Omnicell - Chart Of The Day

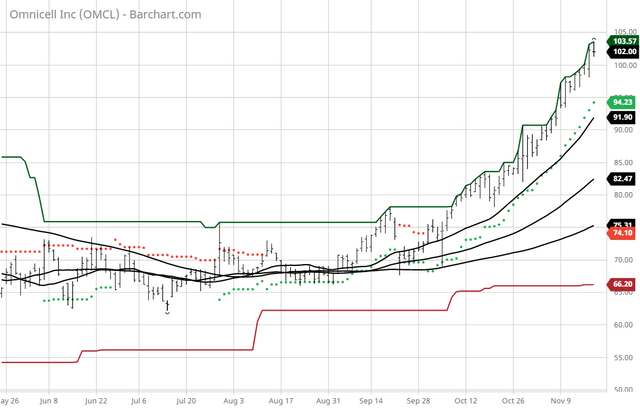

The Barchart Chart of the Day belongs to the medical information company Omnicell (Nasdaq: OMCL). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 9/30 the stock gained 36.62%.

Omnicell, Inc., together with its subsidiaries, provides medication management automation solutions and adherence tools for healthcare systems and pharmacies worldwide. The company offers central pharmacy automation solutions, including automated storage and retrieval systems, such as XR2 Automated Central Pharmacy System, a building block of autonomous pharmacy vision; IV compounding robots and workflow management systems; inventory management software; and controlled substance management systems. It also provides a point of care automation solutions to improve clinician workflows in patient care areas of the healthcare system; XT Series automated dispensing systems for medications and supplies used in nursing units and other clinical areas of the hospital, as well as specialized automated dispensing systems for the operating room; Omnicell Interface Software that offers interface and integration between its medication-use products or supply products, and a healthcare facility's in-house information management systems; and robotic dispensing systems used in hospitals and retail pharmacies for handling the stocking and retrieval of boxed medications.

In addition, the company provides single dose automation solutions to fill and label for incoming prescriptions; medication blister card packaging and packaging supplies to enhance medication adherence in non-acute care settings; automated systems to help pharmacies in filling its multimedia adherence packaging based on individual patient medication orders; and semi-automated filling equipment for the long-term care institutional pharmacy. Further, it offers Omnicell Patient Engagement, a web-based nexus of solutions; and patient communication tools, such as interactive voice response, outbound communications, and mobile app. The company was formerly known as Omnicell Technologies, Inc. and changed its name to Omnicell, Inc. in 2001. Omnicell, Inc. was founded in 1992 and is headquartered in Mountain View, California.

Barchart technical indicators:

- 100% technical buy signal

- 58.30+ Weighted Alpha

- 41.96% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 23.68% in the last month

- Relative Strength Index 82.23%

- Technical support level at 101.02

- Recently traded at 102.00 with a 50 day moving average of 82.47

Fundamental factors:

- Market Cap $4.33 billion

- P/E 62.20

- Revenue expected to grow 16.70% next year

- Earnings estimated to increase 31.50% next year and continue to compound at an annual rate of 15.00% for the next 5 years

- Wall Street analysts issued 2 strong buy, 3 buy and 3 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 169 to 9 that the stock will beat the market

- 2,460 investors are monitoring the stock on Seeking Alpha

Disclosure: None.