Custom Put Spreads – Optimizing Risk Mitigation

Introduction:

Leveraging a minimal amount of capital, mitigating risk and maximizing returns is the objective of an options-based portfolio. Options trading can offer the optimal balance between risk and reward while providing a margin of downside protection with a high probability of success. Proper portfolio construction and optimal risk management is essential when engaging in options trading as a means to drive portfolio performance. Key pillars of risk mitigation are rooted in maintaining liquidity, risk-defining trades, staggering options expiration dates, trading across a wide array of uncorrelated tickers, maximizing the number of trades, appropriate position allocation and selling options to collect the premium income. Customizing your option trade structure is another element that can be layered into the overall strategy for long-term success in options trading. A risk-defined custom put spread offers layers of protection thus optimizing the risk management aspect of an options trade while maximizing return on investment.

Custom Put Spreads: Results

Leveraging a minimal amount of capital and maximizing returns with risk-defined trades optimizes the risk-reward profile. Whether you have a small account or a large account, a defined risk (i.e. custom put spreads) strategy enables you to leverage a minimal amount of capital which opens the door to trading virtually any stock on the market regardless of share price such as Apple (AAPL), Amazon (AMZN), Chipotle (CMG), Facebook (FB), etc. Risk-defined options can easily yield double-digit realized gains over the course of a typical one month contract (Figures 1, 2, and 3).

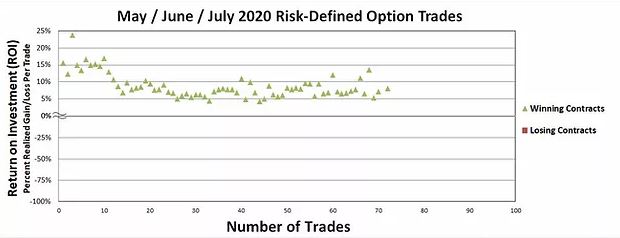

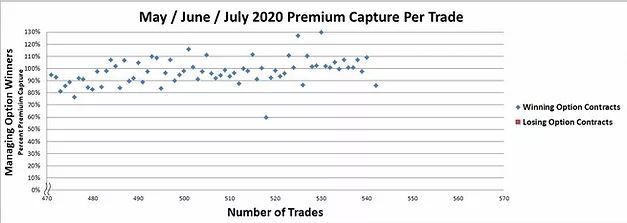

Figure 1 – Average income per trade of $201, average return per trade of 7.6% and 98% premium capture over 63 trades in May and June

Figure 2 – Options win rate of 100% across 26 unique tickers using put spreads and custom put spreads with an options winning streak of 73 consecutive trades.

Figure 3 – Average return on investment (ROI) per trade of 7.6% using a risk defined strategy via leveraging a minimal amount of capital to maximize returns

Figure 4 – Average premium capture per trade of 98% with numerous trades with greater than 100% premium capture using a custom put spread strategy

An Effective Long-Term Options Strategy:

A slew of protective measures should be deployed if options are used as a means to drive portfolio results. One of the main pillars when building an options-based portfolio is maintaining a significant portion of cash on-hand. This cash position provides the ability to rapidly adapt when faced with extreme market conditions such as COVID-19 and Q4 2018 sell-offs. When selling options and running an options-based portfolio the following guidelines are essential (Figure 5):

-

Trade across a wide array of uncorrelated tickers

-

Maximize sector diversity

-

Spread option contracts over various expiration dates

-

Sell options in high implied volatility environments

-

Manage winning trades

-

Use defined-risk trades

-

Maintains a ~50% cash level

-

Maximize the number of trades so the probabilities play out to the expected outcomes

-

Continue to trade through all market environments

-

Appropriate position sizing/trade allocation

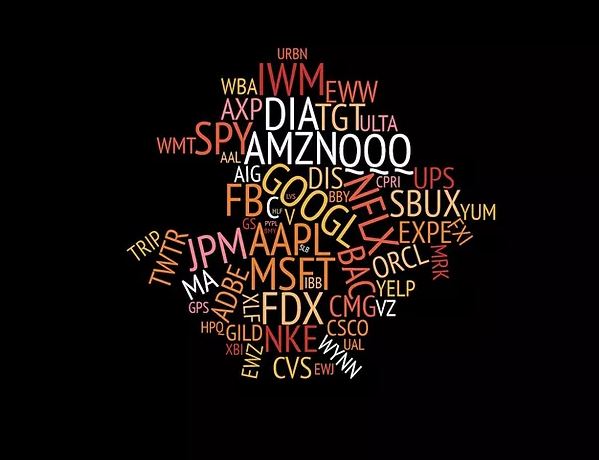

Figure 5 – A composite of ~80 tickers that can be used as a means to trade uncorrelated tickers across diverse sectors. This list can be downloaded Options Trading Ticker List that ties into the Trade Notification Service.

Basic Framework - Custom Put Spreads:

Options are a leveraged vehicle thus minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. A custom put credit spread strategy is an ideal way to balance risk and reward in options trading. This strategy involves selling a put option and buying a further dated put option while collecting a credit in the process. When selling the put option, premium is collected and simultaneously using some of that premium income to buy a further dated put option at a lower strike price. The net result will be a credit on the two-leg pair trade with defined risk since the purchase of the put option serves as protection. By selling the put option, you agree to buy shares at the agreed upon price by the agreed upon expiration date. By buying the put option, you have the right to sell shares at the agreed upon price by the agreed upon expiration date. Thus risk is defined and capital requirements are minimal since you have the ability to sell shares at a specific price regardless of stock movement. This will cap any losses beyond the price at which you have the right to sell shares.

Why Buy A Further Dated Protection Leg?

Buying the further dated put protection offers more protection if the stock moves against you near expiration. For instance, one sold a $95 strike option with an expiration 02JUL20 and bought the $90 strike with an expiration 10JUL20 and received a net premium credit of $37. For the trade set-up, max loss (if both legs co-expired) would be $95-$90 x 100 shares less the premium received. So max loss per contact (if the legs co-expired together) translates into $500 - $37 = $463 with a potential ROI of 8% on the trade ($37/$463).

If the stock struggled to remain at $95 on the expiration date, you are able to buy-to-close the $95 leg for a debit and since the $95 leg was being challenged, the $90 protection leg was becoming more valuable since it was dated a week further out. The credit received for selling-to-close the $90 strike protection leg will exceed the debit spent on buying-to-close the $95 leg if the stock is trading on the upper end of the $5 wide strike width. This scenario likely result in a premium capture of over 100% premium since the $90 strike protection was further dated and the $95 strike was nearing expiration and becoming worthless when shares were hovering at ~$95 per share at expiration. The ROI will jump from 8% to a higher level as well after factoring in the additional premium income credit from closing out the legs for additional net credit.

Even if the stock would have traded around $94 this "loss" would have still been a winner because of the trade structure. The further dated protection will enable you to avoid any max loss situations since these legs do not co-expire and value will still be present in the further dated leg. This will allow you to still win a trade if the stock falls on the upper end between the two strikes when factoring in the original premium income and value retained in the protection leg that can be taken in as a credit to offset any potential losing trades.

Potential Scenarios:

A normal put spread with the same expiration dates will expire together worthless with defined risk. If the option expires between the strikes then losses will incur and if the stock moves below your protection put then max losses will occur at expiration. In a black swan event, clusters of options trades can incur max losses and really jeopardize your profit/loss statement. My goal is to limit the losses and not absorb any max losses to optimize risk management.

The further dated put protection leg in a custom put spread will allow you to sell-to-close the leg to extract value from the trade if it goes against you. If there's a week left in the further dated option then you still have time premium and if the stock really moves against you then you may have intrinsic value too to partially offset losses. The further dated put protection leg provides more tail-end risk mitigation.

Example:

Sell a custom put spread at a strike of $100 / 10JUL20 and bought a put strike at $90 / 17JUL20 to net $100 in premium

1) If the stock stays above $100 at expiration then you net the $100 in premium AND you can sell-to-close the $90 strike for any remaining value to net more than $100 on the trade and capture more than 100% premium capture

2) If the stock trades below $99 then you begin losing money but the $90 strike gains in value and you can sell this $90 strike to offset losses since there's a week left in the contract due to time value. If the stock trades ~$98 at expiration then selling-to-close the further dated put protection will likely circumvent any loss on the trade and still result in a winning trade.

3) If the stock trades below $90 then the $90 strike will gain in value penny for a penny below $90 so you can sell this option to avoid any max losses and recapture value from the contract. You would buy-to-close the $100 strike leg to avoid assignment and then sell-to-close the further dated put leg with remaining time value to avoid any max loss situation.

Conclusion:

Options are a leveraged vehicle thus minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. A custom put credit spread strategy is an ideal way to balance risk and reward in options trading. The overall options-based portfolio strategy is to sell options which enable you to collect premium income in a high-probability manner while generating consistent income for steady portfolio appreciation despite market conditions. This options-based approach provides a margin of safety while mitigating drastic market moves and containing portfolio volatility.

Options trading is a long-term game that requires discipline, patience and time. The COVID-19 black swan event reinforces why keeping liquidity, spreading out expiration dates, maximizing sector exposure, maximizing ticker diversity, risk defining trades and continuing to sell options through all market conditions is essential. Continuing to stick to the fundamentals with defined risk trades via leveraging small amounts of capital to maximize profits is essential. Keeping a significant portion of your portfolio in cash is essential to the overall strategy. Custom put spreads offer superior risk mitigation in the event option trades challenge your protection legs.

Disclosure: The author holds shares in AAL, AAPL, AMC, AMZN, AXP, DIA, DIS, FB, GOOGL, JPM, KSS, MA, MSFT, QQQ, SPY, UPS and USO. However, he may engage in options trading in any of the ...

more