VIX Speculators Continue To Pare Bearish Bets For 3rd Week

VIX Non-Commercial Speculator Positions:

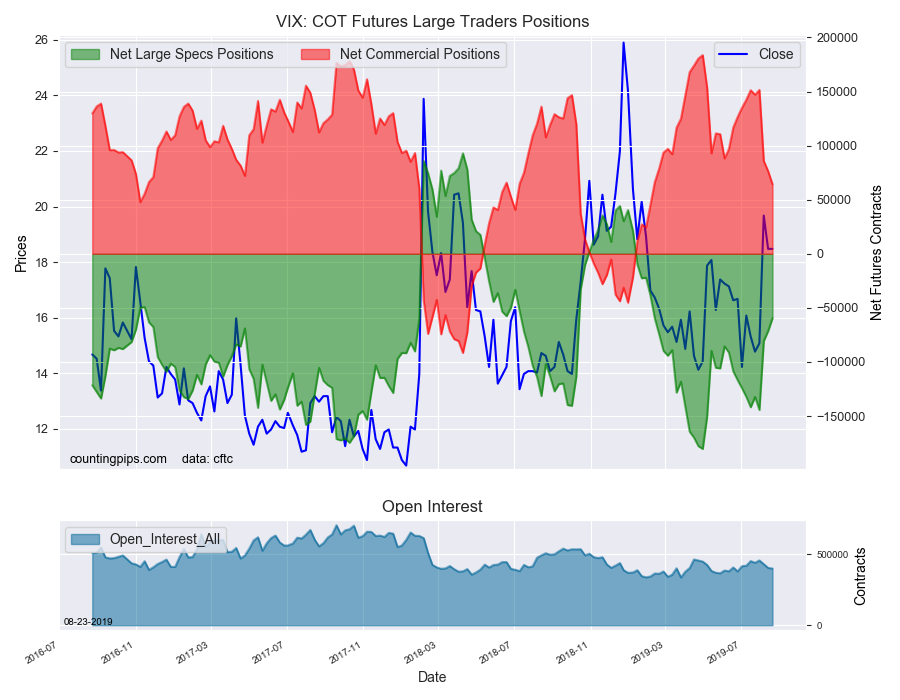

Large volatility speculators reduced their bearish net positions in the VIX futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of -59,498 contracts in the data reported through Tuesday August 20th. This was a weekly change of 11,873 net contracts from the previous week which had a total of -71,371 net contracts.

The week’s net position was the result of the gross bullish position (longs) dropping by -12,129 contracts (to a weekly total of 125,463 contracts) while the gross bearish position (shorts) decreased by a larger amount of -24,002 contracts for the week (to a total of 184,961 contracts).

VIX speculators cut back on their bearish bets for a third straight week and for the fourth time out of the past five weeks. Over the last three weeks alone, speculators have trimmed the bearish standing by a total of 84,816 contracts.

Up until July 30th, speculators were consistently adding to their weekly bearish positions and had pushed the bearish standing to the highest level (-144,314 contracts) since reaching an all-time record high bearish position on April 30th of 2019 (at a total of -180,359 contracts).

The current level of speculative positions is now at the least bearish standing since February 5th of this year.

VIX Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 64,294 contracts on the week. This was a weekly decrease of -12,166 contracts from the total net of 76,460 contracts reported the previous week.

VIX Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX Futures (Front Month) closed at approximately $18.47 which was virtually no change from the previous close, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here.

Disclosure:Receive our weekly COT Reports by Email

Risk