Nvidia Enters Intel Territory

When it was primarily known for making video game chips, Nvidia would have models dressed up as video game characters at its trade show booths. Here, one dresses up as some kind of fairy.

Nvidia Enters Intel Territory

Chipmaker Nvidia (NVDA) has come a long way. From vying for gamers' attention with models dressed as videogame characters eight years ago.

To vying for a piece of Intel's (INTC) data center business today.

Intel shares dive after Nvidia announces plans to make its first chip for servers and data centers https://t.co/DyneXDAzB0 pic.twitter.com/C1OwpFZpKb

— CNBC Now (@CNBCnow) April 12, 2021

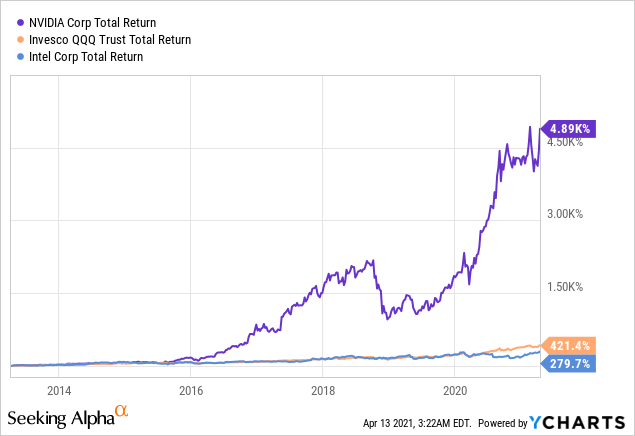

Over the past eight years, Nvidia shares are blown past those of Intel and the Nasdaq 100 ETF QQQ.

Data by YCharts

Why Didn't You Tell Us About This Before?

One of the comments we got on our previous post about Lovesac (LOVE), another company that's been on a tear, is why we didn't write about the company before its big gains. In the case of the furniture maker Lovesac, it hadn't come up on our screens. In the case of Nvidia, it's been on our screens since the beginning of 2016, and we've written about it numerous times since. Here, for example, is a screen capture from an article we wrote about Nvidia that year.

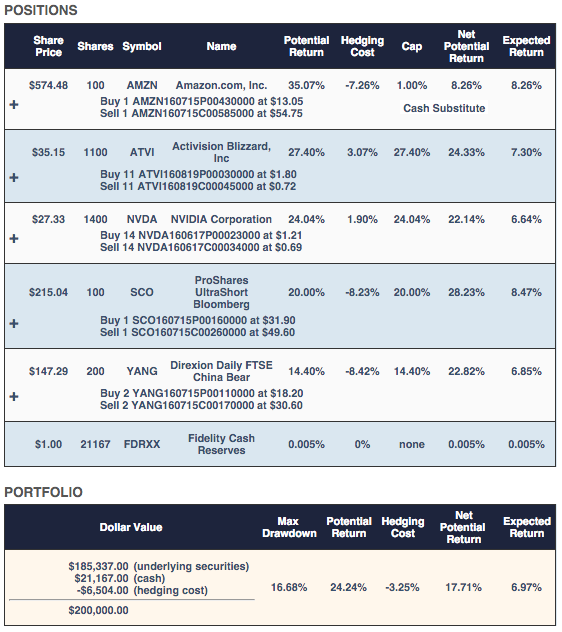

That article was prompted by an FT column highlighting the stock, but our system's gauges of options market sentiment had picked NVDA up when it was trading at a little over $27 per share in January of 2016. In a post then, we shared this hedged portfolio which included Nvidia.

Focusing On Where A Stock Can Go

A human reaction to hearing about a stock when it was trading at $27 per share and then seeing it trade at more than $500 per share is to avoid it, figuring you missed the run-up. An advantage of an algorithmic system such as ours is that it's not human. Its focus is on where the stock might be in six months. You tell it how much money you want to invest, and what's the largest drawdown you're willing to risk over the next six months, and it presents you with a portfolio designed to maximize your return while strictly limiting your risk per your specification.

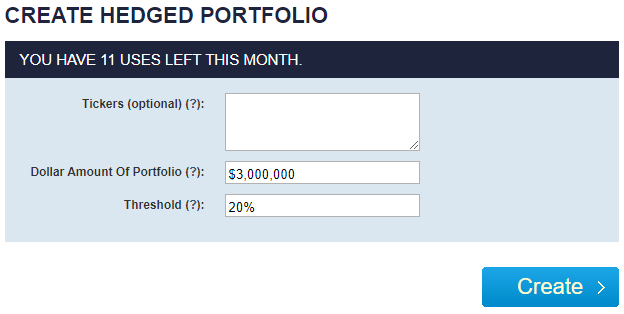

If you asked it to create a portfolio hedged against a >20% decline on Christmas Eve of last year,

This and subsequent screen captures are via Portfolio Armor.

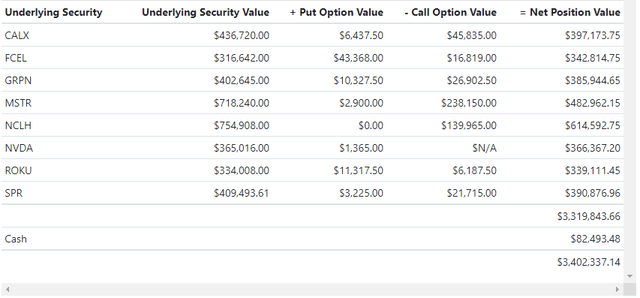

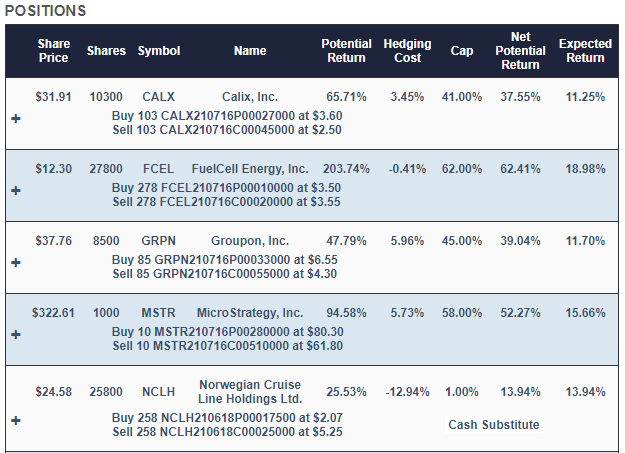

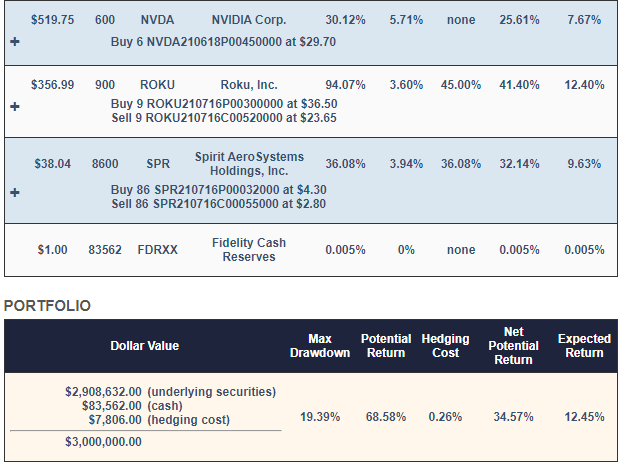

It would have presented you with this portfolio, which included Nvidia at $519.75 per share, along with Calix (CALX), FuelCell Energy (FCEL), Groupon (GRPN), MicroStrategy (MSTR), Roku (ROKU), and Spirit AeroSystems (SPR) as primary positions, based on its estimate of their potential returns over the next six months, net of hedging cost.

Our system started with roughly equal dollar amounts of each, and then rounded them down to round lots, to reduce hedging costs. It swept up most of the leftover cash from the rounding-down process into a tightly hedged Norwegian Cruise Lines (NCLH) position, to further reduce hedging cost. The expected return for this portfolio over the next six months was 12.45%, as you can see in the bottom right of the screen capture above.

Hedging Nvidia

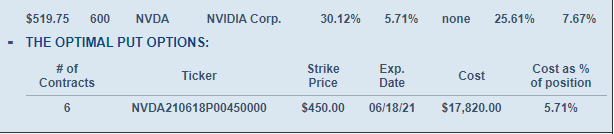

In that portfolio, each of the positions was hedged. The "+" signs on our site expand the hedges. Here's what the Nvidia hedge looked like expanded.

Nvidia was hedged with optimal put options, while the other names were hedged with optimal collars. Our system estimates returns both ways to determine which type of hedge is best. We elaborated on that process in a recent post: When To Hedge With Puts Versus Collars.

Performance Of That Portfolio So Far

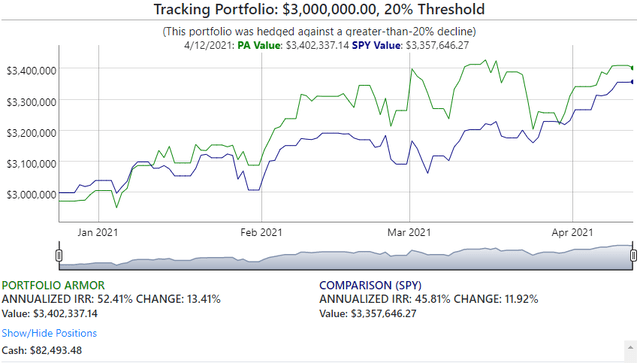

Here's how that portfolio has performed so far, as of Monday's close, net of hedging and trading costs.

That portfolio is up 13.41% so far, in the ballpark of its expected return of 12.45%, and outpacing SPY which is up 11.92% over the same time frame.

Our System's Take On Nvidia Now

Christmas Eve is the last time Nvidia ranked highly enough in our system to make it into one of our hedged portfolios. Our system is modestly bullish on Nvidia now, estimating a low-teens return for it over the next six months. The stock has hit our top names repeatedly over the last several years, so we wouldn't be surprised if it ends up in our top ten again later this year.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more