Oil Shorts On Notice After Russia, Saudis Agree To "Cooperate Closely" To Keep Energy Market Stable

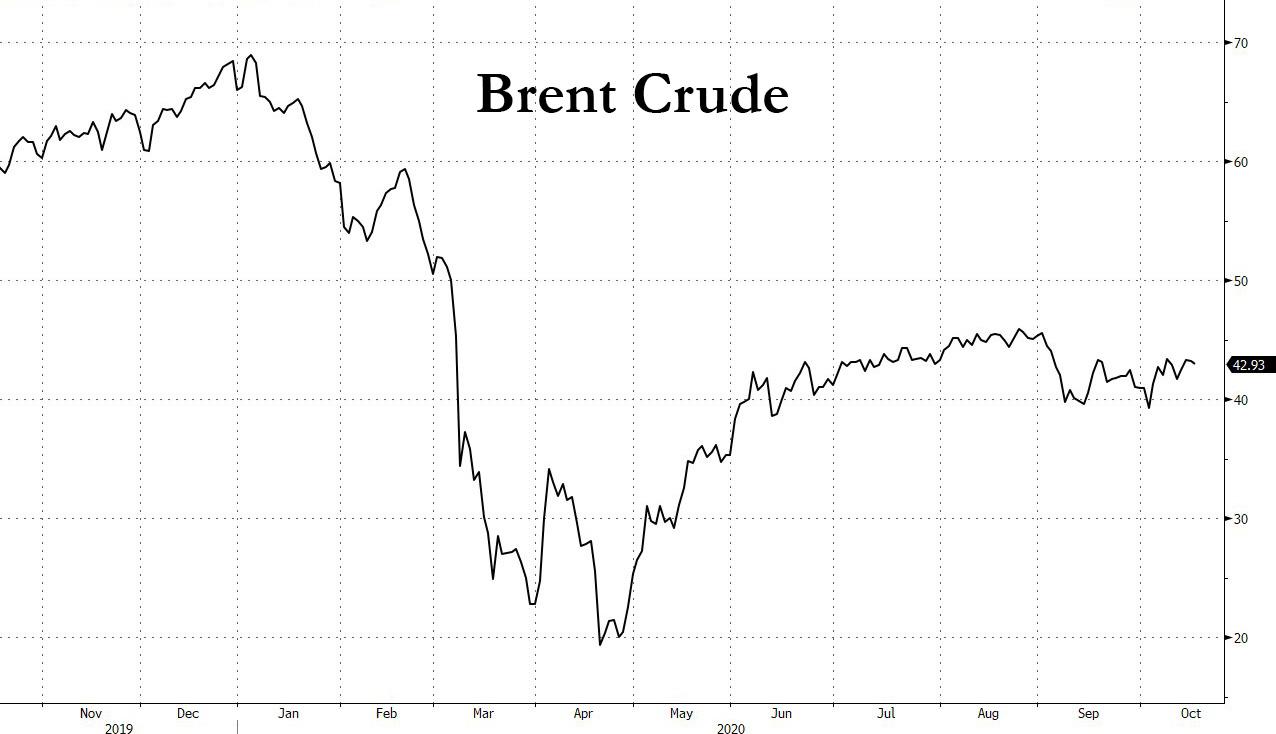

With the price of Brent crude trading in a narrow - and low - range since the COVID-19 crisis, and now that we live in a work from home world where demand for gasoline, oil, and energy is far less than before March, OPEC countries have been hurting greatly.

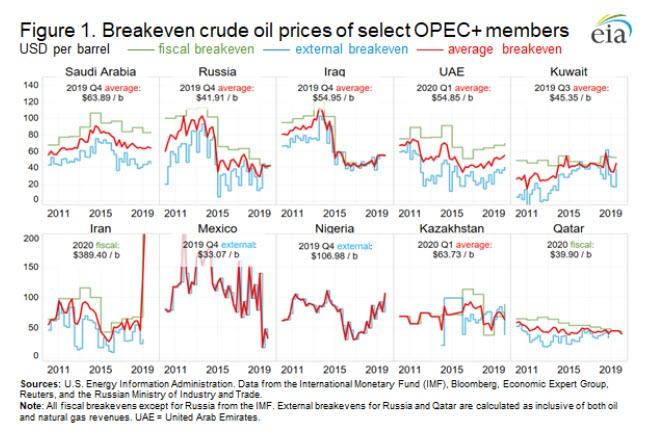

As the following summary chart from the EIA shows, Brent in the low $40's is well below the fiscal breakeven prices for most members of the oil-producing cartel (with the exception of Russian, Qatar, and Mexico).

Which is why we have been surprised at how patiently the world's biggest oil exporters have handled themselves since the pandemic breakout, even as their net capital position has been slowly draining month after month.

That may be about to change, however, with the two largest OPEC producers - Russia and Saudi Arabia - announcing on Saturday that they are "ready to cooperate closely to keep the global energy market stable," as the Kremlin said in an emailed statement after President Vladimir Putin and Saudi Arabia’s Crown Prince Mohammed Bin Salman held their second phone call this week.

According to Bloomberg, the two leaders spoke "extensively" about the OPEC+ cooperation, "continuing an Oct. 13 conversation during which they reviewed efforts to balance supply and demand in the oil market and boost the global economy."

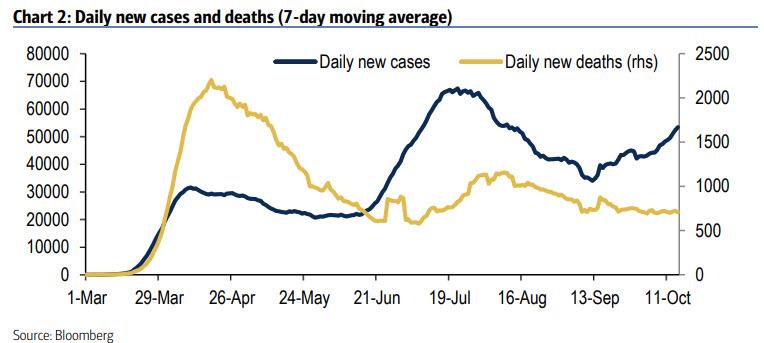

The calls came before a small group of the world’s main oil exporters are scheduled to review compliance with production cuts on October 19, and ahead of the next OPEC+ summit on November 30 - December 1. This is when the cartel is expected the reassess and possibly scrap its previous plan of increasing output by 2mmb/d in January, as the demand destruction from the second wave of COVID-19 cases in the US persists.

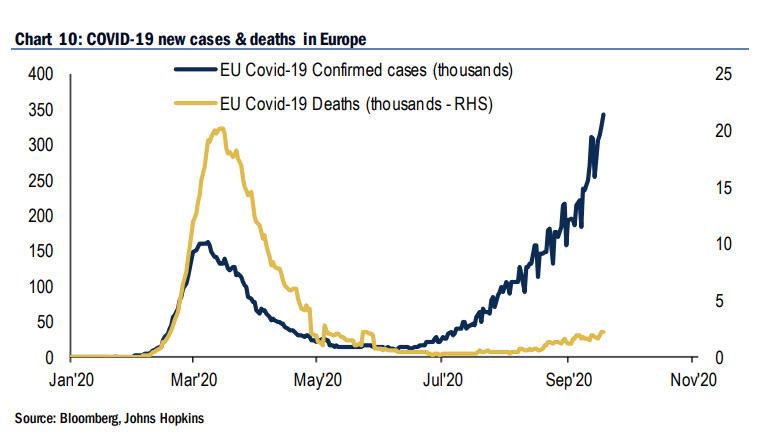

This is apparent in Europe, as well.

For now, the status quo is set to remain: earlier this week, Russian Energy Minister Alexander Novak and his counterpart from the United Arab Emirates, Suhail Al Mazrouei, said that the group plans to proceed with the supply boost as scheduled. We expect this will not only change, but likely reverse, with even more coordinated production cuts in the coming weeks.

That's because OPEC’s joint technical committee on Friday warned that, under a negative scenario, global oil stockpiles could increase by an average 200,000 barrels a day next year. The scenario, which is not the base case for the group, could materialize if Libya manages to revive supply and the pandemic hits demand harder than expected, according to a document seen by Bloomberg.

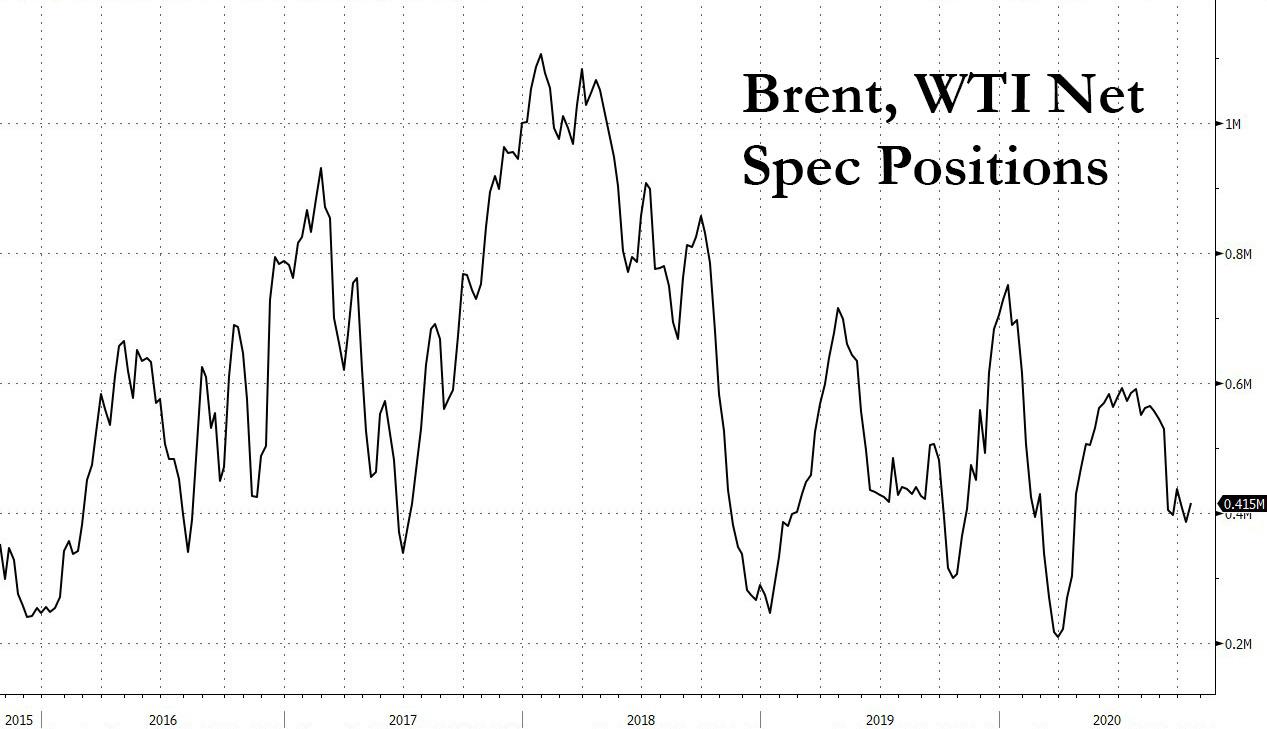

And while the market balance continues to be a fairly strong headwind to OPEC's efforts to push the price of oil higher, one short-term option OPEC has to boost the price of oil is to force a speculative squeeze: as shown in the chart below, net Brent and WTI specs are at the lowest level since WTI briefly went negative on April 20, and more than 50% below the recent highs hit in early 2018.

Of course, a more viable option to pump prices is to have one or more OPEC exporters simply stop producing as a result of their economic implosion: something we have already seen in Venezuela, and which will spread to other oil-producing countries if oil is unable to lift from its current fiscally-unsustainable levels.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more