NXT-ID’s Crypto Play Awaits Traction Amidst Delisting Warning

TM Editors' Note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Medical technology company NXT-ID’s (NXTD) diversification into the cryptocurrency sector is underway. The move into the volatile industry, announced in 2017, marked a decision that appears to leverage existing company assets that overlap with the payments-focused elements of the cryptocurrency market. Now that initial orders of their retail-focused product called Flip, which launched under NXT-ID’s subsidiary Fit Pay, have reportedly been fulfilled earlier this year, it is yet to be seen the level of traction the product gets in stores that support its use.

Bearing the shape of physical coin, a company blog post described Flip as “a contactless payment device that enables Bitcoin (BITCOMP) holders to exchange their cryptocurrency into U.S. dollars and use that value to make contactless purchases at millions of retail locations.”

The Melbourne, FL-based NXT-ID publicly shared last September it would be spinning off the portion of the company focused on payments and authentication technology, most notably Fit Pay, into a new public entity called PartX. Though some delays have pushed back the spin-off being seen to fruition, the SEC is reportedly reviewing the Form 10 Registration Statement and should matters go as expected, NXT-ID shareholders will receive PartX equity following the transaction. Amongst other benefits, the move allows NXT-ID’s other involvements, primarily its health business LogicMark, to not be financially commingled with what truly appears to be a wholly distinct company in Fit Pay.

While both US customers and merchants, the only targeted audience so far for the product, have been slow to adopt mobile payments and digital wallets in the face the reliable physical debit and credit card system, NXT-ID is clearly making a bet on the future of how people transact. Further, there is little evidence to support that US consumers who own bitcoin want to spend it, as many view it as a speculative investment as opposed to digital cash, and “selling” bitcoin into dollars, which happens when Flip users deposit bitcoin on to their devices, can trigger some tricky tax situations under current US law. Regardless, should either of these trends change, NXT-ID appears to be positioning itself for well to benefit from the shift.

Given NXT-ID’s familiarity with contactless technology from supporting Garmin, Swatch, and even some initiatives from major credit card companies, as well as this being an opportunity to break into the growing, forward-looking cryptocurrency industry, the move appears strategic and rooted in future investment. The product is in the IoT (“Internet of Things”) category, which denotes everyday items that connect to applications and/or send data to “the cloud”, and leverages NFC (“Near Field Communication”) technology, comparable to the way that Apple Pay and Samsung Pay work.

Many remember bitcoin from its run up to nearly $20,000 in late 2017 before dropping shedding around 85% of its value to the low $3,000 range in 2018. The asset has continued to be an exciting one to follow in 2019, climbing well past $13,000 in June. The asset’s price is currently hovering between $9,000 and $10,000.

Given that the Flip product will allow users to convert bitcoin into USD, NXT-ID will likely be handling some share of bitcoin. While it’s not exactly clear how the bitcoin that customers convert to USD through Flip while be custodied, it’s plausible that the company will take on at least some proprietary cryptocurrency position because of this initiative. The volatility of bitcoin is something many companies, and even funds have continued to stay away from due to the perceived and real risks associated with getting involved with the cryptocurrency. Beyond the financial risk, there’s reputational risk on the table as well, as many still consider cryptocurrency disreputable and dangerous.

Given this, what is tempting NXT-ID to invest the bitcoin space? While the move into payments and authentication technology seems natural given the company’s past endeavors, it may make sense from a larger risk-return standpoint as well.

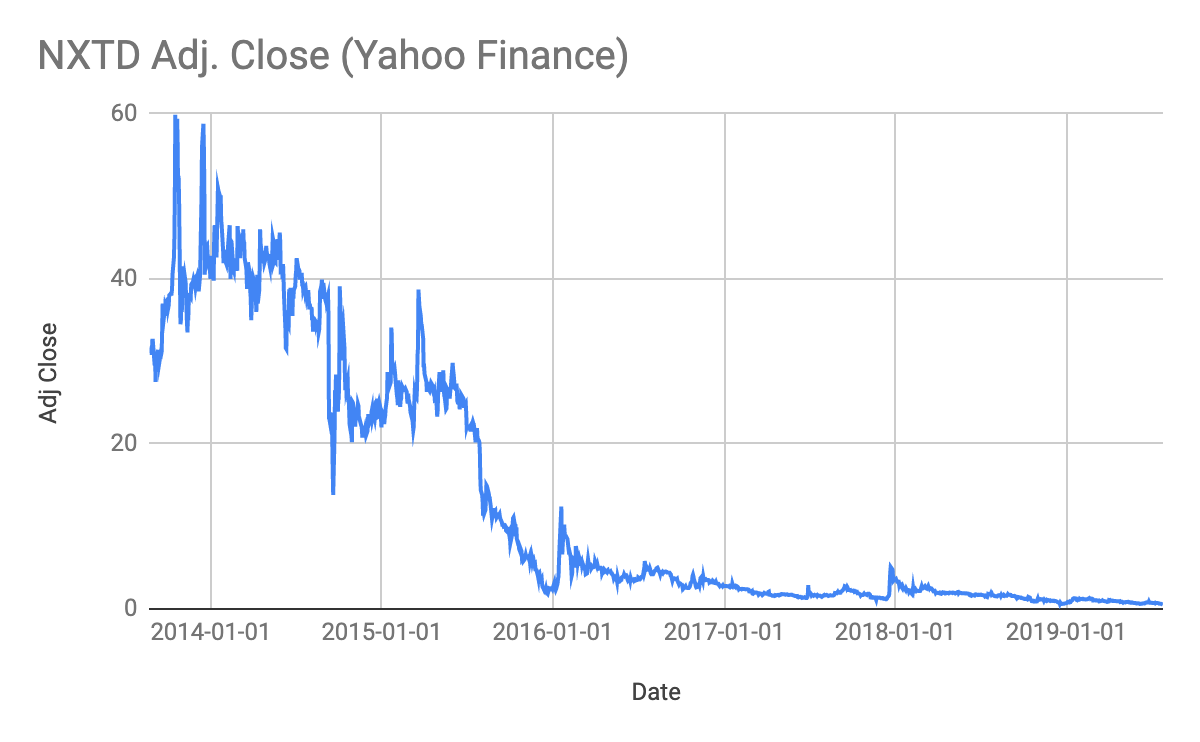

NXT-ID is buckling in the shadow of a 99% drawdown in stock price from its peak in late 2013, as the company has received merciless treatment from the public markets. Despite gaining 26% in Q1 of 2019, the stock has shed 42% since that point and is already down 32% in Q2 through the end of last week. The valuation trend has been negative on nearly every time frame in the recent past. The equity once trading near $60 dollars closed this past week at an all-time low of $0.5.

Despite trading above the $1 mark for some time earlier in the year, the stock has traded below it for more than 70 consecutive sessions, violating Nasdaq’s compliance policies, and warranting a delisting warning. The company has until later this year to get the stock price back above the dollar benchmark should it wish to stay on the exchange.

The argument can be made that the company, floundering in certain respects, needs to make a splash in order to survive in a meaningful way. While NXT-ID has been growing in some respects over the past few years, for example boosting its annual revenue from $7.74M in 2016 to $17.12M in 2018, having exposure to bitcoin could provide a much-needed lift to a company looking to stay relevant in the public markets. With that said, the volatile nature of bitcoin means the move doesn’t come without legitimate risks, both from financial and reputational standpoints, leaving NXT-ID in a position to greatly benefit from consumer adoption in cryptocurrency and mobile payment technology, while simultaneously opening up the door to a new host of challenges and risks.

Related article: Nxt-ID Gets A New Lease On Life

This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time and ...

more

I like your articles, where can I read more by you?

Seems so odd for a medical company to move into crypto. Seems like everyone is getting on #crypto or #blockchain these days.

Great article on $NXTD. Would like you to investigate the following from a journalistic point of view. I’ve emailed the SEC asking them if the Form 10 was effective and they responded, yes 60 days after they filed on April 29th. Gino said on the last webcast they’d announce the spinoff after the SEC made registration statement effective. That’s complete according to an SEC attorney. What’s the hold up?

Seems like everyone and their grandma is getting into #crytocurrency or #blockchain these days!

Excellent read.

You make an excellent point - I often wondered why anyone would actually use #bitcoins to buy items (except for criminals of course), when it is so volatile. It reminds me of Germany's currency after World War I when people never knew how much their money would by the next day. #Facebook's #Libra is a stale coin which makes far more sense to me. Will $NCTD's Flip Pay be compatible with that?