Big Drop In The Bitcoin Stock We Bragged About

Microstrategy meme via CryptoCrunchApp.

Macro Drop From MicroStrategy

We bragged about picking MicroStrategy (MSTR) in our last post (Silver: The Family Circus Of Investments). Then it dropped 23% on Wednesday.

Here, we recap what happened, update our take on it, and show how its drop impacted our hedged investors.

MicroStrategy, Riot Blockchain, And Tesla

MicroStrategy and Riot Blockchain (RIOT), another recent top name of ours, both spiked on Monday. We explained why in our last post:

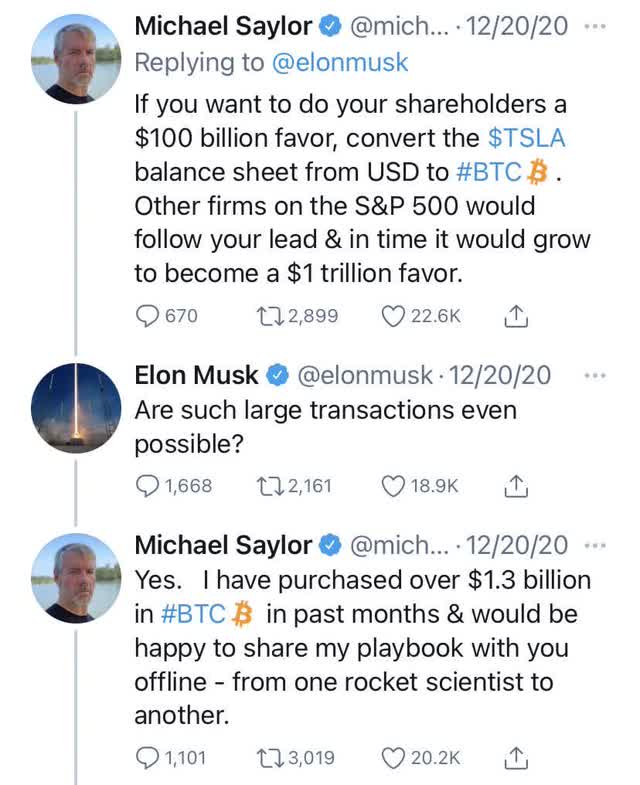

Like MicroStrategy, it was boosted by the actions of another recent top name of ours, Tesla (TSLA). And Tesla's actions were apparently inspired by the CEO of MicroStrategy, Michael Saylor.

We love synergy.

The action of Tesla, of course, was adding bitcoin to its balance sheet.

Gains Continued On Tuesday

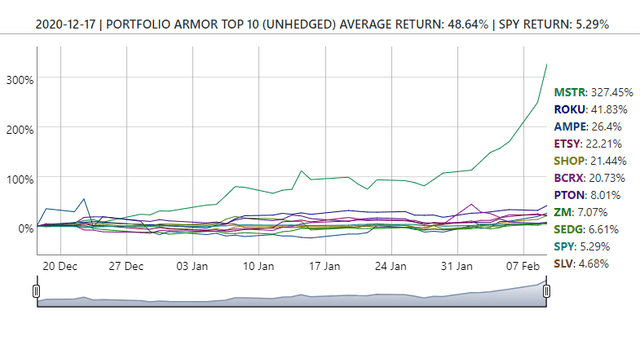

That spike continued Tuesday, fueling more gains for MSTR and RIOT. As of Tuesday's close, MSTR was up more than 327% from when it first appeared on our top ten names on December 17th.

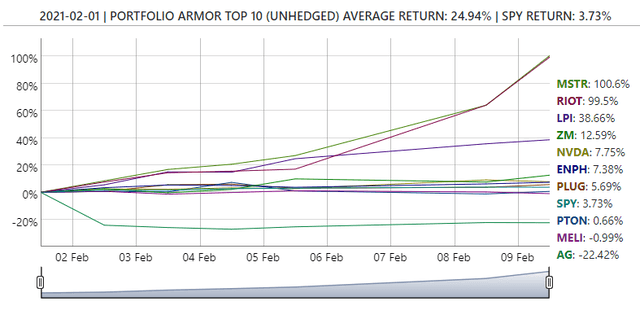

As a reminder, we update our top ten names each trading day, based on our system's analysis of total returns and options market sentiment for every underlying security with options traded on it in the U.S. MSTR and RIOT were both top ten names on February 1st. Both had about doubled by Tuesday's close.

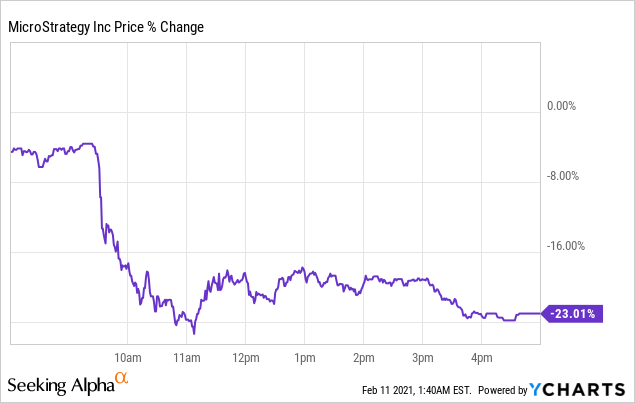

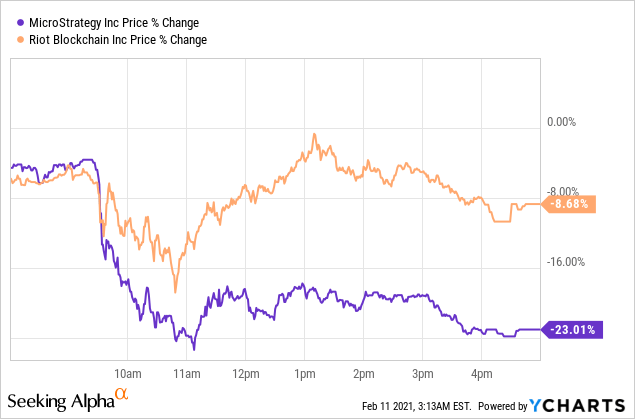

Wednesday's Drop

Then came Wednesday's drop, which was much worse for MSTR.

Interestingly, our system was much more bullish on MSTR than RIOT after Wednesday's drop. MSTR was our #1 name, and RIOT was #53. That was due to much more positive options market sentiment on MSTR.

MicroStrategy And Hedged Investors

The fear of stocks like high-flying stocks like MicroStrategy tanking keeps some investors away from them. Our approach to investing in the face of that fear is to buy likely winners and hedge away the fear. You indicate the maximum decline you're willing to risk over the next six months, and we create a hedged portfolio designed to maximize your returns while strictly limiting your risk. You can indicate you're willing to risk a decline of as little as 2%, and our system will create a portfolio to maximize your returns while hedged against a >2% decline.

That sort of portfolio wouldn't include a stock like MSTR, because it's not possible to hedge it against a decline that small. So let's consider an aggressive portfolio that would have included it.

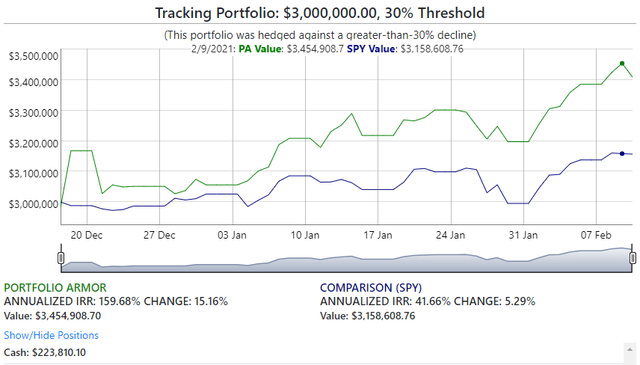

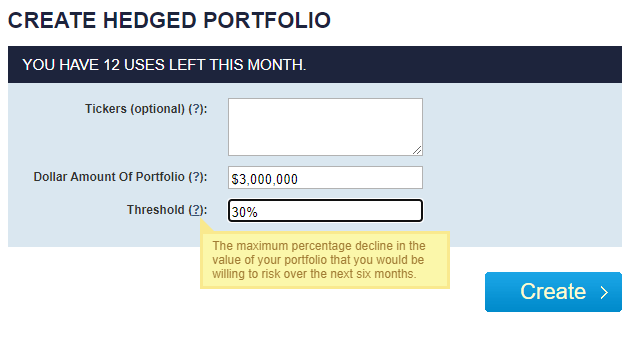

Here's an example, followed by an explanation. Let's say you had a few million dollars to put to work back on December 17th (the first date MSTR hit our top ten), and you were willing to tolerate a drop of 30% over six months, but not one larger than that. Here's what you could have inputted on our site then:

This and subsequent screen captures via Portfolio Armor.

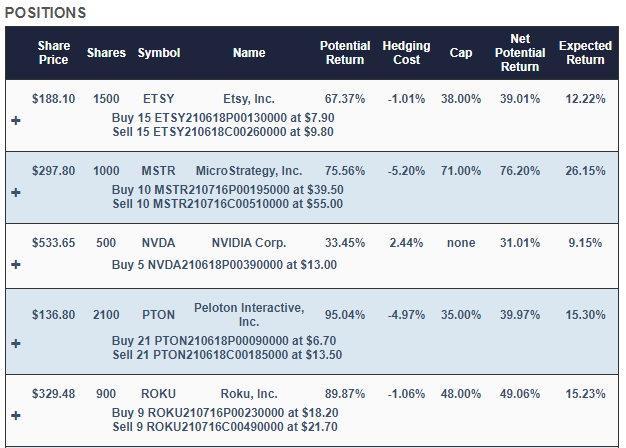

This is the portfolio it would have presented to you.

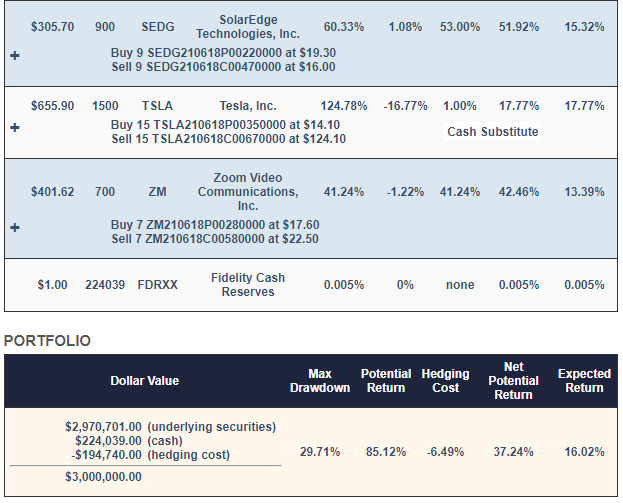

With this, your maximum drawdown over the next six months - that is, if every underlying security went to zero - would be a decline of 29.71%. Your best-case scenario would be a gain of about 37%, and your expected return (a more likely scenario) would be a gain of about 16%.

Why These Stocks?

Our system selected Etsy (ETSY), MicroStrategy, Nvidia (NVDA), Peloton (PTON), Roku (ROKU), SolarEdge (SEDG), and Zoom (ZM) because they were among our top names - the ones that had the highest potential returns, net of hedging costs. It started with roughly equal dollar amounts of each, and then rounded them down to round lots, to reduce hedging costs. It swept up most of the leftover cash from the rounding-down process into a tightly hedged Tesla position, to further reduce hedging cost.

Why These Hedges?

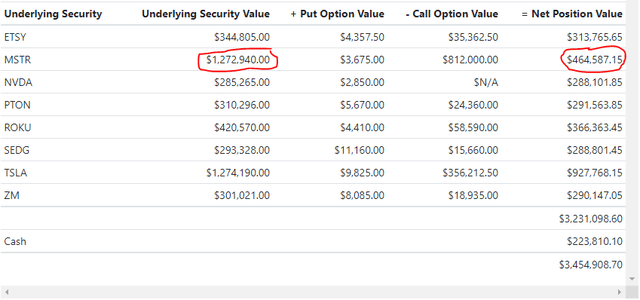

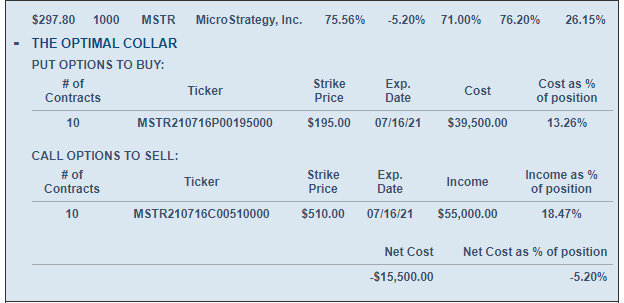

On our website, if you click the plus signs in the portfolio above, the positions expand to give you a better look at the hedges. For example, this is what the MSTR position looked like expanded.

MSTR was hedged with an optimal, or least expensive, collar. Some of the other positions are hedged with optimal puts. Our system estimates returns both ways to determine which type of hedge is best. We elaborated on that process in a recent post: When To Hedge With Puts Versus Collars.

How MSTR's Drop Impacted Hedged Investors

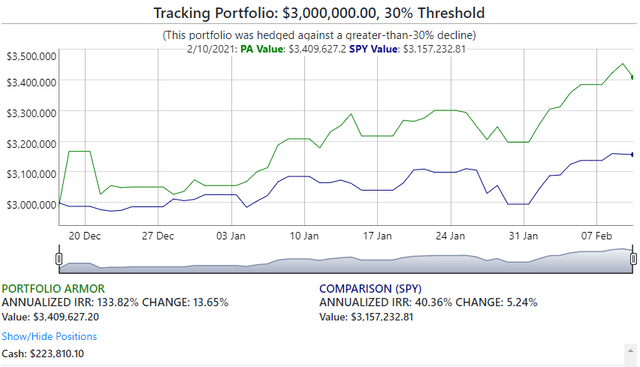

This was how the hedged portfolio above had performed as of Tuesday's close.

You were up 15.16% in this portfolio, net of hedging and trading costs, as of Tuesday's close. We've circled the underlying position value and net position value for MSTR as of Tuesday's close above.

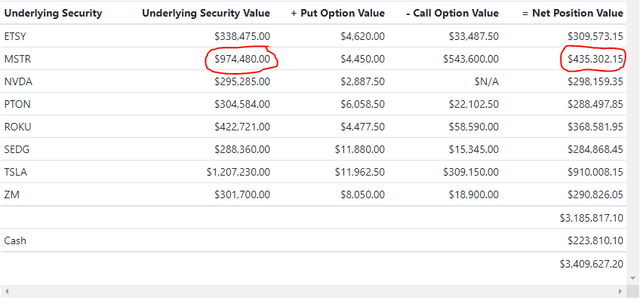

And here's where you were after Wednesday's close.

Although MSTR was down 23% on the day, the net value of the hedged MSTR position was only down 6.3%. The portfolio as a whole had dropped 1.31%, and you were still up 13.65% since mid-December, while SPY was up 5.24% over the same period.

Note that, although this was a $3 million portfolio, our system can create portfolios as small as $30,000. A $30,000 portfolio wouldn't have included MSTR though, because its share price was too high to fit a round lot of it and another name.