Discovery In The Amazon

An Amazon delivery agent at work (photo via author's Shutterstock subscription).

Amazon Delivers Blowout Earnings

In our last post, we included this video on how to hedge Amazon (AMZN) ahead of earnings, in case it posted a miss as Mott Capital Management warned it might.

As it turns out, Mott's concerns about AWS (Amazon Web Services) were misplaced. AWS's operating margin was over 30% in Q1.

The oligopolistic retail giant conventional wisdom suggested would continue to benefit from the COVID lockdowns did just that. Nothing surprising there in the end. But in writing our previous post on Amazon, we discovered something interesting.

What Doesn't Work On Wall Street

"What Works On Wall Street" was the title of Jim O'Shaughnessy's classic book on patterns he'd found that delivered strong returns. For example, his "Tiny Titans" strategy screened for cheap (low price-to-sales) microcaps with strong price momentum. Our system looks at price momentum too, but rather than screening for fundamentals, it looks at various gauges of options market sentiment (the reason it doesn't look at fundamentals is that our universe isn't limited to stocks: it also includes fixed income, precious metals, bearish, and other exchange-traded products where equity ratios such as price-to-sales wouldn't apply).

Indicator Flips To Negative

One of our gauges of options market sentiment that signaled outperformance in real time security selection over the last three and a half years in back tests for more than a decade before flipped to being a negative indicator earlier this year. Our system took this into account as soon as it happened, but we didn't notice it until we looked up Amazon on our admin panel before writing our last post and saw this.

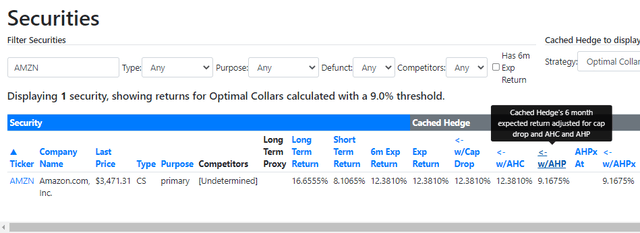

Screen capture via Portfolio Armor's admin panel.

The "AHP" in the "w/AHP" column there stands for "Also Hedgeable with Puts". One of our initial screens is that it's possible to hedge a security with an optimal, or least-expensive collar, against a greater-than-9% decline over the six months. "AHP" means it's also possible to hedge the security against the same decline over the same time frame with optimal puts. Seeing that Amazon passed that screen and as a result our potential return for it went down was a surprise.

Scanning For AHP Names

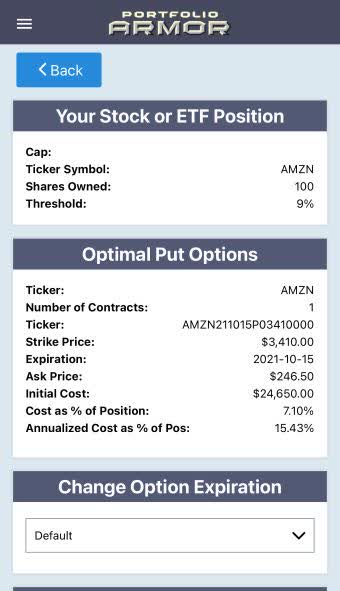

To see if a security is also hedgeable with puts against >9% declines, you simply attempt to scan for that kind of hedge using the options expiration date that's close to six months out (in our app, that's the default expiration date). In Amazon's case, that looked like this on Thursday.

Screen capture via the Portfolio Armor iPhone app as of Thursday's close.

This is essentially a measure of risk: it was possible to hedge Amazon against a >9% decline over six months because the cost of that protection was less than 9% of position value; that the cost of the hedge was relatively low suggests options market participants weren't too concerned about Amazon dropping by more than 9% by then.

Once A Significant Source Of Outperformance

We backtested our basic security selection method by running our analysis every trading day over an eleven-year period and then looking at the actual returns of the securities with the highest potential returns on our daily scans over the next six months. Over that 11-year period, we conducted 25,412 comparisons of our calculated potential returns to actual returns, an average of 9.4 top-ranked securities each trading day. The average actual return over the next six months, unhedged, was 6.84%. The subset of those securities that were AHP generated actual returns of 9.35%on average over 6 months. Without the AHP names, the average performance of the other top names dropped to 6.12% over 6 months. So there was an outpeformance of 3.23% for AHP versus versus non-AHP names.

That AHP outperformance continued after we started posting our top names to our site each trading day in 2017 and tracking their returns in real time over the next six months. Each trading day, as new returns come in, our system adjusts these calibration factors up or down accordingly.

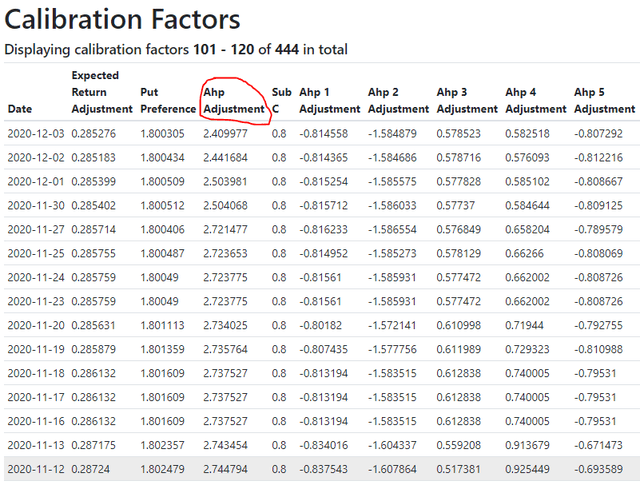

For example, in our previous post, we mentioned that the last time Amazon was one of our top ten names on November 12th of last year. As of that date, AHP names had an average outperformance of 2.74% over 6 months, so our system boosted AHP names such as Amazon in its selection process accordingly.

This and the next screen capture are via our admin panel.

Now A Source Of Underperformance

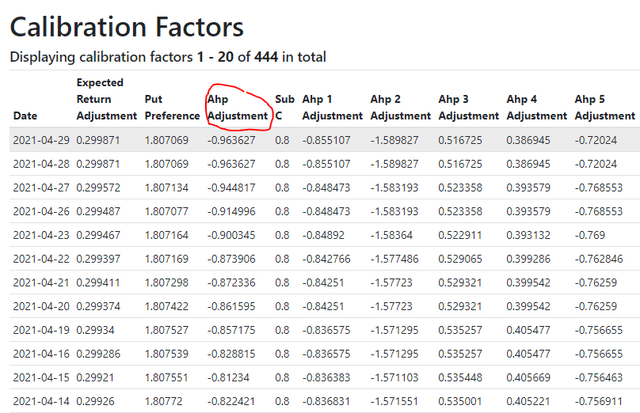

Here's a look at those calibration factors as of Thursday's close.

As you can see, the AHP factor has flipped to negative and has been getting worse this month.

What This All Means

Among our top names, the riskier ones have outperformed the safer ones as the market has melted up from its March 2020 bottom, and that trend has been increasing. Our system is taking that into account as it makes its current selections. You might want to consider doing the same.

That said, if you're going to hold riskier names, you should consider hedging them. Even if it costs a bit more to hedge them, if their average returns are significantly higher, your returns net of hedging cost ought to be attractive too.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more