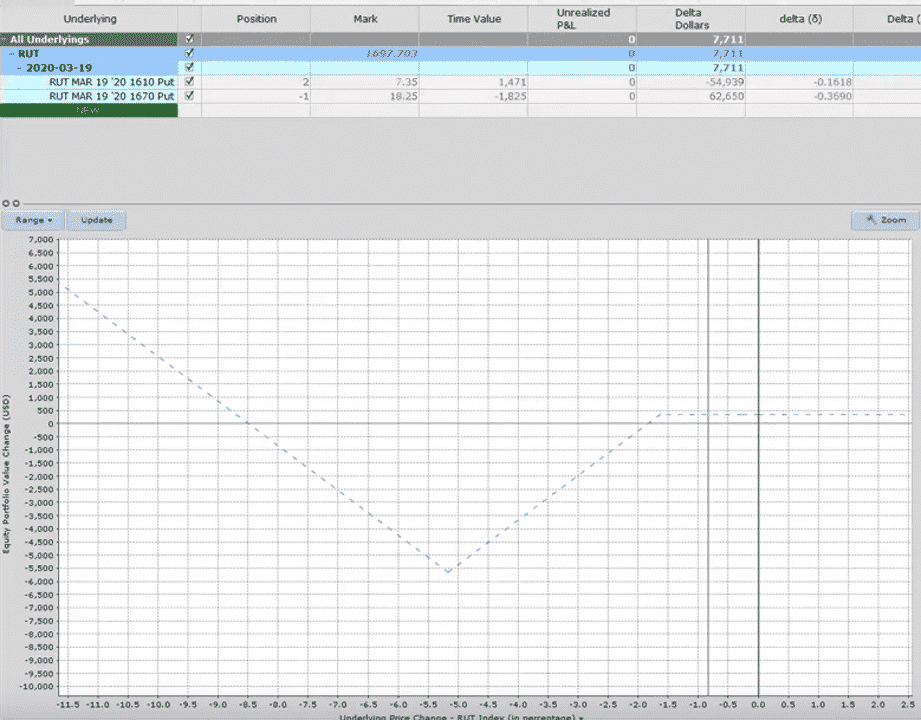

#4 – Use Put Ratio Backspreads

When I placed the trade above, the initial trade I was looking at was a put ratio backspread. Unfortunately for me, I went with the butterfly.

While the butterfly is +$450, the ratio spread would have been +$3,050.

(Click on image to enlarge)

#5 – Look for financial assets with negative correlations

The correlation of two assets measures how one asset behaves in comparison to the other. This correlation is measured by observing the historical performance of both assets and it results in a positive or negative number that varies from 0 to 1.

In a bear market, a financial asset that has a correlation between -0.7 and -1 with the S&P500 should be a good investment as it will grow in value as the S&P declines.

Historically, currencies and investment-grade bonds tend to have a negative correlation with the S&P 500.

Bottom Line

The possibility of a bear market has become more real than ever as the aftermath of the coronavirus could open the door for a severe global economic recession.

If you also believe that this is a real possibility you can hedge your positions right away by using some of the strategies mentioned above.

These strategies should help you in both surviving and prospering, even under harsh market conditions.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more