Don't Trade Naked Calls

Selling a naked call is when you sell a call option without owning the underlying stock and it is not paired with another hedging option. When you do so, you are exposed to dangerous price movements and volatility changes of the underlying stock — both of which are very difficult to predict. You can certainly lose more money than you have.

It is an undefined-risk strategy — meaning there is no limit to how much you can lose (in theory).

The Setup

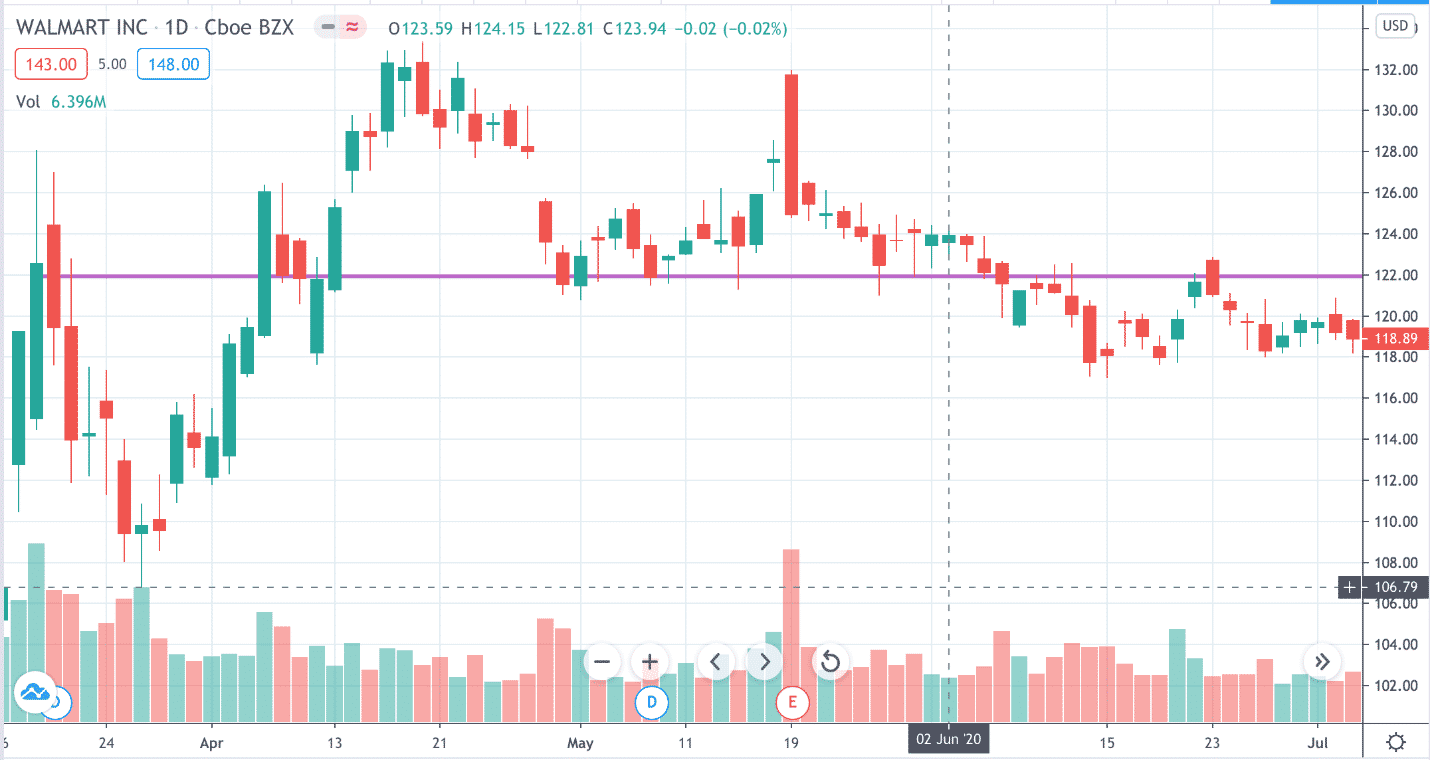

Let’s see how wrong selling a naked call can end up by finding an example based on historic options data using Option Net Explorer. On July 6, Walmart (WMT) is looking quite bearish, with the price closing just below the 200-day moving average.

The price is below both the downward sloping 20 and 50 moving averages, with the 20 below the 50. For the past week, WMT has not been able to close above the 20-day moving average. There is no upcoming earnings risk.

This is typically a pretty good setup for a bearish option trade. Additionally, there is resistance at $122, which we don’t expect WMT to go above.

Suppose we sell the $122 call option expecting WMT to continue downward, or at least not come up to our call strike at $122. Here are our statistics:

- Date: July 6, 2020.

- Price: $118.89.

- Sell 1 July 17, WMT $122 call @ $0.47 (delta at 0.2174).

- Delta dollars: -0.2174 * 100 * $118.89 = –$2,585.

- Premium received: $47.

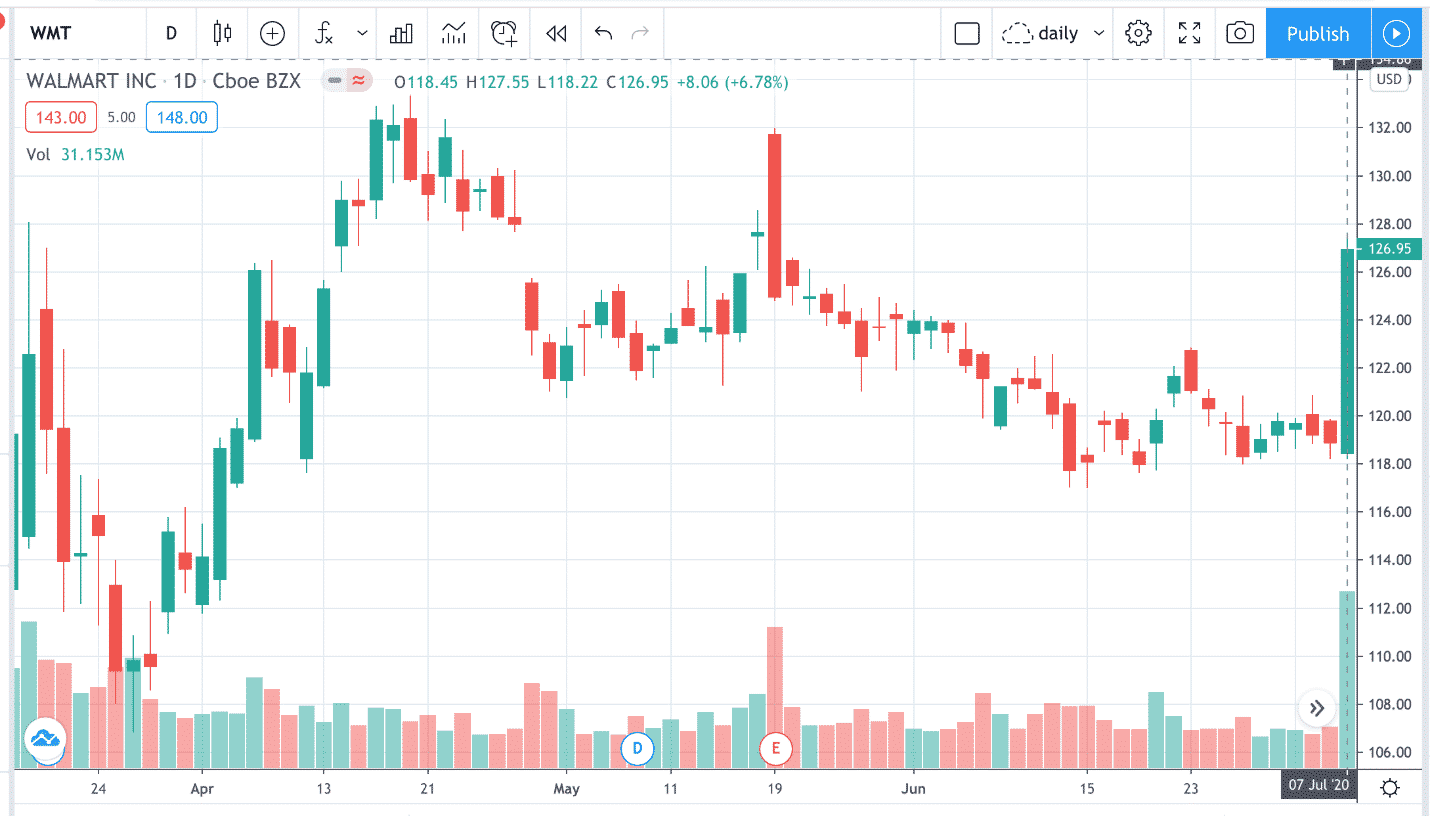

WMT Reversed Direction

The next day, WMT reversed direction and then proceeded to relentlessly go up to close at $126.95 — up about 6.8%.

We have no idea why WMT went up like that. The overall market did not go up that day. All we know is that stocks can do anything they want at any time they want. They don’t have to follow technicals, fundamentals, nor the news. They certainly do not need to obey support and resistance levels, nor do they care about our opinion.

The trade is now down –$520.50, and our delta notational has gone way up. Here are our results:

- Profit/Loss: –$520.50,

- Delta Dollars: -0.7988 * 100 * $126.95 = –$10,140.77.

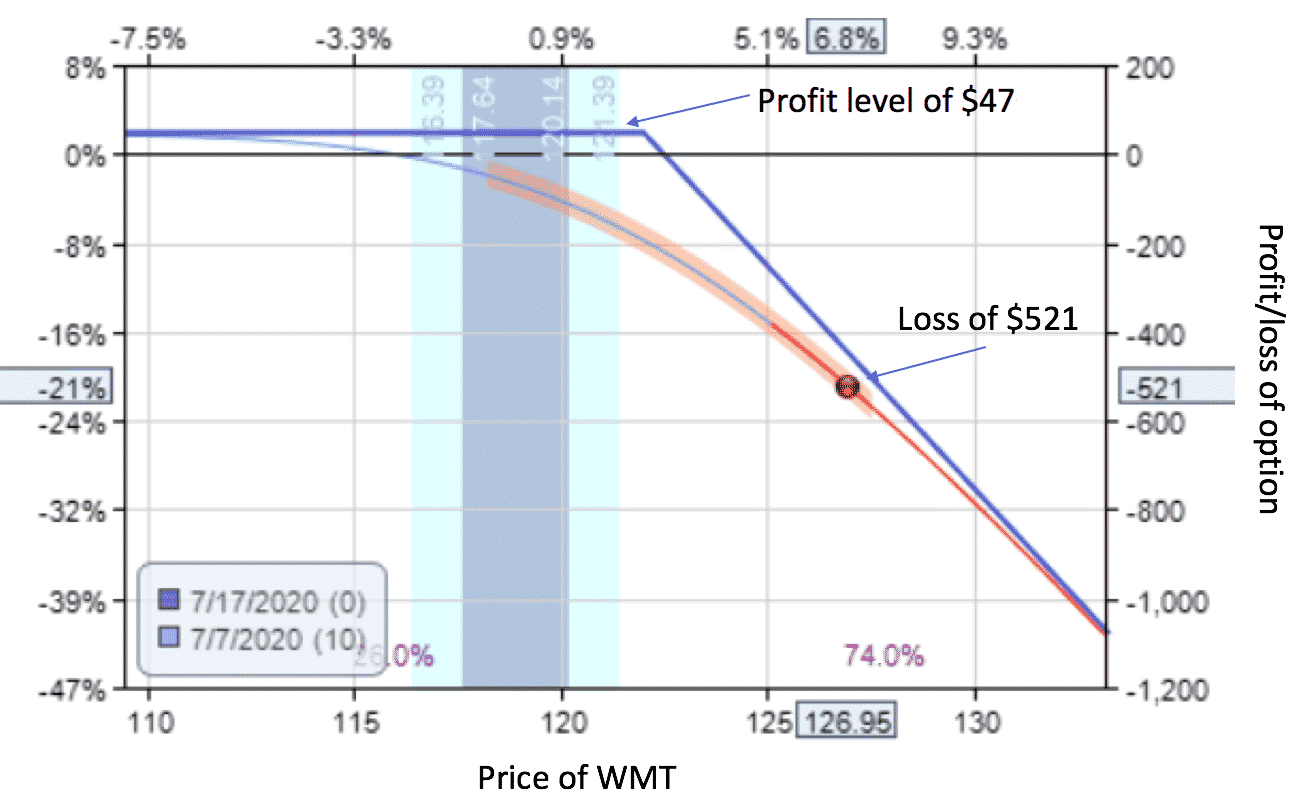

Payoff Diagram

The following is the payoff diagram for selling a call option. The price of WMT is on the horizontal axis. The profit and loss of the option are on the right vertical axis.

The dark blue line is the profit and loss at expiration. It is known as the expiration line. The curve line is the profit and loss as of the current date. It is known as the T-0 line. As the price of WMT goes down, we make money. If WMT price is lower than $122 at expiration, we keep the full $47 premium received.

The expiration breakeven price is calculated by taking the 122 strike and adding the premium received, which gives $122.47. If the price of WMT goes up, we lose money. The higher the price goes, the faster we lose money. Note that the curve line has an increasingly negative slope as price increases to the right.

In theory, that line does not end, meaning unlimited losses. In reality, there is probably an upper reasonable limit on how high the stock goes before expiration. There is also the possibility that your broker may close the trade for you after you’ve hit the limit on your margin. What is worse is that this trade has a maximum reward of only $47.

In one day, we have lost 11 times more than what we could have possibly make on this trade. Not a good risk to reward ratio. Think of it as picking up pennies in front of a steam roller.

Just Close The Trade

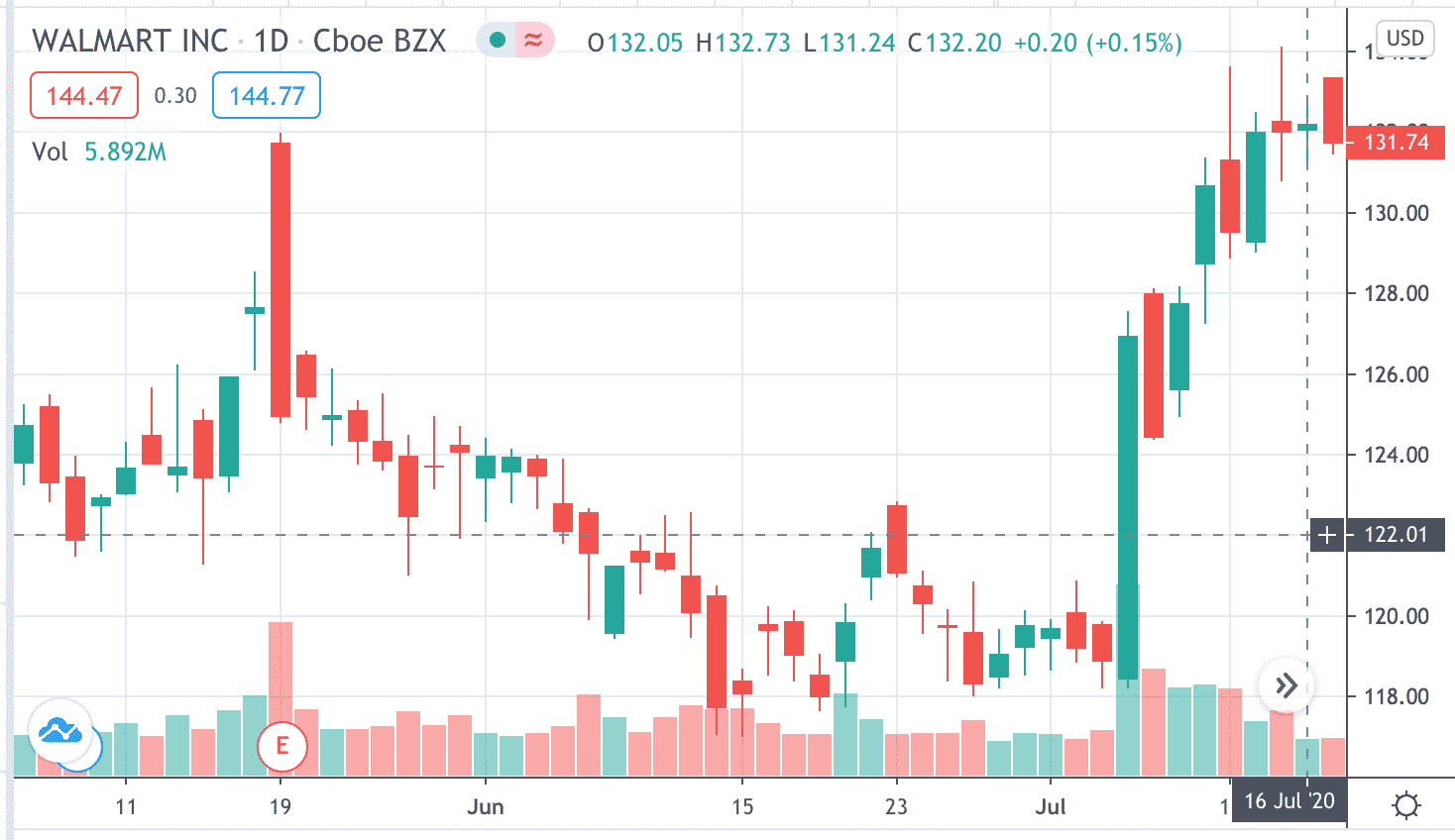

Because no one will know what WMT will do tomorrow, it is wise at this point to remove any additional risk off the table and close the trade. We don’t want WMT to continue upwards and accelerate our losses. To close the trade we have to buy one contract of July 17, WMT $122 call @ $5.67.

Quick math shows the loss to be ($5.67 – $0.47) * 100 = $520. Ouch.

The price of the call option has risen to $5.67 — more than a 12 fold increase from the$0. 47 price at which we sold it. And if we did not, these would be the profits and losses at market close for each day:

- July 8 –$326.

- July 9 –$558.

- July 10 –$876.

- July 13 –$726.

- July 14 –$1023.

- July 15 –$943.

- July 16 –$963.

- July 17 –$926.

The market does not seem to be friendly to those who are stubborn or those who are relying on hope that price of WMT goes back down.

Called Away at Expiration

WMT closed at $131.74 at expiration on July 17 — above our strike price of $122.

If we had held to expiration, our option would have been exercised. We will have to sell 100 shares of WMT at the price of $122. The problem is that we don’t have 100 shares of WMT. So, we will have to purchase 100 shares at market price and the difference is our loss.

- ($131.74 – $122.00) * 100 = $974 loss from stock sale.

We received $47 credit for selling the call.

- Total loss if we held to expiration: $974 – $47 = $927.

This example is using only one contract, the smallest possible size. In a typical trade of 10 contracts, multiple the numbers by 10. Now you know why you should never sell naked calls. This is the reason why a lot of brokers will restrict new traders from selling naked calls.

Covered Call

If we had owned 100 shares of WMT, then it would not be so bad. We would have just sold our existing shares at $122. Based on at what price we had bought WMT, we may or may not be profitable. Selling calls while owning the stock is called a covered call, and is perfectly reasonable.

It is no longer naked because we are covered by having stock on hand. In fact, by owning the stock, you’ve turned one of the most dangerous strategies (selling naked calls) into one of the least dangerous strategies (selling covered calls). However, a covered call is a bullish strategy and is typically done when we think price of stock is going up, which is not the case of our initial opinion here.

Better Strategies

Instead of selling naked calls, there are far better and safer strategies to use when we have a bearish opinion on a stock. The bear call spread, bear put spread, bearish broken wing butterfly, or buying puts are all risk-defined alternatives — meaning there is a maximum loss amount that is known at the start of the trade.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more