Ontrak: Superstar, At Least Revenue-Wise

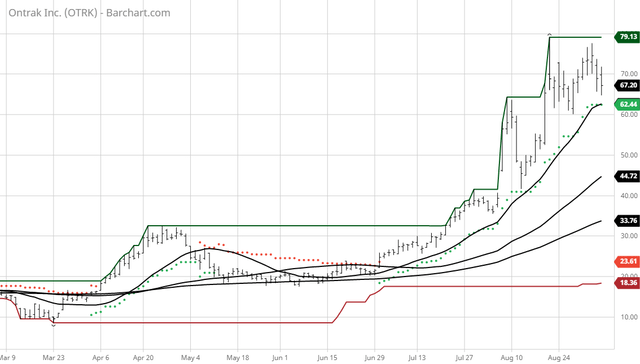

The Barchart Chart of the Day belongs to the medical outpatient and home care company Ontrak (Nasdaq:OTRK). I found the stock by using Value Line to screen for companies their analysts predict will have at least a 25% annual Revenue growth rate for the next 5 years. I then used Barchart to sort that list by the highest technical buy signals and used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 7/1 the stock gained 163.74%.

Ontrak, Inc. operates as an artificial intelligence powered, virtualized outpatient healthcare treatment company that provides in-person or telehealth intervention services to health plans and other third-party payors. Its Ontrak PRE (Predict-Recommend-Engage) platform predicts people whose chronic disease will improve with behavior change, recommends care pathways that people are willing to follow, and engages people who aren't getting the care they need. The company's technology-enabled, OnTrak, program is designed to treat health plan members with unaddressed behavioral health conditions that cause or exacerbate chronic medical diseases, such as diabetes, hypertension, coronary artery disease, COPD, and congestive heart failure. The OnTrak integrates evidence-based psychosocial and medical interventions delivered in-person or via telehealth along with care coaching and in-market community care coordinators who address the social and environmental determinants of health. The company was formerly known as Catasys, Inc., with OTC ticker CATS, and changed its name to Ontrak, Inc. in July 2020. The company was founded in 2003 and is headquartered in Santa Monica, California.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 208.20+ Weighted Alpha

- 391.23% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 5 new highs and up 86.67% in the last month

- Relative Strength Index 61.73%

- Technical support level at 64.06

- Recently traded at 67.20 with a 50 day moving average of 44.72

Fundamental factors:

- Market Cap $1.16 billion

- Revenue expected to grow 152.30% this year and another 92.90% next year

- Earnings estimated to increase 14.10% this year, an additional 49.30% next year and continue to compound at an annual rate of 30.00% for the next 5 years

- Wall Street analysts issued 2 strong buy and 3 buy recommendations on the stock

Disclosure: None.