Nominal Income Targeting And Measurement Issues

Nominal GDP targeting has been advocated in a recent Joint Economic Committee report “Stable Monetary Policy to Connect More Americans to Work”.

The best anchor for monetary policy decisions is nominal income or nominal spending—the amount of money people receive or pay out, which more or less equal out economy-wide. Under an ideal monetary regime, spending should not be too scarce (characterized by low investment and employment), but nor should it be too plentiful (characterized by high and increasing inflation). While this balance may be easier to imagine than to achieve, this report argues that stabilizing general expectations about the level of nominal income or nominal spending in the economy best allows the private sector to value individual goods and services in the context of that anchored expectation, and build long-term contracts with a reasonable degree of certainty. This target could also be understood as steady growth in the money supply, adjusted for the private sector’s ability to circulate that money supply faster or slower.

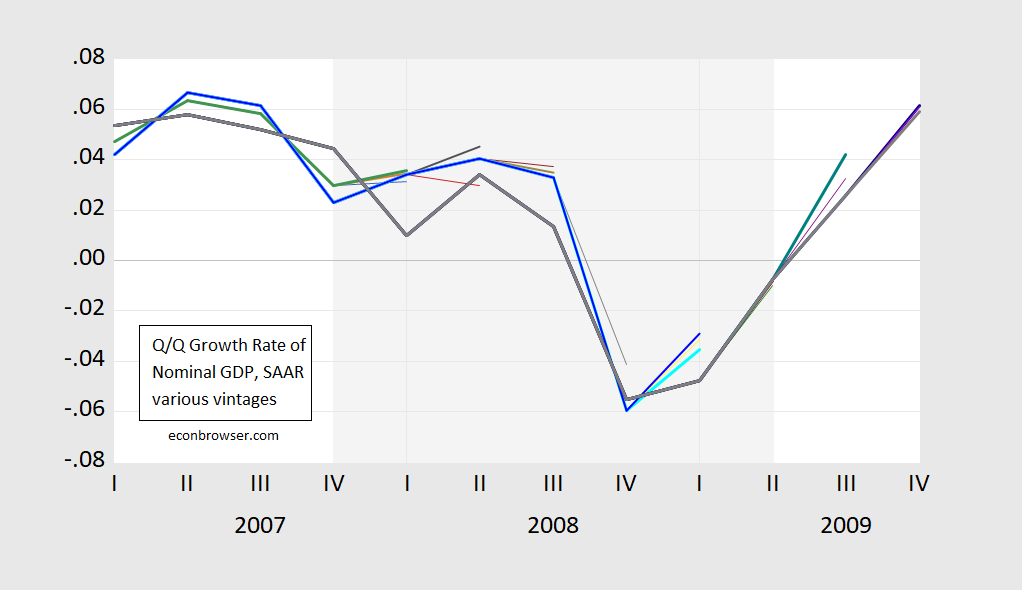

One challenge to implementation is the relatively large revisions in the growth rate of this variable (and don’t get me started on the level). Here’s an example from our last recession.

(Click on image to enlarge)

Figure 1: Q/Q nominal GDP growth, SAAR, from various vintages. NBER defined recession dates shaded gray. Source: ALFRED.

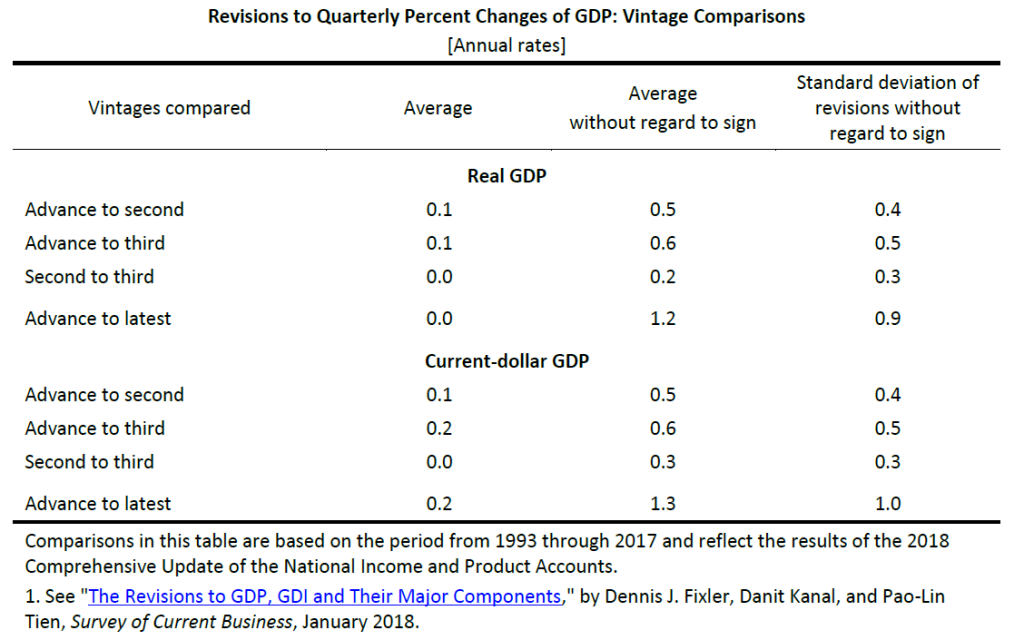

How big are the revisions? The BEA provides a detailed description. This table summarizes the results.

(Click on image to enlarge)

The standard deviation of revisions going from Advance to Latest is one percent (annualized), mean absolute revision is 1.3 percent. Now, the Latest Vintage might not be entirely relevant for policy, so lets look at Advance to Third revision standard deviation of 0.5 percent (0.6 percent mean absolute).

Compare against the personal consumption expenditure deflator, at the monthly — not quarterly — frequency; the mean absolute revision is 0.5 percent going from Advance to Third. The corresponding figure for Core PCE is 0.35 percent. Perhaps this is why the Fed focused more on price/inflation targets, i.e.:

…variants of so-called makeup strategies, “so called” because they at times require the Committee to deliberately target rates of inflation that deviate from 2 percent on one side so as to make up for times that inflation deviated from 2 percent on the other side. Price-level targeting (PLT) is a useful benchmark among makeup policies but also represents a more significant and perhaps undesirable departure from the flexible inflation-targeting framework compared with other alternatives. “Nearer neighbors” to flexible inflation targeting are more flexible variants of PLT, which include temporary PLT—that is, use of PLT only around ELB episodes to offset persistently low inflation—and average inflation targeting (AIT), including one-sided AIT, which only restores inflation to a 2 percent average when it has been below 2 percent, and AIT that limits the degree of reversal for overshooting and undershooting the inflation target.10

Admittedly, the estimation of output gap is fraught with much larger (in my opinion) measurement challenges than the trend in nominal GDP, as it compounds the problems of real GDP measurement and potential GDP estimation; this is a point made by Beckworth and Hendrickson (JMCB, 2019). Even the use of the unemployment rate, which can be substituted for the output gap in the Taylor principle by way of Okun’s Law, encounters a problem. As Aruoba (2008) notes, the unemployment rate is not subject to large and/or biased revisions; however the estimated natural rate of unemployment, on the other hand, does change over time, as estimated by CBO by Fed, and others, so there is going to be revision to the implied unemployment gap (this point occupies a substantial portion of JEC report). Partly for this reason, the recently announced modification of the Fed’s policy framework stresses shortfalls rather than deviations, discussed in this post.

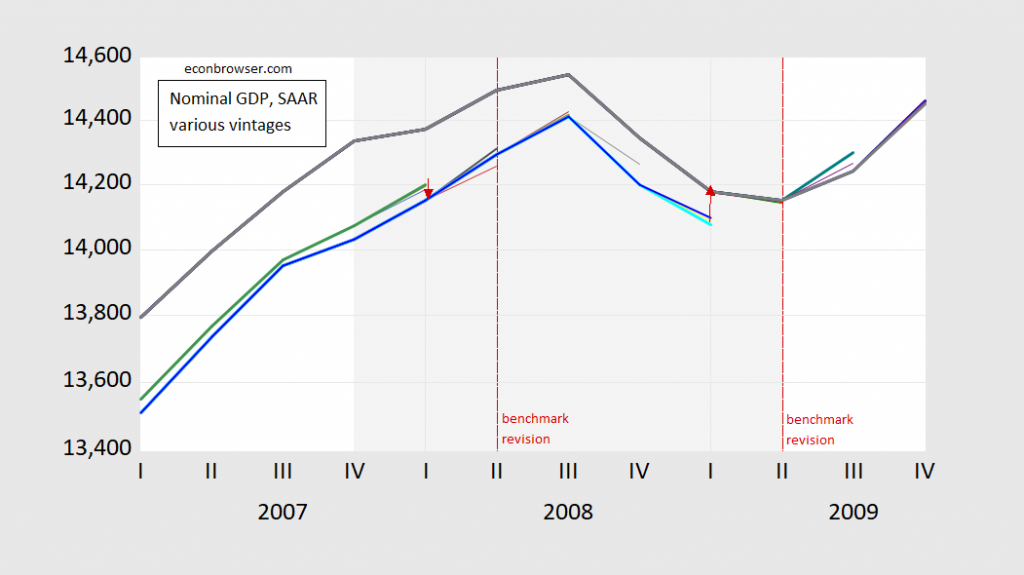

One interesting aspect of the debate over nominal GDP targeting relates to growth rates vs. levels. If it’s growth rates (as in Beckworth and Hendrickson (JMCB, 2019), there is generally a “fire and forget” approach to setting rates. An actual nominal GDP target of the level implies that past errors are not forgotten (McCallum, 2001) (this is not a distinction specific to GDP as we know from the inflation vs. price level debate). Targeting the level of nominal GDP faces another — perhaps even more problematic — challenge, as suggested by Figure 2.

(Click on image to enlarge)

Figure 2: Nominal GDP in billions of current dollars, SAAR, from various vintages. NBER defined recession dates shaded gray. Dashed red line at annual benchmark revisions. Red arrows denote implied revisions to last overlapping observation between two benchmarked series. Source: ALFRED.

Revisions can be large at benchmark revisions, shown as dashed lines in the above Figure. But even non benchmark revision can be large, as in 2009Q3. ( Beckworth (2019) suggests using a Survey of Professional Forecasters forecast relative to target and a level gap as means of addressing this issue — I think — insofar as the target can be moved relative to the current vintage.)

None of the foregoing should be construed as a comprehensive case against some form of nominal GDP targeting — after all Frankel with Chinn (JMCB, 1995) provides some arguments in favor. But it suggests that the issue of data revisions in the conduct of monetary policy is not inconsequential.

Disclosure: None.