No Market For Old Men

I gotta be honest, I think “Forget it Johnny, It’s Teslatown” is a more fitting title for this post, and you’ll soon see why, but alas, as a citizen of the Federation, I am a slave to the people.

“Contrary to what a lot of the financial press has stated, looking at the great bull markets of this century, the best environment for stocks is a very dull, slow economy that the Federal Reserve is trying to get going” ~ Druckenmiller

“Don’t fight the Fed.” ~ Anon Genius Savant

Read those two quotes. Read them again and again and again. Read them one more time for good measure. Are they seared into your memory yet? Good. Now explain to me why in God’s holy f*ck are you bearish this market?

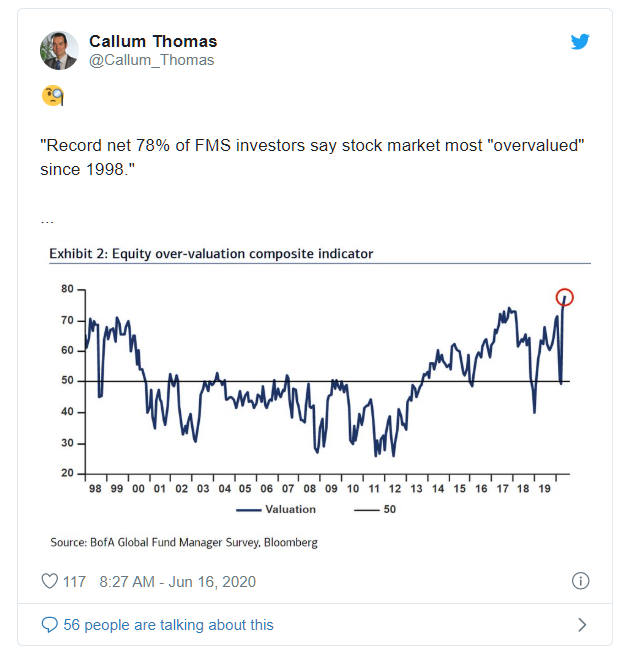

What’s your excuse? Is it because the market is overvalued?

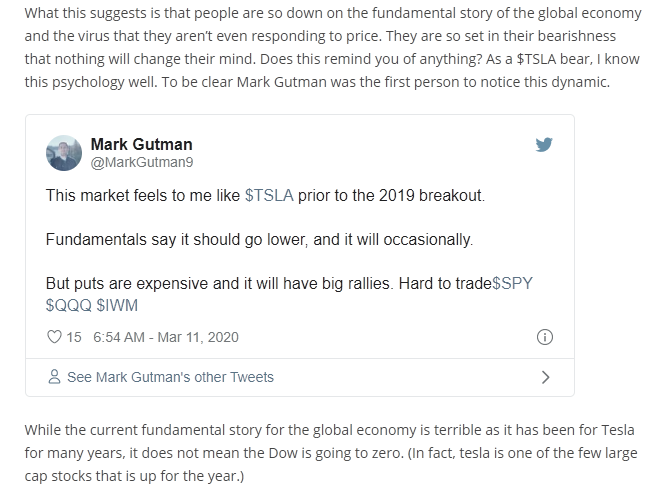

Or is it because there are retail traders participating in the rally? So what? As I argued in late March, the market had turned into a Tesla market.

Fast forward a couple of months and the market has rallied at a historic pace against the backdrop of a “fundamental” bear case that is arguably stronger than ever. In fact, more Americans are unemployed now than when I wrote that blog post in late March. But wait, there’s more, because just like in the case of Tesla, we have an inordinate amount of “dumb money” led by young retail traders leading the charge into stocks.

But how is that bearish? Is the Fed threatening to pull the punch bowl away? No, they’re actually discussing new tools that they can bring to bear.

And somewhat hilariously predictably, the equity market bears, who have been beaten so badly, have doubled down on the most obvious factor in markets, virus case counts. The bears are now so focused on rising virus counts in the US that somehow they think that they alone can see that the virus has spread across the US at an increasing rate. If this is a Tesla (TSLA) market, which I think it is, then the virus count is almost entirely irrelevant. China shut down Beijing the other day. Have you checked what their stock market did?

You may have other reasons why you are short or not buying the market here or whatever, but they’re probably too logical or too emotional. I’m sure many of you are overwhelmed by your political biases or the fact that you live in a city which means not only were you more impacted by the Wuhan Flu, but the riots (and the fine people who were protesting peacefully) and social disorder in which the lockdowns caused. The fact of the matter is that the market, like Anton Chigurh, does not care about your feelings. What does it care about, more than anything in our increasingly financialized economy is liquidity.

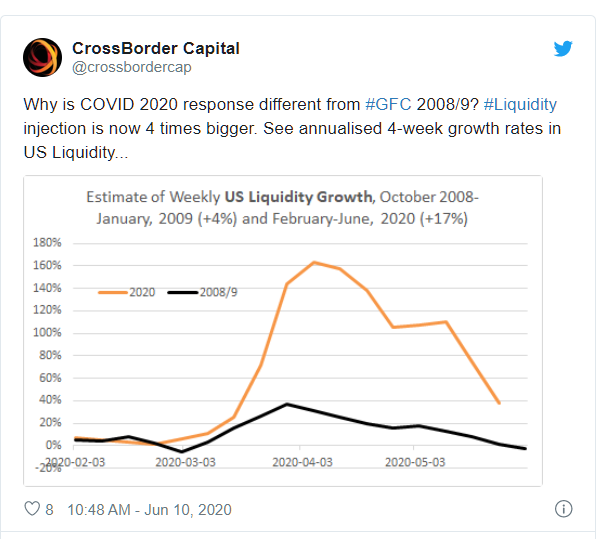

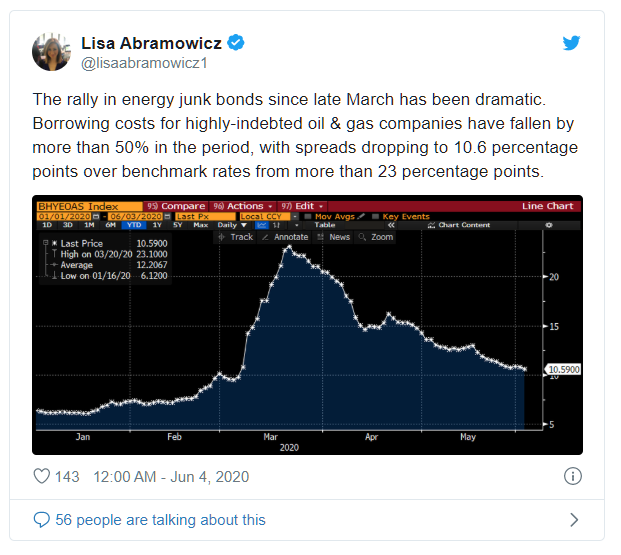

The Fed has expanded its balance sheet at an unprecedented pace. The Fed is buying individual corporate bonds. I’m told they even own a few HTZ bonds. This seems to have an effect similar to what Draghi’s “whatever it takes” speech had on European Periphery bonds.

The result is falling bond yields despite terrible fundamentals.

And with the economy in such bad shape, the Fed is in no hurry despite the growing bubbles in financial assets to tighten monetary conditions! In fact, they are coming up with even more tools to manipulate financial assets, I mean, support the economy.

Meanwhile, the US government is expanding its borrowing at a record pace as well. I hear we’re gonna get at least another $1T stimulus package. Every major government is doing the same thing. China is set to increase its debt by a new record $2.8T this year. Even Germany is spending some money.

And the best part, for equities that is, there’s no inflation… So these central planners can do whatever the f*ck they want. It doesn’t matter how irresponsible they are. The bill will come eventually. 3 months maybe, 6 months definitely. But until it does, the market will not price in an end to these extravagant and wasteful government policies. So don’t fight them or at least, to paraphrase William Prescott, “don’t short till you see the whites of inflation’s eyes”.

The best part is that you will probably find a reason to discard everything I’ve said. After all I’m young and foolish, and the market is overvalued, and the p/c ratio is super low and these are all true. I’m not denying that. I am however noting that liquidity and sentiment will trump these facts. So many months from now if the market does in fact hit all time highs I want you to ask yourself a simple question…

“If the rule you followed brought you to this, of what use was the rule?” ~ Anton Chigurh

Disclaimer: My blog is the diary of a twenty something hedge fund manager who has never stepped foot inside a wall street bank. I have not taken an economic or business course since high school ...

more