Off The Charts: Extreme Moves In ETFs

Today begins a semi-regular column that focuses on a handful of ETFs that have recently posted extreme changes. The playing field starts with nearly 100 equity funds (US and foreign). For a complete list, see a recent edition of The ETF Portfolio Strategist. The goal: highlighting some of the gains and losses at the outer edge of market action of late, where the odds may be slightly higher for developing quasi-reliable near-term expectations, perhaps for use in adding context to strategic-oriented return estimates. In any case, all the standard caveats still apply and so proceed accordingly.

Before we dive in, note that the funds below are ranked at or near the extremes of momentum (negative and positive) via a methodology based on the average of ten metrics (moving averages and trailing-performances, as defined in The ETF Portfolio Strategist, page 14). Note, too, that today’s roundup is limited to equities, targeting US and foreign markets in broad and narrow terms. In future updates we’ll look at other asset classes.

Let’s start with a US equity fund that stands out for relatively strong performance these days: Invesco S&P 500 Equal Weight ETF (RSP). Although American shares generally are riding high this year, a portfolio of equally weighting companies in the S&P 500 has outperformed the standard cap-weighted mix by a modest degree over the past three months with an 11.0% return vs. 10.5% for the conventionally designed SPDR S&P 500 (SPY), based on trading through Wednesday (Nov. 27).

Another red-hot US equity ETF: Vanguard High Dividend Yield (VYM). Favoring American shares with the highest yields, this ETF rose to yet another record close on Wednesday (based on the fund’s 13-year history).

Looking overseas, the iShares MSCI Ireland (EIRL) also stands out lately for upside action. This ETF has turned bullish in the extreme, closing up sharply on Wednesday (Nov. 27) by rebounding to a high last seen more than a year ago.

Despite a bull market in many corners of equities, rest assured that there are still losers to be found. On the short list of suffering you’ll find SPDR S&P Oil & Gas Exploration & Production (XOP). This battered fund closed on Wednesday near its all-time low (based on a trading history that starts in 2006). In recent days, XOP has been testing anew what appears to be a support zone of roughly $20. A decisive downside break below that level would signal an even darker outlook for the fund.

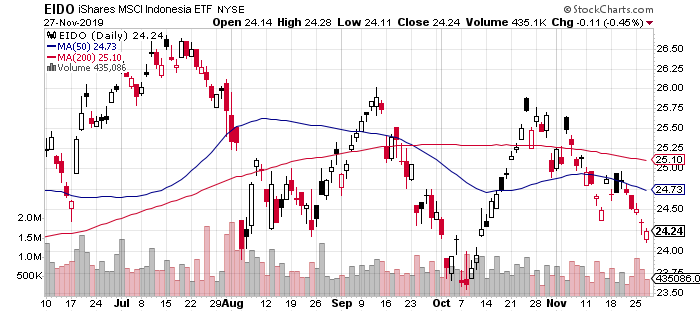

Another equity ETF showing a hefty degree of downside bias these days: iShares MSCI Indonesia (EIDO). After a strong run higher in 2016-2017, this country fund has been trading in a range for much of the past 12 months, although the latest downturn suggests that the bearish momentum is building.

Another foreign equity fund that’s showing a renewed downside skew lately: iShares Latin America 40 (ILF). The ETF has been basically treading water for much of the past two years, but the latest selloff may presage a fresh run of downside trending.

Disclosure: None.