Thursday Thump – Is It A Bouncy Bottom Or A Pause On The Way Down?

Wheeeeeee!

Wheeeeeee!

I love it when a plan comes together. I'm not going to say "I told you so" – I think my 9am tweet on Tuesday already made that abundantly clear. That morning post had already been published for our Members at 8:08 am, where I said:

Why then, do I prefer cash when there is so much money to be made? Because, at this point in a bubble, it can all be taken away from you just as quickly, and the minute you lose site of that you are in BIG TROUBLE! My question to you is, if you can make 20%, 40%, 50% on short-term trades like these, why leave anything on the table? Make a trade, make your money and get back to cash. Don't stay at the table and play until you give it all back!

At 8:23, our first Futures Trade Idea in Member chat was shorting the Dow (/YM) at 16,000 and shorting the Russell (/TF) at 1,130 and we were in and out a few times since but we caught 15,800 on the Dow yesterday for $1,000 per contract gained in 2 days and 1,100 on the Russell for a whopping $3,000 per contract in less then 48 hours. This is what I was talking about – why leave money on the table when we can make hit and run plays like this?

At 9:01 I reminded our Members to short oil at the $98.50 line, we rode those down for $1,000+ gains per contact below $96.50 yesterday and we're hoping oil goes back to $98 this morning so we can short them again! As I said in last week's Webcast, where we made a short play on oil miles ahead of the drop, we saw no way that OPEC was going to get their act together to reign in the oversupply of crude.

At 9:01 I reminded our Members to short oil at the $98.50 line, we rode those down for $1,000+ gains per contact below $96.50 yesterday and we're hoping oil goes back to $98 this morning so we can short them again! As I said in last week's Webcast, where we made a short play on oil miles ahead of the drop, we saw no way that OPEC was going to get their act together to reign in the oversupply of crude.

We also focused on the Russell as our favorite short, using 20 TZA Jan $19/23 bull call spreads at $1.86, selling 20 Jan $17 puts for net $720. That spread finsihed the day yesterday at $2,180 for a $1,460 gain in a week (up 202%) and THAT is how you hedge to the downside!

You can get trade ideas like this every day by becoming a Member at Philstockworld. A PSW Annual Report Membership gives you access to all of our daily posts as well as archived chat sessions AND a subscription to Stock World Weekly, all for less than $1 per day. Doesn't that make a perfect Christmas gift for all the investors on your list?

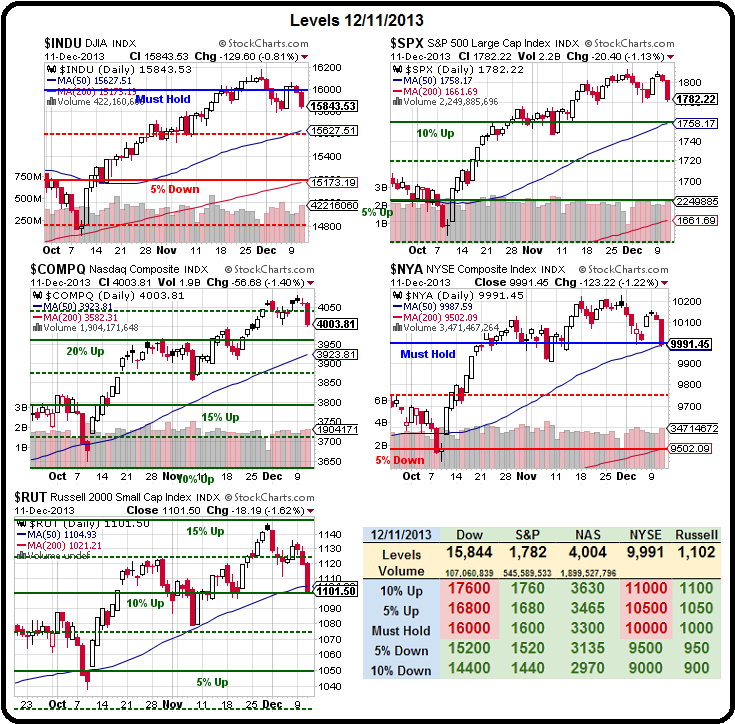

This morning we can play the Russell LONG off the 1,100 line (/TF) in the Futures as it's a good support line and should give us a bounce. Speaking of bounces, when we have corrections like this, we look to see if we get strong or weak bounces off these support lines and per our 5% Rule™, we're going to be looking for the following today before we even consider getting seriously bullish again:

- Dow 15,900 (weak) and 15,950 (strong)

- S&P 1,786 (weak) and 1,792 (strong)

- Nasdaq 4,010 (weak) and 4,020 (strong)

- NYSE 10,030 (weak) and 10,060 (strong)

- Russell 1,107 (weak) and 1,115 (strong)

Generally, if we break over 3 of 5 weak bounce levels, we'll stop out of our monthly short plays until we cross back under (or re-set at a higher level). Our daily/weekly short plays are already cashed out, including our Futures shorts as we already made PLENTY on this week's drop. We have no interest in going long (other than quick trades like the RUT Futures) until we see 3 of 5 strong bounces broken and, keep in mind that these are dynamic targets that we recalculate daily – it's the 5% lines on the Big Chart that remain constant.

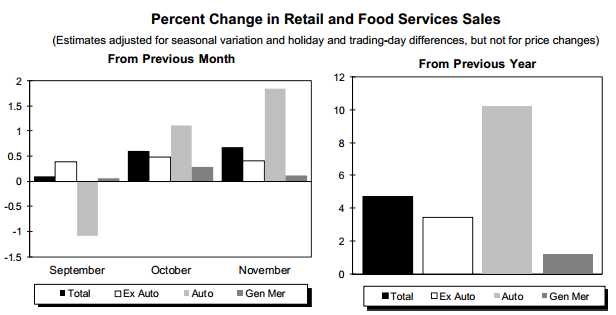

8:30 Update: Retail Sales came in up 0.7% for November vs up 0.6% expected.

8:30 Update: Retail Sales came in up 0.7% for November vs up 0.6% expected.

Ex-Auto it was only up 0.4% but still better than feared so a bit of a relief move in the Futures but what matters is whether or not those weak bounce lines are taken out and then, whether or not they hold up for the day.

Unfortunately, the Retail Sales report is a month/month report and we're coming off a TERRIBLE Septermber and an October that didn't make up for it so, essentially, all it shows is people waiting for Black Friday/Cyber Monday to BUYBUYBUY and we already know those numbers could have been better. The year/year number on General Merchandise is up just 0.6% – hardly seems to justlfy a 45% rise in XRT (Retail ETF) since January, does it? So we're still going to like the XRT Jan $90 puts, probably around $3.50 this morning with XRT jumping to $89 on the news.

Meanwhile, those Retail Workers are already getting cut ahead of the holidays, with 368,000 people losing their jobs last week, up from 325,000 last week and continuing claims jumped 40,000 to 2,79M people, 1.5M of whom are about to have their benefits cut off on December 31st – Merry F'ing Christmas!

Meanwhile, those Retail Workers are already getting cut ahead of the holidays, with 368,000 people losing their jobs last week, up from 325,000 last week and continuing claims jumped 40,000 to 2,79M people, 1.5M of whom are about to have their benefits cut off on December 31st – Merry F'ing Christmas!

As expected, we are back to $98 on oil (/CL in the Futures) and, of course, we're shorting again. Yesterday we had our inventory report, which showed a whopping 10.6M barrel draw down on oil stocks but, upon closer inspection (those damned Fundamentals again) we noticed that there was a BUILD in Gasoline of 6.7Mb and a BUILD of Distillates of 4.5Mb for a net BUILD of 600,000 barrels for the week.

Essentially, the US Oil Cartel is engaged in channel stuffing, forcing crude out of inventory and letting refined product pile up at the retail level but, getting back to our Retail Sales Report (see – smart!), we can see that annual gasoline sales are down, indicating the demand simply isn't there. We also notice that 1.649Mb PER DAY of refined products were shipped out of the country, over 1Mb/day more than last year. That reduced the total supply by 11.54Mb and we STILL had a 600,000 barrel build. In short, US demand is down and supply is growing.

That's why our friends at XOM are lobbying hard for the Government to lift restrictions on oil exports that have been in place since 1973 to insure our nation's energy security. "We are not dealing with an era of scarcity, we are dealing with a situation of abundance," Ken Cohen, Exxon's vice president of public and government affairs, said in an interview. "We need to rethink the regulatory scheme and the statutory scheme on the books." That's very interesting considering XOM is charging US consumers $98 for a barrel of oil this year while they only charged $85.45 last year (up 14.7%) – this is part of the inflation our Government refuses to see.

Keep in mind, they are alreay exporting 150% more oil than last year to create an artificially short supply and jack up prices for US consumers – the same consumers that essentially give away their nation's oil while other countries get 50% of the money generated from selling their precious natural resources. Remember when the GOP was trying to sell us "drill baby, drill" as the solution to high oil prices – what good does it do us if they drill and ship it overseas?

Write your Congressman here and tell him how angry this makes you!

The material presented in this commentary is provided for informational purposes only and is based upon information that is considered to be reliable. However, neither Philstockworld, LLC (PSW) nor ...

more