Boeing Shares Have Been On Fire Too

A Pratt & Whitney engine on a Boeing 777 catches fire during United Airlines flight 328 in February (image via passenger video at CNN).*

Betting On Boeing Again

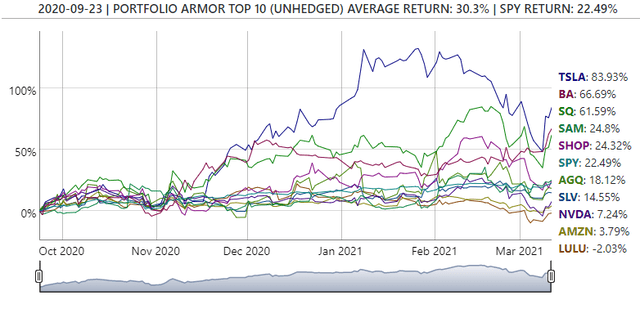

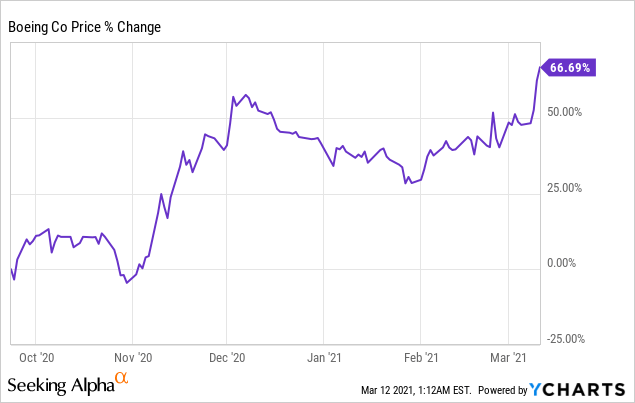

If you only pay attention to Boeing (BA) when an engine on one of its planes catches fire, or when another one suffers a similar fate the same day, or when a third Boeing plane makes an emergency landing a couple of weeks later, you may be surprised to hear this. Since our system selected Boeing as one of its top ten names last September, Boeing shares are up 66%.

On Thursday, Boeing hit our top ten names again. Our system's security selections can seem counterintuitive, but the proof is in the performance. Boeing is our second-best performing name so far from our September 23rd top names cohort, just after Tesla (TSLA).

Screen capture via Portfolio Armor.

Selecting Boeing as a top pick in September seemed counterintuitive too.

Betting On "Clowns And Monkeys"

When we wrote about Boeing in January of 2020, we quoted a Boeing employee who described the 737 MAX as a plane "designed by clowns who in turn are supervised by monkeys". So when our system selected Boeing as one of its top ten names in September of 2020, we titled our post, "Betting On Clowns And Monkeys".

That's what made the Boeing selection seem counterintuitive before mishaps this month and last, and before the Boeing crash in Indonesia in January: the sense that this was a company in decline. Indeed, if you were selecting stocks that you had to hold onto for decades, you probably wouldn't buy Boeing. We take a different approach though. We look for names that have a shot of doing well over the next six months and are relatively inexpensive to hedge in case they don't.

Stocks For The Next Six Months

Wharton professor Jeremy Siegel wrote a famous book a few decades ago called "Stocks For The Long Run". If we wrote a book on stock selection, we'd call it "stocks for the next six months". Our view is it's easier to estimate what's going to happen over the next six months than what's going to be a good stock in a decade or two. To do that, we look at a few different metrics:

- How the stock (or ETF or ETN) does over the average 6-month period over the long term.

- How it did over the most recent six months.

- What option market participants are betting it will do over the next six months.

When Boeing scored highly on our gauges of options market sentiment in September, at first we wondered why. Then we came up with a couple of theories:

- Lack of competition. Airlines looking to buy jumbo jets are faced with a duopoly: Boeing and Airbus. The occasional 737 MAX falling out of the sky is fatal for its passengers and crew, but not for Boeing.

- Hope for a return to normal after the election. Some observers have speculated that the continued COVID-19 lockdowns have been driven in part by politics: to make voters miserable so they turn against the incumbent. If that's true, then there will be less reason to maintain the lockdowns after the election. And a decline in lockdowns may release pent-up demand for travel which could spur airlines to order more planes.

If you listened to President Biden's speech Thursday night, it didn't sound like he was describing a return to normal anytime soon. Nevertheless, our theory for a pent-up demand for travel spurring airlines to order more planes has come to pass.

In Case We're Wrong About Boeing This Time

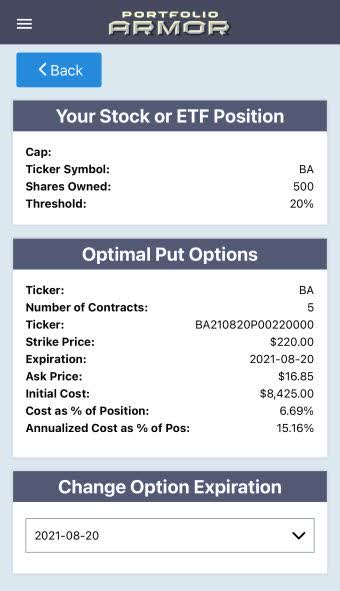

In case we're wrong about Boeing over the next six months, like all of our top names, it can be cost-effectively hedged. For example, this was the optimal put hedge to protect against a greater-than-20% drop in Boeing between now and late August (the closest options expiration to six months out).

Screen capture via the PA iPhone app.

The cost of that hedge was 6.69% of position value (calculated conservatively, using the ask price of the puts; in practice, you can often buy and sell options within the bid-ask spread). We consider that a cost-effective hedge for two reasons. First, Boeing has a reasonable shot of gaining another 20% or 30% over that time frame. If that happens, you'd still have a healthy double-digit return, net of hedging cost. And second, if Boeing shares plummet instead, your maximum loss of 20% includes that hedging cost; i.e., you'll only be down a maximum of 13.31% not including the hedging cost.

In Case You Don't Want To Pay To Hedge

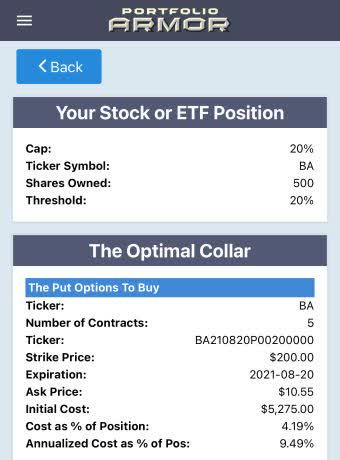

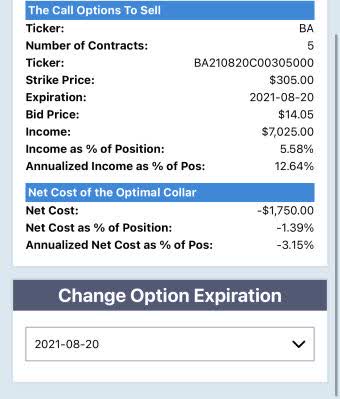

That said, if you don't want to pay any hedging cost to protect your Boeing position, you can hedge with an optimal collar instead. As of Thursday's close, this was the optimal collar to hedge against the same >20% drop over the same time frame, while capping your possible upside at 20%.

Note that the strike of the put leg in this collar is different from the strike in the previous hedge - the algorithm adjusts both strikes to find the lowest net cost while protecting you against the decline threshold you entered. In this case, that net cost is negative, meaning you would have collected a net credit of $1,750, or 1.39% of position value when opening this collar. That's assuming, conservatively (again), that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

*As everyone who's read Michael Crichton's novel "Airframe" knows, Boeing doesn't make engines. Nevertheless, investigations are ongoing to determine why these engines failed on Boeing airframes.