Observations On The Coffee Prices

Who does not like the freshly brewed scent of a coffee in the morning? And who does not think about the prices of the lovely coffee that we drink? I’m not sure that you actually think about the prices after you bought it but we do.

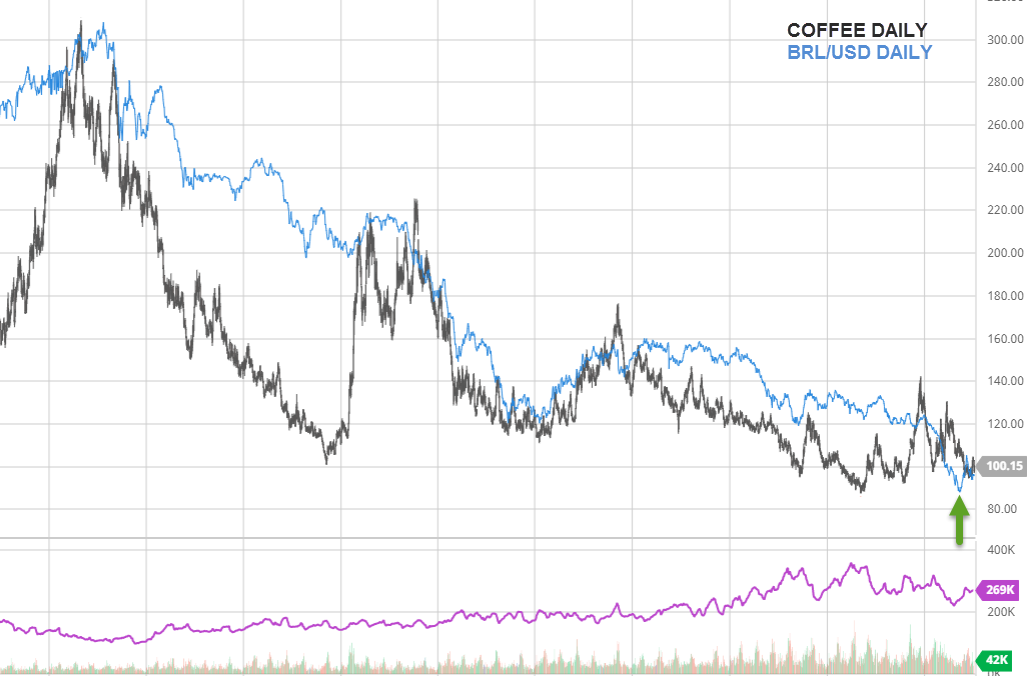

Well, there is much to learn about coffee prices. One thing to know is that the biggest exporter of Coffee is Brazil; therefore the coffee prices have been affected by the fluctuations of the Brazilian Real and the US Dollar in which coffee is traded internationally. A weakness in the Real has a positive effect on higher Brazilian Coffee production and export followed by lower coffee prices in the US dollar. That’s because a weaker real increases the producer’s prices relative to local costs. As a result, a strong Dollar raises the prices in euros which is actually a top importer of coffee but lowers the world coffee prices in US Dollars, according to the International Coffee Organization.

Here a chart which compares the price of the Coffee Futures contract with the rate of the BRL/USD pair in order to have the visual aid:

(Click on image to enlarge)

Looking at this chart we can observe a lately strength on the BRL side of this foreign exchange rate. With different other factors, the price of the coffee got into a balanced behavior and started to trend.

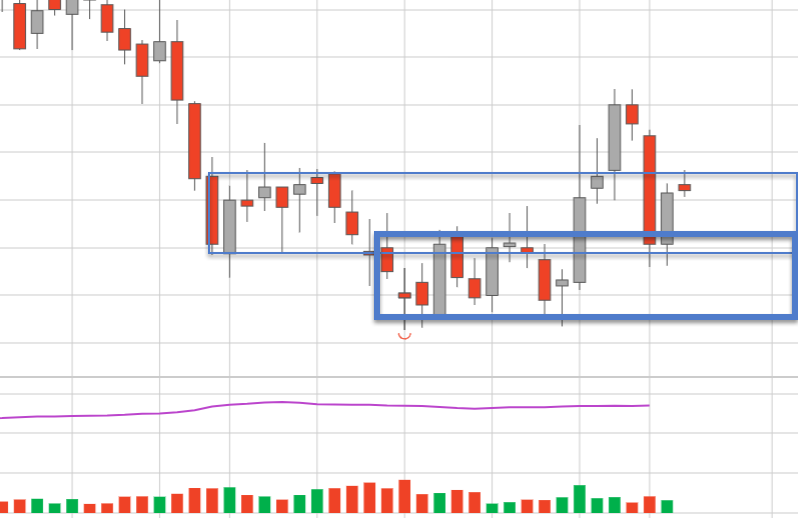

To understand the current price structure from a technical point of view we should take a deeper look into the daily periodicity of the Coffee Futures contract of September called KCU20. We can identify to balance area which is kind of accepted as levels of support and resistance. Currently, the market testing a prior bracket high. Additionally, we can observe an inside day from yesterday’s close. The result of this could be an inside day failure or an inside daybreak pattern on the next day. We could expect an inside day failure pattern for which we need to see some absorption patterns around yesterday’s high.

(Click on image to enlarge)

Long positions could be build-up around the swing low in our opinion; therefore waiting for the market to develop the mentioned patterns is important. An expected scenario would be a bearish behavior with an inside day failure followed by a rotation lower towards the swing low to plan a long position. The second scenario would a surge higher testing the swing highs to form a potential new balance area.

With a quick glance at the lower intra-day perspective we can observe the first signs of absorption around yesterday’s highs. Quite some bullish volume in the first minutes of the open with a larger bearish wick at the candle. Let’s see how this will play out in the next couple of hours.

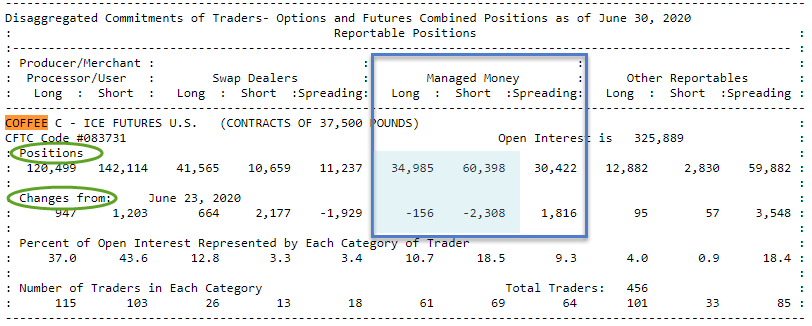

Of course, this is only a purely technical point of view. Various fundamental aspects such as the current impact of the world situation should have an effect on the development of the price, in an instance. 60% of Brazil’s 2020 crop has been sold already and strong internet sales of coffee surged in the past months, according to recent articles from Bloomberg. Also, to be noted is the drop in exports which raises concerns about the demand. It is reported that money managers turning bearish — looking at the current COT report we can observe larger amounts of contracts on the short side but we can also see a decrease of hold positions in the past weeks.

(Click on image to enlarge)