Call Option Payoff Graph

Call Option Basics

A long call is one of the easiest option trades and a great place for beginners to start their learning journey. A call option is a contract between a buyer and seller. The contract will be for the right to purchase a certain stock at a certain price up until a certain date (called the expiration date).

What this means is that up until the contract expires, the buyer of a call has the right to purchase the stock at the agreed price.

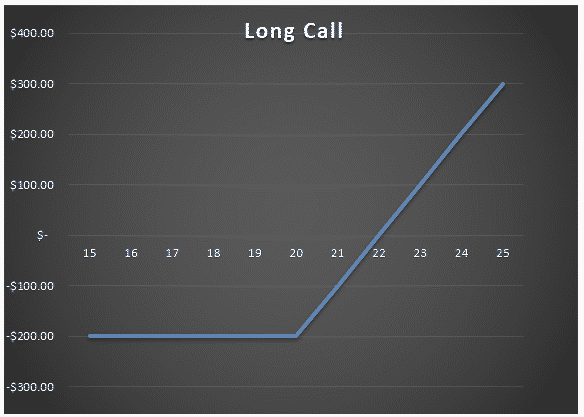

Call Option Payoff Graph

Understanding payoff graphs (or diagrams as they are sometimes referred as) is absolutely essential for option traders. A payoff graph will show the option position’s total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example:

What we are looking at here is the payoff graph for a long call option strategy. In this example, the trader has bought a 20 strike call for $2 per contract (or $200 for a standard option contract representing 100 shares). The premium of $200 is the most the trade can lose. That occurs at an underlying stock price of $20 and below. Above the strike price of 20, the line slopes upward as the payoff rises in proportion with the stock price.

The lines crosses into profit at a certain point when the stock price rises above the breakeven point. The breakeven point is simply the strike price plus the premium paid. In this case it would be:

If the premium paid had been slightly higher at $2.20, then the breakeven price would be $22.20

Different Scenarios At Expiration

Four different scenarios can occur at expiration for a long call trade.

- The underlying stock price is below the strike price.

If the underlying stock price is below the strike price at expiration, the call option will expire worthless. The loss for the trade will be equal to the premium paid and no more. In our example, this would be $2 per contract, or $200 in total. Think about it this way, if the stock is trading at $18 at expiry, it makes no sense to exercise the option to buy the stock at $20.

The good thing about a long call is that the loss is limited to the premium paid, so it doesn’t matter how low the stock goes as the most the trader can lose is the $200 in this example.

- The underlying stock price is equal to the strike price.

The stock price ending right at the strike price at expiration would be incredibly rare, but it could happen. In this case, it also doesn’t make sense to exercise the option because the trader could just buy the stock in the market for the same price without having to pay the assignment fees.

- The underlying stock price is above the strike price, but below the breakeven price.

If the stock is above the strike price at expiration, the trader may think that’s great but unless it gets above the breakeven price, it will not end in a profit. For example, let’s say the stock ends at $21. The 20 strike call option has $1 of value left and can either be sold in the market or exercised. But the $1 of value is less than the $2 paid, so in this scenario, even though the call option has some value at expiration, the trader has lost $1 per contract.

- The underlying stock price is higher than the breakeven price.

This is the ideal scenario that the trader was hoping for. Ideally the stock would be a long way above the breakeven price. The trade can either exercise the option or sell it in the market for a profit.

Let’s assume the stock finished at $26, the 20 strike call option will have a value of $6. The profit to the trader is $6 less the $2 paid, for a total profit of $4. If the trader chooses to exercise the call option, they will buy the stock at $20 and can immediately sell it in the market for $26. Or if they don’t want to exercise the option, they can sell the call back before expiration for $6.

Payoff Graph At Interim Dates

So far, we’ve only considered the payoff graph at expiration. The payoff graph at interim dates will look very different and will be impacted by factors such as time decay and implied volatility.

Calculating the profit and loss at expiration is quite simple if you use Microsoft Excel, or you could even calculate it in your head if you are half decent at mathematics. Calculating profits and losses at interim dates is much more complex and requires more advanced software than just Excel, however. Any decent options broker will have the ability to show option profits and losses at interim dates.

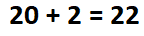

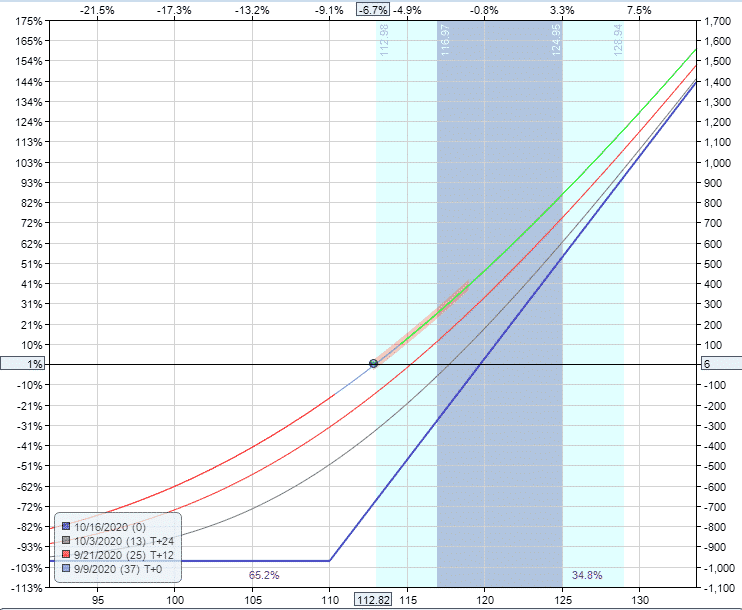

The below call option payoff is from Interactive Brokers. The call option was an AAPL 110 strike call purchased for $9.70 per contract, or $970 in total. The breakeven price at expiration is 119.70 (strike price plus the premium paid).

The blue line shows the expiration payoff that you are now familiar with and the purple line shows what is known as a “T+0” line. T+0 simply means, what does the trade look like as of today? Notice that the breakeven price as of today is the current AAPL price as of this writing. This makes sense because we just bought the call, so wouldn’t expect to have made or lost any money yet.

Notice that profits occur much before the expiration breakeven price and below 100. The losses are not the maximum loss. As time goes by, the interim line slowly moves towards the expiration line.

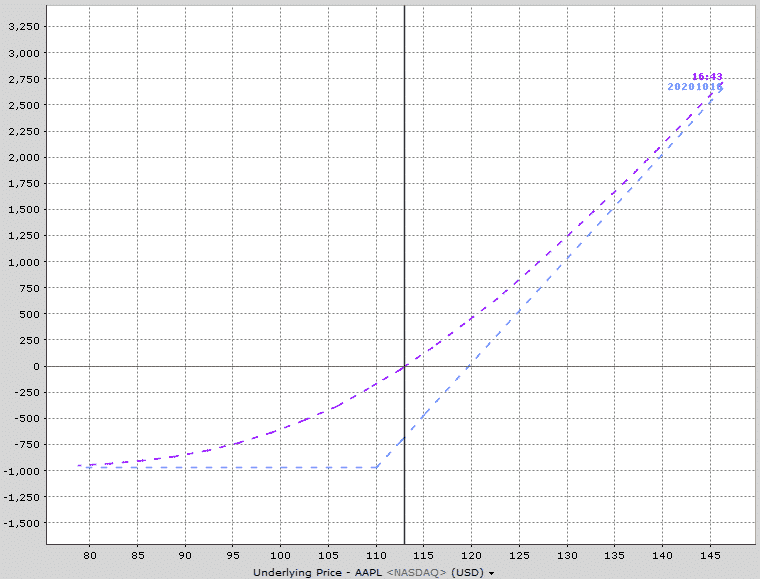

Here’s how the payoff diagram is estimated to look at one week before expiration.

See how the purple line is now much closer to the expiration payoff line? Most brokers will be able to provide this sort of graphical information for you (I like to use Option Net Explorer because they can show multiple interim date lines).

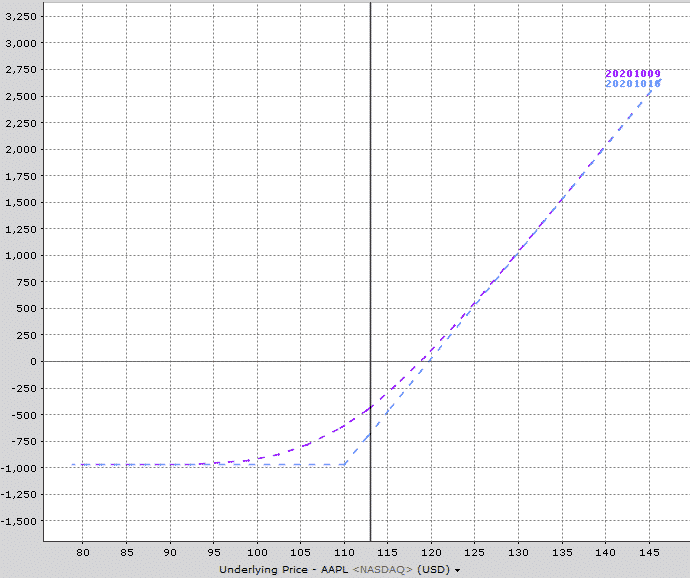

Looking at the payoff graph below, notice that there are three interim lines – T+0, T+12, and T+24. This gives you a good appreciation of how the trade will progress over time after 12 days, as well as after 24 days.

How Changes In Volatility Impact The Payoff Graph

Changes in implied volatility will not have any impact on the payoff graph at expiration, but it will impact the interim dates. A long call strategy has positive vega, meaning that it will benefit from an increase in implied volatility after placing the trade.

This AAPL trade example has vega of +14, which means that for every 1% rise in implied volatility, the trade will make $14 with all other factors being equal. The opposite is true if implied volatility drops.

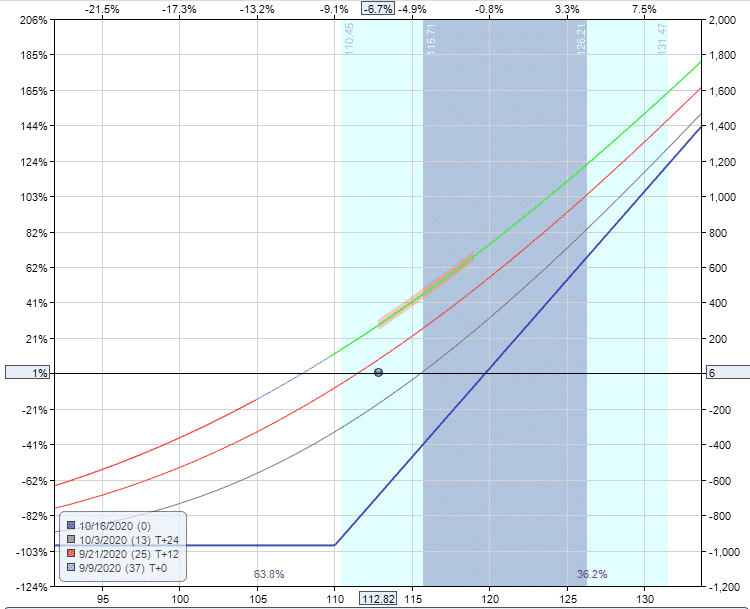

Let’s take a look at how a 20% rise in volatility impacts the interim lines. Notice that the expiration line hasn’t changed at all, but the interim lines have all moved higher.

Now, let’s see how the diagram changes, assuming a 20% drop in volatility. All the interim lines have dropped significantly.

With a long call strategy, delta is the main driver of the trade, but we can clearly see that big changes in implied volatility will also affect the trade.

Call Option Payoff Summary

You should now be intimately familiar with the call option payoff graph. Let’s summarize some key points.

- Long call options are a bullish strategy with limited risk and unlimited upside.

- The maximum loss is equal to the premium paid for the long call.

- The breakeven price is equal to the strike price plus the premium paid.

- The position will lose value as expiration approaches due to time decay.

- As a positive vega trade, increases in implied volatility will help the trade, but only at interim dates.

If you’re still having trouble or want to learn more about these concepts, you can check out this 12,000 word ...

more